11+ 5th directive money laundering amendment information

Home » money laundering idea » 11+ 5th directive money laundering amendment informationYour 5th directive money laundering amendment images are available. 5th directive money laundering amendment are a topic that is being searched for and liked by netizens today. You can Get the 5th directive money laundering amendment files here. Find and Download all royalty-free vectors.

If you’re looking for 5th directive money laundering amendment pictures information connected with to the 5th directive money laundering amendment keyword, you have visit the right blog. Our site frequently gives you suggestions for viewing the highest quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

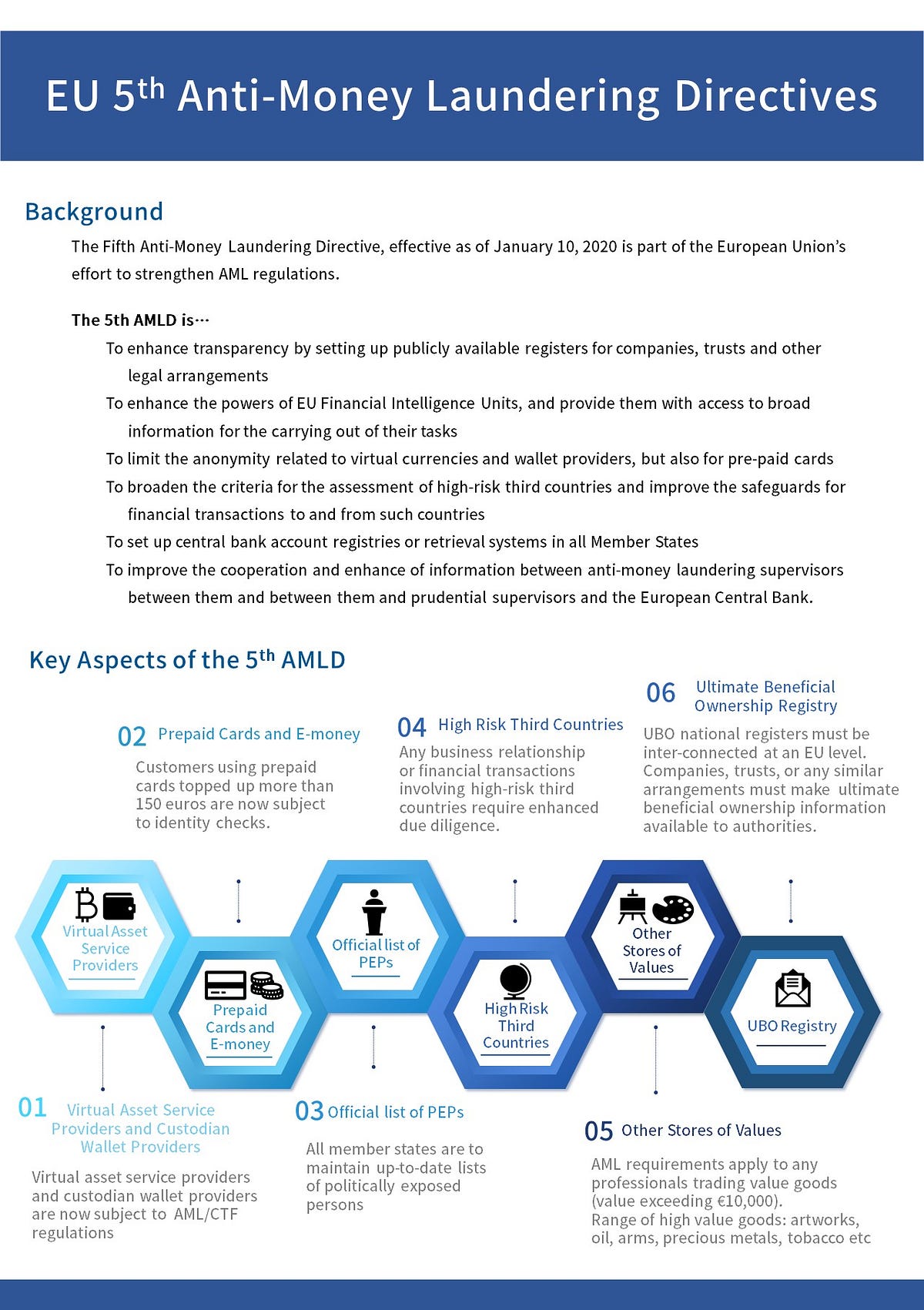

5th Directive Money Laundering Amendment. Key Changes introduced by the 2021 Act Bringing certain dealers and intermediaries in the art trade within the scope of the regime. The sources of the money in precise are criminal and the cash is invested in a method that makes it appear like clear cash and conceal the id of the legal a part of the cash earned. This will bring the country in line with the current European anti-money laundering and countering the financing of terrorism AMLCFT framework. Since the objective of this Directive namely the protection of the financial system by means of prevention detection and investigation of money laundering and terrorist financing cannot be sufficiently achieved by the Member States as individual measures adopted by Member States to protect their financial systems could be inconsistent with the functioning of the internal market and with the.

What Is The Fifth Money Laundering Directive Vinciworks Blog From vinciworks.com

What Is The Fifth Money Laundering Directive Vinciworks Blog From vinciworks.com

On 19 April 2018 the European Parliament adopted the 5th AntiMoney Laundering Directive. This will bring the country in line with the current European anti-money laundering and countering the financing of terrorism AMLCFT framework. The transposition of this EU directive has resulted in amendments to the existing Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The idea of cash laundering is very important to be understood for those working within the financial sector. In addition to the implementation of the Amending Directive Directive EU 2018843 the so-called Fifth EU Anti-Money Laundering Directive the amendment of the GwG introduces new obligations and stricter individual requirements for obliged persons subject to the GwG which must be taken into account especially in relation to customer onboarding and ongoing AML- compliance. This change has been driven by the EUs Fifth Money Laundering Directive the effect of which has despite Brexit been brought into English law by the Money Laundering and Terrorist Financing Amendment EU Exit Regulations 2020 most of which came into force on 6 October 2020 2020 Regulations.

The European Unions EU fifth Anti-Money Laundering Directive AMLD was drafted to enhance the previous AMLDs by increasing the transparency requirements for trusts.

Since the objective of this Directive namely the protection of the financial system by means of prevention detection and investigation of money laundering and terrorist financing cannot be sufficiently achieved by the Member States as individual measures adopted by Member States to protect their financial systems could be inconsistent with the functioning of the internal market and with the. The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the. Ad Search for 5th directive at TravelSearchExpert. The Money Laundering and Terrorist Financing Amendment Regulations 2019. In addition to the implementation of the Amending Directive Directive EU 2018843 the so-called Fifth EU Anti-Money Laundering Directive the amendment of the GwG introduces new obligations and stricter individual requirements for obliged persons subject to the GwG which must be taken into account especially in relation to customer onboarding and ongoing AML- compliance. The objective of the increased requirements were anticipated to yield the same transparency results and standards placed on corporate structures.

Source: arachnys.com

Source: arachnys.com

DIRECTIVE EU 2018843 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 30 May 2018 amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives 2009138EC and. This will bring the country in line with the current European anti-money laundering and countering the financing of terrorism AMLCFT framework. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering. Since the objective of this Directive namely the protection of the financial system by means of prevention detection and investigation of money laundering and terrorist financing cannot be sufficiently achieved by the Member States as individual measures adopted by Member States to protect their financial systems could be inconsistent with the functioning of the internal market and with the. On June 19th 2018 the fifth EU Anti-Money Laundering Directive AMLD 5 was published in the official journal of the European Union.

Source: vinciworks.com

Source: vinciworks.com

Key Changes introduced by the 2021 Act Bringing certain dealers and intermediaries in the art trade within the scope of the regime. Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission. In addition to the implementation of the Amending Directive Directive EU 2018843 the so-called Fifth EU Anti-Money Laundering Directive the amendment of the GwG introduces new obligations and stricter individual requirements for obliged persons subject to the GwG which must be taken into account especially in relation to customer onboarding and ongoing AML- compliance. This change has been driven by the EUs Fifth Money Laundering Directive the effect of which has despite Brexit been brought into English law by the Money Laundering and Terrorist Financing Amendment EU Exit Regulations 2020 most of which came into force on 6 October 2020 2020 Regulations. The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the.

Source: idenfy.com

Source: idenfy.com

This change has been driven by the EUs Fifth Money Laundering Directive the effect of which has despite Brexit been brought into English law by the Money Laundering and Terrorist Financing Amendment EU Exit Regulations 2020 most of which came into force on 6 October 2020 2020 Regulations. The idea of cash laundering is very important to be understood for those working within the financial sector. The UKs revisions implement the European Unions Fifth Anti-Money Laundering Directive commonly referred to as 5MLD and are designed to strengthen. This change has been driven by the EUs Fifth Money Laundering Directive the effect of which has despite Brexit been brought into English law by the Money Laundering and Terrorist Financing Amendment EU Exit Regulations 2020 most of which came into force on 6 October 2020 2020 Regulations. Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission.

Source: smartsearch.com

Source: smartsearch.com

The idea of cash laundering is very important to be understood for those working within the financial sector. The Money Laundering and Terrorist Financing Amendment Regulations 2019. The idea of cash laundering is very important to be understood for those working within the financial sector. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering. On June 19th 2018 the fifth EU Anti-Money Laundering Directive AMLD 5 was published in the official journal of the European Union.

Source: tech-prospect.com

Source: tech-prospect.com

The objective of the increased requirements were anticipated to yield the same transparency results and standards placed on corporate structures. Ad Search for 5th directive at TravelSearchExpert. The idea of cash laundering is very important to be understood for those working within the financial sector. Its a process by which dirty cash is transformed into clear cash. The Money Laundering and Terrorist Financing Amendment Regulations 2019.

Source: medium.com

Source: medium.com

On June 19th 2018 the fifth EU Anti-Money Laundering Directive AMLD 5 was published in the official journal of the European Union. The 5th Money Laundering Directive was implemented on 10th January 2020 and is now known as. FIFTHANTI-MONEY LAUNDERINGDIRECTIVEAMLD5 Directive EU 2018843 of the European Parliament and of the Council of 30 May 2018 amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives 2009138EC and 201336EU. The European Unions EU fifth Anti-Money Laundering Directive AMLD was drafted to enhance the previous AMLDs by increasing the transparency requirements for trusts. On 19 April 2018 the European Parliament adopted the 5th AntiMoney Laundering Directive.

Source: argoskyc.medium.com

Source: argoskyc.medium.com

Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission. The UKs revisions implement the European Unions Fifth Anti-Money Laundering Directive commonly referred to as 5MLD and are designed to strengthen. This will bring the country in line with the current European anti-money laundering and countering the financing of terrorism AMLCFT framework. The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the. Its a process by which dirty cash is transformed into clear cash.

Source: vinciworks.com

Source: vinciworks.com

The idea of cash laundering is very important to be understood for those working within the financial sector. Its a process by which dirty cash is transformed into clear cash. On April 19 2018 the European Parliament EP adopted the European Commissions the Commission proposal for a Fifth Anti-Money Laundering Directive AMLD5 to prevent terrorist financing and money laundering through the European Unions EU financial system. The objective of the increased requirements were anticipated to yield the same transparency results and standards placed on corporate structures. Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission.

Source: companyformations.ie

Source: companyformations.ie

The 5th Money Laundering Directive was implemented on 10th January 2020 and is now known as. Since the objective of this Directive namely the protection of the financial system by means of prevention detection and investigation of money laundering and terrorist financing cannot be sufficiently achieved by the Member States as individual measures adopted by Member States to protect their financial systems could be inconsistent with the functioning of the internal market and with the. In addition to the implementation of the Amending Directive Directive EU 2018843 the so-called Fifth EU Anti-Money Laundering Directive the amendment of the GwG introduces new obligations and stricter individual requirements for obliged persons subject to the GwG which must be taken into account especially in relation to customer onboarding and ongoing AML- compliance. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering. The idea of cash laundering is very important to be understood for those working within the financial sector.

Source: mortgagefinancegazette.com

Source: mortgagefinancegazette.com

The European Unions EU fifth Anti-Money Laundering Directive AMLD was drafted to enhance the previous AMLDs by increasing the transparency requirements for trusts. Ad Search for 5th directive at TravelSearchExpert. The 5th Money Laundering Directive was implemented on 10th January 2020 and is now known as. On April 19 2018 the European Parliament EP adopted the European Commissions the Commission proposal for a Fifth Anti-Money Laundering Directive AMLD5 to prevent terrorist financing and money laundering through the European Unions EU financial system. The 2021 Act amends the Criminal Justice Money Laundering and Terrorist Financing Act 2010 2010 Act and transposes the Fifth Money Laundering Directive - Directive EU 2018843 5MLD into Irish Law.

Source: fineksus.com

Source: fineksus.com

In addition to the implementation of the Amending Directive Directive EU 2018843 the so-called Fifth EU Anti-Money Laundering Directive the amendment of the GwG introduces new obligations and stricter individual requirements for obliged persons subject to the GwG which must be taken into account especially in relation to customer onboarding and ongoing AML- compliance. This change has been driven by the EUs Fifth Money Laundering Directive the effect of which has despite Brexit been brought into English law by the Money Laundering and Terrorist Financing Amendment EU Exit Regulations 2020 most of which came into force on 6 October 2020 2020 Regulations. The European Unions EU fifth Anti-Money Laundering Directive AMLD was drafted to enhance the previous AMLDs by increasing the transparency requirements for trusts. In addition to the implementation of the Amending Directive Directive EU 2018843 the so-called Fifth EU Anti-Money Laundering Directive the amendment of the GwG introduces new obligations and stricter individual requirements for obliged persons subject to the GwG which must be taken into account especially in relation to customer onboarding and ongoing AML- compliance. The sources of the money in precise are criminal and the cash is invested in a method that makes it appear like clear cash and conceal the id of the legal a part of the cash earned.

Source: sygna.io

This change has been driven by the EUs Fifth Money Laundering Directive the effect of which has despite Brexit been brought into English law by the Money Laundering and Terrorist Financing Amendment EU Exit Regulations 2020 most of which came into force on 6 October 2020 2020 Regulations. On June 19th 2018 the fifth EU Anti-Money Laundering Directive AMLD 5 was published in the official journal of the European Union. The transposition of this EU directive has resulted in amendments to the existing Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Since the objective of this Directive namely the protection of the financial system by means of prevention detection and investigation of money laundering and terrorist financing cannot be sufficiently achieved by the Member States as individual measures adopted by Member States to protect their financial systems could be inconsistent with the functioning of the internal market and with the. On 19 April 2018 the European Parliament adopted the 5th AntiMoney Laundering Directive.

Source: mondaq.com

Source: mondaq.com

Since the objective of this Directive namely the protection of the financial system by means of prevention detection and investigation of money laundering and terrorist financing cannot be sufficiently achieved by the Member States as individual measures adopted by Member States to protect their financial systems could be inconsistent with the functioning of the internal market and with the. Since the objective of this Directive namely the protection of the financial system by means of prevention detection and investigation of money laundering and terrorist financing cannot be sufficiently achieved by the Member States as individual measures adopted by Member States to protect their financial systems could be inconsistent with the functioning of the internal market and with the. The UKs revisions implement the European Unions Fifth Anti-Money Laundering Directive commonly referred to as 5MLD and are designed to strengthen. The 5th Money Laundering Directive was implemented on 10th January 2020 and is now known as. The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 5th directive money laundering amendment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 17+ Bsa aml penalties information