17++ Aml risk definition info

Home » money laundering idea » 17++ Aml risk definition infoYour Aml risk definition images are available in this site. Aml risk definition are a topic that is being searched for and liked by netizens now. You can Find and Download the Aml risk definition files here. Get all royalty-free photos.

If you’re looking for aml risk definition pictures information related to the aml risk definition interest, you have visit the ideal blog. Our website frequently provides you with suggestions for seeking the highest quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

Aml Risk Definition. What is AML Anti-Money Laundering. The source of money laundering is serious crimes such as financing of terrorism bribery corruption drug trafficking human trafficking arms smuggling. Visit our website for and find what you are looking for. Some risk factors like smoking can be changed.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

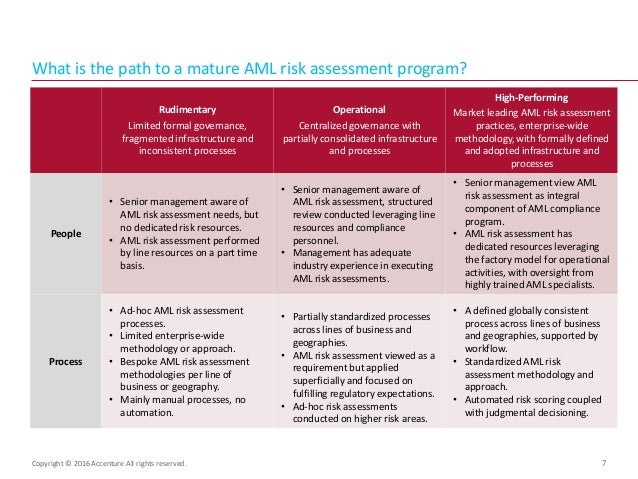

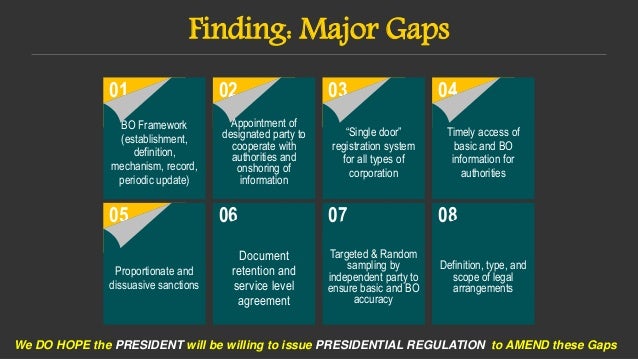

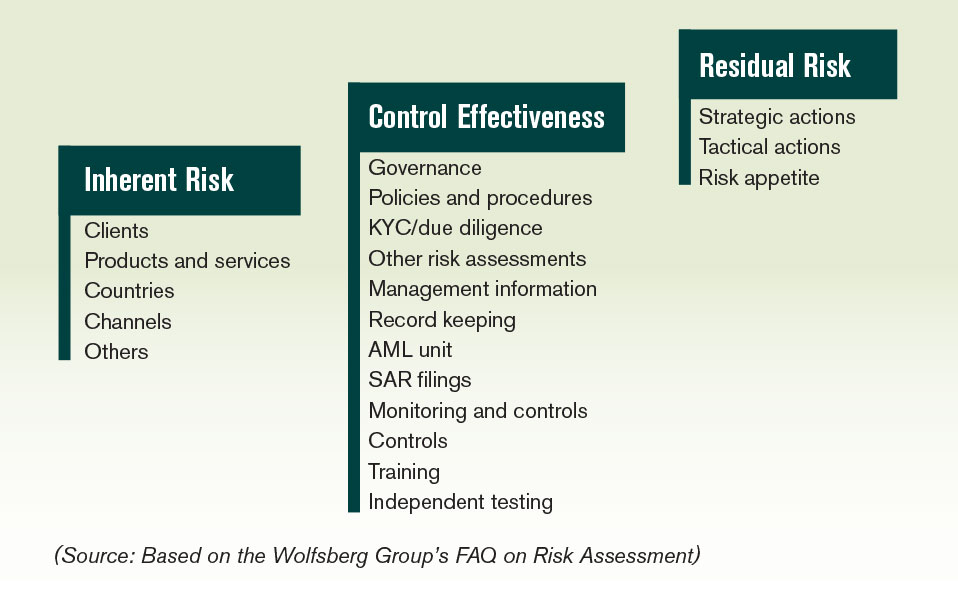

Different cancers have different risk factors. In February 2012 FATF published its updated International Standards on Combating Money Laundering and the Financing of Terrorism and Proliferation the revised FATF 40 Recommendations which clearly defines the risk-based AML principle ultimately ushering in an era of revolutionary change in the international AML arena. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. Latest news reports from the medical literature videos from the experts and more. AML scheme requires an assessment of corruption-related risk and protecting against the laundering of corruption proceeds across the spectrum of customers and business relationships regardless of whether a FATF-defined PEP is involved. Simply put the risk-based principle requires.

Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones.

Ad Find the ideal search results on Sample aml risk assessment at TravelSearchExpert. Ad Search for results at TravelSearchExpert. In a short period of time virtual currencies such as Bitcoin have developed into a powerful payment method with ever growing global acceptance. The universal definition of risk is this. Three levels of risk likelihood are shown in the sample table below. Aml risk definition.

Source: bi.go.id

Source: bi.go.id

Key Definitions and Potential AMLCFT Risks. In a short period of time virtual currencies such as Bitcoin have developed into a powerful payment method with ever growing global acceptance. Three levels of risk likelihood are shown in the sample table below. Such an approach acknowledges the realities of the methods of laundering the proceeds of corruption. Visit our website for and find what you are looking for.

Source: bi.go.id

Source: bi.go.id

Updated over a week ago. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in. Visit our website for and find what you are looking for. Such an approach acknowledges the realities of the methods of laundering the proceeds of corruption. Ad Find the ideal search results on Sample aml risk assessment at TravelSearchExpert.

Source: slideshare.net

Source: slideshare.net

Key Definitions and Potential AMLCFT Risks. Visit our website for and find what you are looking for. Ad Find the ideal search results on Sample aml risk assessment at TravelSearchExpert. Aml risk definition. Some risk factors like smoking can be changed.

Source: pinterest.com

Source: pinterest.com

Ad Search for results at TravelSearchExpert. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Visit our website for and find what you are looking for. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. In February 2012 FATF published its updated International Standards on Combating Money Laundering and the Financing of Terrorism and Proliferation the revised FATF 40 Recommendations which clearly defines the risk-based AML principle ultimately ushering in an era of revolutionary change in the international AML arena.

Source: pinterest.com

Source: pinterest.com

Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. Browse our site for relevant results and information. The central bank in any nation provides full guides to AML and CFT to combat such actions. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. In February 2012 FATF published its updated International Standards on Combating Money Laundering and the Financing of Terrorism and Proliferation the revised FATF 40 Recommendations which clearly defines the risk-based AML principle ultimately ushering in an era of revolutionary change in the international AML arena.

Source: slideshare.net

Source: slideshare.net

Latest news reports from the medical literature videos from the experts and more. The universal definition of risk is this. Simply put the risk-based principle requires. Browse our site for relevant results and information. Ad Find the ideal search results on Sample aml risk assessment at TravelSearchExpert.

Source: pinterest.com

Source: pinterest.com

Ad AML coverage from every angle. The universal definition of risk is this. Updated over a week ago. The central bank in any nation provides full guides to AML and CFT to combat such actions. Ad AML coverage from every angle.

Source: in.pinterest.com

Source: in.pinterest.com

Three levels of risk likelihood are shown in the sample table below. In a short period of time virtual currencies such as Bitcoin have developed into a powerful payment method with ever growing global acceptance. What is AML Anti-Money Laundering. Three levels of risk likelihood are shown in the sample table below. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in.

Source: pinterest.com

Source: pinterest.com

In a short period of time virtual currencies such as Bitcoin have developed into a powerful payment method with ever growing global acceptance. Some risk factors like smoking can be changed. In February 2012 FATF published its updated International Standards on Combating Money Laundering and the Financing of Terrorism and Proliferation the revised FATF 40 Recommendations which clearly defines the risk-based AML principle ultimately ushering in an era of revolutionary change in the international AML arena. The source of money laundering is serious crimes such as financing of terrorism bribery corruption drug trafficking human trafficking arms smuggling. What is AML Anti-Money Laundering.

Source: bi.go.id

Source: bi.go.id

Some risk factors like smoking can be changed. Browse our site for relevant results and information. The universal definition of risk is this. But having a risk factor or even several risk. AML scheme requires an assessment of corruption-related risk and protecting against the laundering of corruption proceeds across the spectrum of customers and business relationships regardless of whether a FATF-defined PEP is involved.

Source: pinterest.com

Source: pinterest.com

Ad Find the ideal search results on Sample aml risk assessment at TravelSearchExpert. Different cancers have different risk factors. A likelihood scale refers to the possibility or potential MLTF Risk occurring in the business for the particular risk being assessed. Ad AML coverage from every angle. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering.

Source: acamstoday.org

Source: acamstoday.org

Such an approach acknowledges the realities of the methods of laundering the proceeds of corruption. Simply put the risk-based principle requires. Risk Factors for Acute Myeloid Leukemia AML A risk factor is something that affects your chance of getting a disease such as cancer. Risk levelScore Likelihood Impact. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in.

Source: pinterest.com

Source: pinterest.com

An anti-money laundering risk assessment measures risk exposure. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Three levels of risk likelihood are shown in the sample table below. Key Definitions and Potential AMLCFT Risks.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml risk definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information