11+ 5th money laundering directive jersey ideas

Home » money laundering idea » 11+ 5th money laundering directive jersey ideasYour 5th money laundering directive jersey images are ready. 5th money laundering directive jersey are a topic that is being searched for and liked by netizens today. You can Find and Download the 5th money laundering directive jersey files here. Get all free vectors.

If you’re searching for 5th money laundering directive jersey images information connected with to the 5th money laundering directive jersey keyword, you have pay a visit to the right site. Our website frequently provides you with suggestions for seeing the highest quality video and image content, please kindly search and locate more informative video articles and images that match your interests.

5th Money Laundering Directive Jersey. Setting up centralised bank account registers or retrieval systems. The Fifth Anti-Money Laundering Directive 5AMLD came into effect on the 10th January 2020 and serves to address new issues that have been exposed since the Fourth Anti-Money Laundering Directive which came into force back in 2017. GOV UK Consultation Paper on Fifth Money Laundering Directive Trust Registration Service. Jersey maintains its effective stance against money laundering Jerseys anti-money laundering legislation has been extended and has also been supplemented by detailed guidance in accordance with the standards of international best practice.

Anti Money Laundering 6th Directive To Follow Shortly After 5th Directive Pinel Advocates From pineladvocates.com

Anti Money Laundering 6th Directive To Follow Shortly After 5th Directive Pinel Advocates From pineladvocates.com

For simplicity and clarity money laundering hereafter mentioned is in consideration of efforts to combat terrorist financing unless expressly stated otherwise. With the 5th EU Anti-Money Laundering Directive EU Directive 2018843 of May 30 2018 which entered into force on July 9 2018 the European legislator now intends to further improve the preventive regime created by the implementation of the 4th EU Anti-Money Laundering Directive in order to combat money laundering practices and terrorist financing more effectively. Setting up centralised bank account registers or retrieval systems. 5AMLD is perceived as being the EUs reaction to among other things the terrorist attacks which occurred across Europe in 2016. The Fifth AML Directive is a response to the recent terrorist attacks across the EU and the offshore. As per the European Commissions fact sheet on the 5 th Anti-Money Laundering Directive this directive aims at.

Nicholas Ryder a Professor in Financial Crime at UWE Bristols School of Law talked to us about the 5th Anti-Money Laundering Directive and how its not fit for purpose particularly when it comes to regulating and monitoring virtual currencies and crypto assets.

First however the Jersey government will consider its position in relation to the 4th and 5th anti-money laundering Directive of the European Union in due course. The Fifth Anti-Money Laundering Directive 5AMLD came into effect on the 10th January 2020 and serves to address new issues that have been exposed since the Fourth Anti-Money Laundering Directive which came into force back in 2017. 5AMLD is perceived as being the EUs reaction to among other things the terrorist attacks which occurred across Europe in 2016. Its a process by which dirty cash is transformed into clear cash. 4AMLD required EU Member States to implement a central register of beneficial ownership for companies and other legal entities. The idea of cash laundering is very important to be understood for those working within the financial sector.

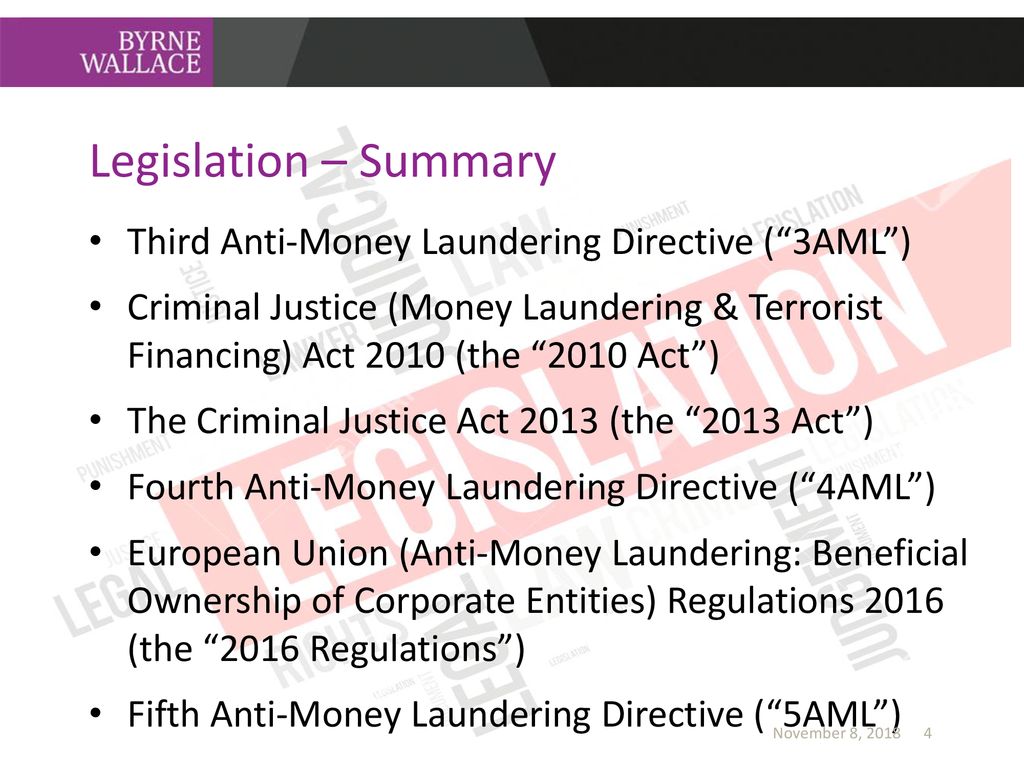

Source: slideplayer.com

Source: slideplayer.com

GOV UK Consultation Paper on Fifth Money Laundering Directive Trust Registration Service. With the 5th EU Anti-Money Laundering Directive EU Directive 2018843 of May 30 2018 which entered into force on July 9 2018 the European legislator now intends to further improve the preventive regime created by the implementation of the 4th EU Anti-Money Laundering Directive in order to combat money laundering practices and terrorist financing more effectively. The sources of the money in precise are criminal and the cash is invested in a method that makes it appear like clear cash and conceal the id of the legal a part of the cash earned. The fifth directive of 30 May 2018 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing the Fifth AML Directive was published yesterday in the Official Journal of the European Union. First however the Jersey government will consider its position in relation to the 4th and 5th anti-money laundering Directive of the European Union in due course.

Source: jerseyfinance.je

Source: jerseyfinance.je

Enhancing cooperation between financial supervisory authorities. 5AMLD is the successor to the EUs Fourth Anti-Money Laundering Directive 4AMLD which has been operative since 26 June 2017. Jersey maintains its effective stance against money laundering Jerseys anti-money laundering legislation has been extended and has also been supplemented by detailed guidance in accordance with the standards of international best practice. Jersey Guernsey and the Isle of Man are not members of the European Union and are not obligated to adopt the EUs Fourth Anti-Money Laundering Directive as the UK has done with the Money Laundering Regulations 2017. The Fifth AML Directive is a response to the recent terrorist attacks across the EU and the offshore.

Source: basisid.com

Source: basisid.com

OQ1942019 Does the Jersey Government share the approach adopted by the UK. 4AMLD required EU Member States to implement a central register of beneficial ownership for companies and other legal entities. For simplicity and clarity money laundering hereafter mentioned is in consideration of efforts to combat terrorist financing unless expressly stated otherwise. With the 5th EU Anti-Money Laundering Directive EU Directive 2018843 of May 30 2018 which entered into force on July 9 2018 the European legislator now intends to further improve the preventive regime created by the implementation of the 4th EU Anti-Money Laundering Directive in order to combat money laundering practices and terrorist financing more effectively. First however the Jersey government will consider its position in relation to the 4th and 5th anti-money laundering Directive of the European Union in due course.

Source: slideplayer.com

Source: slideplayer.com

As per the European Commissions fact sheet on the 5 th Anti-Money Laundering Directive this directive aims at. 4AMLD required EU Member States to implement a central register of beneficial ownership for companies and other legal entities. The Fifth Anti-Money Laundering Directive 5AMLD came into effect on the 10th January 2020 and serves to address new issues that have been exposed since the Fourth Anti-Money Laundering Directive which came into force back in 2017. We welcome views and evidence on the draft regulations and additional proposals to expand the Trust Registration Service to comply with the Fifth Money Laundering Directive. Its a process by which dirty cash is transformed into clear cash.

Source: ifcreview.com

Source: ifcreview.com

Its a process by which dirty cash is transformed into clear cash. GOV UK Consultation Paper on Fifth Money Laundering Directive Trust Registration Service. The idea of cash laundering is very important to be understood for those working within the financial sector. The Fifth AML Directive is a response to the recent terrorist attacks across the EU and the offshore. We welcome views and evidence on the draft regulations and additional proposals to expand the Trust Registration Service to comply with the Fifth Money Laundering Directive.

Source: accountancydaily.co

Source: accountancydaily.co

5AMLD is the successor to the EUs Fourth Anti-Money Laundering Directive 4AMLD which has been operative since 26 June 2017. On 19 April 2018 the European Parliament adopted the 5th AntiMoney Laundering Directive. The Fifth AML Directive is a response to the recent terrorist attacks across the EU and the offshore. Lifting the anonymity on electronic money. The 5th Anti-Money laundering directive has been adopted and entered into force on 9 July 2018.

Source: mondaq.com

Source: mondaq.com

OQ1942019 Does the Jersey Government share the approach adopted by the UK. Adopting EU standards on financial crime can be important for market access to the EU and to ensure that the jurisdiction is not considered to be a high risk third country by the EU. 4AMLD required EU Member States to implement a central register of beneficial ownership for companies and other legal entities. 5AMLD is perceived as being the EUs reaction to among other things the terrorist attacks which occurred across Europe in 2016. On 19 April 2018 the European Parliament adopted the 5th AntiMoney Laundering Directive.

The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020. Nicholas Ryder a Professor in Financial Crime at UWE Bristols School of Law talked to us about the 5th Anti-Money Laundering Directive and how its not fit for purpose particularly when it comes to regulating and monitoring virtual currencies and crypto assets. Its a process by which dirty cash is transformed into clear cash. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. The Fifth Anti-Money Laundering Directive 5AMLD came into effect on the 10th January 2020 and serves to address new issues that have been exposed since the Fourth Anti-Money Laundering Directive which came into force back in 2017.

Source: slideshare.net

Source: slideshare.net

5AMLD is perceived as being the EUs reaction to among other things the terrorist attacks which occurred across Europe in 2016. OQ1942019 Does the Jersey Government share the approach adopted by the UK. Enhancing the powers of EU Financial Intelligence Units and facilitating their cooperation. The Fifth AML Directive is a response to the recent terrorist attacks across the EU and the offshore. The sources of the money in precise are criminal and the cash is invested in a method that makes it appear like clear cash and conceal the id of the legal a part of the cash earned.

Source: taxjustice.net

Source: taxjustice.net

Adopting EU standards on financial crime can be important for market access to the EU and to ensure that the jurisdiction is not considered to be a high risk third country by the EU. 5AMLD is the successor to the EUs Fourth Anti-Money Laundering Directive 4AMLD which has been operative since 26 June 2017. Its a process by which dirty cash is transformed into clear cash. We welcome views and evidence on the draft regulations and additional proposals to expand the Trust Registration Service to comply with the Fifth Money Laundering Directive. The idea of cash laundering is very important to be understood for those working within the financial sector.

Source: pineladvocates.com

Source: pineladvocates.com

The AMLD that was first adopted in 1990 has since evolved from the first directive to the fifth directive with the sixth directive already in contemplation by the EU. OQ1942019 Does the Jersey Government share the approach adopted by the UK. 5AMLD is the successor to the EUs Fourth Anti-Money Laundering Directive 4AMLD which has been operative since 26 June 2017. However with close to 100 licensed banks tens of thousands of regulated professionals and hundreds of billions of pounds in. Government in response to the Fifth Anti-Money Laundering Directive that journalists researchers or other members of the public will have to present evidence of.

Source: slideplayer.com

Source: slideplayer.com

Independent endorsement of the standards of Jerseys regulation and its anti-money. Enhancing cooperation between financial supervisory authorities. Enhancing the powers of EU Financial Intelligence Units and facilitating their cooperation. The fifth directive of 30 May 2018 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing the Fifth AML Directive was published yesterday in the Official Journal of the European Union. The 5th Anti-Money laundering directive has been adopted and entered into force on 9 July 2018.

Source: iclg.com

Source: iclg.com

Lifting the anonymity on electronic money. 5AMLD is the successor to the EUs Fourth Anti-Money Laundering Directive 4AMLD which has been operative since 26 June 2017. The Fifth Anti-Money Laundering Directive 5AMLD came into effect on the 10th January 2020 and serves to address new issues that have been exposed since the Fourth Anti-Money Laundering Directive which came into force back in 2017. Directive EU 2018843 of the European Parliament and of the Council of 30 May 2018 amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives 2009138EC and 201336EU Entered into force on 9 July 2018. OQ1942019 Does the Jersey Government share the approach adopted by the UK.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 5th money laundering directive jersey by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information