12+ Aml definition banking information

Home » money laundering idea » 12+ Aml definition banking informationYour Aml definition banking images are available. Aml definition banking are a topic that is being searched for and liked by netizens now. You can Download the Aml definition banking files here. Find and Download all free photos.

If you’re looking for aml definition banking images information related to the aml definition banking keyword, you have come to the right site. Our site always provides you with suggestions for downloading the highest quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

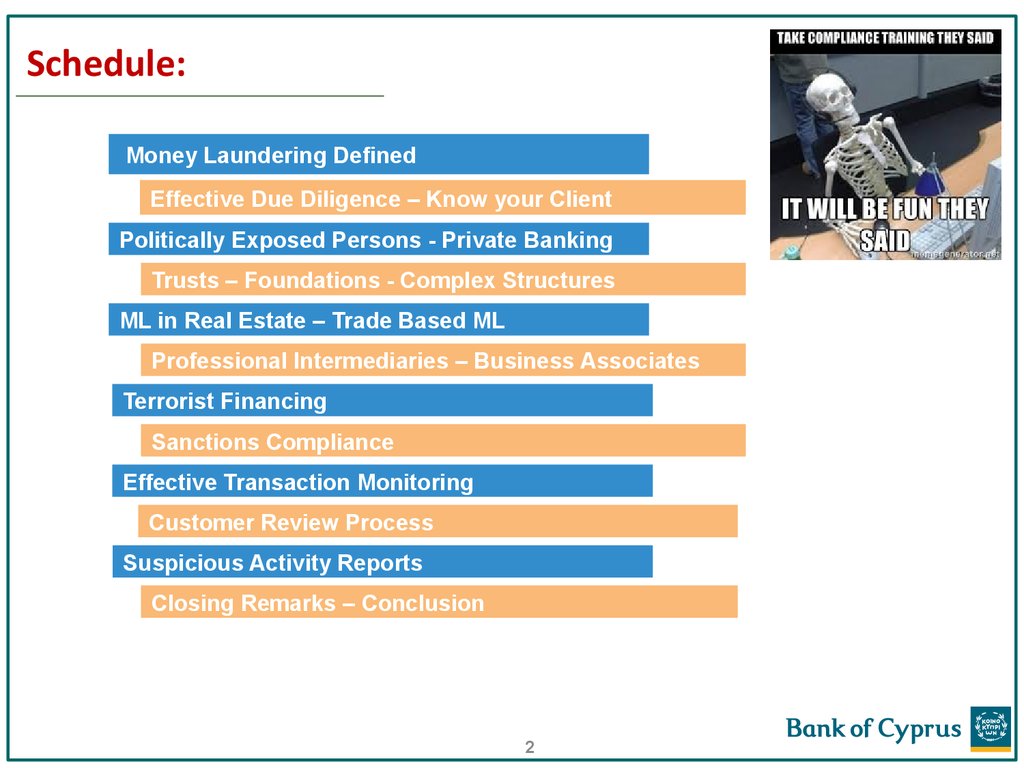

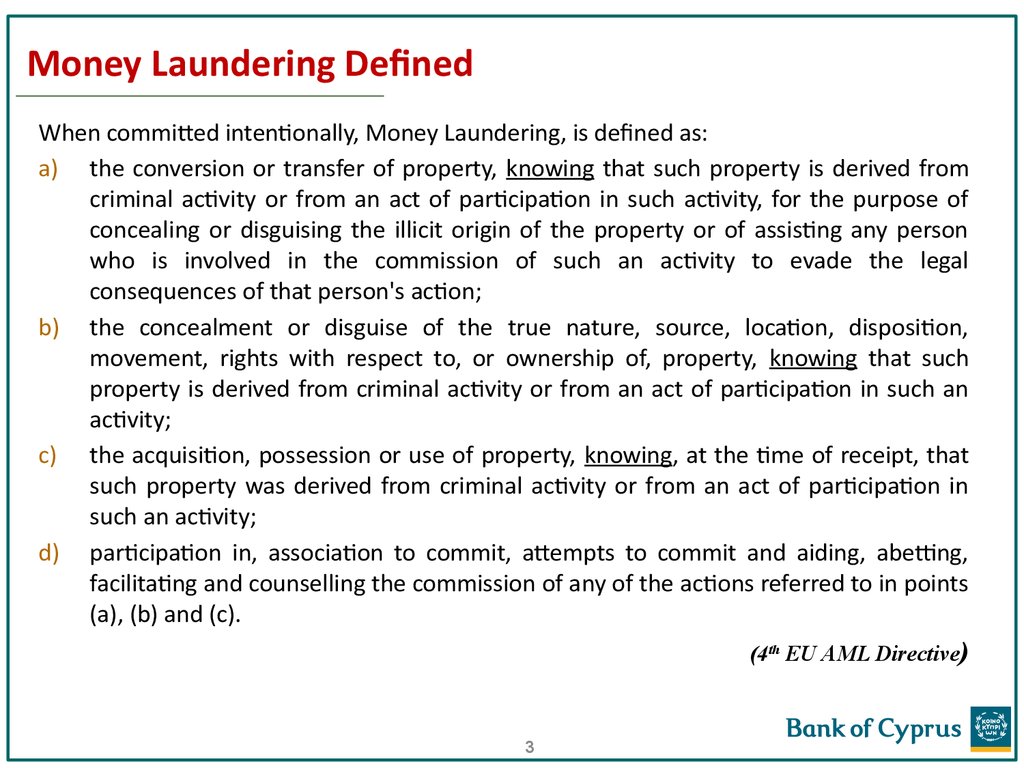

Aml Definition Banking. The underlying criminal act is referred to as predicate crime. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. Most jurisdictional differences relate to what activity qualifies as a predicate crime. Setting anti-money laundering AML and countering the financing of terrorism standardsCFT through regularly updated FATF Recommendations.

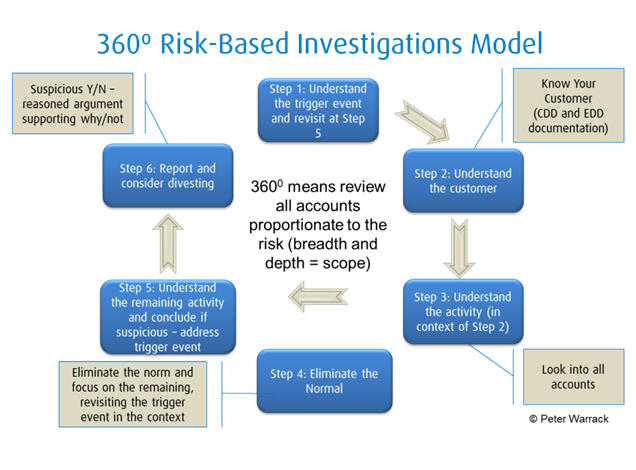

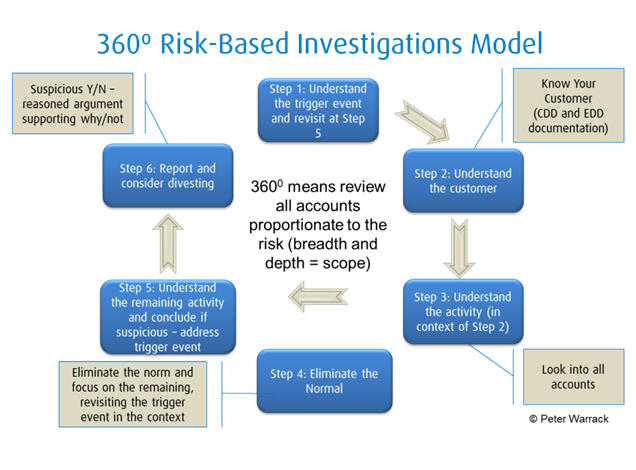

An Introduction To The 360 Degree Aml Investigation Model Acams Today From acamstoday.org

An Introduction To The 360 Degree Aml Investigation Model Acams Today From acamstoday.org

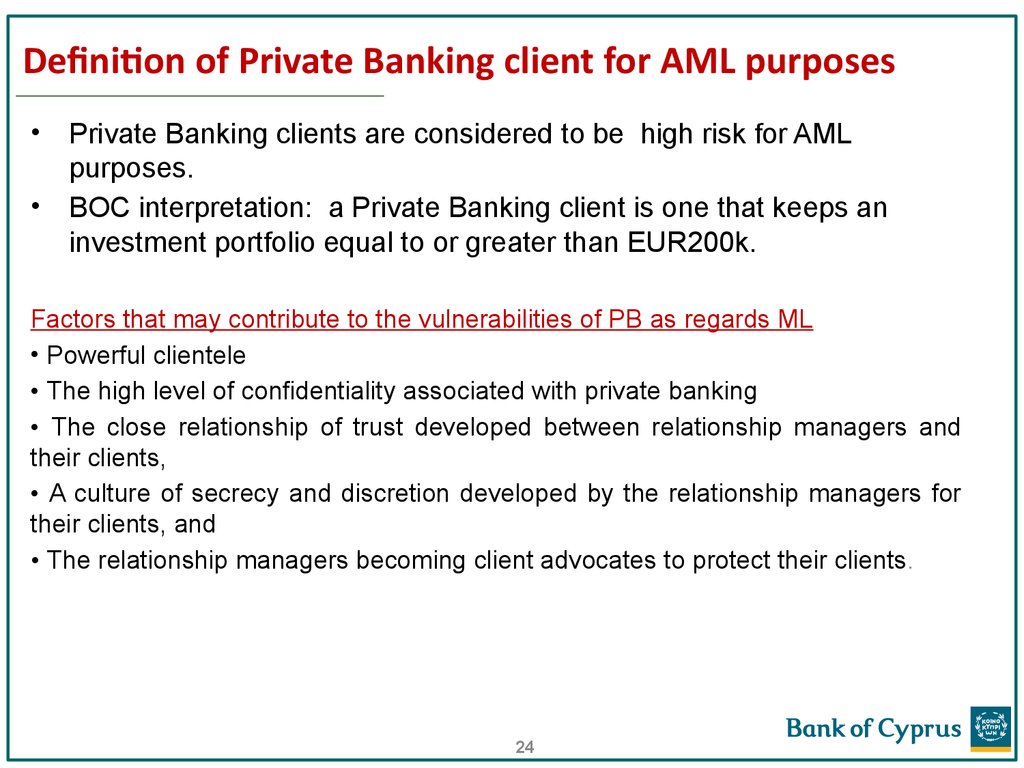

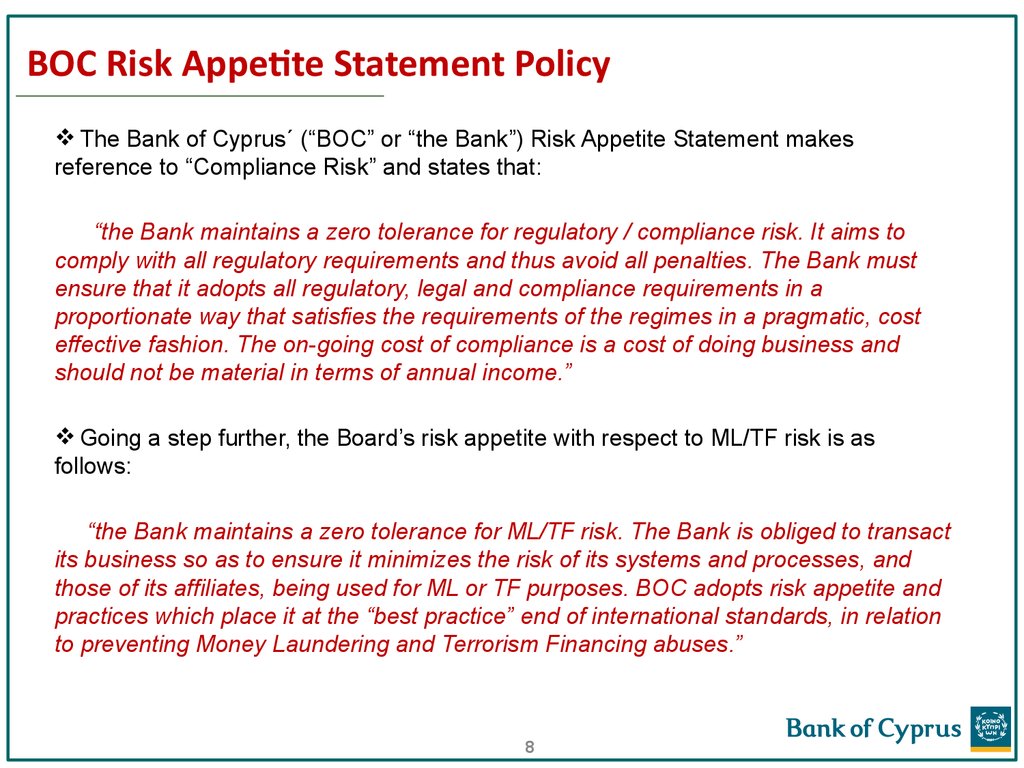

Assess the adequacy of the banks systems to manage the risks associated with private banking activities and managements ability to implement effective due diligence monitoring and reporting systems. For more information about the FATF please visit the website. The exact legal definition of ML varies across jurisdictions but it generally refers to acts that acquire transfer or conceal proceeds of a certain criminal act. At a minimum an anti-money laundering program should include. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. The European Investment Bank Group EIB Group consisting of the European Investment Bank EIB and the European Investment Fund EIF places great emphasis on integrity and good governance and is committed to the highest standards of anti-money laundering AML and combating the financing of terrorism CFT and together with AML AML-CFT in line with the.

The underlying criminal act is referred to as predicate crime.

Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. The current version dating from 2012 was last updated in 2020. Understanding correspondent banking is vital to being able to perform my job. The BSA is intended to combat money laundering and ensure that banks and financial institutions do not facilitate or become complicit in it. In the 2017 Correspondent Banking in Emerging Markets Survey2 of over 300 banking clients in 92 countries more than a quarter of global survey participants claimed reductions in correspondent banking relationships CBRs. 2 Correspondent Banking Correspondent Banking is the provision of a current or other liability account and related.

Source: ppt-online.org

Source: ppt-online.org

AML is a set of regulations laws and procedures that detect and prevent criminals from disguising illegal funds as legitimate income. Most jurisdictional differences relate to what activity qualifies as a predicate crime. At a minimum an anti-money laundering program should include. The current version dating from 2012 was last updated in 2020. For example the interest rate may be stated as LIBOR 1 The mortgage may or may not have a cap on how much the interest rate can rise or fall or on how often the interest rate.

Source: ppt-online.org

Source: ppt-online.org

Generally speaking an adjustable rate mortgage is linked to some major benchmark rate. Setting anti-money laundering AML and countering the financing of terrorism standardsCFT through regularly updated FATF Recommendations. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. FFIEC BSAAML Risks Associated with Money Laundering and Terrorist Financing - Correspondent Accounts Domestic. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions.

Source: bi.go.id

Source: bi.go.id

The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. The BSA imposes a range of compliance obligations. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. Setting anti-money laundering AML and countering the financing of terrorism standardsCFT through regularly updated FATF Recommendations. The exact legal definition of ML varies across jurisdictions but it generally refers to acts that acquire transfer or conceal proceeds of a certain criminal act.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Increasingly correspondent banks are paying greater attention to their respondents Anti-Money Laundering Combating the. The European Investment Bank Group EIB Group consisting of the European Investment Bank EIB and the European Investment Fund EIF places great emphasis on integrity and good governance and is committed to the highest standards of anti-money laundering AML and combating the financing of terrorism CFT and together with AML AML-CFT in line with the. 2 Correspondent Banking Correspondent Banking is the provision of a current or other liability account and related. Setting anti-money laundering AML and countering the financing of terrorism standardsCFT through regularly updated FATF Recommendations. For more information about the FATF please visit the website.

Source: bi.go.id

Source: bi.go.id

At a minimum an anti-money laundering program should include. Generally speaking an adjustable rate mortgage is linked to some major benchmark rate. The current version dating from 2012 was last updated in 2020. The exact legal definition of ML varies across jurisdictions but it generally refers to acts that acquire transfer or conceal proceeds of a certain criminal act. Identify and verify the identity of clients monitor transactions and report suspicious transactions.

Source: bi.go.id

Source: bi.go.id

At a minimum an anti-money laundering program should include. Setting anti-money laundering AML and countering the financing of terrorism standardsCFT through regularly updated FATF Recommendations. Assess the adequacy of the banks systems to manage the risks associated with private banking activities and managements ability to implement effective due diligence monitoring and reporting systems. The BSA imposes a range of compliance obligations. Most jurisdictional differences relate to what activity qualifies as a predicate crime.

Source: ppt-online.org

Source: ppt-online.org

Setting anti-money laundering AML and countering the financing of terrorism standardsCFT through regularly updated FATF Recommendations. Understanding correspondent banking is vital to being able to perform my job. In most other respects dealing with TF is analogous to dealing with ML. The BSA is intended to combat money laundering and ensure that banks and financial institutions do not facilitate or become complicit in it. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering.

Source: acamstoday.org

Source: acamstoday.org

Most jurisdictional differences relate to what activity qualifies as a predicate crime. At its most basic Correspondent Banking means a bank is acting as an intermediary to provide banking services to another bank. Increasingly correspondent banks are paying greater attention to their respondents Anti-Money Laundering Combating the. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. Generally speaking an adjustable rate mortgage is linked to some major benchmark rate.

Source: slideserve.com

Source: slideserve.com

Because Im an AML analyst. Is an independentlaundering AML and counter-terrorist financingFor more information about the FATF please visit money laundering terrorist inter-governmental body that develops and promotes Recommendations are recognised financing the financing anti-money of standard. At its most basic Correspondent Banking means a bank is acting as an intermediary to provide banking services to another bank. In the 2017 Correspondent Banking in Emerging Markets Survey2 of over 300 banking clients in 92 countries more than a quarter of global survey participants claimed reductions in correspondent banking relationships CBRs. In most other respects dealing with TF is analogous to dealing with ML.

Source: americanbanker.com

Source: americanbanker.com

Increasingly correspondent banks are paying greater attention to their respondents Anti-Money Laundering Combating the. In the 2017 Correspondent Banking in Emerging Markets Survey2 of over 300 banking clients in 92 countries more than a quarter of global survey participants claimed reductions in correspondent banking relationships CBRs. At its most basic Correspondent Banking means a bank is acting as an intermediary to provide banking services to another bank. The BSA imposes a range of compliance obligations. The BSA is intended to combat money laundering and ensure that banks and financial institutions do not facilitate or become complicit in it.

Source: ppt-online.org

Source: ppt-online.org

The current version dating from 2012 was last updated in 2020. Setting anti-money laundering AML and countering the financing of terrorism standardsCFT through regularly updated FATF Recommendations. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. AML policies help banks and financial institutions combat financial crimes. 2 Correspondent Banking Correspondent Banking is the provision of a current or other liability account and related.

Source: tookitaki.ai

Source: tookitaki.ai

The BSA is intended to combat money laundering and ensure that banks and financial institutions do not facilitate or become complicit in it. In the 2017 Correspondent Banking in Emerging Markets Survey2 of over 300 banking clients in 92 countries more than a quarter of global survey participants claimed reductions in correspondent banking relationships CBRs. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. The exact legal definition of ML varies across jurisdictions but it generally refers to acts that acquire transfer or conceal proceeds of a certain criminal act. At its most basic Correspondent Banking means a bank is acting as an intermediary to provide banking services to another bank.

Source: ppt-online.org

Source: ppt-online.org

Assess the adequacy of the banks systems to manage the risks associated with private banking activities and managements ability to implement effective due diligence monitoring and reporting systems. For example the interest rate may be stated as LIBOR 1 The mortgage may or may not have a cap on how much the interest rate can rise or fall or on how often the interest rate. Assess the adequacy of the banks systems to manage the risks associated with private banking activities and managements ability to implement effective due diligence monitoring and reporting systems. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. The Bank Secrecy Act.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml definition banking by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information