18++ Aml kyc requirements uk ideas in 2021

Home » money laundering Info » 18++ Aml kyc requirements uk ideas in 2021Your Aml kyc requirements uk images are available in this site. Aml kyc requirements uk are a topic that is being searched for and liked by netizens now. You can Get the Aml kyc requirements uk files here. Find and Download all free photos and vectors.

If you’re looking for aml kyc requirements uk pictures information linked to the aml kyc requirements uk keyword, you have pay a visit to the ideal blog. Our site always gives you suggestions for seeing the maximum quality video and image content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Aml Kyc Requirements Uk. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options. KYC and AML requirements are a key focus for organizations to ensure they are following compliance requirements for meeting the increasing regulatory demands. An AML check should include Know Your Customer KYC procedures so you can prove you know who you are dealing with. With our global AI powered solution verify user ID Passports drivings licenses instantly.

Pin On Udemy Free Coupons From pinterest.com

Pin On Udemy Free Coupons From pinterest.com

In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to. An individual must be appointed as Money Laundering Reporting Officer to. In the UK these requirements come mainly from the. AML legislation in Europe is currently defined by the 4th Anti-Money Laundering Directive 4AMLD which covers everything from KYC requirements and virtual currencies to internal company policies that specifically address money laundering and terrorist financing. KYC and AML requirements are becoming more stringent and these laws are the primary focus of all the organisations. In the UK the EUs Fourth Anti-Money Laundering Directive 4MLD significantly changed the approach to conducting AML checks with a more prescriptive approach to record keeping and when enhanced due diligence is required.

Latest news reports from the medical literature videos from the experts and more.

FCA has introduced some arrangements to reduce and eliminate money laundering risks in trading UK crypto exchanges in the UK. KYC and AML requirements are becoming more stringent and these laws are the primary focus of all the organisations. KYCAML Requirements This article explains the KYCAML requirements as part of the merchant onboarding process. Ad A review of the completeness of your current policies. Firms must submit suspicious activity reports SAR to the National Crime Agency when potential money laundering activity is detected. A comprehensive guide to KYC and AML compliance in the UK.

Source: pinterest.com

Source: pinterest.com

Firms must submit suspicious activity reports SAR to the National Crime Agency when potential money laundering activity is detected. Latest news reports from the medical literature videos from the experts and more. Latest news reports from the medical literature videos from the experts and more. In the UK these requirements come mainly from the. Ad A review of the completeness of your current policies.

Source: pinterest.com

Source: pinterest.com

Latest news reports from the medical literature videos from the experts and more. AML legislation in Europe is currently defined by the 4th Anti-Money Laundering Directive 4AMLD which covers everything from KYC requirements and virtual currencies to internal company policies that specifically address money laundering and terrorist financing. Banks in the UK are required by law to comply with anti-money laundering AML laws and Know your Customer KYC requirements to prevent criminals and terrorists from using financial products or services to store and move around their money. An AML check involves identity checks and verification plus monitoring of financial transactions to detect fraud. Latest news reports from the medical literature videos from the experts and more.

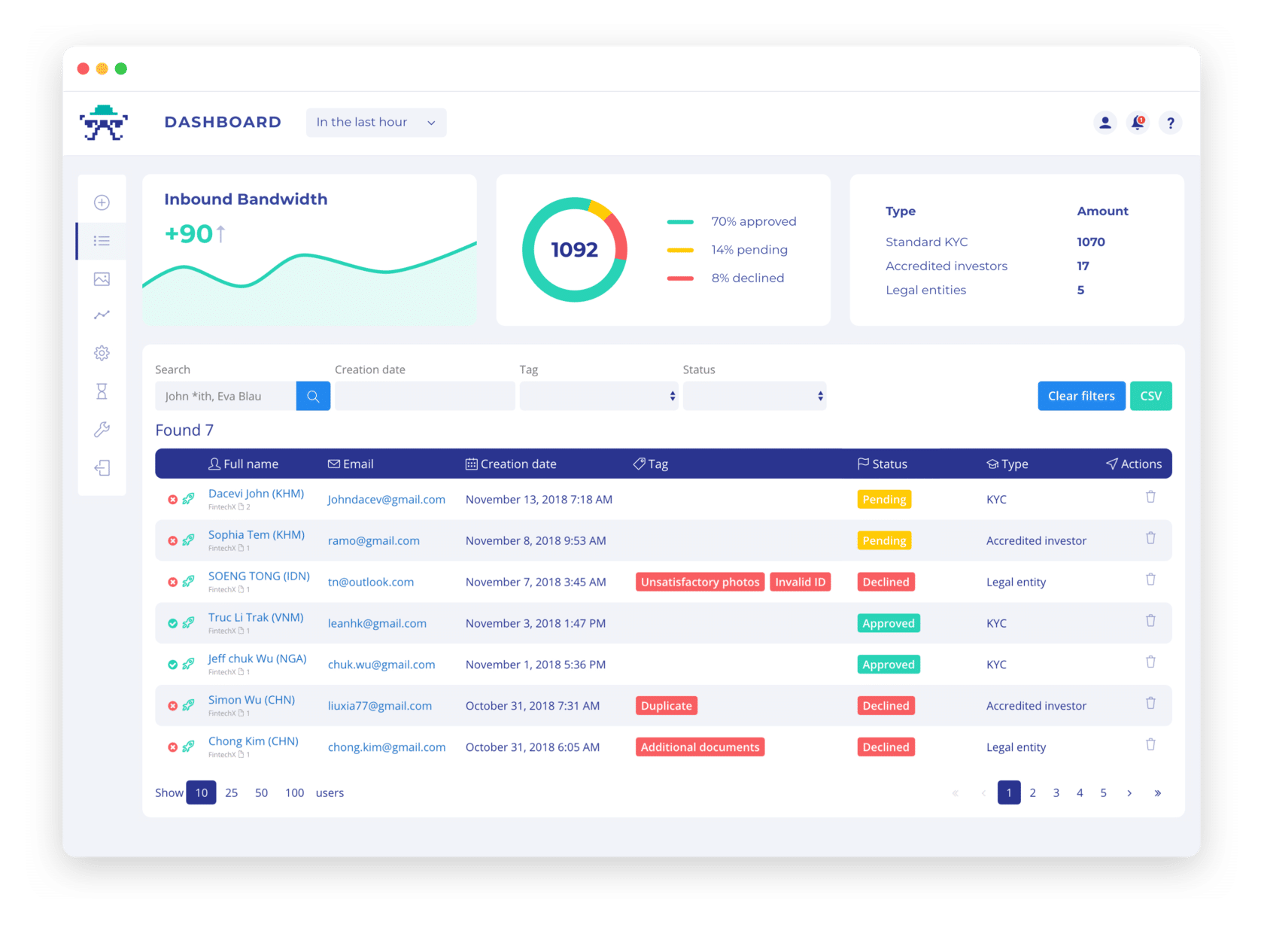

Source: sumsub.com

Source: sumsub.com

Latest news reports from the medical literature videos from the experts and more. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to. Within Europe national AML laws can vary and UK businesses must ensure they can meet KYC procedures that are permissible in a particular member state. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among. In the UK these requirements come mainly from the.

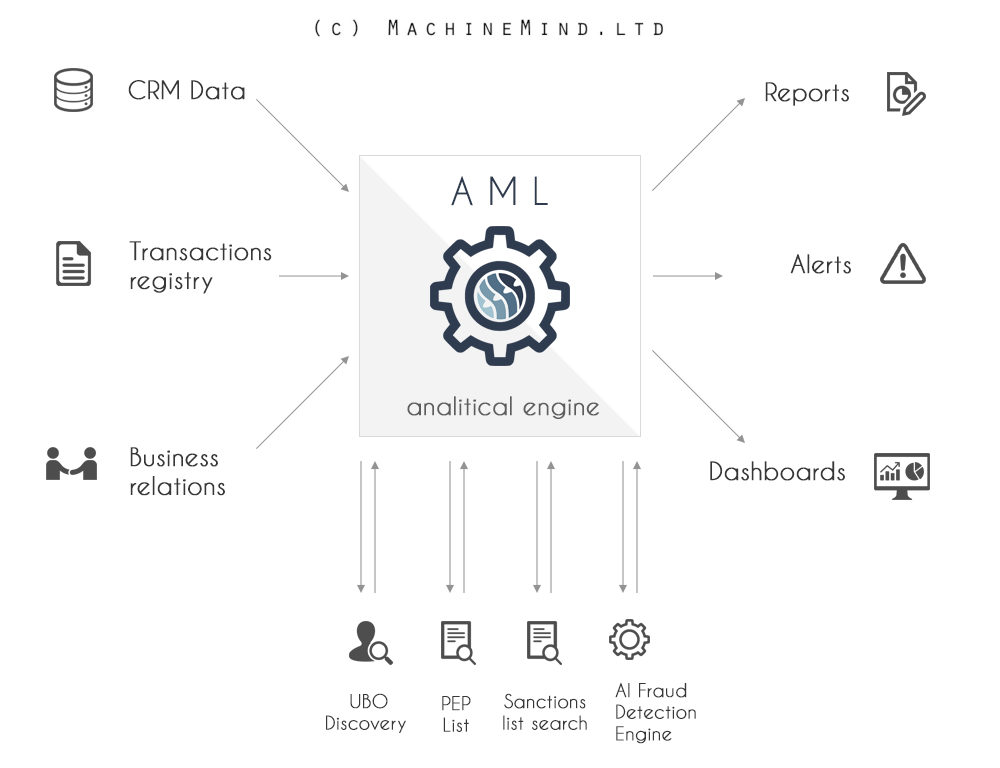

Source: machinemind.ltd

Source: machinemind.ltd

In the UK the EUs Fourth Anti-Money Laundering Directive 4MLD significantly changed the approach to conducting AML checks with a more prescriptive approach to record keeping and when enhanced due diligence is required. Within Europe national AML laws can vary and UK businesses must ensure they can meet KYC procedures that are permissible in a particular member state. KYC and CDD procedures should be. With our global AI powered solution verify user ID Passports drivings licenses instantly. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options.

Source: pinterest.com

Source: pinterest.com

With our global AI powered solution verify user ID Passports drivings licenses instantly. Before you can start accepting digital currency with NetCents youll need to provide us with documentation to verify your business. Member states follow a combination of guidelines established under the Financial Action Task Force FATF implementation of AML Directives the latest being AMLD5 and the upcoming AMLD6 and national AML Acts. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. An AML check should include Know Your Customer KYC procedures so you can prove you know who you are dealing with.

Source: medium.com

Source: medium.com

FCA has introduced some arrangements to reduce and eliminate money laundering risks in trading UK crypto exchanges in the UK. KYCAML Requirements This article explains the KYCAML requirements as part of the merchant onboarding process. An individual must be appointed as Money Laundering Reporting Officer to. In the UK these requirements come mainly from the. With our global AI powered solution verify user ID Passports drivings licenses instantly.

Source: shuftipro.com

Source: shuftipro.com

What Are the Requirements of Regulations for Crypto Businesses. Ad AML coverage from every angle. KYC and AML requirements are a key focus for organizations to ensure they are following compliance requirements for meeting the increasing regulatory demands. Within Europe national AML laws can vary and UK businesses must ensure they can meet KYC procedures that are permissible in a particular member state. A comprehensive guide to KYC and AML compliance in the UK.

Source: pinterest.com

Source: pinterest.com

Ad A review of the completeness of your current policies. KYCAML Requirements This article explains the KYCAML requirements as part of the merchant onboarding process. KYC and AML requirements are becoming more stringent and these laws are the primary focus of all the organisations. KYC and AML requirements are a key focus for organizations to ensure they are following compliance requirements for meeting the increasing regulatory demands. This guidance has been written both as a result of the changes made to the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 by the Money Laundering and Terrorist Financing Amendment Regulations 2019 that came into force on 10 January 2020 and an extensive review of the previous guidance by the Legal Sector Affinity Group.

Source: id.pinterest.com

Source: id.pinterest.com

KYC and AML requirements are becoming more stringent and these laws are the primary focus of all the organisations. KYC and CDD procedures should be. Ad AML coverage from every angle. Money Laundering Reporting Officer. 5MLD changes this further specifically in relation to beneficial ownership which we discuss in more detail below.

Source: pinterest.com

Source: pinterest.com

Ad AML coverage from every angle. An individual must be appointed as Money Laundering Reporting Officer to. In the UK the EUs Fourth Anti-Money Laundering Directive 4MLD significantly changed the approach to conducting AML checks with a more prescriptive approach to record keeping and when enhanced due diligence is required. Latest news reports from the medical literature videos from the experts and more. Member states follow a combination of guidelines established under the Financial Action Task Force FATF implementation of AML Directives the latest being AMLD5 and the upcoming AMLD6 and national AML Acts.

Source: shuftipro.com

Source: shuftipro.com

What Are the Requirements of Regulations for Crypto Businesses. What are the AML and KYC obligations of a Bank in the UK. An individual must be appointed as Money Laundering Reporting Officer to. With our global AI powered solution verify user ID Passports drivings licenses instantly. With our global AI powered solution verify user ID Passports drivings licenses instantly.

Source: shuftipro.com

Source: shuftipro.com

In the UK the EUs Fourth Anti-Money Laundering Directive 4MLD significantly changed the approach to conducting AML checks with a more prescriptive approach to record keeping and when enhanced due diligence is required. What Are the Requirements of Regulations for Crypto Businesses. FCA has introduced some arrangements to reduce and eliminate money laundering risks in trading UK crypto exchanges in the UK. With our global AI powered solution verify user ID Passports drivings licenses instantly. KYCAML Requirements This article explains the KYCAML requirements as part of the merchant onboarding process.

Source: arachnys.com

Source: arachnys.com

What Are the Requirements of Regulations for Crypto Businesses. With our global AI powered solution verify user ID Passports drivings licenses instantly. Firms must submit suspicious activity reports SAR to the National Crime Agency when potential money laundering activity is detected. The risk-based approach to anti-money laundering. Banks in the UK are required by law to comply with anti-money laundering AML laws and Know your Customer KYC requirements to prevent criminals and terrorists from using financial products or services to store and move around their money.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml kyc requirements uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas