17+ Aml structuring definition ideas in 2021

Home » money laundering idea » 17+ Aml structuring definition ideas in 2021Your Aml structuring definition images are ready. Aml structuring definition are a topic that is being searched for and liked by netizens now. You can Get the Aml structuring definition files here. Get all royalty-free photos and vectors.

If you’re searching for aml structuring definition pictures information related to the aml structuring definition interest, you have pay a visit to the ideal site. Our site always gives you hints for refferencing the maximum quality video and image content, please kindly search and locate more enlightening video articles and images that match your interests.

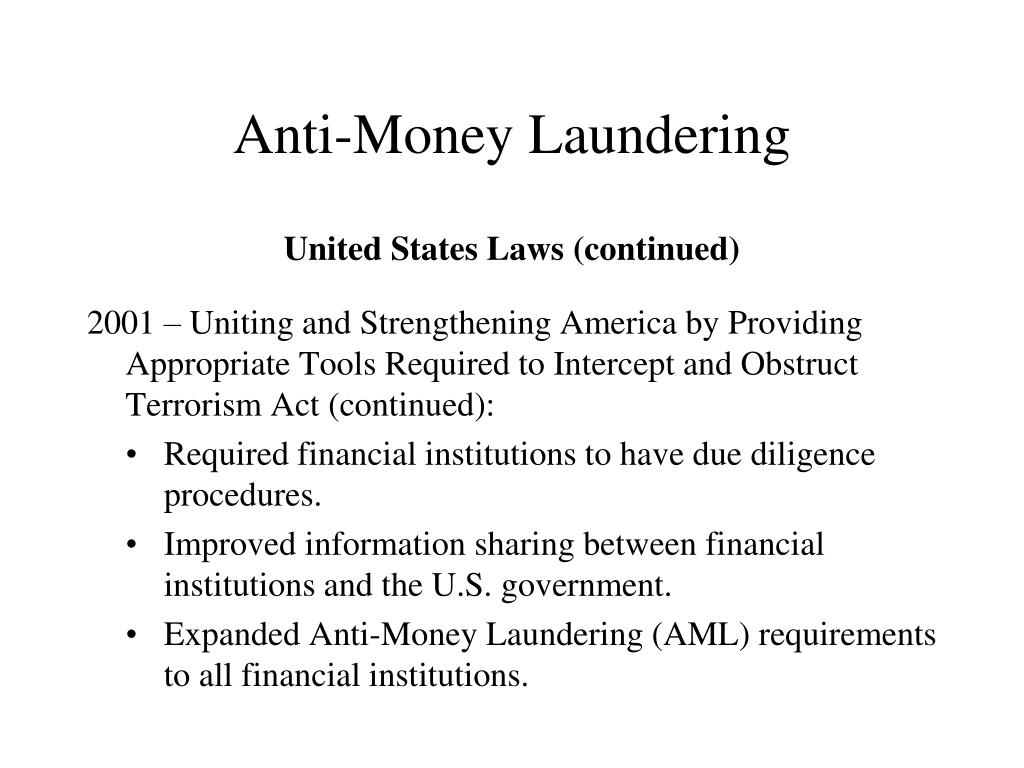

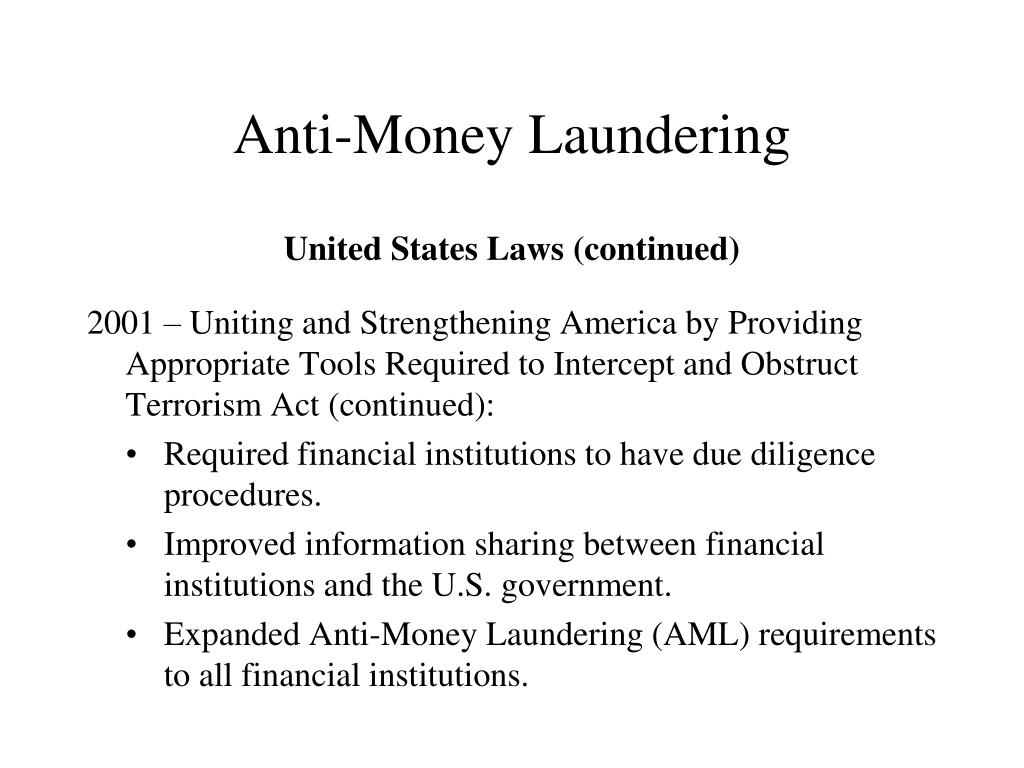

Aml Structuring Definition. A person has to transfer significant amounts of money overseas. The fewer bills in play the fewer counting handling moving and storing issues one faces. Deposits are structured through multiple branches of the same bank or by groups of people who enter a single branch at the same time. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering.

Ppt Anti Money Laundering Powerpoint Presentation Free Download Id 6682795 From slideserve.com

Ppt Anti Money Laundering Powerpoint Presentation Free Download Id 6682795 From slideserve.com

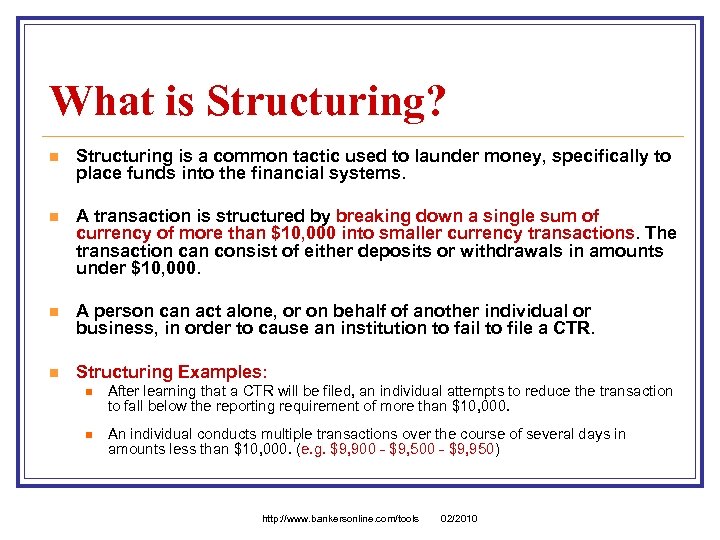

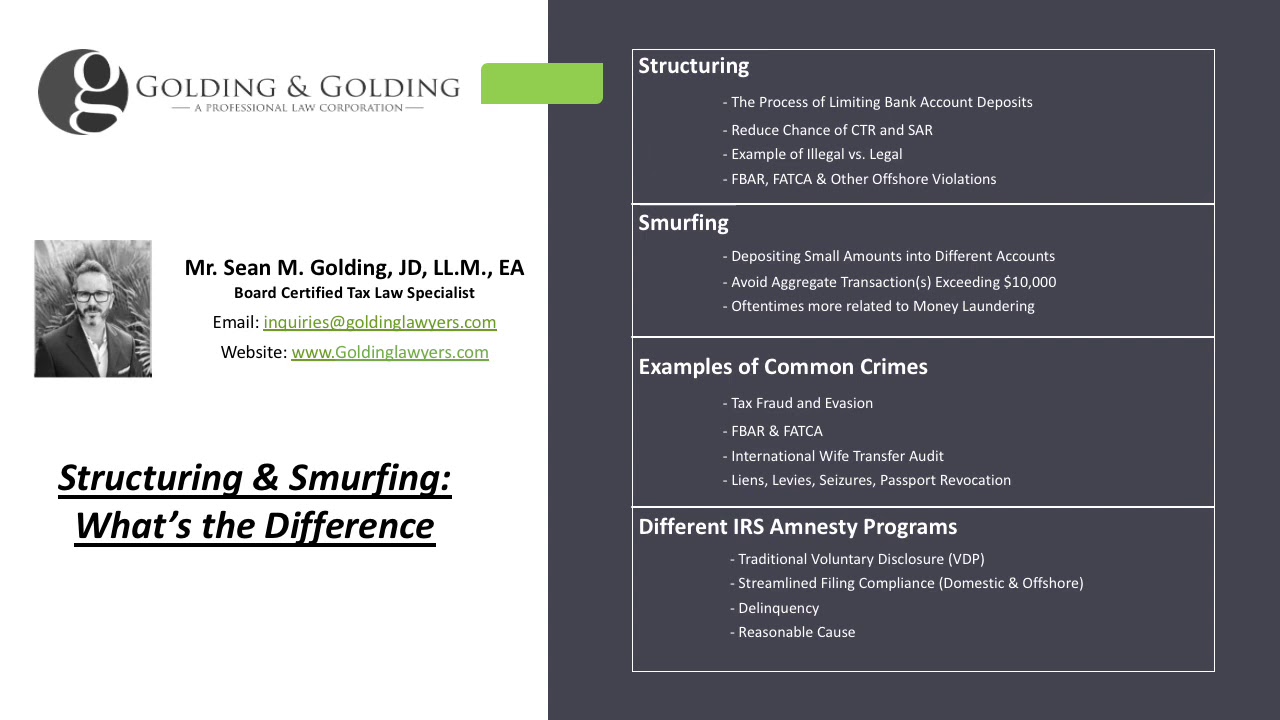

John Smith sells a car and goes to the bank with 14000 in cash to deposit. Criminals use money laundering to conceal their crimes and the money derived from them. Structuring is where a person deliberately. So SMURFING is the act of using runners to perform multiple financial transactions to avoid the currency reporting requirements. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering.

Obviously one of the challenges for a drug dealer is physically handling the money.

Obviously one of the challenges for a drug dealer is physically handling the money. Artificially structuring reducing the amount of cash deposits withdrawals or other cash transactions to avoid cash deposit limits and the issuance of a CTR is the definition of structuring. Structuring is the breaking up of transactions for the purpose of evading the Bank Secrecy Act reporting and recordkeeping requirements and if appropriate thresholds are met should be reported as a suspicious transaction under 31. Obviously one of the challenges for a drug dealer is physically handling the money. Structuring or structured transactions are frequently done by money launderers to avoid the Bank Secrecy Act mandate that requires banks to report any single daily transaction that is over 10000 through a currency. Investing in other legitimate business interests.

Source: calert.info

Source: calert.info

Structuring or structured transactions are frequently done by money launderers to avoid the Bank Secrecy Act mandate that requires banks to report any single daily transaction that is over 10000 through a currency. A person has to transfer significant amounts of money overseas. Reselling high-value goods such as artwork or any type of stored-value product such as jewelry or prepaid cards. Currency is deposited or withdrawn in amounts just below identification or reporting thresholds. Investing in real estate.

Source: allbankingalerts.com

Source: allbankingalerts.com

The overall layout of the AML Compliance Manual should be well structured so as to ensure that it is easy to be read and understood by all employees and thus easy to apply in practice. This may occur as a single transaction approaching 10k or several smaller transactions in different locations of the same institution on the same day. Deposits are structured through multiple branches of the same bank or by groups of people who enter a single branch at the same time. A well-structured AML Compliance Manual should include the following. Artificially structuring reducing the amount of cash deposits withdrawals or other cash transactions to avoid cash deposit limits and the issuance of a CTR is the definition of structuring.

Source: ppt-online.org

Source: ppt-online.org

Investing in other legitimate business interests. Structured transactions also known as structuring are the process whereby a person or entity conducts banking transactions to avoid reporting requirements. Ad AML coverage from every angle. The definition of structuring encompasses transactions that attempt to evade the Currency Transaction Reporting CTR requirement of deposits or withdrawals of cashcash instruments over 10000. Investing in other legitimate business interests.

Source: slideserve.com

Source: slideserve.com

This may occur as a single transaction approaching 10k or several smaller transactions in different locations of the same institution on the same day. What is AML Anti-Money Laundering. Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets. This may occur as a single transaction approaching 10k or several smaller transactions in different locations of the same institution on the same day. John Smith sells a car and goes to the bank with 14000 in cash to deposit.

Source: brainstudy.info

Source: brainstudy.info

A person has to transfer significant amounts of money overseas. Trusts and offshore companies useful for hiding the identity of the real beneficial owners. Structured transactions also known as structuring are the process whereby a person or entity conducts banking transactions to avoid reporting requirements. So SMURFING is the act of using runners to perform multiple financial transactions to avoid the currency reporting requirements. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones.

Source: amlcft.bnm.gov.my

Source: amlcft.bnm.gov.my

Ad AML coverage from every angle. What is AML Anti-Money Laundering. John Smith sells a car and goes to the bank with 14000 in cash to deposit. Example of Illegal Structuring. Currency is deposited or withdrawn in amounts just below identification or reporting thresholds.

Source: aml-assassin.com

Source: aml-assassin.com

Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. Smurfing lodging small amounts of money below the AML reporting threshold to bank accounts or credit cards then using these to pay expenses etc. The fewer bills in play the fewer counting handling moving and storing issues one faces. Investing in other legitimate business interests. A well-structured AML Compliance Manual should include the following.

Source: goldinglawyers.com

Source: goldinglawyers.com

According to the International Monetary website in the AMLCFT context the term typologies refers to the various techniques used to launder money or finance terrorism. Trusts and offshore companies useful for hiding the identity of the real beneficial owners. Investing in real estate. Latest news reports from the medical literature videos from the experts and more. John Smith sells a car and goes to the bank with 14000 in cash to deposit.

Source: ppt-online.org

Source: ppt-online.org

Example of Illegal Structuring. A well-structured AML Compliance Manual should include the following. The consumer has a large balance with the Bank. So SMURFING is the act of using runners to perform multiple financial transactions to avoid the currency reporting requirements. Example of Illegal Structuring.

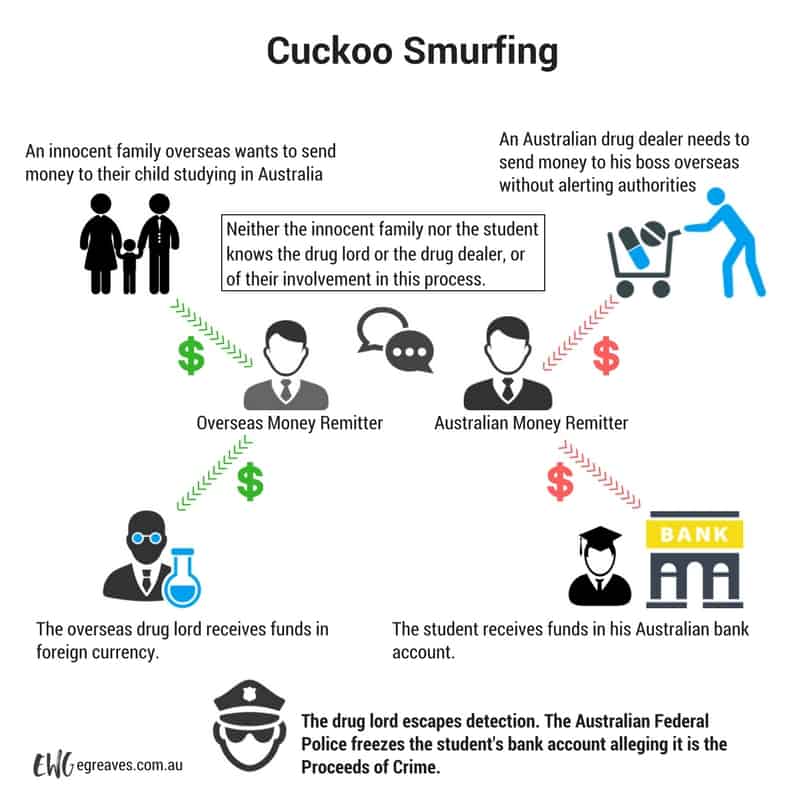

Source: egreaves.com.au

Source: egreaves.com.au

Latest news reports from the medical literature videos from the experts and more. The overall layout of the AML Compliance Manual should be well structured so as to ensure that it is easy to be read and understood by all employees and thus easy to apply in practice. Structuring or structured transactions are frequently done by money launderers to avoid the Bank Secrecy Act mandate that requires banks to report any single daily transaction that is over 10000 through a currency. John Smith sells a car and goes to the bank with 14000 in cash to deposit. Trusts and offshore companies useful for hiding the identity of the real beneficial owners.

Source: ppt-online.org

Source: ppt-online.org

Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Structuring or structured transactions are frequently done by money launderers to avoid the Bank Secrecy Act mandate that requires banks to report any single daily transaction that is over 10000 through a currency. Structuring is where a person deliberately. Artificially structuring reducing the amount of cash deposits withdrawals or other cash transactions to avoid cash deposit limits and the issuance of a CTR is the definition of structuring. Criminals use money laundering to conceal their crimes and the money derived from them.

Source: calert.info

Source: calert.info

The fewer bills in play the fewer counting handling moving and storing issues one faces. Trusts and offshore companies useful for hiding the identity of the real beneficial owners. So SMURFING is the act of using runners to perform multiple financial transactions to avoid the currency reporting requirements. Structuring is the breaking up of transactions for the purpose of evading the Bank Secrecy Act reporting and recordkeeping requirements and if appropriate thresholds are met should be reported as a suspicious transaction under 31. Latest news reports from the medical literature videos from the experts and more.

Source: amlcompliance.ie

Source: amlcompliance.ie

What is AML Anti-Money Laundering. The overall layout of the AML Compliance Manual should be well structured so as to ensure that it is easy to be read and understood by all employees and thus easy to apply in practice. The definition of structuring as set forth in 31 CFR 1010100 xx which was implemented before a USA PATRIOT Act provision extended the prohibition on structuring to geographic targeting orders and BSA recordkeeping requirements states a person structures a transaction if that person acting alone or in conjunction with or on behalf of other persons conducts or attempts to conduct one or more transactions in currency in any amount at one or more financial institutions on one or. Investing in real estate. Trusts and offshore companies useful for hiding the identity of the real beneficial owners.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title aml structuring definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information