13+ Aml customer risk scoring excel information

Home » money laundering Info » 13+ Aml customer risk scoring excel informationYour Aml customer risk scoring excel images are ready. Aml customer risk scoring excel are a topic that is being searched for and liked by netizens today. You can Get the Aml customer risk scoring excel files here. Download all free images.

If you’re searching for aml customer risk scoring excel images information linked to the aml customer risk scoring excel topic, you have come to the right site. Our website always gives you hints for seeking the maximum quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

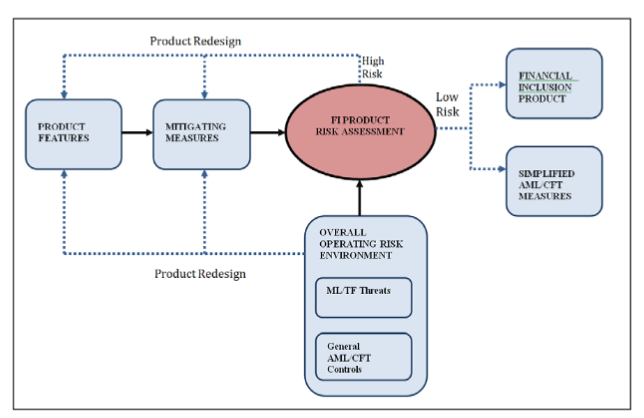

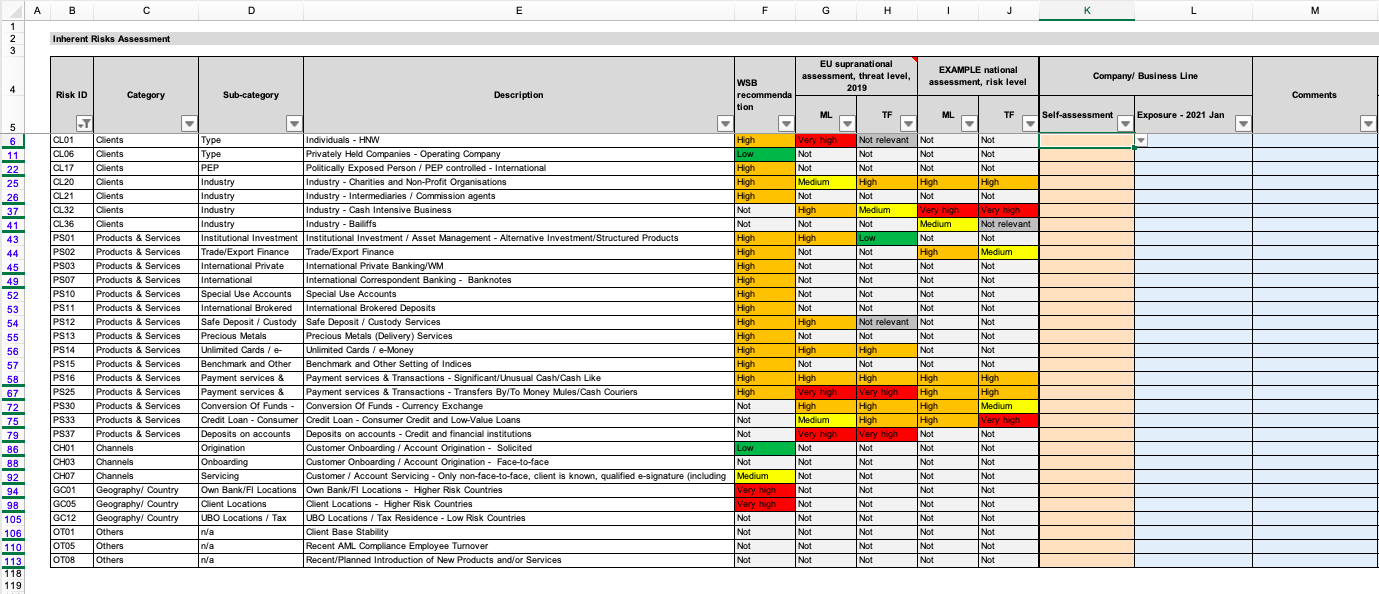

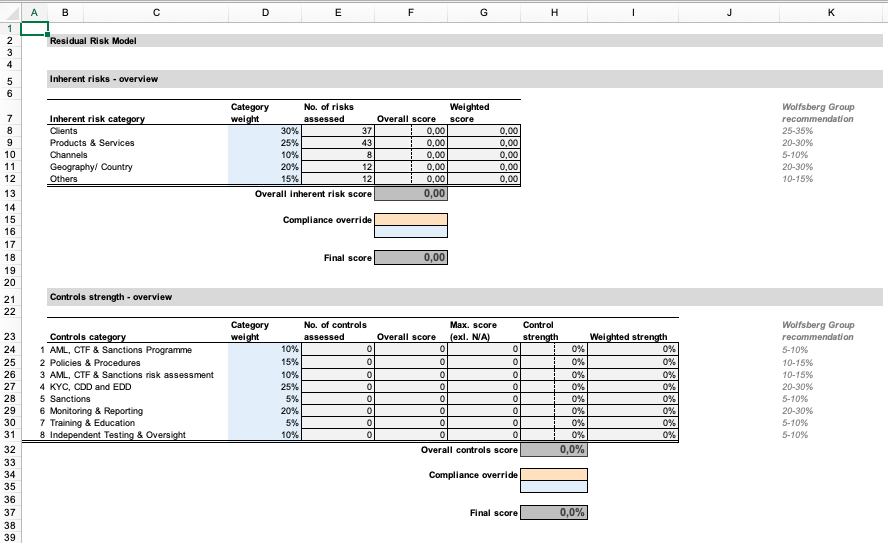

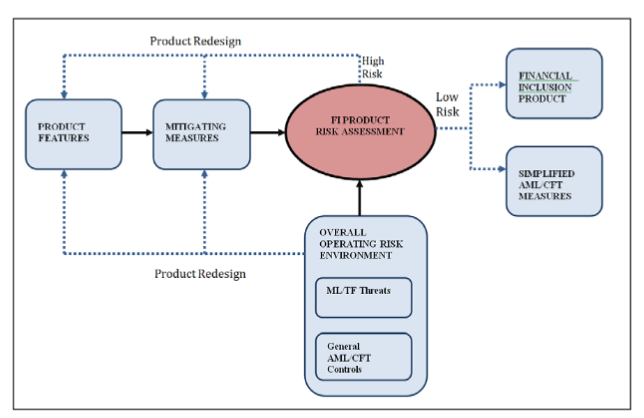

Aml Customer Risk Scoring Excel. Quantitative and qualitative criteria customisable risk factors such as customer risk country risk productservice risk industry risk and delivery channel risk. Put in place systems and controls carry out the risk plan AMLCTF program Monitor review the risk plan. FIs typically use a high-risk country list for two primary purposes. AML Accelerate calculates the consolidated risk ratings at levels 1 2 3 and 4 by assigning a numerical score to the rating results at the level below and aggregating those scores to determine.

Annex 6 Examples Of Risk Assessment Tools Fatf Guidance Anti Money Laundering And Terrorist Financing Measures And Financial Inclusion With A Supplement On Customer Due Diligence Updated November 2017 Better Regulation From service.betterregulation.com

Annex 6 Examples Of Risk Assessment Tools Fatf Guidance Anti Money Laundering And Terrorist Financing Measures And Financial Inclusion With A Supplement On Customer Due Diligence Updated November 2017 Better Regulation From service.betterregulation.com

Or the level of financial exclusion. Such factors may affect the MLFT risks and increase or reduce the effectiveness of AMLCFT measures. Low Medium or High The firm may also use a risk category of Low or High without the Medium rating When the risk rating tool generates a final rating the AML Compliance Officer will be sent a notification for approval. Low Medium High c Geographical Location Risk Total Percentage Local Headquarters and Branch Location No of branches including headquarters located. An exhaustive audit trail. AML Accelerate calculates the consolidated risk ratings at levels 1 2 3 and 4 by assigning a numerical score to the rating results at the level below and aggregating those scores to determine.

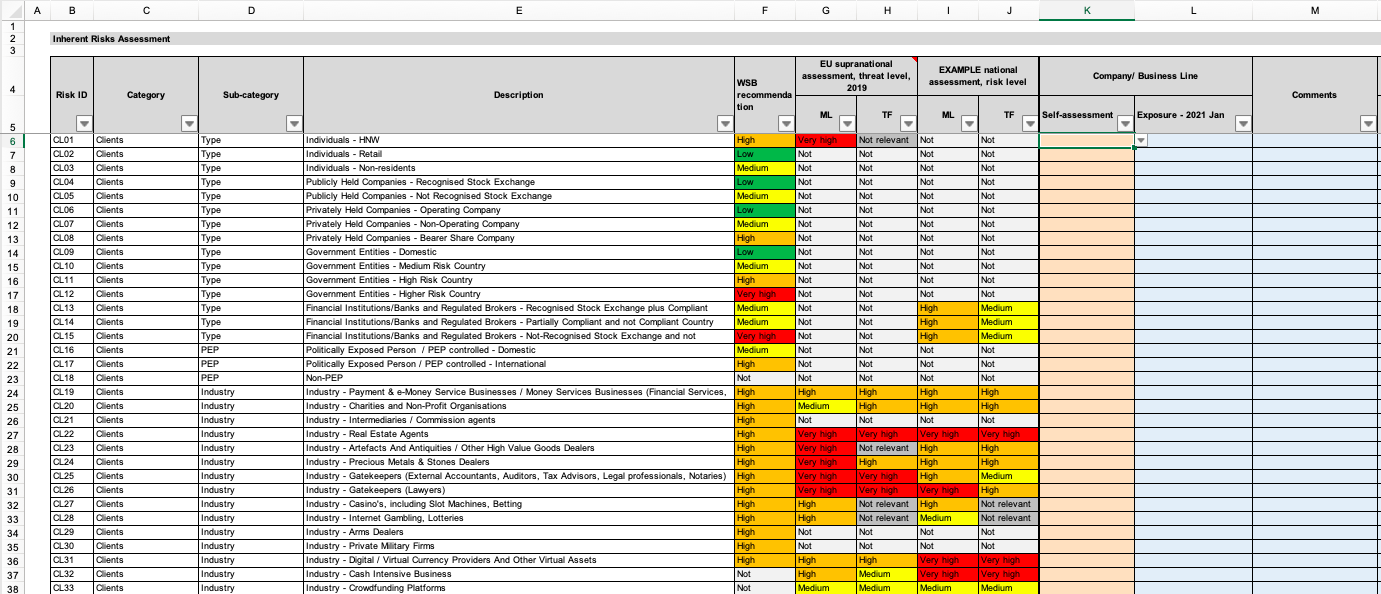

Risk assessment and scoring tool to assess the AML Risk for your clients based on the customers profile risk factors and weighted parameters.

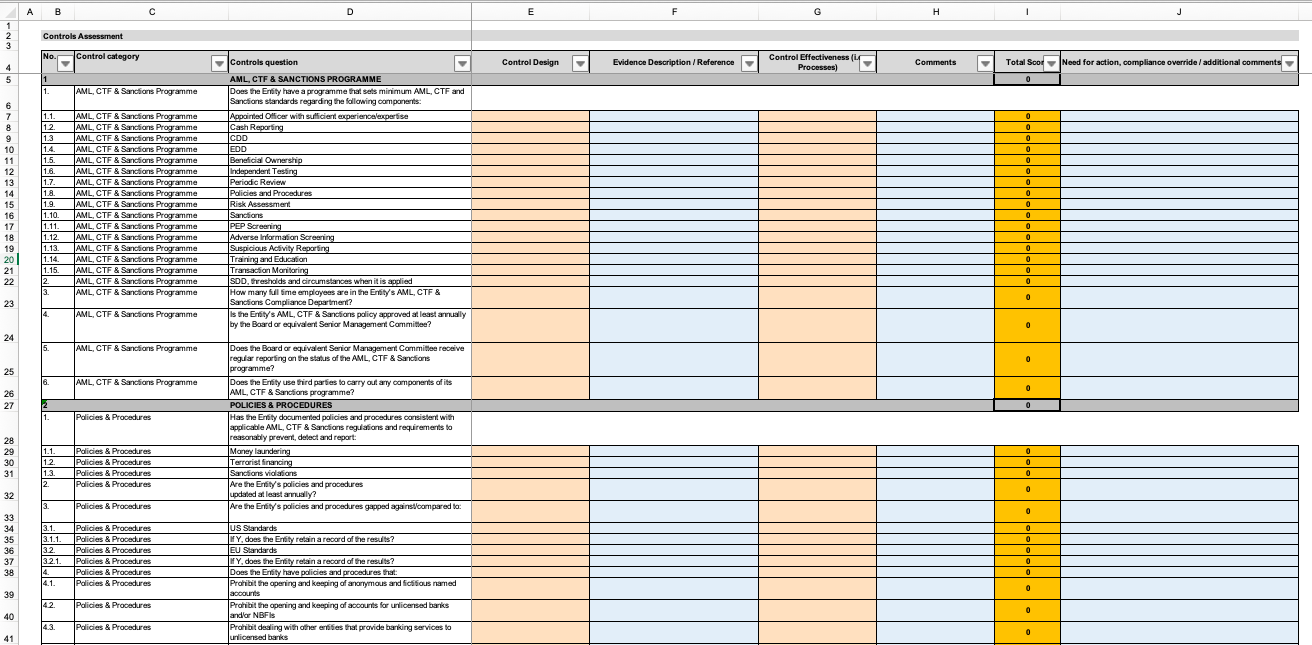

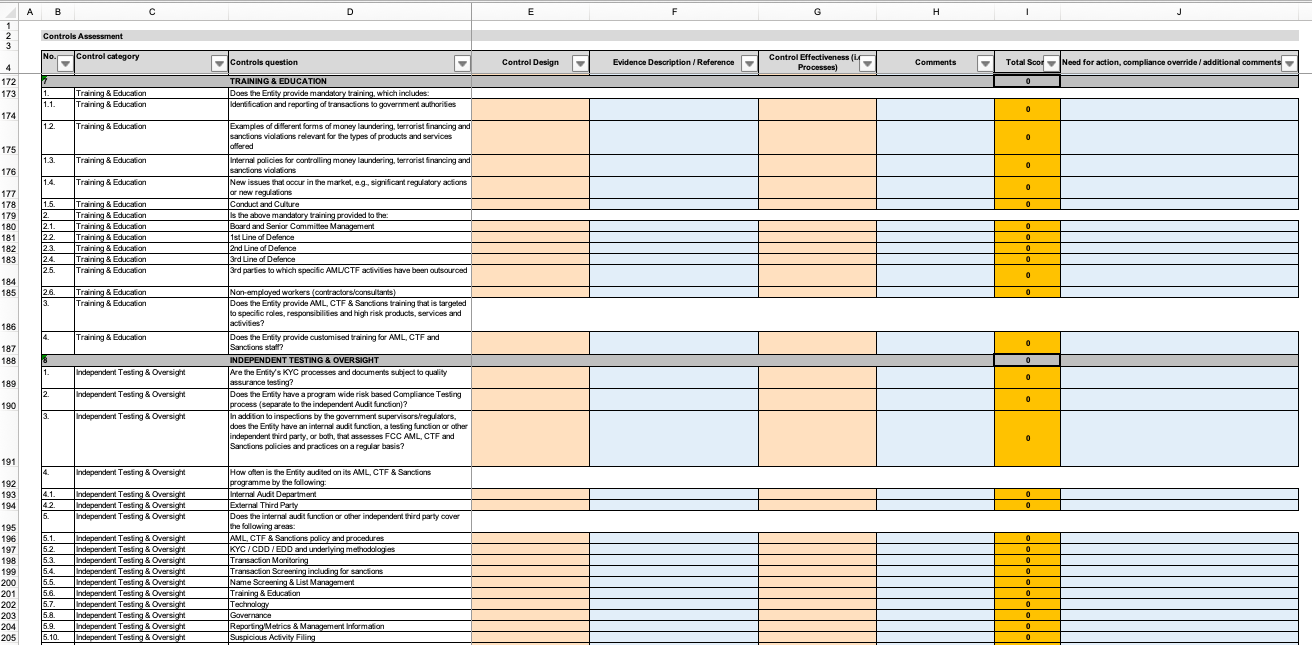

All foreign customers Customer from higher risk countries 8 Other factors please specify. AML Accelerate calculates the consolidated risk ratings at levels 1 2 3 and 4 by assigning a numerical score to the rating results at the level below and aggregating those scores to determine. Model is populated with the most common AML CTF Sanctions risks as well as controls questionnaire. An exhaustive audit trail. Or the level of financial exclusion. AML compliance programme aligns with its risk profile develop risk mitigation strategies including applicable internal controls and therefore lower a business unit or business lines residual risk exposure ensure senior management are made aware of the key risks control gaps and remediation efforts.

Source: eloquens.com

Source: eloquens.com

If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. These risk assessment templatesmatrices have detailed risk scoring logic and formulas that calculate the overall risk score. FIs typically use a high-risk country list for two primary purposes. Such factors may affect the MLFT risks and increase or reduce the effectiveness of AMLCFT measures. Quantitative and qualitative criteria customisable risk factors such as customer risk country risk productservice risk industry risk and delivery channel risk.

Source:

Additionally FATCA monitoring for change in circumstances is not riskbased must be monitored as it occurs and applies to all customers January 2015 the FDIC released a statement encouraging institutions to take a risk based approach in assessing all. AMLKYC reviews the threshold is normally 25 for low risk customers. Assess the Risk by using. Generating a Customer Risk Rating. AML Accelerate calculates the consolidated risk ratings at levels 1 2 3 and 4 by assigning a numerical score to the rating results at the level below and aggregating those scores to determine.

Source: service.betterregulation.com

Source: service.betterregulation.com

The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank. AML compliance programme aligns with its risk profile develop risk mitigation strategies including applicable internal controls and therefore lower a business unit or business lines residual risk exposure ensure senior management are made aware of the key risks control gaps and remediation efforts. The risk model should be designed to generate a revised risk score and rating when such an event is triggered. 255 rows Risk assessment templates used by financial institution firms are either in Excel in a third-party platform or built into and managed within an internal tool. This is particularly valuable for financial institutions since government regulators encourage organizations to conduct annual risk assessments to expose potential money laundering and terrorist financing activities.

Source: rur.senecvks.pw

Source: rur.senecvks.pw

AML compliance programme aligns with its risk profile develop risk mitigation strategies including applicable internal controls and therefore lower a business unit or business lines residual risk exposure ensure senior management are made aware of the key risks control gaps and remediation efforts. Automated Custom Risk Scoring Fully dynamic risk engine allowing you to define any aspect of risk both regulatory and internal risk appetite. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. Model is populated with the most common AML CTF Sanctions risks as well as controls questionnaire. The level of corruption and the impact of measures to combat corruption.

Source: eloquens.com

Source: eloquens.com

Additionally FATCA monitoring for change in circumstances is not riskbased must be monitored as it occurs and applies to all customers January 2015 the FDIC released a statement encouraging institutions to take a risk based approach in assessing all. Assess the Risk by using. What types of customers pose a risk. 255 rows Risk assessment templates used by financial institution firms are either in Excel in a third-party platform or built into and managed within an internal tool. The below customer elements need to be risked assessed by entering into the risk rating tool to generate an overall customer risk rating of.

Source:

The risk model should be designed to generate a revised risk score and rating when such an event is triggered. 255 rows Risk assessment templates used by financial institution firms are either in Excel in a third-party platform or built into and managed within an internal tool. FIs typically use a high-risk country list for two primary purposes. Quantitative and qualitative criteria customisable risk factors such as customer risk country risk productservice risk industry risk and delivery channel risk. Or the level of financial exclusion.

Source: advisoryhq.com

Source: advisoryhq.com

The level of corruption and the impact of measures to combat corruption. Generating a Customer Risk Rating. Model is populated with the most common AML CTF Sanctions risks as well as controls questionnaire. The ever-present dependence on individual subjective assessments and inherent bias is totally eliminated from the on-boarding process thanks to KYC Portals risk assessment module. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm.

Source: eloquens.com

Source: eloquens.com

The first purpose is to assign customers with a risk score as part of the institutions due diligence processes. Based on the customers risk score the KYC system determines the next review date. Minimise and manage the risks apply strategies policies and procedures Manage the regulatory risks. This should indicate why customers have been rated as high medium or low and also if any customer has been overridden manually to a higher or lower risk rating over the system generated risk score and rating. All foreign customers Customer from higher risk countries 8 Other factors please specify.

Source: advisoryhq.com

Source: advisoryhq.com

Model is populated with the most common AML CTF Sanctions risks as well as controls questionnaire. Overall customer risk assessment. This should indicate why customers have been rated as high medium or low and also if any customer has been overridden manually to a higher or lower risk rating over the system generated risk score and rating. AML Accelerate calculates the consolidated risk ratings at levels 1 2 3 and 4 by assigning a numerical score to the rating results at the level below and aggregating those scores to determine. Or the level of financial exclusion.

Source: advisoryhq.com

Source: advisoryhq.com

AML compliance programme aligns with its risk profile develop risk mitigation strategies including applicable internal controls and therefore lower a business unit or business lines residual risk exposure ensure senior management are made aware of the key risks control gaps and remediation efforts. Develop and carry out monitoring process keep necessary records review risk plan and AMLCTF program. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. These risk assessment templatesmatrices have detailed risk scoring logic and formulas that calculate the overall risk score. Equal weights or custom user defined.

Source: eloquens.com

Source: eloquens.com

Quantitative and qualitative criteria customisable risk factors such as customer risk country risk productservice risk industry risk and delivery channel risk. Generating a Customer Risk Rating. Overall customer risk assessment. The below customer elements need to be risked assessed by entering into the risk rating tool to generate an overall customer risk rating of. Or the level of financial exclusion.

Source: eloquens.com

Source: eloquens.com

255 rows Risk assessment templates used by financial institution firms are either in Excel in a third-party platform or built into and managed within an internal tool. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank. Low Medium High c Geographical Location Risk Total Percentage Local Headquarters and Branch Location No of branches including headquarters located. The below customer elements need to be risked assessed by entering into the risk rating tool to generate an overall customer risk rating of. Overall customer risk assessment.

Source: service.betterregulation.com

Source: service.betterregulation.com

Low Medium High c Geographical Location Risk Total Percentage Local Headquarters and Branch Location No of branches including headquarters located. New customers carrying out large one-off transactions Introduced customers because the introducer may not have carried out due diligence thoroughly Customers who arent local to you Customers involved in a. AML Accelerate calculates the consolidated risk ratings at levels 1 2 3 and 4 by assigning a numerical score to the rating results at the level below and aggregating those scores to determine. Such factors may affect the MLFT risks and increase or reduce the effectiveness of AMLCFT measures. These risk assessment templatesmatrices have detailed risk scoring logic and formulas that calculate the overall risk score.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml customer risk scoring excel by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas