20+ Aml customer risk scoring methodology information

Home » money laundering idea » 20+ Aml customer risk scoring methodology informationYour Aml customer risk scoring methodology images are ready. Aml customer risk scoring methodology are a topic that is being searched for and liked by netizens today. You can Find and Download the Aml customer risk scoring methodology files here. Get all royalty-free photos.

If you’re searching for aml customer risk scoring methodology pictures information connected with to the aml customer risk scoring methodology topic, you have pay a visit to the ideal blog. Our site always provides you with hints for viewing the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that match your interests.

Aml Customer Risk Scoring Methodology. What types of customers pose a risk. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank. Fully dynamic risk engine allowing you to define any aspect of risk both regulatory and internal risk appetite.

Aml 5 Business Risk Assessment Rulebook From dfsaen.thomsonreuters.com

Aml 5 Business Risk Assessment Rulebook From dfsaen.thomsonreuters.com

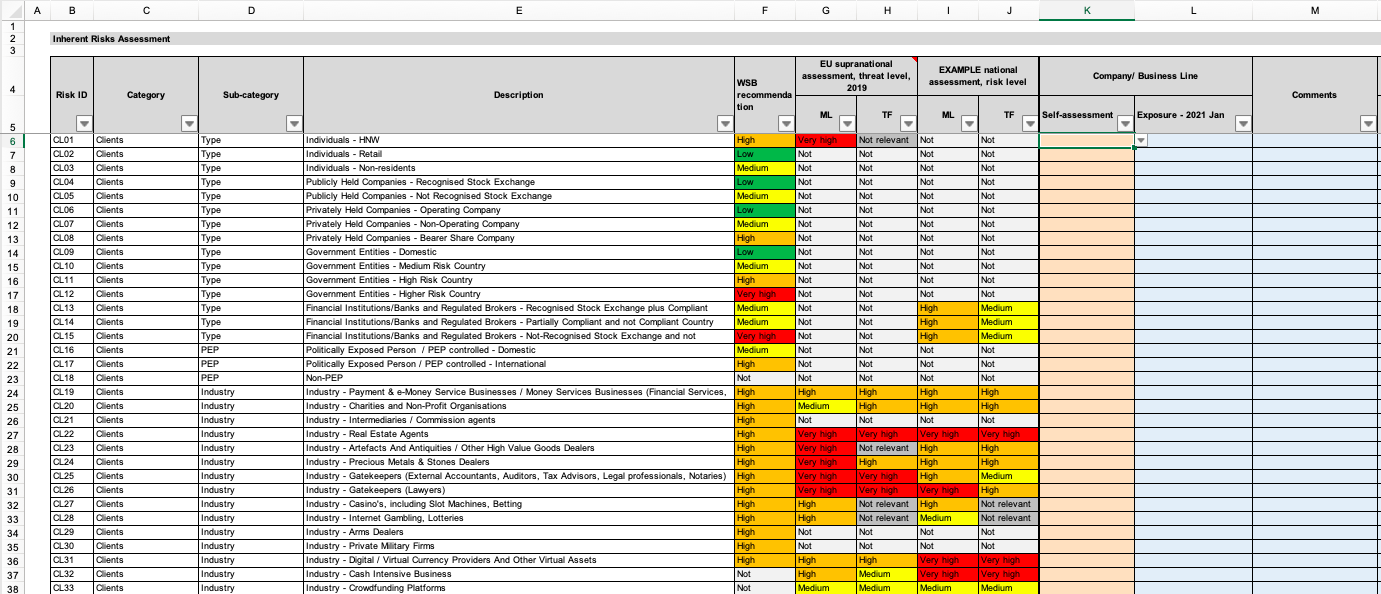

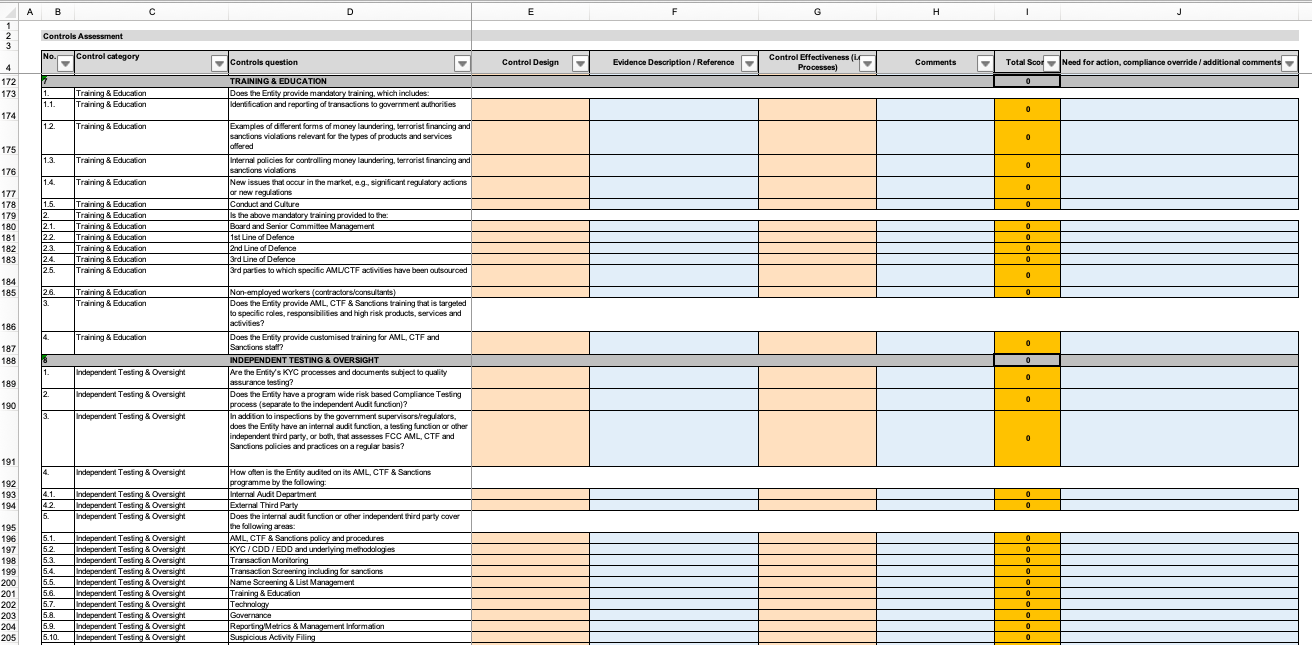

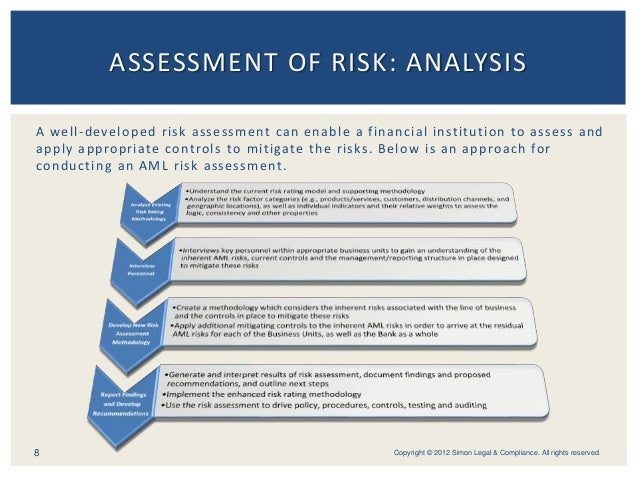

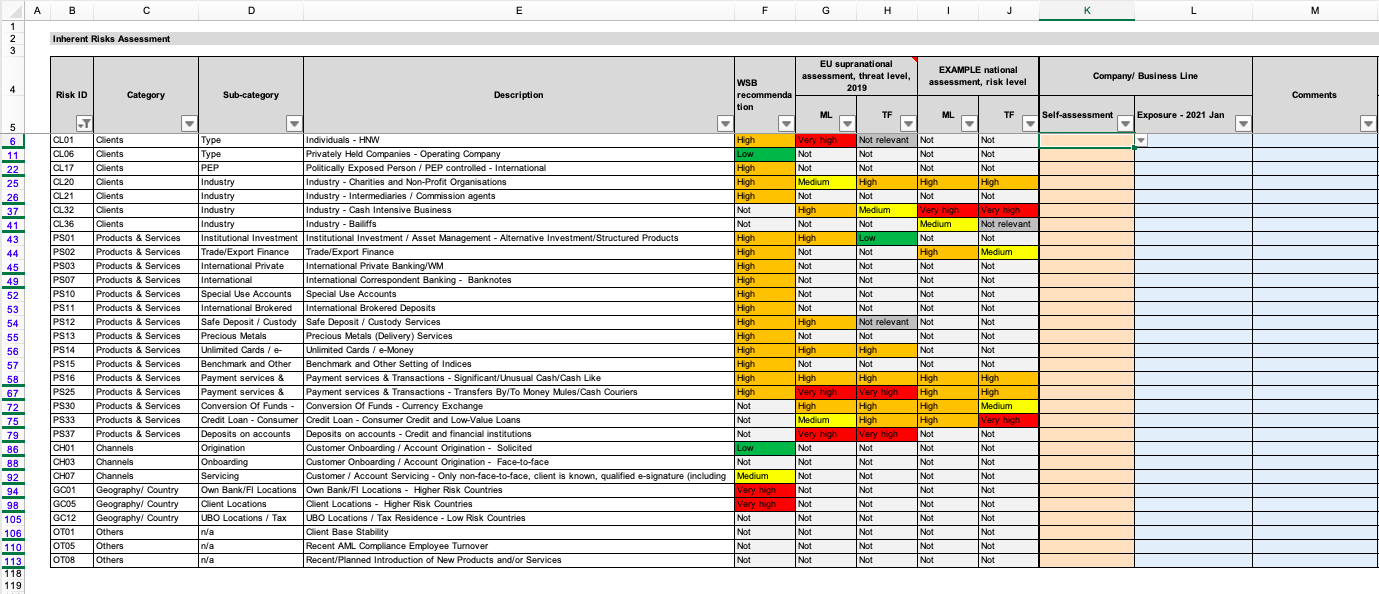

Background World Bank has attached high importance to money laundering and terrorist financing risk assessment from the early years of the recognition of risk based approach in AMLCFT area and has helped actively client countries to assess these risks. The theory supporting risk assessment tools and templates is based on the concept that a clients risk AML profile can be measured by applying data-driven and risk-based calculations on risk categories identified by financial experts and the regulatory community. AML 3 Interpretation and Terminology. We established a scoring methodology for each risk factor and it was cumulative. Remember we are not considering any factor in a vacuum. The workflow of KYC enables financial institutions to perform Due Diligence Enhanced Due Diligence and continuous monitoring of customers.

AML Risk Scoring or Customer Risk Rating.

The level of corruption and the impact of measures to combat corruption. Automated Custom Risk Scoring. In this webinar we explore one objective methodology financial institutions may consider to assess individual countries money laundering risk which in turn may be used in transaction activity monitoring customer risk scoring and the institutions high level money laundering risk assessment. The customer footprint within the customer base which consists of their geographic location and if they are engaged in business activities that are vulnerable to MLTF. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating. Not only was a baseline CRR methodology established across the organization it was done without revising any lines of business.

Source: service.betterregulation.com

Source: service.betterregulation.com

The level of corruption and the impact of measures to combat corruption. Without a standard model for risk scoring risk and security teams would continually struggle to communicate internally about how to allocate resources appropriately in order to minimize costs and impact to business. The methodology applied to assess customer MLTF risk at an enterprise level through the AML Accelerate platform defines customer risk as the combination of. The workflow of KYC enables financial institutions to perform Due Diligence Enhanced Due Diligence and continuous monitoring of customers. AML 3 Interpretation and Terminology.

Source: eloquens.com

Source: eloquens.com

Background World Bank has attached high importance to money laundering and terrorist financing risk assessment from the early years of the recognition of risk based approach in AMLCFT area and has helped actively client countries to assess these risks. The theory supporting risk assessment tools and templates is based on the concept that a clients risk AML profile can be measured by applying data-driven and risk-based calculations on risk categories identified by financial experts and the regulatory community. Fully dynamic risk engine allowing you to define any aspect of risk both regulatory and internal risk appetite. AML Risk Scoring or Customer Risk Rating. Our validation methods assess whether AMLCRR effectively determine the risk level each customer presents to your organization including Model Governance review Model Methodology Assessment Model Scoring.

Source: eloquens.com

Source: eloquens.com

So if a customer had very few risk factors they would have a lower risk rating. The methodology applied to assess customer MLTF risk at an enterprise level through the AML Accelerate platform defines customer risk as the combination of. Automated Custom Risk Scoring. New customers carrying out large one-off transactions Introduced customers because the introducer may not have carried out due diligence thoroughly Customers who arent local to you Customers involved in a. The level of corruption and the impact of measures to combat corruption.

Source:

The customer footprint within the customer base which consists of their geographic location and if they are engaged in business activities that are vulnerable to MLTF. Automated Custom Risk Scoring. Fully dynamic risk engine allowing you to define any aspect of risk both regulatory and internal risk appetite. AML 4 Applying a Risk-Based Approach. The customer footprint within the customer base which consists of their geographic location and if they are engaged in business activities that are vulnerable to MLTF.

Source: slideshare.net

Source: slideshare.net

So if a customer had very few risk factors they would have a lower risk rating. The methodology applied to assess customer MLTF risk at an enterprise level through the AML Accelerate platform defines customer risk as the combination of. 255 rows Key Assessment Factors. The risk model should be designed to generate a revised risk score and rating when such an event is triggered. Such factors may affect the MLFT risks and increase or reduce the effectiveness of AMLCFT measures.

Source: dfsaen.thomsonreuters.com

Source: dfsaen.thomsonreuters.com

The attributes differ based on the customer type. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating. Or the level of financial exclusion. Automated Custom Risk Scoring. In this webinar we explore one objective methodology financial institutions may consider to assess individual countries money laundering risk which in turn may be used in transaction activity monitoring customer risk scoring and the institutions high level money laundering risk assessment.

Source: eloquens.com

Source: eloquens.com

The methodology applied to assess customer MLTF risk at an enterprise level through the AML Accelerate platform defines customer risk as the combination of. AML 6 Customer Risk Assessment. In other words the higher your score the higher your risk rating. AML 4 Applying a Risk-Based Approach. We established a scoring methodology for each risk factor and it was cumulative.

Source: advisoryhq.com

Source: advisoryhq.com

AML 4 Applying a Risk-Based Approach. New customers carrying out large one-off transactions Introduced customers because the introducer may not have carried out due diligence thoroughly Customers who arent local to you Customers involved in a. We established a scoring methodology for each risk factor and it was cumulative. This should indicate why customers have been rated as high medium or low and also if any customer has been overridden manually to a higher or lower risk rating over the system generated risk score and rating. Or the level of financial exclusion.

Source: dfsaen.thomsonreuters.com

Source: dfsaen.thomsonreuters.com

The customer footprint within the customer base which consists of their geographic location and if they are engaged in business activities that are vulnerable to MLTF. The level of corruption and the impact of measures to combat corruption. Without a standard model for risk scoring risk and security teams would continually struggle to communicate internally about how to allocate resources appropriately in order to minimize costs and impact to business. Not only was a baseline CRR methodology established across the organization it was done without revising any lines of business. AML 2 Overview and Purpose of the Module.

Source: youtube.com

Source: youtube.com

Anti-Money Laundering Counter-Terrorist Financing and Sanctions Module AML VER1704-20 AML 1 Introduction. The methodology applied to assess customer MLTF risk at an enterprise level through the AML Accelerate platform defines customer risk as the combination of. We established a scoring methodology for each risk factor and it was cumulative. What types of customers pose a risk. Anti-Money Laundering Counter-Terrorist Financing and Sanctions Module AML VER1704-20 AML 1 Introduction.

Source:

What types of customers pose a risk. Fully dynamic risk engine allowing you to define any aspect of risk both regulatory and internal risk appetite. AML models include transaction monitoring software vendor products large homegrown transaction monitoring systems customer risk rating models if with a quantitative scoring component and alert risk scoring models again if with a quantitative scoring component. Remember we are not considering any factor in a vacuum. The customer footprint within the customer base which consists of their geographic location and if they are engaged in business activities that are vulnerable to MLTF.

Source: advisoryhq.com

Source: advisoryhq.com

Such factors may affect the MLFT risks and increase or reduce the effectiveness of AMLCFT measures. AMLCFT measures include the maturity and sophistication of the regulatory and supervisory regime in the country. Oracle Financial Services Know Your Customer assesses the risk associated with a customer by considering different attributes of the customer. The methodology applied to assess customer MLTF risk at an enterprise level through the AML Accelerate platform defines customer risk as the combination of. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank.

Source: finchecker.eu

Source: finchecker.eu

Such factors may affect the MLFT risks and increase or reduce the effectiveness of AMLCFT measures. The World Bank Risk Assessment Methodology 1. AMLCFT measures include the maturity and sophistication of the regulatory and supervisory regime in the country. 255 rows Key Assessment Factors. AML 6 Customer Risk Assessment.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml customer risk scoring methodology by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information