13+ Aml stages in banking ideas in 2021

Home » money laundering idea » 13+ Aml stages in banking ideas in 2021Your Aml stages in banking images are ready in this website. Aml stages in banking are a topic that is being searched for and liked by netizens today. You can Get the Aml stages in banking files here. Get all free photos and vectors.

If you’re searching for aml stages in banking pictures information connected with to the aml stages in banking topic, you have come to the ideal blog. Our website frequently gives you hints for downloading the maximum quality video and picture content, please kindly hunt and find more informative video content and graphics that fit your interests.

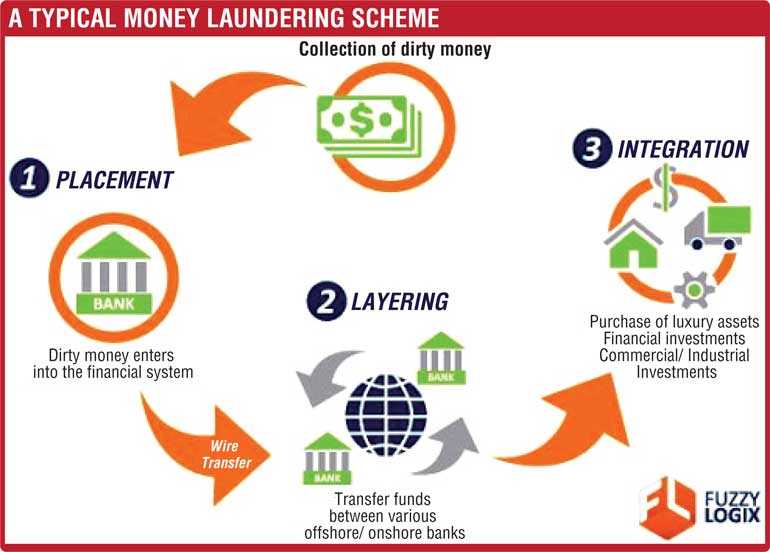

Aml Stages In Banking. Know Your Customer KYC Customer due diligence CDD Customer and transaction screening. Placement layering and integration. The banks first-level review process to identify suspicious entities and activities met compliance standards. Banks or the banking sector are under the AML obligations because they are at risk of financial crime.

Aml Introduction Stages Of Money Laundering Learn With Flip Youtube From youtube.com

Aml Introduction Stages Of Money Laundering Learn With Flip Youtube From youtube.com

John Smith sells a car and goes to the bank with 14000 in cash to deposit. The sources of the cash in actual are criminal and the money is invested. And at the same time hiding its source. Of course each company has to consider its AML actions depending on the industry and business specifics. Know Your Customer KYC Customer due diligence CDD Customer and transaction screening. Banks and other financial institutions entered 2017 facing an increasingly daunting framework of anti-money-laundering AML laws and regulations.

Pre-placement and placement is carried out when dirty money is put into a range of different places from cash-heavy legitimate businesses to foreign bank accounts in order to assimilate funds into legitimate financial systems without triggering AML procedure.

Chris Caruana VP of AML Solutions at Feedzai said AI will enable us to think ahead to the problems of 2025 using deep learning and neuro-analytics to think like criminals do especially at the placement stage Rene Kartodikromo Director of Deloitte Netherlands Financial Services practice confirms. ML typically consists of three main phases. Banks or the banking sector are under the AML obligations because they are at risk of financial crime. Updating Anti-Money Laundering controls and guidelines according to legislation and sharing the changes with staff. There are three stages involved in money laundering. However it is important to remember that money laundering is a single process.

Source: ft.lk

Source: ft.lk

Regular staff meetings concerning the latest AML issues on the market. The idea of money laundering is essential to be understood for these working in the financial sector. Of course each company has to consider its AML actions depending on the industry and business specifics. Layering Stage Of Aml on August 09 2021 Get link. We need to switch from traditional monitoring to smart monitoring at present many banks AML.

Source: amlbot.com

Source: amlbot.com

Under Financial Action Task Force FATF regulations banks must take a risk-based approach to AMLCFT. However it is important to remember that money laundering is a single process. Updating Anti-Money Laundering controls and guidelines according to legislation and sharing the changes with staff. Under Financial Action Task Force FATF regulations banks must take a risk-based approach to AMLCFT. There are hundreds of local and global regulators in total doing AML studies in the world.

Source: dimensiongrc.com

Source: dimensiongrc.com

There are hundreds of local and global regulators in total doing AML studies in the world. Pre-placement and placement is carried out when dirty money is put into a range of different places from cash-heavy legitimate businesses to foreign bank accounts in order to assimilate funds into legitimate financial systems without triggering AML procedure. There are hundreds of local and global regulators in total doing AML studies in the world. Of course each company has to consider its AML actions depending on the industry and business specifics. How Does AML Work in Banking.

Source: thekeepitsimple.com

Source: thekeepitsimple.com

AntiMoney Laundering AML Customer Lifecycle Management CLM Sanctions Screening Mortgage Lending Claims Intake Policy Management Supply Chain Accounts Payable Reduce manual work and costs by 50 so your patients can receive better care and your company can produce superior results. The Layering Process Layering is often considered the most complex component of the money laundering process because it deliberately incorporates multiple financial instruments and transactions to confuse AML controls. It is a course of by which soiled cash is transformed into clean money. The next stage of money laundering layering allows criminals to remove that traceability and lend legitimacy to their funds. Under Financial Action Task Force FATF regulations banks must take a risk-based approach to AMLCFT.

Source: youtube.com

Source: youtube.com

The idea of money laundering is essential to be understood for these working in the financial sector. Aml 3 stages of money laundering. The Layering Process Layering is often considered the most complex component of the money laundering process because it deliberately incorporates multiple financial instruments and transactions to confuse AML controls. Under Financial Action Task Force FATF regulations banks must take a risk-based approach to AMLCFT. The first one is placement.

Source: allbankingalerts.com

Source: allbankingalerts.com

The next stage of money laundering layering allows criminals to remove that traceability and lend legitimacy to their funds. The suspect must have placed a large amount of money of unlawfully acquired funds in a financial company. There are hundreds of local and global regulators in total doing AML studies in the world. Placement layering and integration. How Does AML Work in Banking.

Source: youtube.com

Source: youtube.com

The true origin of funds is concealed eg by moving bank account balances often across national borders. Updating Anti-Money Laundering controls and guidelines according to legislation and sharing the changes with staff. However it is important to remember that money laundering is a single process. ML typically consists of three main phases. There are hundreds of local and global regulators in total doing AML studies in the world.

Source: ft.lk

Source: ft.lk

Chris Caruana VP of AML Solutions at Feedzai said AI will enable us to think ahead to the problems of 2025 using deep learning and neuro-analytics to think like criminals do especially at the placement stage Rene Kartodikromo Director of Deloitte Netherlands Financial Services practice confirms. There are hundreds of local and global regulators in total doing AML studies in the world. This means that banking institutions must implement AML responses that are proportional to the criminal risks that they face applying more intense customer due diligence sanctions screening and transaction monitoring measures to higher-risk customers and simplified measures to lower-risk. AML regulations contain measures that companies must take to detect and prevent financial crimes and these regulations are determined by AML regulators and are a guide for businesses. There are four key areas banks must address with their anti-money laundering compliance program.

Source: researchgate.net

Source: researchgate.net

He fills out a deposit slip and goes to the teller. AntiMoney Laundering AML Customer Lifecycle Management CLM Sanctions Screening Mortgage Lending Claims Intake Policy Management Supply Chain Accounts Payable Reduce manual work and costs by 50 so your patients can receive better care and your company can produce superior results. Chris Caruana VP of AML Solutions at Feedzai said AI will enable us to think ahead to the problems of 2025 using deep learning and neuro-analytics to think like criminals do especially at the placement stage Rene Kartodikromo Director of Deloitte Netherlands Financial Services practice confirms. During the past several years regulatory agencies have been aggressively stepping up their enforcement actions and theyve levied huge fines for compliance failures. John Smith sells a car and goes to the bank with 14000 in cash to deposit.

Source: calert.info

Source: calert.info

Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. There are hundreds of local and global regulators in total doing AML studies in the world. Placement layering and integration. During the past several years regulatory agencies have been aggressively stepping up their enforcement actions and theyve levied huge fines for compliance failures. The money laundering cycle can be broken down into three distinct stages.

Source: letstalkaml.com

Source: letstalkaml.com

AntiMoney Laundering AML Customer Lifecycle Management CLM Sanctions Screening Mortgage Lending Claims Intake Policy Management Supply Chain Accounts Payable Reduce manual work and costs by 50 so your patients can receive better care and your company can produce superior results. There are three stages involved in money laundering. How Does AML Work in Banking. Banks or the banking sector are under the AML obligations because they are at risk of financial crime. The suspect must have placed a large amount of money of unlawfully acquired funds in a financial company.

Source: brittontime.com

Source: brittontime.com

Banks or the banking sector are under the AML obligations because they are at risk of financial crime. How Does AML Work in Banking. The stages of money laundering include the. Placement layering and integration. The idea of money laundering is essential to be understood for these working in the financial sector.

Source: researchgate.net

Source: researchgate.net

The stages of money laundering include the. John Smith sells a car and goes to the bank with 14000 in cash to deposit. Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. Regular staff meetings concerning the latest AML issues on the market. It is a course of by which soiled cash is transformed into clean money.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title aml stages in banking by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information