17++ Aml customer risk scoring template info

Home » money laundering idea » 17++ Aml customer risk scoring template infoYour Aml customer risk scoring template images are ready. Aml customer risk scoring template are a topic that is being searched for and liked by netizens today. You can Get the Aml customer risk scoring template files here. Get all royalty-free photos and vectors.

If you’re looking for aml customer risk scoring template pictures information linked to the aml customer risk scoring template interest, you have visit the right blog. Our site frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that fit your interests.

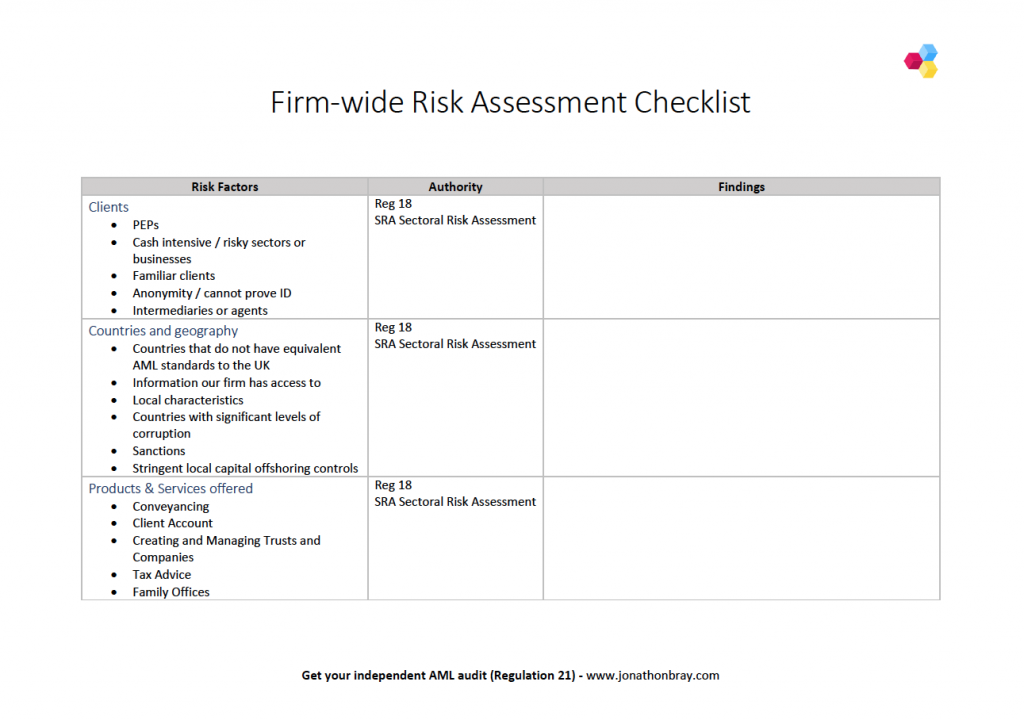

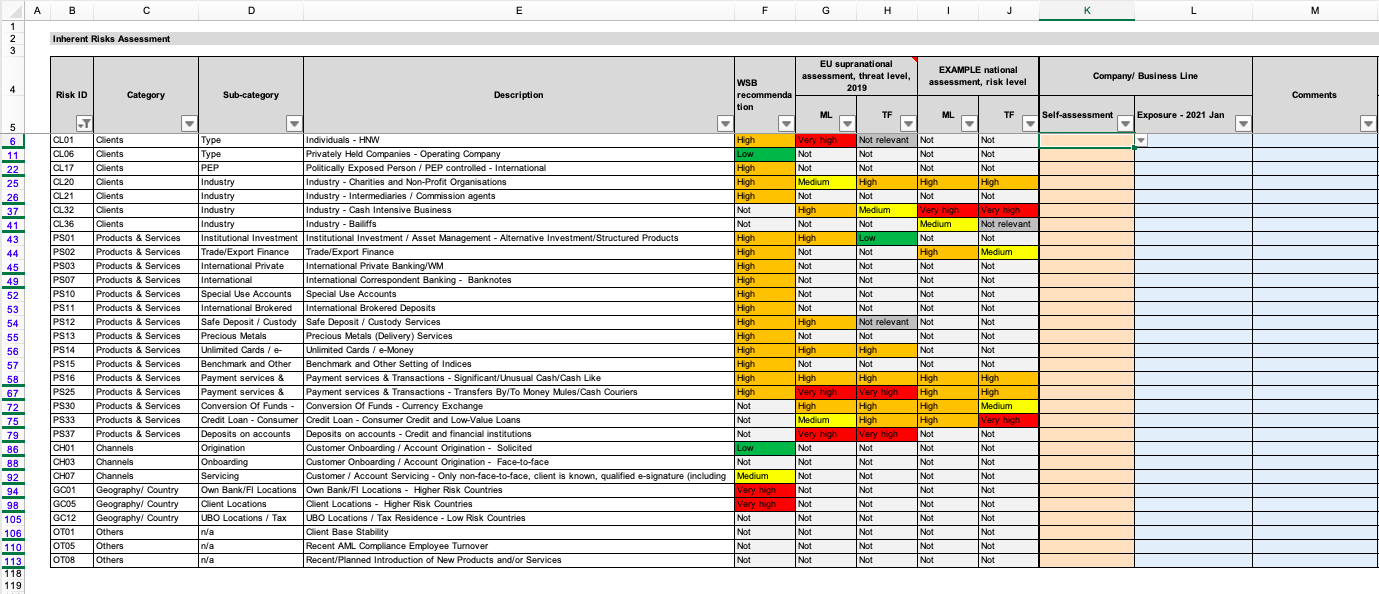

Aml Customer Risk Scoring Template. Based on the customers risk score the KYC system determines the next review date. Fore refence inherent risk scores template includes EU assessment of the risk of ML and TF affecting the internal market and relating to cross-border activities from 2019 as well as an example of national ML TF risk assessment with actual scores. Please also refer to Guidance on Application of Risk-Based Approach Application. Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the AMLCFT Act or the Act.

Aml Kyc Risk Rating Assessment Template Methodology Rating Matrix Download Template Advisoryhq From advisoryhq.com

Aml Kyc Risk Rating Assessment Template Methodology Rating Matrix Download Template Advisoryhq From advisoryhq.com

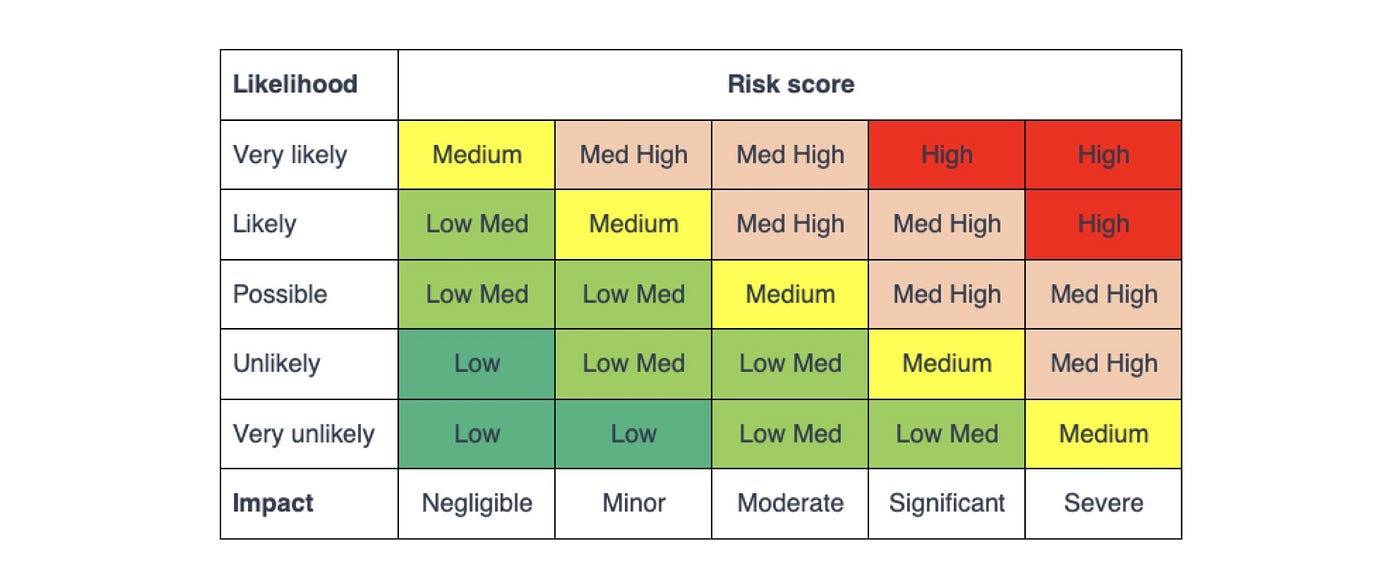

Applying Risk Findings 3. As a result of using this template. Fore refence inherent risk scores template includes EU assessment of the risk of ML and TF affecting the internal market and relating to cross-border activities from 2019 as well as an example of national ML TF risk assessment with actual scores. WeakInadequate Risk Assessment Template As required under. The risk tolerance of the organization what products are used what data is available and the weighting of each risk factor are just some of the variables that need to be considered to determine whether the overall aggregate score is considered high- medium- or low- risk. Model is populated with the most common AML CTF Sanctions risks as well as controls.

To determine a customers overall risk rating a.

Low - Indicates truly minimal activity related to high-AML risk customers or products and services. For example you may offer high-risk products to customers in high-risk countries resulting in a very high compounded MLTF risk rating. AML KYC BSA risk assessment and rating is performed during the client onboarding phase and also throughout the life of the customer. Managing internal risk escalation of FCC or AML risks to leadership AML risk heat maps regulatory issues audit and risk assessment outcomes client product risk vs business strategy issues Governance Effectiveness of CDD gate keeping customer identification and verification screening Transactions surveillance and governance of. Customer risk rating is an integral part of the customer due diligence process yet it can be a difficult tool to implement. AML 3 Interpretation and Terminology.

Source: advisoryhq.com

Source: advisoryhq.com

Front Counter Staff Eg. The supervisory authorities advise that once a firm has completed their money laundering risk assessment they will then need to. Managing internal risk escalation of FCC or AML risks to leadership AML risk heat maps regulatory issues audit and risk assessment outcomes client product risk vs business strategy issues Governance Effectiveness of CDD gate keeping customer identification and verification screening Transactions surveillance and governance of. Then adjust the risk weight accordingly to your company specific conditions and enter the risk scores in the table below to arrive at the Risk Assessment Score. A transaction monitoring product in its most basic form is not a model.

Source: service.betterregulation.com

Source: service.betterregulation.com

The online survey was emailed to the entire ACAMS database. AML 3 Interpretation and Terminology. Background World Bank has attached high importance to money laundering and terrorist financing risk assessment from the early years of the recognition of risk based approach in AMLCFT area and has helped actively client countries to assess these risks. As a result of using this template. Section 19 of the AMLA.

Source: lexology.com

Source: lexology.com

AML models include transaction monitoring software vendor products large homegrown transaction monitoring systems customer risk rating models if with a quantitative scoring component and alert risk scoring models again if with a quantitative scoring component. AML 3 Interpretation and Terminology. AML 6 Customer Risk Assessment. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. THE NATURE OF AMLCFT RISK ASSESSMENTS Business Customer 1.

Source: medium.com

Source: medium.com

AML Risk Assessment Template AML Policy Template. AML 3 Interpretation and Terminology. Low - Indicates truly minimal activity related to high-AML risk customers or products and services. Please also refer to Guidance on Application of Risk-Based Approach Application. Managing internal risk escalation of FCC or AML risks to leadership AML risk heat maps regulatory issues audit and risk assessment outcomes client product risk vs business strategy issues Governance Effectiveness of CDD gate keeping customer identification and verification screening Transactions surveillance and governance of.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

Front Counter Staff Eg. Managing internal risk escalation of FCC or AML risks to leadership AML risk heat maps regulatory issues audit and risk assessment outcomes client product risk vs business strategy issues Governance Effectiveness of CDD gate keeping customer identification and verification screening Transactions surveillance and governance of. Risk Scoring Template Executive Summary Template An analysis of the sources of AML risk together with an assessment of the controls and risk mitigants in place. Anti-Money Laundering Counter-Terrorist Financing and Sanctions Module AML VER1704-20 AML 1 Introduction. WeakInadequate Risk Assessment Template As required under.

Source: pt.slideshare.net

Source: pt.slideshare.net

The World Bank Risk Assessment Methodology 1. Background World Bank has attached high importance to money laundering and terrorist financing risk assessment from the early years of the recognition of risk based approach in AMLCFT area and has helped actively client countries to assess these risks. AML 3 Interpretation and Terminology. Put in place policies controls and procedures to reduce any risks of money laundering as identified. From February 25 - March 12 2013 LexisNexis and ACAMS conducted a joint research study to examine how the Anti-Money Laundering community is managing their Customer Enhanced Due Diligence and AML Risk Assessment processes.

Source: eloquens.com

Source: eloquens.com

Risks assessed by the AML Accelerate risk assessment model. The online survey was emailed to the entire ACAMS database. Managing internal risk escalation of FCC or AML risks to leadership AML risk heat maps regulatory issues audit and risk assessment outcomes client product risk vs business strategy issues Governance Effectiveness of CDD gate keeping customer identification and verification screening Transactions surveillance and governance of. Customer Risk Rating Tool and Methodology. WeakInadequate Risk Assessment Template As required under.

Low - Indicates truly minimal activity related to high-AML risk customers or products and services. THE NATURE OF AMLCFT RISK ASSESSMENTS Business Customer 1. Section 19 of the AMLA. Developing a AMLCFT risk methodology 2. Please also refer to Guidance on Application of Risk-Based Approach Application.

Source:

Based on the customers risk score the KYC system determines the next review date. THE NATURE OF AMLCFT RISK ASSESSMENTS Business Customer 1. Fore refence inherent risk scores template includes EU assessment of the risk of ML and TF affecting the internal market and relating to cross-border activities from 2019 as well as an example of national ML TF risk assessment with actual scores. Applying Risk Findings 3. Based on the customers risk score the KYC system determines the next review date.

Source: advisoryhq.com

Source: advisoryhq.com

Customer Risk Rating Tool and Methodology. Customer Due Diligence Perspective Of The Financial. And Paragraphs 102 and 103 of the AMLCFT and TFS for DNFBPs and NBFIs. AML Risk Assessment Template AML Policy Template. Background World Bank has attached high importance to money laundering and terrorist financing risk assessment from the early years of the recognition of risk based approach in AMLCFT area and has helped actively client countries to assess these risks.

Source:

The theory supporting risk assessment tools and templates is based on the concept that a clients risk AML profile can be measured by applying data-driven and risk-based calculations on risk categories identified by financial experts and the regulatory community. THE NATURE OF AMLCFT RISK ASSESSMENTS Business Customer 1. Fore refence inherent risk scores template includes EU assessment of the risk of ML and TF affecting the internal market and relating to cross-border activities from 2019 as well as an example of national ML TF risk assessment with actual scores. Managing internal risk escalation of FCC or AML risks to leadership AML risk heat maps regulatory issues audit and risk assessment outcomes client product risk vs business strategy issues Governance Effectiveness of CDD gate keeping customer identification and verification screening Transactions surveillance and governance of. AML 4 Applying a Risk-Based Approach.

Source: advisoryhq.com

Source: advisoryhq.com

Understanding the risks but should not uncritically accept a countrys risk assessment as correct and need not follow all its conclusions. Front Counter Staff Eg. Low - Indicates truly minimal activity related to high-AML risk customers or products and services. Customer Risk Rating Tool and Methodology. As a result of using this template.

Source: rur.senecvks.pw

Source: rur.senecvks.pw

Fore refence inherent risk scores template includes EU assessment of the risk of ML and TF affecting the internal market and relating to cross-border activities from 2019 as well as an example of national ML TF risk assessment with actual scores. AML 5 Business Risk Assessment. The supervisory authorities advise that once a firm has completed their money laundering risk assessment they will then need to. Put in place policies controls and procedures to reduce any risks of money laundering as identified. Based on the customers risk score the KYC system determines the next review date.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml customer risk scoring template by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information