17+ 4th eu aml directive ireland information

Home » money laundering Info » 17+ 4th eu aml directive ireland informationYour 4th eu aml directive ireland images are available in this site. 4th eu aml directive ireland are a topic that is being searched for and liked by netizens today. You can Get the 4th eu aml directive ireland files here. Find and Download all free photos.

If you’re searching for 4th eu aml directive ireland images information linked to the 4th eu aml directive ireland topic, you have visit the right site. Our website frequently provides you with hints for refferencing the highest quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

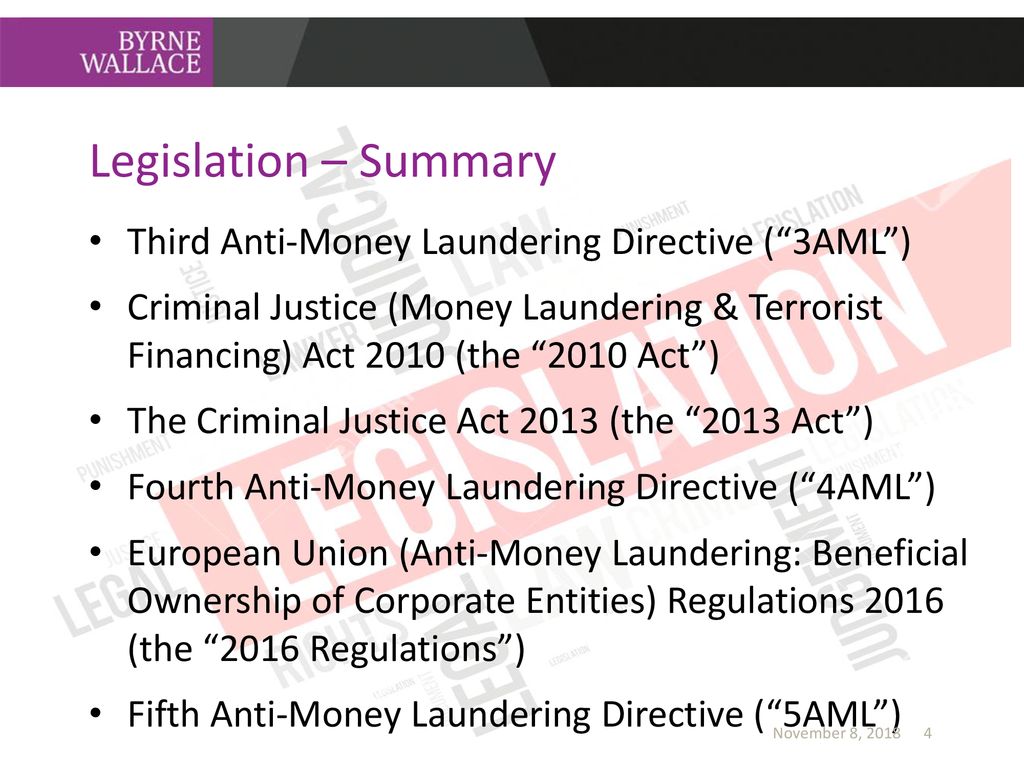

4th Eu Aml Directive Ireland. The negotiations were led by the Department of Finance in consultation with other relevant departments agencies and. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. MLD4 must be enacted by member states and obliged entities must comply with the Directive. L et us get one thing straight.

Eu Court Of Justice Fines Romania Over Anti Money Laundering Directive Romania Insider From romania-insider.com

Eu Court Of Justice Fines Romania Over Anti Money Laundering Directive Romania Insider From romania-insider.com

Statutory obligation to carry out Business Risk Assessment Simplified Due Diligence rules based approach effectively Abolished Enhanced CDD regime. MLD4 must be enacted by member states and obliged entities must comply with the Directive. L et us get one thing straight. The EUs 4th Directive on Anti-Money Laundering MLD4 succeeds the 3rd Directive of 2005. The negotiations were led by the Department of Finance in consultation with other relevant departments agencies and. Ireland has been the subject of EU infringement proceedings due to the Department of Justices failure to transpose the fourth EU anti-money laundering AML directive into Irish.

Banking and financial services.

This will bring Ireland in line with the current European anti-money laundering and countering the financing of terrorism AMLCFT framework. L et us get one thing straight. The EUs 4th Directive on Anti-Money Laundering MLD4 succeeds the 3rd Directive of 2005. Banking and financial services. The Fourth EU Money Laundering Directive 4MLD was finally transposed into Irish law with the enactment on 14. 5 May 2021 Author.

Source: acamstoday.org

Source: acamstoday.org

AML4 was transposed into Irish law in November 2018 through an amendment to the previous Criminal Justice Money Laundering and Terrorist Financing Act 2010. L et us get one thing straight. 4th Anti-Money Laundering Directive 4AMLD Directive 2015849 The 4AMLD and the associated Funds Transfer Regulation FTR were agreed in 2015 at EU level. The Fourth Anti-Money Laundering AML Directive is a directive whereas the General Data Protection Regulation Data Regulation is a regulation. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector.

Source: slidetodoc.com

Source: slidetodoc.com

The Fourth Anti Money Laundering Directive 4AMLD implemented the new recommendation by Financial Action Task Force 2012 FATF and revised the terms of the treaty once more to remove any ambiguities and improve consistency of AML and CTF. 5 May 2021 Author. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector. Domestic PEPs and Higher risk country accounts Countries of Equivalence List Abolished CJMLTFAmend Act 2018 was signed into law in November 2018. Banking and financial services.

The EUs 4th Directive on Anti-Money Laundering MLD4 succeeds the 3rd Directive of 2005. It will also ensure consistency in the application of such laws across all EU Member States. Banking and financial services. Article 301 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owners in their own internal beneficial ownership register. Financial Stability Financial Services and Capital Markets Union.

Source: kbassociates.ie

Source: kbassociates.ie

On 29th January 2016 the Department of Finance and the Department of Justice and Equality the Departments published a consultation paper CP on the Member State discretions available to Ireland in transposing the Fourth Anti-Money Laundering Directive Directive EU 2015849 AMLD4 and the Funds Transfer Regulation Regulation EU 2015847 into Irish law. Financial Stability Financial Services and Capital Markets Union. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. The difference between these two is crucial. MLD4 must be enacted by member states and obliged entities must comply with the Directive.

Source: ireland.representation.ec.europa.eu

Source: ireland.representation.ec.europa.eu

Financial Stability Financial Services and Capital Markets Union. The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law. Statutory obligation to carry out Business Risk Assessment Simplified Due Diligence rules based approach effectively Abolished Enhanced CDD regime. The Fourth EU Money Laundering Directive 4MLD was finally transposed into Irish law with the enactment on 14. Ireland has been the subject of EU infringement proceedings due to the Department of Justices failure to transpose the fourth EU anti-money laundering AML directive into Irish.

Source: irishtimes.com

Source: irishtimes.com

02 June 2020 last update on. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. MLD4 must be enacted by member states and obliged entities must comply with the Directive. Domestic PEPs and Higher risk country accounts Countries of Equivalence List Abolished CJMLTFAmend Act 2018 was signed into law in November 2018. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector.

Source: acamstoday.org

Source: acamstoday.org

The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015. The Bill will transpose the Fifth EU Money Laundering Directive the Directive. The negotiations were led by the Department of Finance in consultation with other relevant departments agencies and. 4th Anti-Money Laundering Directive 4AMLD Directive 2015849 The 4AMLD and the associated Funds Transfer Regulation FTR were agreed in 2015 at EU level. 5 May 2021 Author.

Source: camsafroza.com

Source: camsafroza.com

It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. The changes are in. The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law. The draft Fourth EU Anti Money Laundering Directive AMLD4 is designed to update and improve the EUs Anti-Money Laundering AML and Counter-Terrorist Financing CTF laws. 02 June 2020 last update on.

Source: slideplayer.com

Source: slideplayer.com

AML4 was transposed into Irish law in November 2018 through an amendment to the previous Criminal Justice Money Laundering and Terrorist Financing Act 2010. The changes are in. The draft Fourth EU Anti Money Laundering Directive AMLD4 is designed to update and improve the EUs Anti-Money Laundering AML and Counter-Terrorist Financing CTF laws. The EUs 4th Directive on Anti-Money Laundering MLD4 succeeds the 3rd Directive of 2005. It carried out a number of modifications to the Third EU AML Directive.

Source: kbassociates.ie

Source: kbassociates.ie

On 29th January 2016 the Department of Finance and the Department of Justice and Equality the Departments published a consultation paper CP on the Member State discretions available to Ireland in transposing the Fourth Anti-Money Laundering Directive Directive EU 2015849 AMLD4 and the Funds Transfer Regulation Regulation EU 2015847 into Irish law. The Fourth Anti-Money Laundering AML Directive is a directive whereas the General Data Protection Regulation Data Regulation is a regulation. The Fourth EU Money Laundering Directive 4MLD was finally transposed into Irish law with the enactment on 14. 05 October 2020 last update on. The draft Fourth EU Anti Money Laundering Directive AMLD4 is designed to update and improve the EUs Anti-Money Laundering AML and Counter-Terrorist Financing CTF laws.

Source: romania-insider.com

Source: romania-insider.com

The Fourth Anti-Money Laundering AML Directive is a directive whereas the General Data Protection Regulation Data Regulation is a regulation. Domestic PEPs and Higher risk country accounts Countries of Equivalence List Abolished CJMLTFAmend Act 2018 was signed into law in November 2018. Financial Stability Financial Services and Capital Markets Union. L et us get one thing straight. The Fourth Anti-Money Laundering AML Directive is a directive whereas the General Data Protection Regulation Data Regulation is a regulation.

Source: portal.ieu-monitoring.com

Source: portal.ieu-monitoring.com

The changes are in. Banking and financial services. European Union Ireland November 29 2018. The Fourth Anti-Money Laundering AML Directive is a directive whereas the General Data Protection Regulation Data Regulation is a regulation. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws.

Source: amlcompliance.ie

Source: amlcompliance.ie

The difference between these two is crucial. The Fourth Anti Money Laundering Directive 4AMLD implemented the new recommendation by Financial Action Task Force 2012 FATF and revised the terms of the treaty once more to remove any ambiguities and improve consistency of AML and CTF. The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law. It will also ensure consistency in the application of such laws across all EU Member States. The draft Fourth EU Anti Money Laundering Directive AMLD4 is designed to update and improve the EUs Anti-Money Laundering AML and Counter-Terrorist Financing CTF laws.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 4th eu aml directive ireland by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas