10+ 4th eu money laundering directive beneficial ownership ideas

Home » money laundering idea » 10+ 4th eu money laundering directive beneficial ownership ideasYour 4th eu money laundering directive beneficial ownership images are available in this site. 4th eu money laundering directive beneficial ownership are a topic that is being searched for and liked by netizens now. You can Download the 4th eu money laundering directive beneficial ownership files here. Download all royalty-free vectors.

If you’re searching for 4th eu money laundering directive beneficial ownership images information related to the 4th eu money laundering directive beneficial ownership keyword, you have visit the ideal site. Our website frequently gives you hints for viewing the highest quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

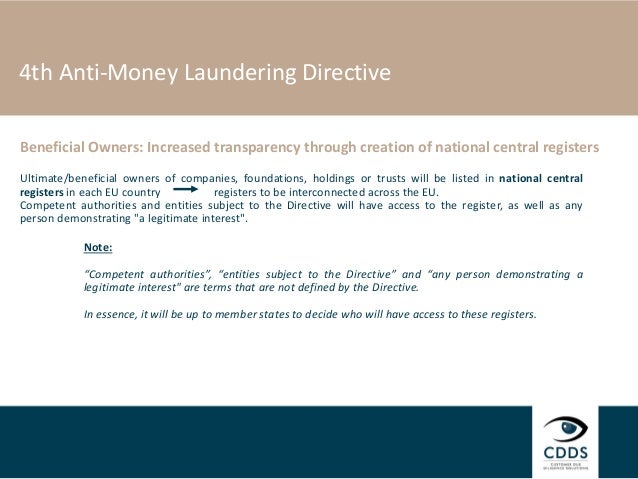

4th Eu Money Laundering Directive Beneficial Ownership. Directive EU 2015849 appeared as a new European Union EU effort to prevent money laundering andor terrorist financing and to maintain the confidence in the Unions financial system. Member States shall ensure that corporate and other legal entities incorporated within their territory are required to obtain and hold adequate accurate and current information on their beneficial ownership including the details of the. In 2013 the European Commission released its proposal for the 4 th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered. It was left up to individual member states to determine how to implement the Directive and in doing so.

The 4th Eu Anti Money Laundering Directive And You From slideshare.net

The 4th Eu Anti Money Laundering Directive And You From slideshare.net

Fifth EU Money Laundering Directive - Beneficial Ownership Transparency 18 November 2019 Welcome to the third of our monthly Fifth EU Money Laundering Directive 5MLD blog series where in the run up to its January 2020 implementation deadline we break down one of the key areas of the 5MLD letting you know what changes are coming and what you need to do. The proposals were based in response to the Financial Action Task Force FATF 2012. CUDA wish to give you an update in relation to the Beneficial Ownership Register requirements under the 4th EU Money Laundering Directive and European Union Anti-Money Laundering. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. For trusts that own a company not incorporated in the EU access to the register should be given upon written request. It will also ensure consistency in the application of such laws across all EU Member States.

Directive EU 2015849 appeared as a new European Union EU effort to prevent money laundering andor terrorist financing and to maintain the confidence in the Unions financial system.

The Directive aims to fight tax evasion money laundering and terrorist financing. In 2013 the European Commission released its proposal for the 4 th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered. Directive EU 2015849 appeared as a new European Union EU effort to prevent money laundering andor terrorist financing and to maintain the confidence in the Unions financial system. For trusts that own a company not incorporated in the EU access to the register should be given upon written request. It will also ensure consistency in the application of such laws across all EU Member States. The new regulation will contain directly applicable rules including in the areas of customer due diligence and beneficial ownership.

Source: financierworldwide.com

Source: financierworldwide.com

BEIS1638 PDF 685KB 43 pages. It also includes the setting up of an EU-wide. Beyond Europe other countries are also following suit in an. The European Commission EC imposed a deadline of 26 June 2017 for member states to transpose the Fourth Anti- Money Laundering Directive into national law. BEIS1638 PDF 685KB 43 pages.

Source: bankinghub.eu

Source: bankinghub.eu

Transposition of Article 30. Implementing the Fourth Money Laundering Directive. A key example of this is the introduction of the 4th Anti-Money Laundering Directive 4th AML Directive from the European Union EU. It also includes the setting up of an EU-wide. Fifth EU Money Laundering Directive - Beneficial Ownership Transparency 18 November 2019 Welcome to the third of our monthly Fifth EU Money Laundering Directive 5MLD blog series where in the run up to its January 2020 implementation deadline we break down one of the key areas of the 5MLD letting you know what changes are coming and what you need to do.

Source: slideshare.net

Source: slideshare.net

This Directive is the fourth directive to address the threat of money laundering. For beneficial owners of trusts and similar legal arrangements the EU Member States must establish registers that should be accessible to everyone with a legitimate interest. For trusts that own a company not incorporated in the EU access to the register should be given upon written request. It also includes the setting up of an EU-wide. Transposition of Article 30.

Source: tookitaki.ai

Source: tookitaki.ai

Fourth Money Laundering Directive MLD4 with proposed changes from COM2021 423 final 20210239 COD 1. A key example of this is the introduction of the 4th Anti-Money Laundering Directive 4th AML Directive from the European Union EU. Beneficial ownership of corporate and other legal entities - discussion paper. CUDA wish to give you an update in relation to the Beneficial Ownership Register requirements under the 4th EU Money Laundering Directive and European Union Anti-Money Laundering. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws.

Source: acumen-corporate-services.lu

Source: acumen-corporate-services.lu

For beneficial owners of trusts and similar legal arrangements the EU Member States must establish registers that should be accessible to everyone with a legitimate interest. The European Commission EC imposed a deadline of 26 June 2017 for member states to transpose the Fourth Anti- Money Laundering Directive into national law. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector. A key example of this is the introduction of the 4th Anti-Money Laundering Directive 4th AML Directive from the European Union EU. For beneficial owners of trusts and similar legal arrangements the EU Member States must establish registers that should be accessible to everyone with a legitimate interest.

Source: actico.com

Source: actico.com

The new regulation will contain directly applicable rules including in the areas of customer due diligence and beneficial ownership. It will also ensure consistency in the application of such laws across all EU Member States. In 2013 the European Commission released its proposal for the 4 th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered. Beyond Europe other countries are also following suit in an. When money is being laundered corruption is being facilitated allowing many standards to be undermined.

Source: actico.com

Source: actico.com

The new regulation will contain directly applicable rules including in the areas of customer due diligence and beneficial ownership. Laundering and terrorist financing the 4th AML Directive requires EU member states to set up registers of the ultimate beneficial owners UBOs of legal entities. For beneficial owners of trusts and similar legal arrangements the EU Member States must establish registers that should be accessible to everyone with a legitimate interest. Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership. Among other measures designed to combat money laundering and terrorist financing the 4th AML Directive requires EU member states to set up registers of the ultimate beneficial owners UBOs of legal entities.

Source: ec.europa.eu

Source: ec.europa.eu

For trusts that own a company not incorporated in the EU access to the register should be given upon written request. Laundering and terrorist financing the 4th AML Directive requires EU member states to set up registers of the ultimate beneficial owners UBOs of legal entities. Among other measures designed to combat money laundering and terrorist financing the 4th AML Directive requires EU member states to set up registers of the ultimate beneficial owners UBOs of legal entities. Transposition of Article 30. Directive EU 2015849 appeared as a new European Union EU effort to prevent money laundering andor terrorist financing and to maintain the confidence in the Unions financial system.

Source: bankinghub.eu

Source: bankinghub.eu

It was left up to individual member states to determine how to implement the Directive and in doing so. Beyond Europe other countries are also following suit in an. Fifth EU Money Laundering Directive - Beneficial Ownership Transparency 18 November 2019 Welcome to the third of our monthly Fifth EU Money Laundering Directive 5MLD blog series where in the run up to its January 2020 implementation deadline we break down one of the key areas of the 5MLD letting you know what changes are coming and what you need to do. The proposals were based in response to the Financial Action Task Force FATF 2012. In 2013 the European Commission released its proposal for the 4 th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered.

Source: coinfirm.com

Source: coinfirm.com

In 2013 the European Commission released its proposal for the 4 th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered. BEIS1638 PDF 685KB 43 pages. Fourth Money Laundering Directive MLD4 with proposed changes from COM2021 423 final 20210239 COD 1. Among other measures designed to combat money laundering and terrorist financing the 4th AML Directive requires EU member states to set up registers of the ultimate beneficial owners UBOs of legal entities. Beyond Europe other countries are also following suit in an.

Source: shuftipro.com

Source: shuftipro.com

The Department of Finance DOF and Central Bank were in attendance. BEIS1638 PDF 685KB 43 pages. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector. The European Commission EC imposed a deadline of 26 June 2017 for member states to transpose the Fourth Anti- Money Laundering Directive into national law. Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership.

Source: camsafroza.com

Source: camsafroza.com

It was left up to individual member states to determine how to implement the Directive and in doing so. Laundering and terrorist financing the 4th AML Directive requires EU member states to set up registers of the ultimate beneficial owners UBOs of legal entities. It will also ensure consistency in the application of such laws across all EU Member States. It also includes the setting up of an EU-wide. For trusts that own a company not incorporated in the EU access to the register should be given upon written request.

Source: slideshare.net

Source: slideshare.net

Implementing the Fourth Money Laundering Directive. It was left up to individual member states to determine how to implement the Directive and in doing so. Beyond Europe other countries are also following suit in an. This Directive is the fourth directive to address the threat of money laundering. The new regulation will contain directly applicable rules including in the areas of customer due diligence and beneficial ownership.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 4th eu money laundering directive beneficial ownership by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information