20+ 5amld risk assessment info

Home » money laundering Info » 20+ 5amld risk assessment infoYour 5amld risk assessment images are ready in this website. 5amld risk assessment are a topic that is being searched for and liked by netizens now. You can Find and Download the 5amld risk assessment files here. Find and Download all free images.

If you’re looking for 5amld risk assessment pictures information linked to the 5amld risk assessment topic, you have come to the right blog. Our site frequently gives you suggestions for viewing the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

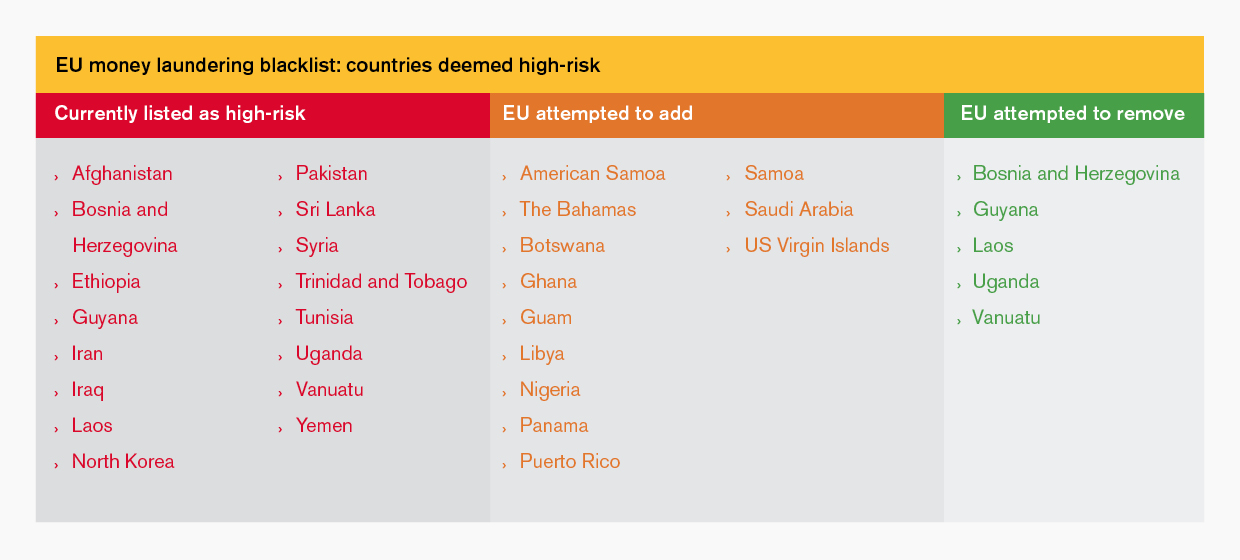

5amld Risk Assessment. This could trigger changes to Client Due Diligence CDDKnow Your Customer KYC and client risk assessments at onboarding and on an ongoing basis to ensure that the firms controls remain. Companies that do business with customers from high-risk third countries are under 5AMLD required to perform enhanced due diligence measures specifically focused on addressing the deficiencies in those countries AML protections and the money laundering risks they present. The 5AMLD came into force on January 10th 2020. By adopting a risk assessment practice to combat money laundering EXMO ensures that measures to prevent or deter money laundering and terrorist financing are commensurate with the risks.

Risky Business 5amld And Edd Acams Today From acamstoday.org

Risky Business 5amld And Edd Acams Today From acamstoday.org

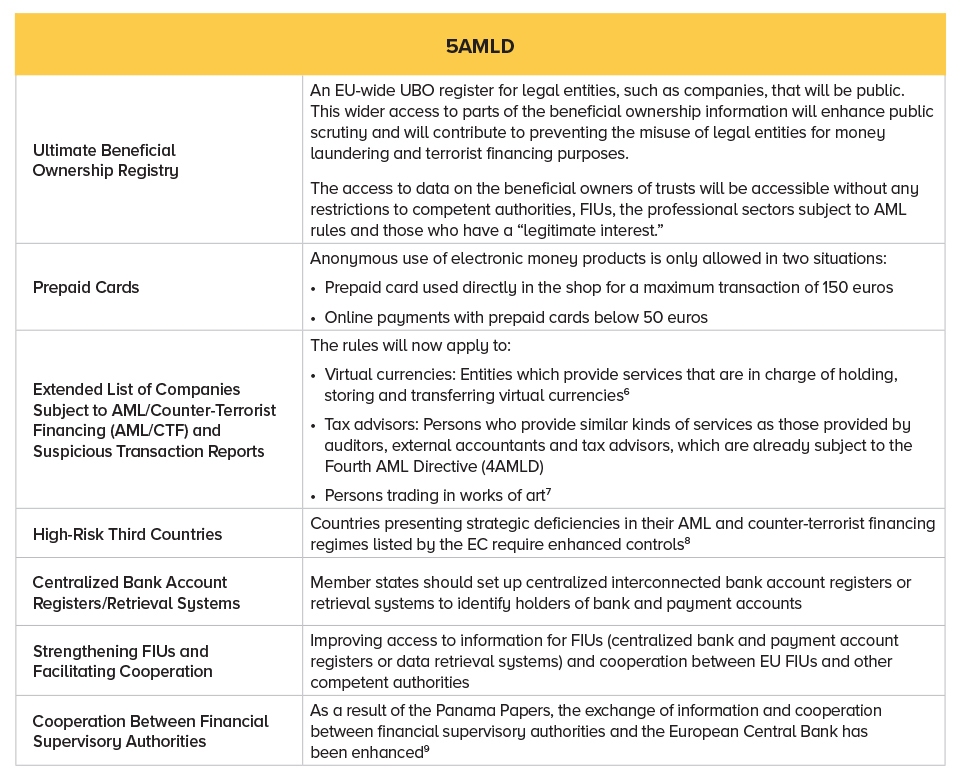

The 5AMLD strengthens these changes including extending the scope to include all tax advisory services art dealers letting agents virtual currency exchanges and custodian wallet providers and introduces new measures including the following. High-Risk Third Countries. One of the aims of the 4AMLD was to discourage firms from blanket screening their clients by introducing a risk-based assessment approach. The full text of the Scheme is available here. There are three things cryptocurrency businesses can do now to start complying with 5AMLD requirements. You can read the directive here.

By adopting a risk assessment practice to combat money laundering EXMO ensures that measures to prevent or deter money laundering and terrorist financing are commensurate with the risks.

There are three things cryptocurrency businesses can do now to start complying with 5AMLD requirements. The 5AMLD came into force on January 10th 2020. The measures require firms to. High-Risk Third Countries. The 5AMLD strengthens these changes including extending the scope to include all tax advisory services art dealers letting agents virtual currency exchanges and custodian wallet providers and introduces new measures including the following. This risk analysis is conceived as a key tool to identify analyse and address money laundering and terrorist financing risks in the EU.

Source: aml-knowledge-centre.org

Source: aml-knowledge-centre.org

13 MLR 2019 contains a number of additional requirements for business relationships or transactions involving a party established in a high-risk country. This risk analysis is conceived as a key tool to identify analyse and address money laundering and terrorist financing risks in the EU. The full text of the Fifth Anti-Money Laundering Directive 5AMLD can be found at httpsbitly2KPksQk. Risk rating methodologies may require updating and may necessitate assessment and modification of KYC systems and procedures to fully address the EDD requirements set out in the 5AMLD for all transactions involving high-risk third countries. The full text of the Scheme is available here.

Source: acamstoday.org

Source: acamstoday.org

These will affect your risk assessment as part of CDD. Additional risk factors have been added including golden visa applicants dealing with a client non face-to-face without reliable electronic CDD and transaction risks including oil arms precious metals tobacco ivory and protected species. Ireland conduct a more comprehensive MLTF risk assessment of how legal persons and arrangements could be abused. One of the aims of the 4AMLD was to discourage firms from blanket screening their clients by introducing a risk-based assessment approach. Other Member States may provide relevant additional information where appropriate to the Member State carrying out the risk assessment.

Source: medium.com

Source: medium.com

Essentially the 5AMLD further raises the benchmarks for the practice of EDD on high-risk customers. There are three things cryptocurrency businesses can do now to start complying with 5AMLD requirements. Fifth Anti-Money Laundering Directive. The risk of such services being used by terrorist organisations looms large on the horizon leading to strict scrutiny measures for the crypto realm in 5AMLD. 13 MLR 2019 contains a number of additional requirements for business relationships or transactions involving a party established in a high-risk country.

Source: acamstoday.org

Source: acamstoday.org

The draft 5AMLD1 was first published in July 2016. In the cryptocurrency space risks include money laundering fraud theft sanctions evasion and terrorism financing. Essentially the 5AMLD further raises the benchmarks for the practice of EDD on high-risk customers. 5AMLD EU 5th Anti-Money Laundering Directive AMLSC Anti-Money Laundering Steering Committee AML Anti-Money Laundering ARF Approved Retirement Fund AMRF Approved Minimum Retirement Fund. One of the aims of the 4AMLD was to discourage firms from blanket screening their clients by introducing a risk-based assessment approach.

Source: pinterest.com

Source: pinterest.com

The European Commission carries out risk assessments in order to identify and respond to risks affecting the EU internal market. In the cryptocurrency space risks include money laundering fraud theft sanctions evasion and terrorism financing. There are three things cryptocurrency businesses can do now to start complying with 5AMLD requirements. Conduct a risk assessment. Additional risk factors have been added including golden visa applicants dealing with a client non face-to-face without reliable electronic CDD and transaction risks including oil arms precious metals tobacco ivory and protected species.

Source: basisid.medium.com

Source: basisid.medium.com

The draft 5AMLD1 was first published in July 2016. One of the aims of the 4AMLD was to discourage firms from blanket screening their clients by introducing a risk-based assessment approach. The risk of such services being used by terrorist organisations looms large on the horizon leading to strict scrutiny measures for the crypto realm in 5AMLD. Virtual currency remittance systems are also at the risk of being used for terrorist and illegal activity financing. The European Commission carries out risk assessments in order to identify and respond to risks affecting the EU internal market.

Source: coinfirm.com

Source: coinfirm.com

The full text of the Scheme is available here. 5AMLD EU 5th Anti-Money Laundering Directive AMLSC Anti-Money Laundering Steering Committee AML Anti-Money Laundering ARF Approved Retirement Fund AMRF Approved Minimum Retirement Fund. 5 th anti-money laundering Directive. Virtual currency remittance systems are also at the risk of being used for terrorist and illegal activity financing. These will affect your risk assessment as part of CDD.

Source: sygna.io

Source: sygna.io

13 MLR 2019 contains a number of additional requirements for business relationships or transactions involving a party established in a high-risk country. High-risk third countries remain those identified by the European Commission as such although 5MLD broadens the assessment criteria suggesting that the list will likely increase. The European Commission carries out risk assessments in order to identify and respond to risks affecting the EU internal market. One of the aims of the 4AMLD was to discourage firms from blanket screening their clients by introducing a risk-based assessment approach. In the cryptocurrency space risks include money laundering fraud theft sanctions evasion and terrorism financing.

Source: globalriskaffairs.com

Source: globalriskaffairs.com

High-Risk Third Countries. 5AMLD EU 5th Anti-Money Laundering Directive AMLSC Anti-Money Laundering Steering Committee AML Anti-Money Laundering ARF Approved Retirement Fund AMRF Approved Minimum Retirement Fund. 5 th anti-money laundering Directive. There are three things cryptocurrency businesses can do now to start complying with 5AMLD requirements. The full text of the Fifth Anti-Money Laundering Directive 5AMLD can be found at httpsbitly2KPksQk.

Source: complyadvantage.com

Source: complyadvantage.com

You can read the directive here. Companies that do business with customers from high-risk third countries are under 5AMLD required to perform enhanced due diligence measures specifically focused on addressing the deficiencies in those countries AML protections and the money laundering risks they present. Ireland conduct a more comprehensive MLTF risk assessment of how legal persons and arrangements could be abused. Risk rating methodologies may require updating and may necessitate assessment and modification of KYC systems and procedures to fully address the EDD requirements set out in the 5AMLD for all transactions involving high-risk third countries. The full text of the Scheme is available here.

Source: basisid.com

Source: basisid.com

The Member States had to transpose this Directive by 10 January 2020. The 5AMLD strengthens these changes including extending the scope to include all tax advisory services art dealers letting agents virtual currency exchanges and custodian wallet providers and introduces new measures including the following. Virtual currency remittance systems are also at the risk of being used for terrorist and illegal activity financing. The draft 5AMLD1 was first published in July 2016. Other Member States may provide relevant additional information where appropriate to the Member State carrying out the risk assessment.

Source: gtreview.com

Source: gtreview.com

5 th anti-money laundering Directive. The draft 5AMLD1 was first published in July 2016. One of the aims of the 4AMLD was to discourage firms from blanket screening their clients by introducing a risk-based assessment approach. The full text of the Fifth Anti-Money Laundering Directive 5AMLD can be found at httpsbitly2KPksQk. This risk analysis is conceived as a key tool to identify analyse and address money laundering and terrorist financing risks in the EU.

Source: elsavco.com

Source: elsavco.com

The implementation of the Fifth Anti-Money Laundering Directive 5AMLD at the start of the year and the newly updated UK National Risk Assessment were long awaited updates that will help to drive positive change within the financial sector and beyond. One of the aims of the 4AMLD was to discourage firms from blanket screening their clients by introducing a risk-based assessment approach. It aims at providing a comprehensive mapping of risks on all relevant areas as well as recommendations to Member States European Supervisory Authorities and obliged entities to mitigate these risks. Essentially the 5AMLD further raises the benchmarks for the practice of EDD on high-risk customers. High-Risk Third Countries.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 5amld risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas