19++ Aml sanctions definition information

Home » money laundering idea » 19++ Aml sanctions definition informationYour Aml sanctions definition images are ready. Aml sanctions definition are a topic that is being searched for and liked by netizens today. You can Get the Aml sanctions definition files here. Download all free photos and vectors.

If you’re searching for aml sanctions definition images information related to the aml sanctions definition interest, you have pay a visit to the ideal site. Our website frequently provides you with hints for downloading the maximum quality video and picture content, please kindly hunt and locate more informative video articles and graphics that match your interests.

Aml Sanctions Definition. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Companies have to implement AML risk assessment in customer onboarding and customer monitoring processes. With the development of technology money laundering events are increasing. What is AML Anti-Money Laundering.

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn From ppt-online.org

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn From ppt-online.org

Anti-Money Laundering Countering Financing of Terrorism and Targeted Financial Sanctions for Financial Institutions AMLCFT and TFS for FIs 1 of 185 Issued on. They are designed to protect businesses from high-risk customers helping to ensure the integrity of the global financial system. Regulators and financial institutions alike are renewing their focus on anti-money laundering AML and sanctions risk assessments as part of sound financial crime risk management resource allocation and compliance program development. Regulatory authorities have become more vigilant in the battle against money laundering and terrorist financing with regulators levying 36 billion in fines worldwide. Financial institutions particularly banks have spent years evolving their AML and sanctions risk. These systems are considered models and as such they are subject to the Guidance.

Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF.

AML systems in an accounting environment can have a tendency to focus on customer due diligence rather than the receipt or transmission of funds. Over the past 10 years enforcement actions related to AML have been on the rise. Regulatory authorities have become more vigilant in the battle against money laundering and terrorist financing with regulators levying 36 billion in fines worldwide. Companies have to implement AML risk assessment in customer onboarding and customer monitoring processes. AML systems in an accounting environment can have a tendency to focus on customer due diligence rather than the receipt or transmission of funds. These systems are considered models and as such they are subject to the Guidance.

Source: slideshare.net

Source: slideshare.net

Funds may be from an entirely legitimate source. As a Global Compliance AML Sanctions CAMS Expert you are part of a specialised team for the themes counter terrorism financing CFT anti-money laundering AML and Sanctions. Funds may be from an entirely legitimate source. Over the past 10 years enforcement actions related to AML have been on the rise. Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF.

Source: sanctionscanner.com

Source: sanctionscanner.com

Sanction lists screening is one of the Anti-Money Laundering and Customer Due Diligence procedures. Anti-Money Laundering Countering Financing of Terrorism and Targeted Financial Sanctions for Financial Institutions AMLCFT and TFS for FIs 1 of 185 Issued on. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Financial institutions particularly banks have spent years evolving their AML and sanctions risk. Accordingly it applies to Relevant Persons but in different degrees as provided.

Source: aml-cft.net

Source: aml-cft.net

Accordingly it applies to Relevant Persons but in different degrees as provided. Acronyms Description and definition of terms AI An Accountable Institution is a person referred to and listed in Schedule 1 of FICA or similarly designated in terms of equivalent legislation in any other country outside SA. 31 December 2019 BNMRHPD 030 -3 PART A OVERVIEW. Regulatory authorities have become more vigilant in the battle against money laundering and terrorist financing with regulators levying 36 billion in fines worldwide. Over the past 10 years enforcement actions related to AML have been on the rise.

Source: ppt-online.org

Source: ppt-online.org

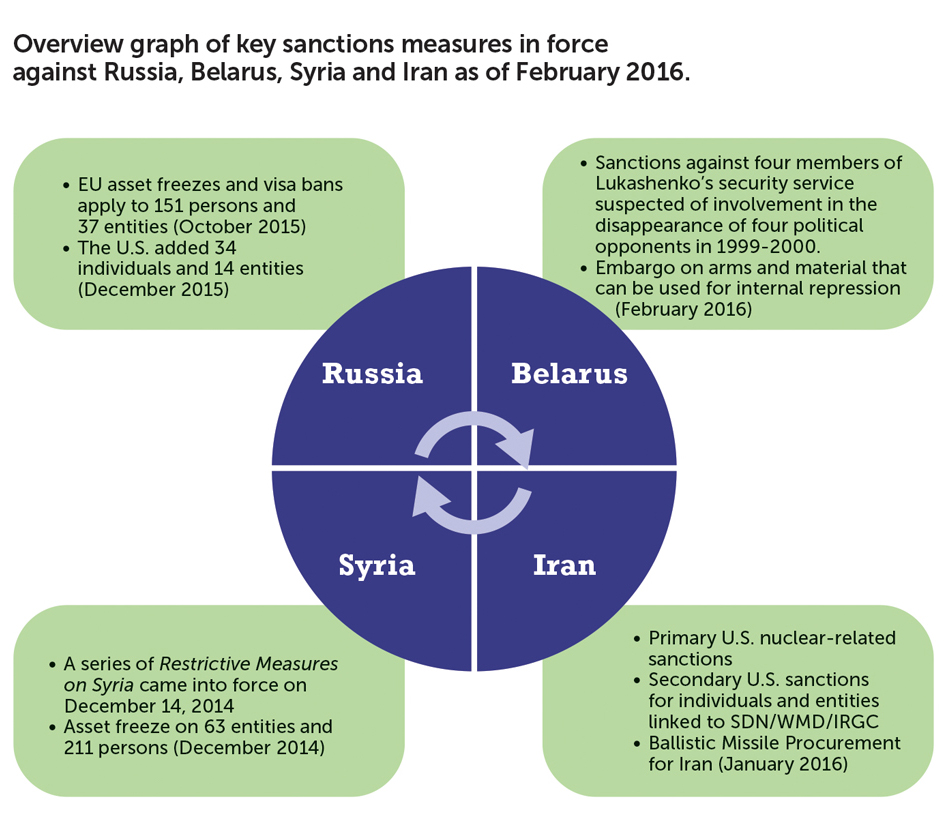

Acronyms Description and definition of terms AI An Accountable Institution is a person referred to and listed in Schedule 1 of FICA or similarly designated in terms of equivalent legislation in any other country outside SA. They are designed to protect businesses from high-risk customers helping to ensure the integrity of the global financial system. Sanctions are legally enforceable measures against countries organisations individuals and other bodies designed to force compliance with international law contain a threat to peace within a geographical boundary or to express condemnation of a countrys specific actions or policies. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF.

Source: slideplayer.com

Source: slideplayer.com

Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. AML regulators impose heavy AML fines on companies that fail. Companies have to implement AML risk assessment in customer onboarding and customer monitoring processes. Financial institutions particularly banks have spent years evolving their AML and sanctions risk. Overview of AML Risk Assessment Actions that show crime assets as income from a legitimate source to hide the illegal source of money are called money laundering.

Source: businessforensics.nl

Source: businessforensics.nl

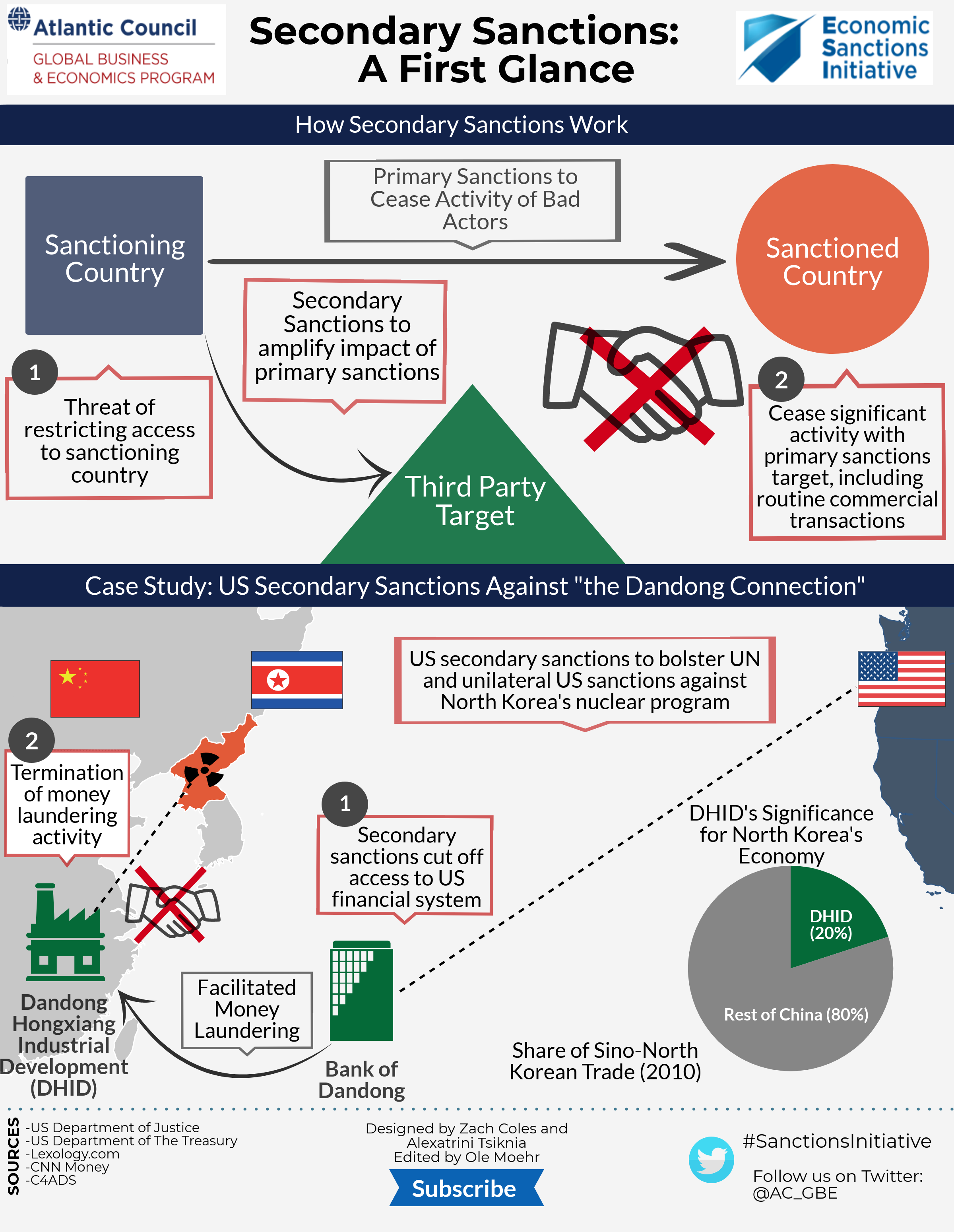

Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. AML CFT Anti-Money Laundering and Combating the Financing of Terrorism. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Compliance with sanctions means knowing to whom payments are being made. Regulators and financial institutions alike are renewing their focus on anti-money laundering AML and sanctions risk assessments as part of sound financial crime risk management resource allocation and compliance program development.

Source: acamstoday.org

Source: acamstoday.org

While not subject to MSBFinancial Instruction requirements Solidity Finance LLC is committed to combating money laundering and. Funds may be from an entirely legitimate source. Accordingly it applies to Relevant Persons but in different degrees as provided. 31 December 2019 BNMRHPD 030 -3 PART A OVERVIEW. Financial institutions particularly banks have spent years evolving their AML and sanctions risk.

Source: financialservicesblog.accenture.com

Source: financialservicesblog.accenture.com

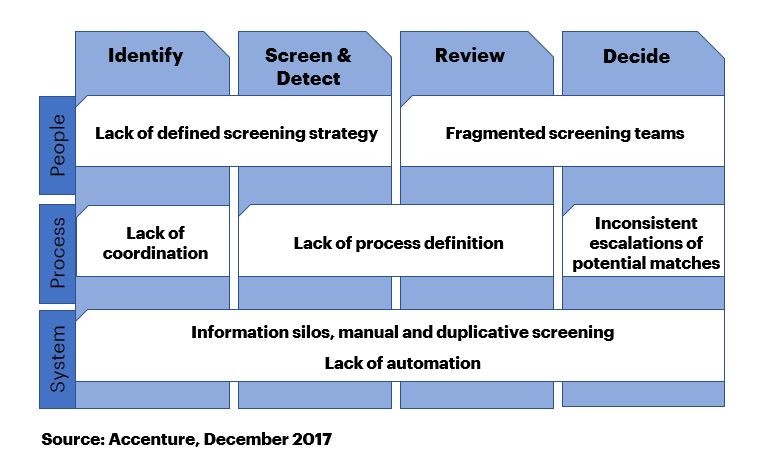

Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. As a Global Compliance AML Sanctions CAMS Expert you are part of a specialised team for the themes counter terrorism financing CFT anti-money laundering AML and Sanctions. Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. While not subject to MSBFinancial Instruction requirements Solidity Finance LLC is committed to combating money laundering and.

Source: ppt-online.org

Source: ppt-online.org

These restrictive measures include but are not limited to financial sanctions trade sanctions restrictions on travel or civil aviation restrictions. Accordingly it applies to Relevant Persons but in different degrees as provided. Regulators and financial institutions alike are renewing their focus on anti-money laundering AML and sanctions risk assessments as part of sound financial crime risk management resource allocation and compliance program development. AML and sanctions screening faces many challenges. AML regulators impose heavy AML fines on companies that fail.

Source: tookitaki.ai

Source: tookitaki.ai

Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF. Financial institutions particularly banks have spent years evolving their AML and sanctions risk. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Sanction lists screening is one of the Anti-Money Laundering and Customer Due Diligence procedures. Without the proper anti-money laundering AML compliance procedures companies are in danger of inadvertently facilitating drug trafficking terrorism financing and other crimes.

Source: atlanticcouncil.org

Source: atlanticcouncil.org

These restrictive measures include but are not limited to financial sanctions trade sanctions restrictions on travel or civil aviation restrictions. Financial institutions particularly banks have spent years evolving their AML and sanctions risk. Regulators and financial institutions alike are renewing their focus on anti-money laundering AML and sanctions risk assessments as part of sound financial crime risk management resource allocation and compliance program development. Anti-Money Laundering Sanctions Policy. Compliance with sanctions means knowing to whom payments are being made.

Source: ppt-online.org

Source: ppt-online.org

The AML Rulebook has been designed to provide a single reference point for all Relevant Persons who are supervised by the Regulator for Anti-Money Laundering and Sanctions compliance in accordance with the scope of application outlined in Rule 121. They are designed to protect businesses from high-risk customers helping to ensure the integrity of the global financial system. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Anti-Money Laundering Sanctions Policy. Over the past 10 years enforcement actions related to AML have been on the rise.

Source: ppt-online.org

Source: ppt-online.org

While not subject to MSBFinancial Instruction requirements Solidity Finance LLC is committed to combating money laundering and. Regulatory authorities have become more vigilant in the battle against money laundering and terrorist financing with regulators levying 36 billion in fines worldwide. They are designed to protect businesses from. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title aml sanctions definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information