19+ Aml training for insurance agents ideas

Home » money laundering idea » 19+ Aml training for insurance agents ideasYour Aml training for insurance agents images are ready. Aml training for insurance agents are a topic that is being searched for and liked by netizens today. You can Get the Aml training for insurance agents files here. Find and Download all royalty-free images.

If you’re looking for aml training for insurance agents pictures information related to the aml training for insurance agents topic, you have pay a visit to the ideal site. Our website always provides you with hints for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that match your interests.

Aml Training For Insurance Agents. Use the link below to access the step-by-step instructions for completing AML training for insurance agentsA common roadblock an independent insurance produ. Jimmy with an insurance agent. Start today with a special offer. This Act requires insurance companies to establish anti-money laundering programs that comply with the minimum standards set by the Department of the Treasury.

Pin By Onlineed On Mortgage Online Education Continuing Education Course Catalog From nl.pinterest.com

Pin By Onlineed On Mortgage Online Education Continuing Education Course Catalog From nl.pinterest.com

Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of. The insurance carriers all have their own requirements. Treasury Department and the Patriot Act require insurance producers who sell products that accumulate cash value or have an. Anti-Money Laundering for Insurance Agents Title 4 credits 37073. Start today with a special offer. You can call us at 8015181956 with any questions or concerns.

Insurance Agent and Broker AML Training Course - 12 AML Training for Insurance Agents and Brokers - 2021 Anti-money laundering compliance training for insurance agents and brokers.

The insurance carriers all have their own requirements. Among all the things an insurance agent does reporting such suspicious activities is a the top of the list. The life insurance carriers we represent that will require AML training include. Certificate awarded upon completion. And development of an independent audit function. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in.

Source: pinterest.com

Source: pinterest.com

Anti-Money Laundering Training Program is a fast easy and inexpensive way for financial services companies to meet key requirements of US. That is why in the insurance company jobs firstly the agents must be trained in AML to get the jobs. Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of. Complete carrier specific AML training. In a friendly accessible style this course teaches employees and agents how money laundering works and the basics of AMLCTF compliance.

Source: support.surancebay.com

Source: support.surancebay.com

Certificate awarded upon completion. Designation of an executive-lvl internal compliance officer. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in. Now that you have figured out how and where to take your required aml training complete and maintain your AML certifications.

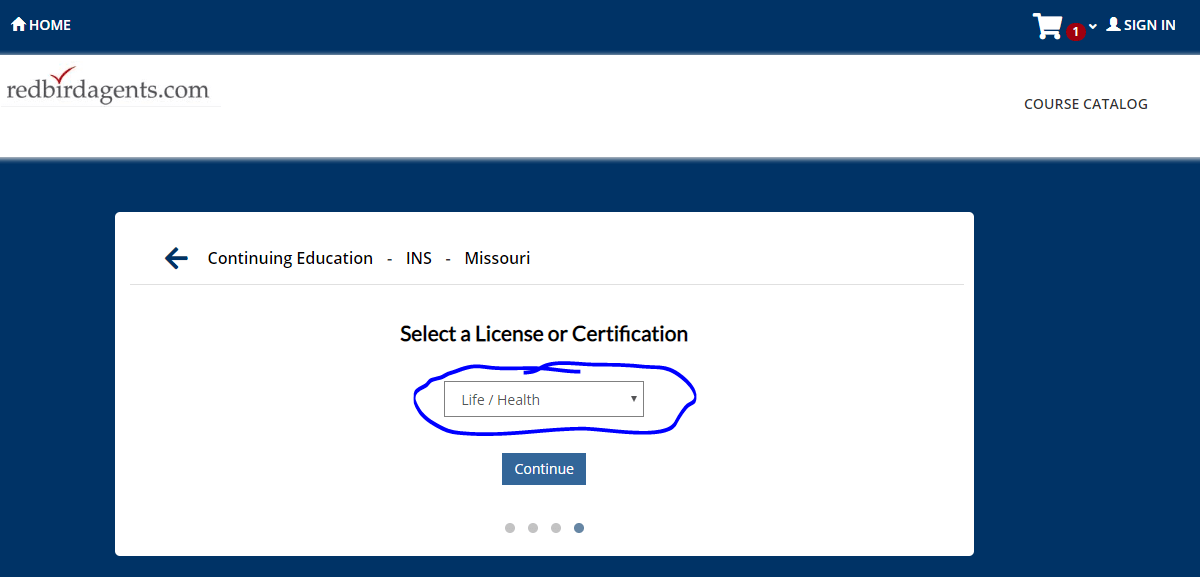

Source: redbirdagents.com

Source: redbirdagents.com

There are three ways to complete AML training for insurance agents. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in. The life insurance carriers we represent that will require AML training include. Buy an AML training course through WebCE. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply.

Source: redbirdagents.com

Source: redbirdagents.com

Treasury Department and the Patriot Act require insurance producers who sell products that accumulate cash value or have an. Carriers have partnered with LIMRA to provide training to contracted agents. That is why AML training for insurance agents is a must and in some states it is fixed by the employee requirements. Anti Money Laundering Training. Creation og an employee training program.

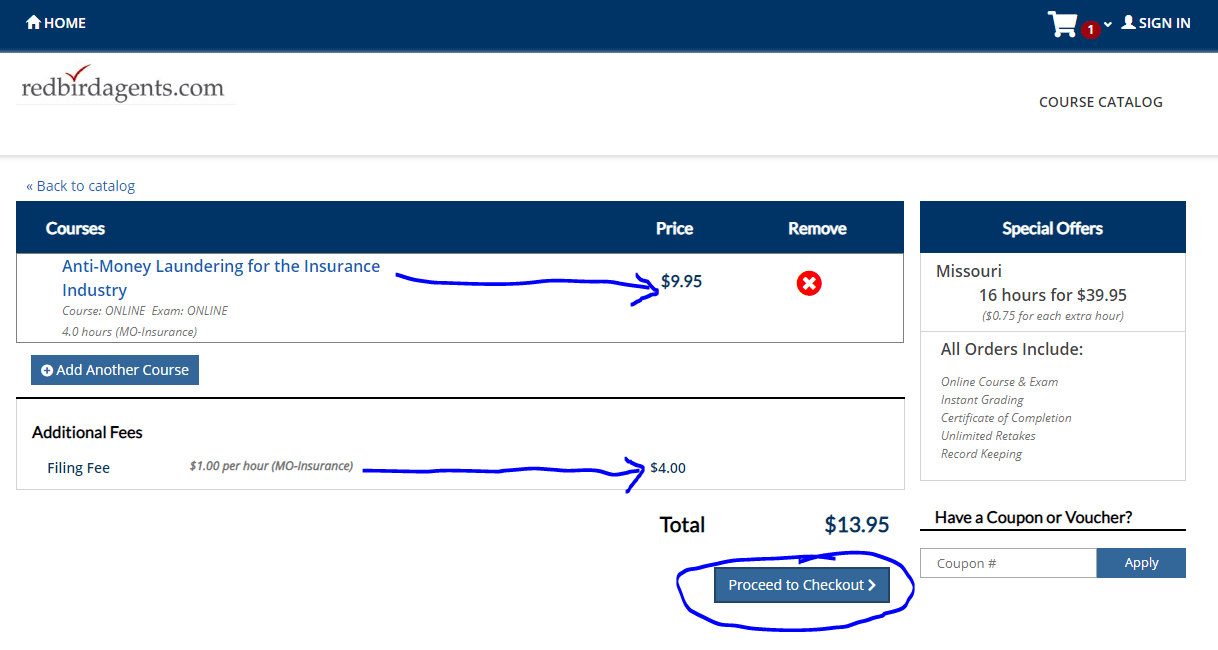

Source: redbirdagents.com

Source: redbirdagents.com

Certificate awarded upon completion. There are three ways to complete AML training for insurance agents. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in. All life and annuity carriers require AML training. Take AML training for free through LIMRA.

Source: redbirdagents.com

Source: redbirdagents.com

Certificate awarded upon completion. This Act requires insurance companies to establish anti-money laundering programs that comply with the minimum standards set by the Department of the Treasury. Rules from the US. Use the link below to access the step-by-step instructions for completing AML training for insurance agentsA common roadblock an independent insurance produ. Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of.

Source: redbirdagents.com

Source: redbirdagents.com

This Act requires insurance companies to establish anti-money laundering programs that comply with the minimum standards set by the Department of the Treasury. There are three ways to complete AML training for insurance agents. Designation of an executive-lvl internal compliance officer. Rules from the US. Each source will provide training instructions and may require you to enter your national producer number NPN or social security number.

Source: webce.com

Source: webce.com

You can call us at 8015181956 with any questions or concerns. Treasury Department and the Patriot Act require insurance producers who sell products that accumulate cash value or have an. The annuity carriers we represent that will require AML training include. Certificate awarded upon completion. There are three ways to complete AML training for insurance agents.

Source: pinterest.com

Source: pinterest.com

Designation of an executive-lvl internal compliance officer. Take AML training base course for free through LIMRA. You can call us at 8015181956 with any questions or concerns. SIRS anti-money laundering compliance training courses address BSA and USA PATRIOT Act AML training requirements. Creation og an employee training program.

Source: youtube.com

Source: youtube.com

There are three ways to complete AML training for insurance agents. The insurance carriers all have their own requirements. Start today with a special offer. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program. Creation og an employee training program.

Source: nl.pinterest.com

Source: nl.pinterest.com

You can call us at 8015181956 with any questions or concerns. Join millions of learners from around the world already learning on Udemy. That is why in the insurance company jobs firstly the agents must be trained in AML to get the jobs. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in. Start today with a special offer.

Source: blog.newhorizonsmktg.com

Source: blog.newhorizonsmktg.com

Jimmy with an insurance agent. You can call us at 8015181956 with any questions or concerns. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program. 28 seconds This version of Flag the Money 1 focuses on specific requirements for insurance professionals. Among all the things an insurance agent does reporting such suspicious activities is a the top of the list.

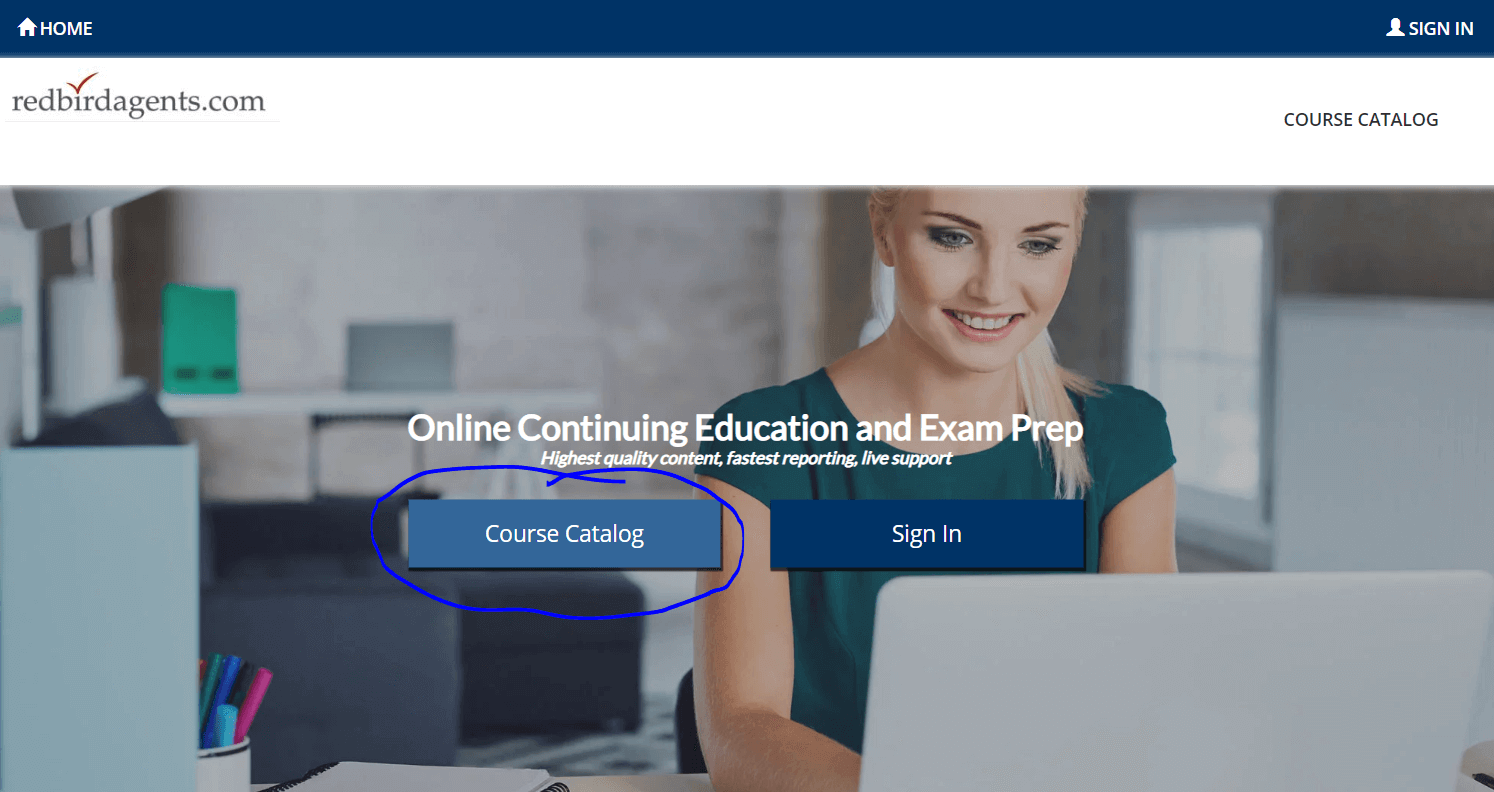

Source: redbirdagents.com

Source: redbirdagents.com

However there is no need to determine whether the transactions are in fact linked to money. Buy an AML training course through WebCE. You can call us at 8015181956 with any questions or concerns. Carriers have partnered with LIMRA to provide training to contracted agents. That is why in the insurance company jobs firstly the agents must be trained in AML to get the jobs.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title aml training for insurance agents by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information