12++ 4th money laundering directive summary ideas in 2021

Home » money laundering Info » 12++ 4th money laundering directive summary ideas in 2021Your 4th money laundering directive summary images are available in this site. 4th money laundering directive summary are a topic that is being searched for and liked by netizens today. You can Get the 4th money laundering directive summary files here. Find and Download all free vectors.

If you’re looking for 4th money laundering directive summary pictures information linked to the 4th money laundering directive summary topic, you have come to the ideal blog. Our site frequently gives you hints for viewing the highest quality video and image content, please kindly surf and find more informative video articles and images that match your interests.

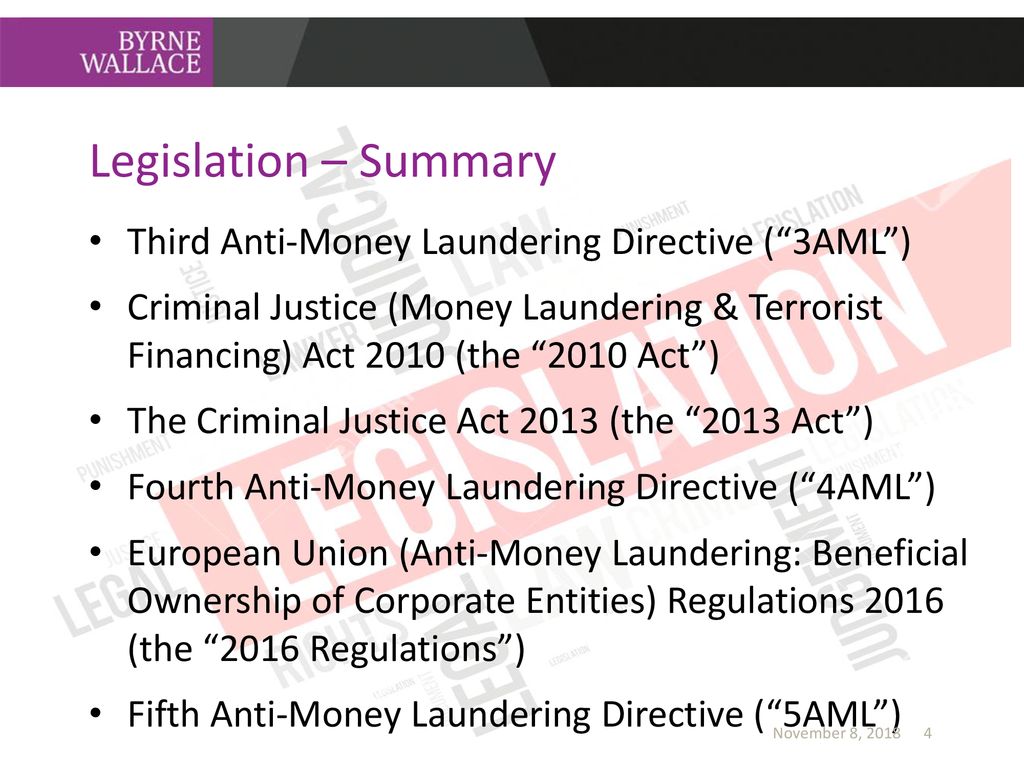

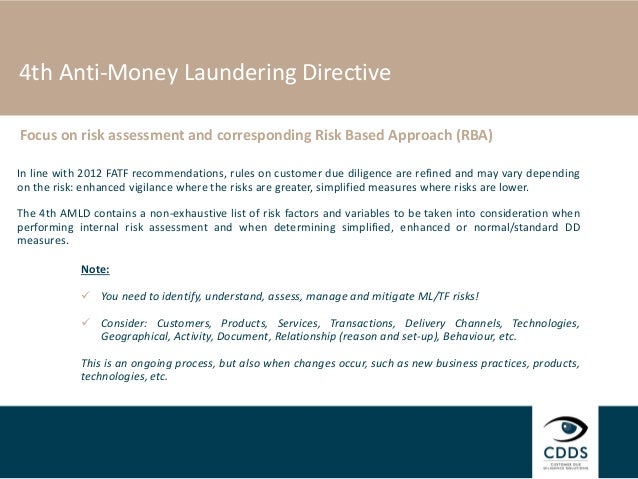

4th Money Laundering Directive Summary. During those ten years the financial industry has faced many challenges and changes which have put more pressure on the regulators to monitor. The draft Fourth EU Anti Money Laundering Directive AMLD4 is designed to update and improve the EUs Anti-Money Laundering AML and Counter-Terrorist Financing CTF laws. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector. Summary of the Fourth Money Laundering Directive 4MLD Last summer on 5th June 2015 the Fourth Money Laundering Directive also referred to as 4MLD or MLD4 was published in the EU Official Journal.

4th Eu Anti Money Laundering Directive From eklawyers.com

4th Eu Anti Money Laundering Directive From eklawyers.com

It will also ensure consistency in the application of such laws across all EU Member States. During those ten years the financial industry has faced many challenges and changes which have put more pressure on the regulators to monitor. The changes are in. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. This Directive is the fourth directive to address the threat of money laundering. The Fourth Money Laundering Directive widens the definition of a Politically Exposed Persons PEP to include citizens holding prominent positions in their home country such as politicians the judiciary and senior members of the armed services as well as those of overseas countries.

The Fourth Money Laundering Directive EU 2015849 MLD4 is designed to strengthen the EUs defences against money laundering and terrorist financing while also ensuring that the EU framework is aligned with the Financial Action Task Forces FATF international anti-money laundering AML and counter-terrorist financing CTF standards.

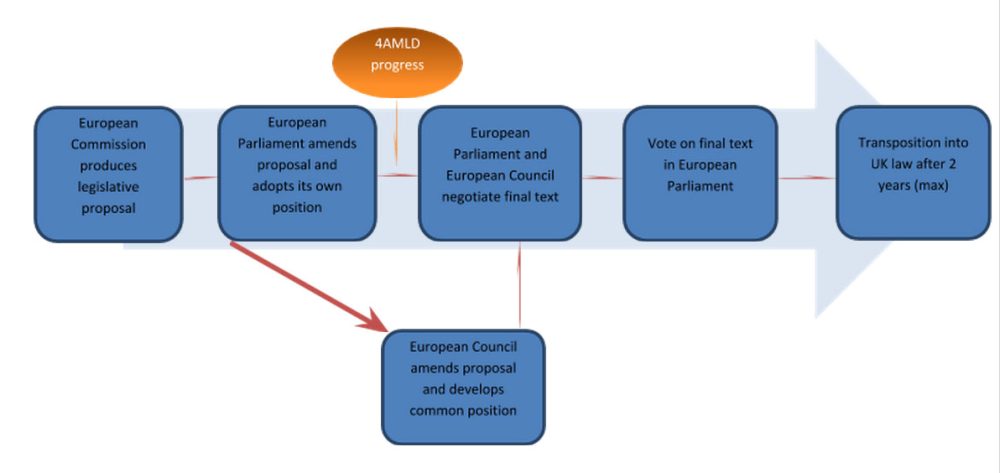

In 2013 the European Commission released its proposal for the 4 th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered. By Nina Kerkez Senior Product Manager KYC Solutions Accuity. In 2013 the European Commission released its proposal for the 4 th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered. It will also ensure consistency in the application of such laws across all EU Member States. DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and reputation of the financial sector and threaten the internal market of the Union as well as international development. This Directive is the fourth directive to address the threat of money laundering.

Source: coinfirm.com

Source: coinfirm.com

When money is being laundered corruption is being facilitated allowing many standards to be undermined. The Fourth EU Money Laundering Directive 4MLD which came into force on June 26 2015 is designed to bring a more robust risk-based approach to the prevention of money laundering and terrorist financing across all. The changes are in. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. During those ten years the financial industry has faced many challenges and changes which have put more pressure on the regulators to monitor.

Source: financierworldwide.com

Source: financierworldwide.com

The Fourth Money Laundering Directive Implementation date. The 4th AMLD recasts the existing 3rd Anti-Money Laundering Directive Directive 200560EU and the corresponding Implementing Directive Commission Directive 200670EC. The Fourth Money Laundering Directive widens the definition of a Politically Exposed Persons PEP to include citizens holding prominent positions in their home country such as politicians the judiciary and senior members of the armed services as well as those of overseas countries. Te n years on since the passing of the Third Money Laundering Directive the EU 4 th Money Laundering Directive 4MLD was finally approved in May 2015 by the European Parliament. The Fourth EU Money Laundering Directive 4MLD which came into force on June 26 2015 is designed to bring a more robust risk-based approach to the prevention of money laundering and terrorist financing across all.

Source: slideplayer.com

Source: slideplayer.com

10 key changes within the fourth EU money laundering directive by Alex Ford Jul 11 2017 All Blog Posts The new regulations will Encompass the use of a risk based approach to customer onboarding a named individual who sits at board level and changes to the due diligence process. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. 26 June 2017 The Fourth Anti Money Laundering Directive broadly focused on aligning EU policy with AMLCFT guidelines from the Financial Action Task Force FATF. The 4th AMLD recasts the existing 3rd Anti-Money Laundering Directive Directive 200560EU and the corresponding Implementing Directive Commission Directive 200670EC. 4MLD looks to give effect to the updated standards that have been set by the Financial Action Task Force FATF.

Source: slideshare.net

Source: slideshare.net

4th Money Laundering Directive Key Changes and how it will impact you The new Fourth Money Laundering Directive EU 2015849 was passed by the EU in June 2015 and will be implemented in the UK by June 2017. The Crown Dependencies have as yet not changed these limits. When money is being laundered corruption is being facilitated allowing many standards to be undermined. 10 key changes within the fourth EU money laundering directive by Alex Ford Jul 11 2017 All Blog Posts The new regulations will Encompass the use of a risk based approach to customer onboarding a named individual who sits at board level and changes to the due diligence process. 4MLD looks to give effect to the updated standards that have been set by the Financial Action Task Force FATF.

Source: coe.int

Source: coe.int

The proposals were based in response to the Financial Action Task Force FATF 2012. The draft Fourth EU Anti Money Laundering Directive AMLD4 is designed to update and improve the EUs Anti-Money Laundering AML and Counter-Terrorist Financing CTF laws. It takes into account the 40 new recommendations adopted by the Financial Action Task Force FATF on 16 February 2012 which the EU Member States have committed to. CDD Simplified CDD will no longer be applicable in most circumstances. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015.

Source: hedgethink.com

Source: hedgethink.com

The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015. The EU Commission determines which countries are. Summary of the Fourth Money Laundering Directive 4MLD Last summer on 5th June 2015 the Fourth Money Laundering Directive also referred to as 4MLD or MLD4 was published in the EU Official Journal. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. Key Aspects of the 4th EU Anti-Money Laundering Directive The EU Regulation 2015849 entered into force on 26 th of June 2017.

Source: bankinghub.eu

Source: bankinghub.eu

26 June 2017 The Fourth Anti Money Laundering Directive broadly focused on aligning EU policy with AMLCFT guidelines from the Financial Action Task Force FATF. Te n years on since the passing of the Third Money Laundering Directive the EU 4 th Money Laundering Directive 4MLD was finally approved in May 2015 by the European Parliament. Key Aspects of the 4th EU Anti-Money Laundering Directive The EU Regulation 2015849 entered into force on 26 th of June 2017. The 4th AMLD recasts the existing 3rd Anti-Money Laundering Directive Directive 200560EU and the corresponding Implementing Directive Commission Directive 200670EC. DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and reputation of the financial sector and threaten the internal market of the Union as well as international development.

Source:

The draft Fourth EU Anti Money Laundering Directive AMLD4 is designed to update and improve the EUs Anti-Money Laundering AML and Counter-Terrorist Financing CTF laws. This Directive is the fourth directive to address the threat of money laundering. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. It takes into account the 40 new recommendations adopted by the Financial Action Task Force FATF on 16 February 2012 which the EU Member States have committed to. Key Changes Within The Fourth EU Money Laundering Directive.

Source: bankinghub.eu

Source: bankinghub.eu

The Fourth Money Laundering Directive widens the definition of a Politically Exposed Persons PEP to include citizens holding prominent positions in their home country such as politicians the judiciary and senior members of the armed services as well as those of overseas countries. It takes into account the 40 new recommendations adopted by the Financial Action Task Force FATF on 16 February 2012 which the EU Member States have committed to. The EU Commission determines which countries are. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015. Under the 4 th Anti-Money Laundering Directive the persons affected were already obliged to exercise greater due diligence when dealing with natural or legal persons established in high-risk third countries.

Source: tookitaki.ai

Source: tookitaki.ai

DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and reputation of the financial sector and threaten the internal market of the Union as well as international development. 26 June 2017 The Fourth Anti Money Laundering Directive broadly focused on aligning EU policy with AMLCFT guidelines from the Financial Action Task Force FATF. 4th Money Laundering Directive Key Changes and how it will impact you The new Fourth Money Laundering Directive EU 2015849 was passed by the EU in June 2015 and will be implemented in the UK by June 2017. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. This Directive is the fourth directive to address the threat of money laundering.

Source: complyadvantage.com

Source: complyadvantage.com

Key Aspects of the 4th EU Anti-Money Laundering Directive The EU Regulation 2015849 entered into force on 26 th of June 2017. The Fourth EU Money Laundering Directive 4MLD which came into force on June 26 2015 is designed to bring a more robust risk-based approach to the prevention of money laundering and terrorist financing across all. The Fourth Money Laundering Directive widens the definition of a Politically Exposed Persons PEP to include citizens holding prominent positions in their home country such as politicians the judiciary and senior members of the armed services as well as those of overseas countries. Tue Jun 7 2016. 10 key changes within the fourth EU money laundering directive by Alex Ford Jul 11 2017 All Blog Posts The new regulations will Encompass the use of a risk based approach to customer onboarding a named individual who sits at board level and changes to the due diligence process.

Source: eklawyers.com

Source: eklawyers.com

The Fourth Directive reduced the transaction limits where CDD is required from 15000 to 10000 and for casinos to 2000 for a stake of collecting winnings. The Fourth Money Laundering Directive Implementation date. The proposals were based in response to the Financial Action Task Force FATF 2012. The changes are in. The 4th AMLD recasts the existing 3rd Anti-Money Laundering Directive Directive 200560EU and the corresponding Implementing Directive Commission Directive 200670EC.

Source: bankinghub.eu

Source: bankinghub.eu

It will also ensure consistency in the application of such laws across all EU Member States. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015. The Fourth Money Laundering Directive Implementation date. The Crown Dependencies have as yet not changed these limits. When money is being laundered corruption is being facilitated allowing many standards to be undermined.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 4th money laundering directive summary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas