14++ Aml governance definition information

Home » money laundering Info » 14++ Aml governance definition informationYour Aml governance definition images are ready in this website. Aml governance definition are a topic that is being searched for and liked by netizens now. You can Download the Aml governance definition files here. Get all free vectors.

If you’re searching for aml governance definition pictures information connected with to the aml governance definition keyword, you have pay a visit to the ideal blog. Our site frequently gives you hints for seeing the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

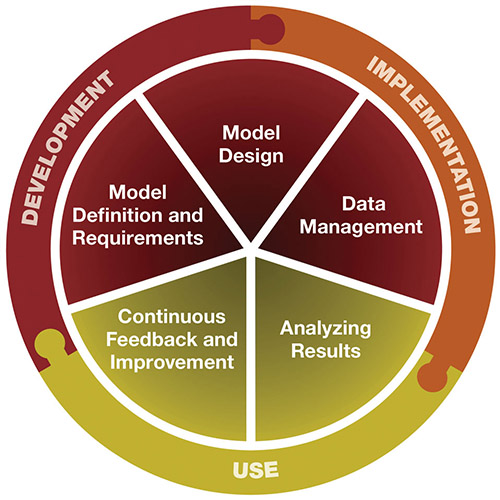

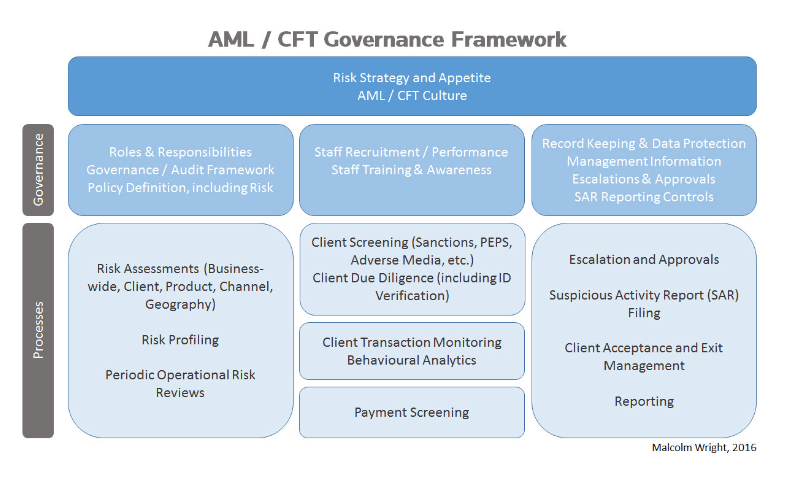

Aml Governance Definition. Advance Resource Access Governance for AML Mar 09 2021 0302 PM Access control is a fundamental building block for enterprise customers where protecting assets at various levels is absolutely necessary to ensure that only the relevant people with certain positions of authority are given access with different privileges. Has senior management identified and assessed the MLTF risks before sign-off. Firms are required to ensure compliance with global sanctions regimes and export controls to prevent terrorism and organised crime. AML Capability Model AML Framework Governance Ownership Responsibility Communication Risk Organisation Risk Based Approach Client On Boarding Transaction Monitoring On Going Management Client Risk Profiling Client Screening Client Due Diligence Client Acceptance Identify Track Suspicious Transactions On Going Client Due Diligence.

Pin By Adele Pienaar On Quality Management Risk Management Business Risk Business Management Degree From za.pinterest.com

Pin By Adele Pienaar On Quality Management Risk Management Business Risk Business Management Degree From za.pinterest.com

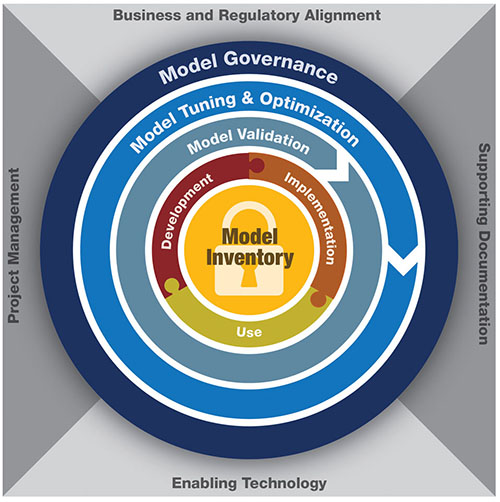

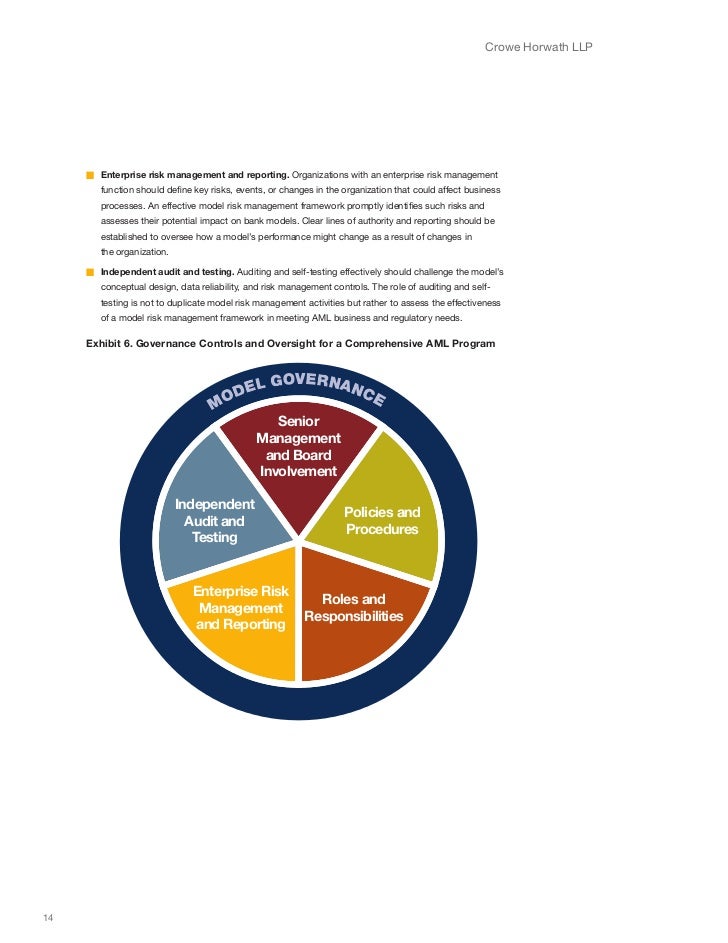

Today it is not uncommon to see the US Justice Department and regulators announce multimillion dollar criminal or civil fines as settlements for AML violations. Strong organisation skills attention to detail and ability to manage and prioritise effectively. According to the guidance Even if model development implementation use and validation are satisfactory a weak governance function will reduce the effectiveness of overall model risk management. Has senior management identified and assessed the MLTF risks before sign-off. By JX 29 Apr 2017. It is therefore important for institutions to define their objectives clearly when designing a data governance function for AML or any other purpose and scope the undertaking appropriately to help them achieve their specific goals of managing protecting ensuring quality and ultimately knowing their data.

All current beneficial owners officers and managers must be approved by their supervisory authority in accordance with R26 Practices must appoint a MLRO money laundering reporting officer who is responsible for receiving disclosures from staff of suspected money laundering and determining whether they warrant the submission of a suspicious activity report SAR to the.

Advance Resource Access Governance for AML Mar 09 2021 0302 PM Access control is a fundamental building block for enterprise customers where protecting assets at various levels is absolutely necessary to ensure that only the relevant people with certain positions of authority are given access with different privileges. To align with our business requirements it incorporates guidance from global standards CBM. Unfortunately such requirements cannot be captured with the existing roles. According to the guidance Even if model development implementation use and validation are satisfactory a weak governance function will reduce the effectiveness of overall model risk management. Has senior management identified and assessed the MLTF risks before sign-off. Advance Resource Access Governance for AML Mar 09 2021 0302 PM Access control is a fundamental building block for enterprise customers where protecting assets at various levels is absolutely necessary to ensure that only the relevant people with certain positions of authority are given access with different privileges.

Source: slideplayer.com

Source: slideplayer.com

Advance Resource Access Governance for AML Mar 09 2021 0302 PM Access control is a fundamental building block for enterprise customers where protecting assets at various levels is absolutely necessary to ensure that only the relevant people with certain positions of authority are given access with different privileges. Defining the organizations AML risk appetite so that it is clear throughout the organization how much AML risk is acceptable. AML Compliance Officer and MLROs knowledge and experience. Financial institutions have invested significant time money and resources into developing and maintaining anti-money laundering AML compliance programs. According to the guidance Even if model development implementation use and validation are satisfactory a weak governance function will reduce the effectiveness of overall model risk management.

Source: pinterest.com

Source: pinterest.com

In light of this scrutiny it is critical that financial institutions make AML. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world. Proactively identify potential risks and interdependencies and propose improvements. Anti-money laundering compliance has been a main focus of regulators and prosecutors in recent years. Unfortunately compliance departments particularly BSAAML.

Source: za.pinterest.com

Source: za.pinterest.com

The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world. Anti-money laundering compliance has been a main focus of regulators and prosecutors in recent years. Liaise with multiple stakeholders to assist in the definition of scope benefits deliverables and timelines. Governance Culture Risk Assessment is a driver of all overall AML risks and resource allocation Is senior management a rubber stamp. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum.

Source: elibrary.imf.org

Source: elibrary.imf.org

In recent years regulators have dramatically stepped up enforcement of antimoney laundering AML and CFT laws and regulations. FCC tops the agenda of regulators globally. Increasing focus has been applied to effective data management in recent years due to the growing reliance on data to manage and optimize operations mitigate risk and support development of new products and services. Monitoring changes in the organizations risk profile performance against stated tolerances. Anti-money laundering and financial crime compliance A viewpoint for revitalization and efficiency Anti-money laundering AML is a fundamentally critical responsibility of the modern financial enterprise.

Source: bi.go.id

Source: bi.go.id

Unfortunately such requirements cannot be captured with the existing roles. All current beneficial owners officers and managers must be approved by their supervisory authority in accordance with R26 Practices must appoint a MLRO money laundering reporting officer who is responsible for receiving disclosures from staff of suspected money laundering and determining whether they warrant the submission of a suspicious activity report SAR to the. Firms are required to ensure compliance with global sanctions regimes and export controls to prevent terrorism and organised crime. Head Office Regions and LOBs Roles of Senior Management from These AML-Related Committees. Enterprise needs a better mechanism to define policies for various assets in AML to satisfy their business specific requirements.

Source: acamstoday.org

Source: acamstoday.org

Data Governance and Management in BSAAML and Sanctions Compliance. This is evidenced by the increase in criminal and regulatory penalties imposed against financial institutions for failures relating to their Bank Secrecy Act and anti-money laundering BSAAML compliance programs. Proactively identify potential risks and interdependencies and propose improvements. All financial institutions that rely on models for AML compliance should implement an appropriate governance program. In order to meet these requirements they will need to monitor regulatory changes and maintain an internal framework to ensure that customers.

Source: hesfintech.com

Source: hesfintech.com

To align with our business requirements it incorporates guidance from global standards CBM. In order to meet these requirements they will need to monitor regulatory changes and maintain an internal framework to ensure that customers. All current beneficial owners officers and managers must be approved by their supervisory authority in accordance with R26 Practices must appoint a MLRO money laundering reporting officer who is responsible for receiving disclosures from staff of suspected money laundering and determining whether they warrant the submission of a suspicious activity report SAR to the. Anti-money laundering and financial crime compliance A viewpoint for revitalization and efficiency Anti-money laundering AML is a fundamentally critical responsibility of the modern financial enterprise. Has senior management identified and assessed the MLTF risks before sign-off.

Source: acamstoday.org

Source: acamstoday.org

Anti-money laundering compliance has been a main focus of regulators and prosecutors in recent years. Designing a governance framework for sanctions. Advance Resource Access Governance for AML Mar 09 2021 0302 PM Access control is a fundamental building block for enterprise customers where protecting assets at various levels is absolutely necessary to ensure that only the relevant people with certain positions of authority are given access with different privileges. Financial institutions have invested significant time money and resources into developing and maintaining anti-money laundering AML compliance programs. Head Office Regions and LOBs Roles of Senior Management from These AML-Related Committees.

Source: slideshare.net

Source: slideshare.net

FCC tops the agenda of regulators globally. Strong organisation skills attention to detail and ability to manage and prioritise effectively. Defining the organizations AML risk appetite so that it is clear throughout the organization how much AML risk is acceptable. AML Compliance Officer and MLROs knowledge and experience. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world.

Source: eba.europa.eu

Source: eba.europa.eu

What Does Data Governance Do. This is evidenced by the increase in criminal and regulatory penalties imposed against financial institutions for failures relating to their Bank Secrecy Act and anti-money laundering BSAAML compliance programs. Unfortunately such requirements cannot be captured with the existing roles. Has senior management identified and assessed the MLTF risks before sign-off. Financial institutions have invested significant time money and resources into developing and maintaining anti-money laundering AML compliance programs.

The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world. All current beneficial owners officers and managers must be approved by their supervisory authority in accordance with R26 Practices must appoint a MLRO money laundering reporting officer who is responsible for receiving disclosures from staff of suspected money laundering and determining whether they warrant the submission of a suspicious activity report SAR to the. Firms are required to ensure compliance with global sanctions regimes and export controls to prevent terrorism and organised crime. Financial institutions have invested significant time money and resources into developing and maintaining anti-money laundering AML compliance programs. AML Compliance Officer and MLROs knowledge and experience.

Source: pinterest.com

Source: pinterest.com

By JX 29 Apr 2017. Governance Culture Risk Assessment is a driver of all overall AML risks and resource allocation Is senior management a rubber stamp. Firms are required to ensure compliance with global sanctions regimes and export controls to prevent terrorism and organised crime. Anti-money laundering compliance has been a main focus of regulators and prosecutors in recent years. To align with our business requirements it incorporates guidance from global standards CBM.

Source: pinterest.com

Source: pinterest.com

To align with our business requirements it incorporates guidance from global standards CBM. AML Capability Model AML Framework Governance Ownership Responsibility Communication Risk Organisation Risk Based Approach Client On Boarding Transaction Monitoring On Going Management Client Risk Profiling Client Screening Client Due Diligence Client Acceptance Identify Track Suspicious Transactions On Going Client Due Diligence. An effective AML governance structure is only possible when its leaders senior management of the organization consistently remain informed of the state of AML compliance within the institution across the firm17 Defining Escalation Requirements for US. By JX 29 Apr 2017. Data Governance and Management in BSAAML and Sanctions Compliance.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml governance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas