13+ Aml placement definition ideas

Home » money laundering Info » 13+ Aml placement definition ideasYour Aml placement definition images are available in this site. Aml placement definition are a topic that is being searched for and liked by netizens now. You can Get the Aml placement definition files here. Get all free photos and vectors.

If you’re looking for aml placement definition images information connected with to the aml placement definition keyword, you have pay a visit to the right blog. Our site frequently gives you hints for downloading the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

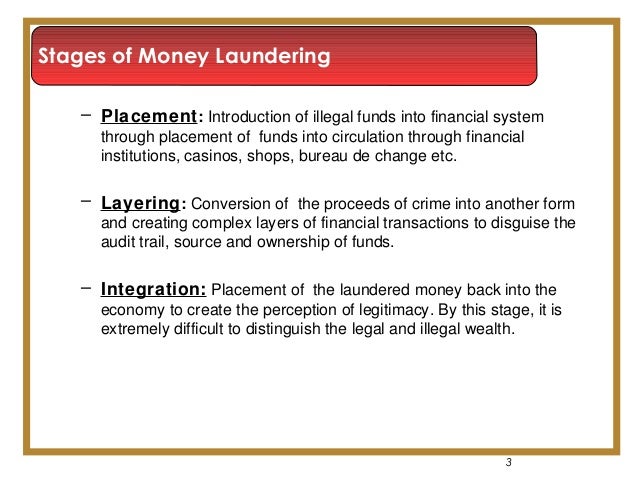

Aml Placement Definition. On occasion the source can be easily disguised or misrepresented. A it relieves the criminal of holding and guarding large amounts of bulky of cash. Placement This is the movement of cash from its source. The money placement stage is the step that makes scammers most vulnerable to the laws surveillance.

What Is Anti Money Laundering Quora From quora.com

What Is Anti Money Laundering Quora From quora.com

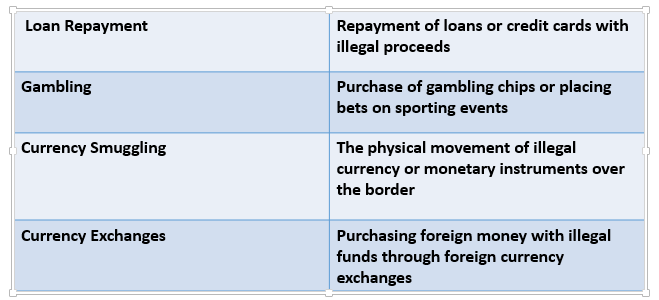

Generally this stage serves two purposes. Placement is one of the ways where illicit funds are separated from their illegal source and are placed into the financial system. Money Laundering Placement Layering Integration three stages. Some of the common methods include. This is followed by placing it into circulation through financial institutions casinos shops bureau de change and other businesses both local and abroad. Breaking down large sums of money into smaller amounts that can be deposited in banks without triggering AML reporting threshold alerts.

Latest news reports from the medical literature videos from the experts and more.

Criminals may use several methodologies to place illegal money in the legitimate financial system including. The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. A Placement - the physical disposal of cash proceeds d erived from illegal activities. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Funneling illegal funds through legitimate businesses that deal heavily in cash transactions. The Placement Stage Filtering.

Source: letstalkaml.com

Source: letstalkaml.com

On occasion the source can be easily disguised or misrepresented. On occasion the source can be easily disguised or misrepresented. This is followed by placing it into circulation through financial institutions casinos shops bureau de change and other businesses both local and abroad. The money placement stage is the step that makes scammers most vulnerable to the laws surveillance. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations.

Source: slideshare.net

Source: slideshare.net

This is followed by placing it into circulation through financial institutions casinos shops bureau de change and other businesses both local and abroad. Depriving the scammer of the necessity to maintain large amounts of value. And b it places the money into the legitimate financial system. Latest news reports from the medical literature videos from the experts and more. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities.

Source: youtube.com

Source: youtube.com

Depriving the scammer of the necessity to maintain large amounts of value. Latest news reports from the medical literature videos from the experts and more. Money laundering placement is used just for two aims. Breaking down large sums of money into smaller amounts that can be deposited in banks without triggering AML reporting threshold alerts. The risk assessment does this by identifying those aspects of a business that are most likely to attract money launderers or those.

Source: amlcompliance.ie

Source: amlcompliance.ie

Latest news reports from the medical literature videos from the experts and more. Best practices for Anti-Money Laundering. Placement This is the movement of cash from its source. Structuring smurfing which the funds are of high value are broken into many small value transactions. Latest news reports from the medical literature videos from the experts and more.

Source: calert.info

Source: calert.info

Latest news reports from the medical literature videos from the experts and more. This is followed by placing it into circulation through financial institutions casinos shops bureau de change and other businesses both local and abroad. Money Laundering Placement Layering Integration three stages. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. B Layering - separating illicit proceeds from their source by creating complex layers of financial transactions designed to disguise the source of the money subvert the audit trail and provide anonymity.

Source: vskills.in

Source: vskills.in

What is AML Anti-Money Laundering. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. Placement This is the movement of cash from its source. Some of the common methods include. Money laundering placement is used just for two aims.

Source: thekeepitsimple.com

Source: thekeepitsimple.com

AML compliance checklist. The risk assessment does this by identifying those aspects of a business that are most likely to attract money launderers or those. Some of the common methods include. B Layering - separating illicit proceeds from their source by creating complex layers of financial transactions designed to disguise the source of the money subvert the audit trail and provide anonymity. Aml placement layering integration.

Source: quora.com

Source: quora.com

Money Laundering Placement Layering Integration three stages. Generally this stage serves two purposes. AML compliance checklist. Criminals may use several methodologies to place illegal money in the legitimate financial system including. Money laundering placement is used just for two aims.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Criminals may use several methodologies to place illegal money in the legitimate financial system including. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Complex layering schemes involve sending the money around the globe using a series of transactions. On occasion the source can be easily disguised or misrepresented. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering.

Source: bitquery.io

Source: bitquery.io

Depriving the scammer of the necessity to maintain large amounts of value. Breaking down large sums of money into smaller amounts that can be deposited in banks without triggering AML reporting threshold alerts. Money Laundering Placement Layering Integration three stages. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism.

Source: calert.info

Source: calert.info

Transferring money into the legit financial system to avoid exposure. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. Best practices for Anti-Money Laundering. A Placement - the physical disposal of cash proceeds d erived from illegal activities.

Source: study.com

Source: study.com

The money placement stage is the step that makes scammers most vulnerable to the laws surveillance. Depositing the ill gotten gains into financial institutions. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. This is followed by placing it into circulation through financial institutions casinos shops bureau de change and other businesses both local and abroad. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones.

Source: eimf.eu

Source: eimf.eu

Some of the common methods include. Money laundering placement is used just for two aims. What is AML Anti-Money Laundering. The money placement stage is the step that makes scammers most vulnerable to the laws surveillance. Criminals may use several methodologies to place illegal money in the legitimate financial system including.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml placement definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas