18+ 4th money laundering directive eu information

Home » money laundering Info » 18+ 4th money laundering directive eu informationYour 4th money laundering directive eu images are available in this site. 4th money laundering directive eu are a topic that is being searched for and liked by netizens today. You can Download the 4th money laundering directive eu files here. Download all free photos.

If you’re looking for 4th money laundering directive eu pictures information linked to the 4th money laundering directive eu interest, you have visit the ideal blog. Our website always provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

4th Money Laundering Directive Eu. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015. It required Member States to prohibit money laundering and to oblige the financial sector comprising credit institutions and a wide range of other financial institutions to identify their. The Directive includes some fundamental changes to the anti-money laundering procedures including changes to CDD a central register for beneficial owners and a focus on risk assessments. Banking and financial services.

Finalization Of The 4th Anti Money Laundering Directive Bankinghub From bankinghub.eu

Finalization Of The 4th Anti Money Laundering Directive Bankinghub From bankinghub.eu

Chapter I General Provisions arts. It carried out a number of modifications to the Third EU AML Directive. 5 May 2021 Author. What is 4th AML Directive and how it affect my company organization. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015.

In 2013 the European Commission released its proposal for the 4 th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered.

Directive 2015849EU - Fourth Money Laundering Directive MLD4 Consolidation Status. The Directive includes some fundamental changes to the anti-money laundering procedures including changes to CDD a central register for beneficial owners and a focus on risk assessments. On June 26th the MLD4 came into force. In the wake of financial crises scandals and massive tax evasion the EU took its fight against Money Laundering to the next level. Money laundering shall be regarded as such even where the activities which generated the property to be laundered were carried out in the territory. In 2013 the European Commission released its proposal for the 4 th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered.

Source: coe.int

Source: coe.int

3 This Directive is the four th directive to address the threat of money launder ing. The aim is to improve the detection of suspicious transactions and activities and close loopholes used by criminals to launder illicit proceeds or finance terrorist activities through the financial system. Regulation EU 2015847 on information on the payer accompanying transfers of funds makes fund transfers more transparent thereby helping law enforcement authorities to track down terrorists and criminals. Chapter I General Provisions arts. In the wake of financial crises scandals and massive tax evasion the EU took its fight against Money Laundering to the next level.

Source: actico.com

Source: actico.com

The aim is to improve the detection of suspicious transactions and activities and close loopholes used by criminals to launder illicit proceeds or finance terrorist activities through the financial system. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015. EU Member States have to implement the 4th AMLD by 26 June 2017 into national law. Financial Stability Financial Services and Capital Markets Union. Banking and financial services.

Source: bankinghub.eu

Source: bankinghub.eu

DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector. Money laundering shall be regarded as such even where the activities which generated the property to be laundered were carried out in the territory. Council Directive 91308EEC 4 defined money launder ing in terms of dr ugs offences and imposed obligations solely on the financial sector. 562015 EN Official Jour nal of the European Union L 14173.

Source: slideshare.net

Source: slideshare.net

2015849 4th AMLD entered into force. This Directive is the fourth directive to address the threat of money laundering. Regulation EU 2015847 on information on the payer accompanying transfers of funds makes fund transfers more transparent thereby helping law enforcement authorities to track down terrorists and criminals. Council Directive 91308EEC 4 defined money launder ing in terms of dr ugs offences and imposed obligations solely on the financial sector. What is 4th AML Directive and how it affect my company organization.

Source: ec.europa.eu

Source: ec.europa.eu

DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and. The European Unions Fourth Anti-Money Laundering Directive came into force on 26th June 2017. Financial Stability Financial Services and Capital Markets Union. In 2013 the European Commission released its proposal for the 4 th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered. Chapter I General Provisions arts.

Source: coinfirm.com

Source: coinfirm.com

It will replace the Third Money Laundering Directive. In the wake of financial crises scandals and massive tax evasion the EU took its fight against Money Laundering to the next level. On June 26th the MLD4 came into force. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector. It required Member States to prohibit money laundering and to oblige the financial sector comprising credit institutions and a wide range of other financial institutions to identify their.

Source: camsafroza.com

Source: camsafroza.com

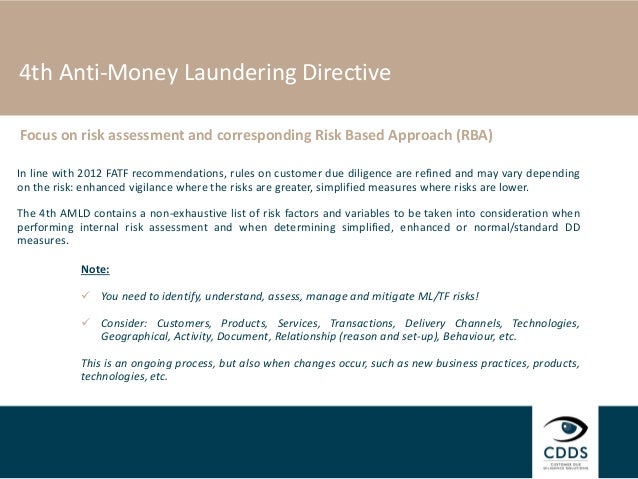

It will replace the Third Money Laundering Directive. 562015 EN Official Jour nal of the European Union L 14173. It carried out a number of modifications to the Third EU AML Directive. The 4th AMLD recasts the existing 3rd Anti-Money Laundering Directive Directive 200560EU and the corresponding Implementing Directive Commission Directive 200670EC. The proposals were based in response to the Financial Action Task Force FATF 2012 recommendations to help improve customer due diligence programs globally.

Source: slideshare.net

Source: slideshare.net

DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 2005. 5 May 2021 Author. DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. Banking and financial services.

Source: bankinghub.eu

Source: bankinghub.eu

Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector. 1-9 Section 1 Subject-matter scope and definitions arts. In 2013 the European Commission released its proposal for the 4 th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered. 4th EU Money Laundering Directive. It required Member States to prohibit money laundering and to oblige the financial sector comprising credit institutions and a wide range of other financial institutions to identify their.

Source: coe.int

Source: coe.int

It will replace the Third Money Laundering Directive. In 2013 the European Commission released its proposal for the 4 th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered. It will replace the Third Money Laundering Directive. This Directive is the fourth directive to address the threat of money laundering. The Fourth Anti Money Laundering Directive 4AMLD implemented the new recommendation by Financial Action Task Force 2012 FATF and revised the terms of the treaty once more to remove any ambiguities and improve consistency of AML and CTF.

Source: bankinghub.eu

Source: bankinghub.eu

Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering Directive and aiming at protecting the Union financial system and the proper functioning of the internal market. 05 October 2020 last update on. What is 4th AML Directive and how it affect my company organization. 1-5 Entered into force. Directive 2015849EU - Fourth Money Laundering Directive MLD4 Consolidation Status.

Source: shuftipro.com

Source: shuftipro.com

3 This Directive is the four th directive to address the threat of money launder ing. Updated to reflect all known changes. The aim is to improve the detection of suspicious transactions and activities and close loopholes used by criminals to launder illicit proceeds or finance terrorist activities through the financial system. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector. It will replace the Third Money Laundering Directive.

Source: actico.com

Source: actico.com

This Directive is the fourth directive to address the threat of money laundering. Financial Stability Financial Services and Capital Markets Union. DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and. The proposals were based in response to the Financial Action Task Force FATF 2012 recommendations to help improve customer due diligence programs globally. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering Directive and aiming at protecting the Union financial system and the proper functioning of the internal market.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 4th money laundering directive eu by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas