10++ All of the following are stages of money laundering except information

Home » money laundering Info » 10++ All of the following are stages of money laundering except informationYour All of the following are stages of money laundering except images are available. All of the following are stages of money laundering except are a topic that is being searched for and liked by netizens today. You can Find and Download the All of the following are stages of money laundering except files here. Get all royalty-free vectors.

If you’re searching for all of the following are stages of money laundering except pictures information related to the all of the following are stages of money laundering except topic, you have pay a visit to the ideal site. Our site frequently gives you hints for viewing the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

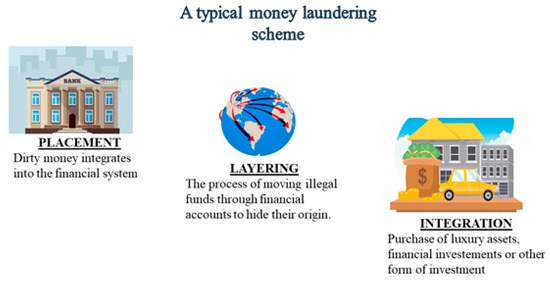

All Of The Following Are Stages Of Money Laundering Except. A it relieves the criminal of holding and guarding large amounts of bulky of cash. Although the specific techniques used to clean dirty money vary financial experts cite three stages of money laundering in the process. Process of Money Laundering. The money laundering process is divided into 3 segments.

Pin On Finance From pinterest.com

Pin On Finance From pinterest.com

All of the following are essential elements of an insurance companys anti-money laundering program EXCEPT V C a quality improvement program The first known case of money laundering in the insurance industry was reported in. The first stage of money laundering placement requires the placement of criminally-derived proceeds in the financial system. What are the Three Stages of Money Laundering. In response to mounting concern over money laundering the Financial Action Task Force on money laundering FATF was established by the G-7 Summit in Paris in 1989 to develop a co-ordinated international response. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into. The three basic stages may occur as separate and distinct phases or may occur simultaneously or more commonly they may overlap.

Most life insurance firms.

Most life insurance firms. The first stage of money laundering placement requires the placement of criminally-derived proceeds in the financial system. Money laundering involves three basic steps to disguise the source of illegally earned money and make it usable. The stages of money laundering include the. Illegal money is converted to seemingly legal money. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into.

Source: pinterest.com

Source: pinterest.com

In the Insurance Sector. The money laundering process most commonly occurs in three key stages. What are the Three Stages of Money Laundering. It is during the placement stage that money launderers. All of the following are essential elements of an insurance companys anti-money laundering program EXCEPT V C a quality improvement program The first known case of money laundering in the insurance industry was reported in.

Source: pinterest.com

Source: pinterest.com

This includes cash money orders and cashiers and travelers checks. Stage 1 of Money Laundering. One of the first tasks of the FATF was to develop Recommendations 40 in all which set out the measures national governments. Which stage of the money laundering process involves carrying out a series of financial transactions to hide the illicit source of the funds. In response to mounting concern over money laundering the Financial Action Task Force on money laundering FATF was established by the G-7 Summit in Paris in 1989 to develop a co-ordinated international response.

Source: pinterest.com

Source: pinterest.com

The money laundering process most commonly occurs in three key stages. The first step is called placement. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. A Withdrawal B Placement. It is during the placement stage that money launderers.

Source: pinterest.com

Source: pinterest.com

The money laundering process begins after criminals acquire illegal funds from criminal activity and seek to introduce them into the legitimate financial system. Illegal money is converted to seemingly legal money. Some common methods of laundering are. The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

Source: pinterest.com

Source: pinterest.com

A Withdrawal B Placement. Placement layering and integration. In the Insurance Sector. A Office foreign asset control OFAC B securities and exchange commission SEC C international monetary fund IMF D financial action task force on money laundering FATF The banks secrecy act requires financial institutions to file reports for currency transactions greater than. The three basic stages may occur as separate and distinct phases or may occur simultaneously or more commonly they may overlap.

Source: pinterest.com

Source: pinterest.com

Placement layering and integration. In response to mounting concern over money laundering the Financial Action Task Force on money laundering FATF was established by the G-7 Summit in Paris in 1989 to develop a co-ordinated international response. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. Which stage of the money laundering process involves carrying out a series of financial transactions to hide the illicit source of the funds. The money laundering process begins after criminals acquire illegal funds from criminal activity and seek to introduce them into the legitimate financial system.

Source: pinterest.com

Source: pinterest.com

An insurance company must manage the risk and may set limits on what types of payment it will accept and the amounts acceptable for different forms of payment. Transactions designed to launder funds can for example be effected in one or two stages depending on the money laundering technique being used. Most life insurance firms. The first stage of money laundering placement requires the placement of criminally-derived proceeds in the financial system. This includes cash money orders and cashiers and travelers checks.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The three basic stages may occur as separate and distinct phases or may occur simultaneously or more commonly they may overlap. One of the first tasks of the FATF was to develop Recommendations 40 in all which set out the measures national governments. The stages of money laundering include the. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Most life insurance firms.

Source: ar.pinterest.com

Source: ar.pinterest.com

Generally this stage serves two purposes. The institution may be anything from a brokerage house or bank to a casino or insurance company. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into. The three basic stages may occur as separate and distinct phases or may occur simultaneously or more commonly they may overlap. One of the first tasks of the FATF was to develop Recommendations 40 in all which set out the measures national governments.

Source: icas.com

Source: icas.com

All Of The Following Are Phases In The Money Laundering Process EXCEPT. Transactions designed to launder funds can for example be effected in one or two stages depending on the money laundering technique being used. In response to mounting concern over money laundering the Financial Action Task Force on money laundering FATF was established by the G-7 Summit in Paris in 1989 to develop a co-ordinated international response. Most life insurance firms. Some common methods of laundering are.

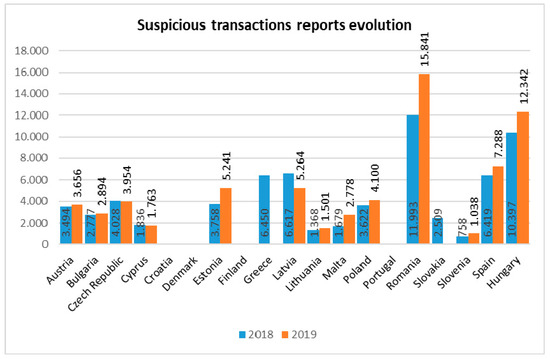

Source: mdpi.com

Source: mdpi.com

With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. Placement in which the money is. The Placement Stage Filtering. A Office foreign asset control OFAC B securities and exchange commission SEC C international monetary fund IMF D financial action task force on money laundering FATF The banks secrecy act requires financial institutions to file reports for currency transactions greater than. The money laundering process begins after criminals acquire illegal funds from criminal activity and seek to introduce them into the legitimate financial system.

Source: pinterest.com

Source: pinterest.com

Each individual money laundering stage can be extremely complex due to the criminal activity involved. Generally this stage serves two purposes. The first stage of money laundering placement requires the placement of criminally-derived proceeds in the financial system. In the Insurance Sector. All of the following are essential elements of an insurance companys anti-money laundering program EXCEPT V C a quality improvement program The first known case of money laundering in the insurance industry was reported in.

Source: mdpi.com

Source: mdpi.com

Which of the following statements best describes the money laundering process. What are the Three Stages of Money Laundering. Placement in which the money is. Although the specific techniques used to clean dirty money vary financial experts cite three stages of money laundering in the process. Placement can take place via cash deposit wire transfer check money order or other methods.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title all of the following are stages of money laundering except by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas