19++ Aml kyc client onboarding process info

Home » money laundering idea » 19++ Aml kyc client onboarding process infoYour Aml kyc client onboarding process images are ready in this website. Aml kyc client onboarding process are a topic that is being searched for and liked by netizens now. You can Download the Aml kyc client onboarding process files here. Download all royalty-free photos and vectors.

If you’re searching for aml kyc client onboarding process pictures information related to the aml kyc client onboarding process topic, you have pay a visit to the right site. Our website frequently gives you suggestions for seeing the highest quality video and image content, please kindly search and locate more informative video content and graphics that fit your interests.

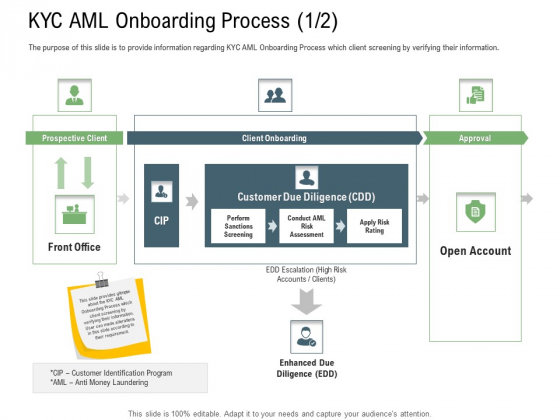

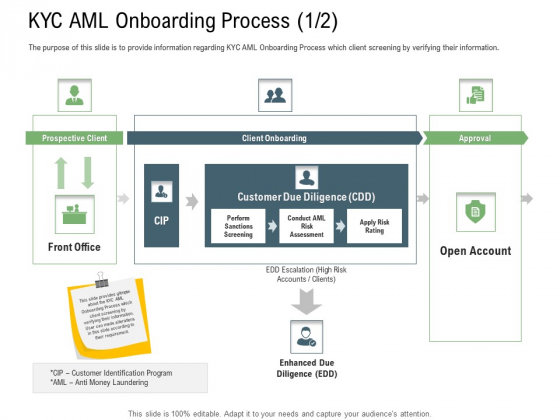

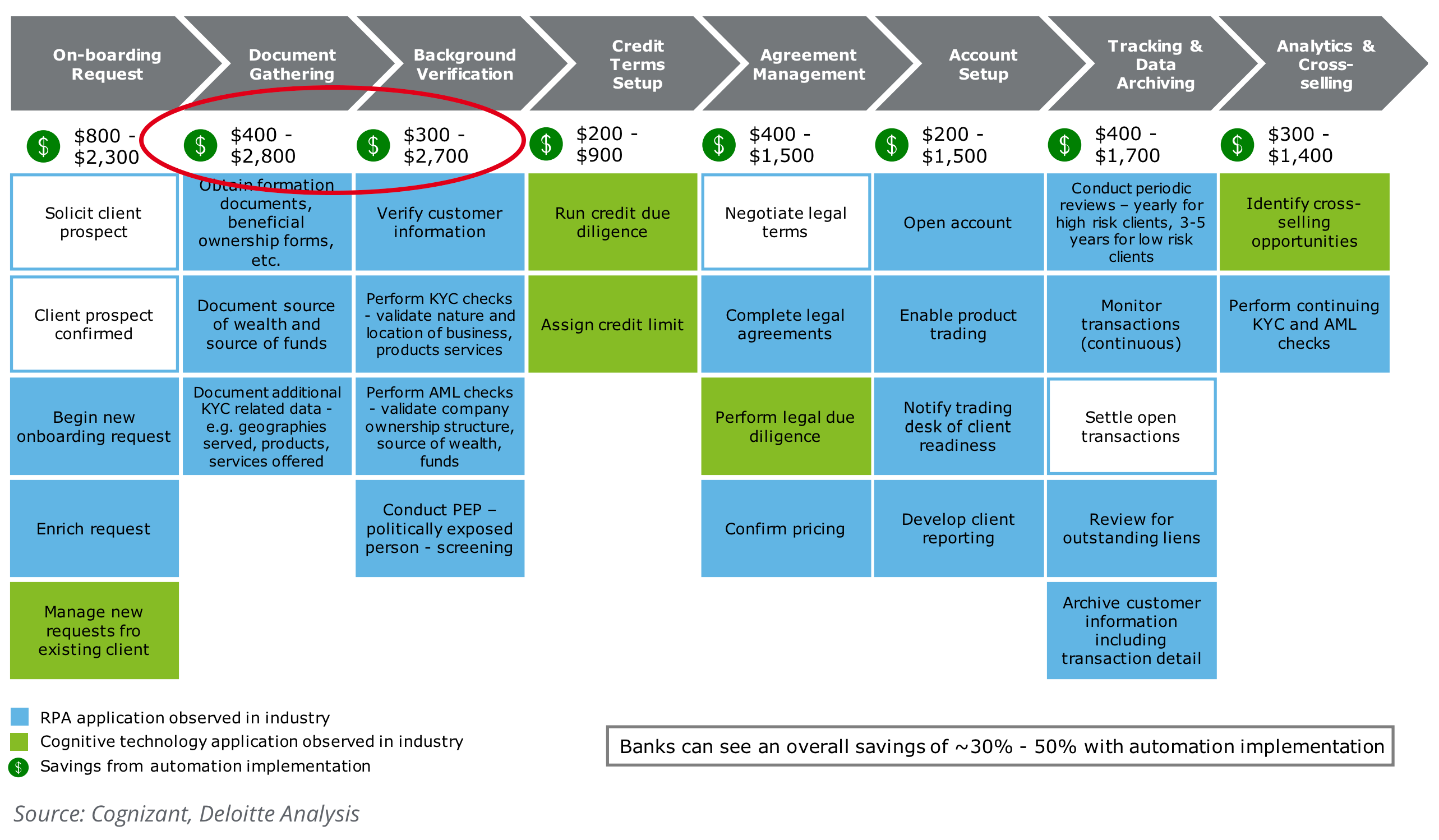

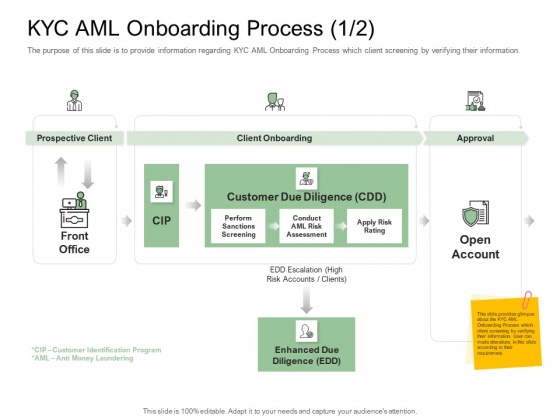

Aml Kyc Client Onboarding Process. 5 Key Considerations for your client onboarding processes KYCAML Compliance Whether your products are credit cards insurance policies wealth management solutions or securities client onboarding for financial services companies including KYCAML compliance obligations can be a pain for all concerned. When assessing a customers AML risk rating during the client onboarding phase AML and Compliance officers normally consider the expected type of transactions and the anticipated level of transactional activities that the customer will be involved in. Banks and FinTechs need to ensure that their customers are genuinely who they claim to be. Onboarding KYC AML RegTek Solution.

Client Onboarding Framework Kyc Aml Onboarding Process Due Structure Pdf Powerpoint Templates From slidegeeks.com

Client Onboarding Framework Kyc Aml Onboarding Process Due Structure Pdf Powerpoint Templates From slidegeeks.com

Anti money laundering AML client onboarding is the beginning of the relationship between a financial service and a customer. Latest news reports from the medical literature videos from the experts and more. A Complete Solution for Client Onboarding and AML Review Process Financial institutions are required to conduct a thorough review of a new customer before accepting that customer as a new client. Decide between automated KYC and manual KYC checks for new client onboarding. If operating a manual KYC check ensure that you thoroughly vet the clients contact and financial information performing a full credit check of the company. Customer identification is the most critical process of KYC.

From the verification of a clients identity to the clarification of beneficial owners and.

Since the introduction of the first Anti-money laundering AML laws in the 1970s the respective regulatory requirements have increased almost on an annual basis. Ad AML coverage from every angle. If operating a manual KYC check ensure that you thoroughly vet the clients contact and financial information performing a full credit check of the company. Reviewing KYC Procedures 23 months have passed and its now time to renew your clients KYC up to current standards as stated in the procedures that your new MLRO issued. KYC AML. Onboarding KYC AML RegTek Solution.

Source: slideteam.net

Source: slideteam.net

KYC as it stands for Know your Customer or Know your Client is a mandatory banking process that involves checking the identity of a client during the onboarding process. Know Your Customer KYC is a process to which financial institutions must adhere in order to comply with global Anti-Money Laundering AML regulations. Below we quickly run through 5 key. KYC AML. Since the introduction of the first Anti-money laundering AML laws in the 1970s the respective regulatory requirements have increased almost on an annual basis.

Source: slideplayer.com

Source: slideplayer.com

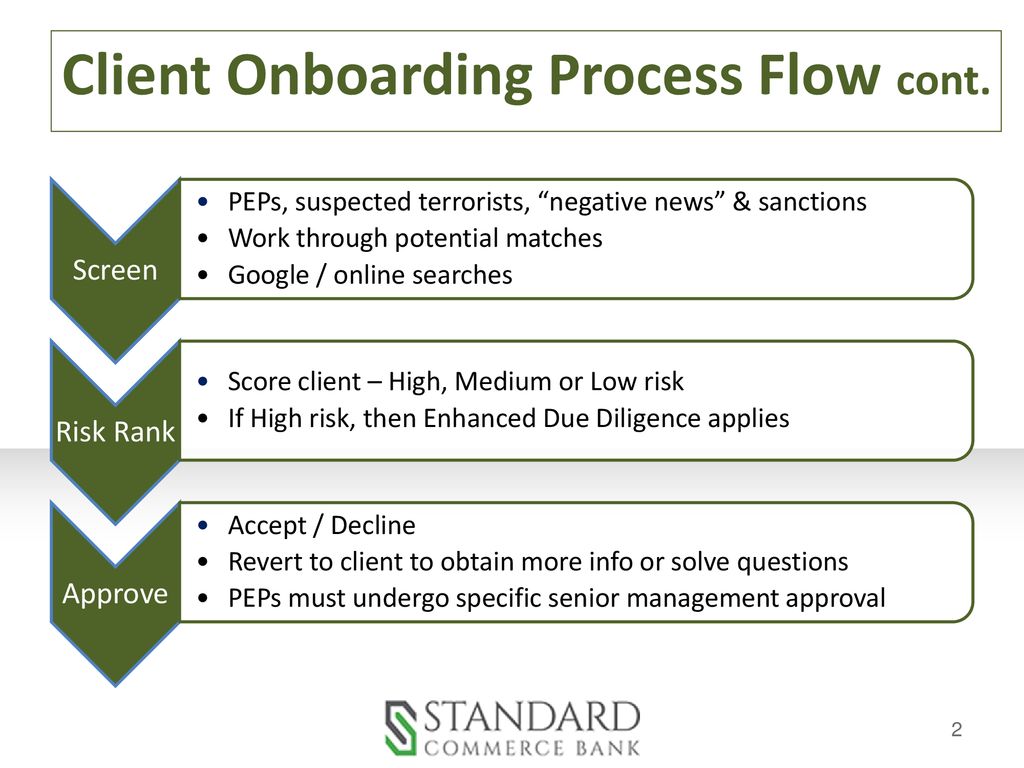

The onboarding process lays a foundation for financial entities to gather essential information concerning the client as an aspect of Know Your Customer KYC and Customer Due Diligence CDD. Decide between automated KYC and manual KYC checks for new client onboarding. Institutions must ensure that they have sufficient procedures in place that list the relevant documentation and information that should be obtained from each customer. Below we quickly run through 5 key. Client registration the following information will be provided by the client and the following checks should occur automatically close to real time to ensure you are performing sanctions and PEP scanning obligations and also for the purposes of managing online fraud risks.

Source: slideteam.net

Source: slideteam.net

What Are The KYC requirements and AML Regulation for The Customer Onboarding Process. What Are The KYC requirements and AML Regulation for The Customer Onboarding Process. Latest news reports from the medical literature videos from the experts and more. Companies have to implement the KYC guidelines of customer onboarding processes. Initiating the AML KYC process involves a notification normally automated being sent to the AML or related KYC group alerting it to commence the AML review process per KYC requirements.

Source: slidegeeks.com

Source: slidegeeks.com

This is part of what is known as the customer onboarding process. It requires the institution to verify the identity of its clients and to obtain detailed due diligence information in order to assess the potential risk of illegal activity. In essence AML KYC client onboarding process instances seek to establish an amicable and transparent relationship between the client and the financial service provider. The client onboarding process today. Client registration the following information will be provided by the client and the following checks should occur automatically close to real time to ensure you are performing sanctions and PEP scanning obligations and also for the purposes of managing online fraud risks.

![]() Source: slideteam.net

Source: slideteam.net

Benefits of using digital client onboarding checks. A Complete Client Lifecycle Management KYC AML On-Premise and SaaS Solution which streamlines all your day-to-day compliance operations from Onboarding to client acceptance transaction monitoring and screening detecting suspicious activity and managing investigations. Decide between automated KYC and manual KYC checks for new client onboarding. Client registration the following information will be provided by the client and the following checks should occur automatically close to real time to ensure you are performing sanctions and PEP scanning obligations and also for the purposes of managing online fraud risks. Banks and FinTechs need to ensure that their customers are genuinely who they claim to be.

Source: slideteam.net

Source: slideteam.net

Below we quickly run through 5 key. Onboarding is the point at which a business must collect a range of important information about their customers as part of the customer due diligence CDD and know your customer KYC process. You add the client to your ongoing KYC and AML monitoring list which will pick up any significant changes in their circumstances and notify you. Since the introduction of the first Anti-money laundering AML laws in the 1970s the respective regulatory requirements have increased almost on an annual basis. Ad AML coverage from every angle.

Source: advisoryhq.com

Source: advisoryhq.com

KYC as it stands for Know your Customer or Know your Client is a mandatory banking process that involves checking the identity of a client during the onboarding process. Decide between automated KYC and manual KYC checks for new client onboarding. Companies have to implement the KYC guidelines of customer onboarding processes. The companies compliance officers fulfill and conduct the liabilities of the companies in the compliance processes. This is part of what is known as the customer onboarding process.

Source: slideteam.net

Source: slideteam.net

Know Your Customer KYC is a process to which financial institutions must adhere in order to comply with global Anti-Money Laundering AML regulations. Anti money laundering AML client onboarding is the beginning of the relationship between a financial service and a customer. Initiating the AML KYC process involves a notification normally automated being sent to the AML or related KYC group alerting it to commence the AML review process per KYC requirements. Customer identification is the most critical process of KYC. You add the client to your ongoing KYC and AML monitoring list which will pick up any significant changes in their circumstances and notify you.

Source: slideteam.net

Source: slideteam.net

This is part of what is known as the customer onboarding process. Below we quickly run through 5 key. Benefits of using digital client onboarding checks. Since the introduction of the first Anti-money laundering AML laws in the 1970s the respective regulatory requirements have increased almost on an annual basis. Client Onboarding CDD Process Assessing High Risk Account Transactions.

Source: specitec.com

Source: specitec.com

What Are The KYC requirements and AML Regulation for The Customer Onboarding Process. When assessing a customers AML risk rating during the client onboarding phase AML and Compliance officers normally consider the expected type of transactions and the anticipated level of transactional activities that the customer will be involved in. Ad AML coverage from every angle. In essence AML KYC client onboarding process instances seek to establish an amicable and transparent relationship between the client and the financial service provider. Below we quickly run through 5 key.

Source: slideteam.net

Source: slideteam.net

Client Onboarding CDD Process Assessing High Risk Account Transactions. This is part of what is known as the customer onboarding process. Institutions must ensure that they have sufficient procedures in place that list the relevant documentation and information that should be obtained from each customer. A Complete Client Lifecycle Management KYC AML On-Premise and SaaS Solution which streamlines all your day-to-day compliance operations from Onboarding to client acceptance transaction monitoring and screening detecting suspicious activity and managing investigations. Latest news reports from the medical literature videos from the experts and more.

Source: arachnys.com

Source: arachnys.com

Benefits of using digital client onboarding checks. The companies compliance officers fulfill and conduct the liabilities of the companies in the compliance processes. From the verification of a clients identity to the clarification of beneficial owners and. 5 Key Considerations for your client onboarding processes KYCAML Compliance Whether your products are credit cards insurance policies wealth management solutions or securities client onboarding for financial services companies including KYCAML compliance obligations can be a pain for all concerned. A Complete Solution for Client Onboarding and AML Review Process Financial institutions are required to conduct a thorough review of a new customer before accepting that customer as a new client.

Source: slidegeeks.com

Source: slidegeeks.com

You add the client to your ongoing KYC and AML monitoring list which will pick up any significant changes in their circumstances and notify you. The client onboarding process today. Customer identification is the most critical process of KYC. Since the introduction of the first Anti-money laundering AML laws in the 1970s the respective regulatory requirements have increased almost on an annual basis. Anti money laundering AML client onboarding is the beginning of the relationship between a financial service and a customer.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title aml kyc client onboarding process by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information