20+ Aml training requirements for insurance companies information

Home » money laundering idea » 20+ Aml training requirements for insurance companies informationYour Aml training requirements for insurance companies images are available in this site. Aml training requirements for insurance companies are a topic that is being searched for and liked by netizens today. You can Download the Aml training requirements for insurance companies files here. Find and Download all royalty-free photos and vectors.

If you’re searching for aml training requirements for insurance companies pictures information linked to the aml training requirements for insurance companies topic, you have come to the ideal site. Our website frequently gives you suggestions for downloading the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

Aml Training Requirements For Insurance Companies. In some cases such agents and brokers have even joined criminals against insurers to facilitate money. Insurance companies must develop a written risk-based BSAAML program addressing the covered insurance products. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. Anti-Money Laundering Training Program is a fast easy and inexpensive way for financial services companies to meet key requirements of US.

Neo Banks Vs Neo Insurers Digital Banking Insurance Business Insurance From pinterest.com

Neo Banks Vs Neo Insurers Digital Banking Insurance Business Insurance From pinterest.com

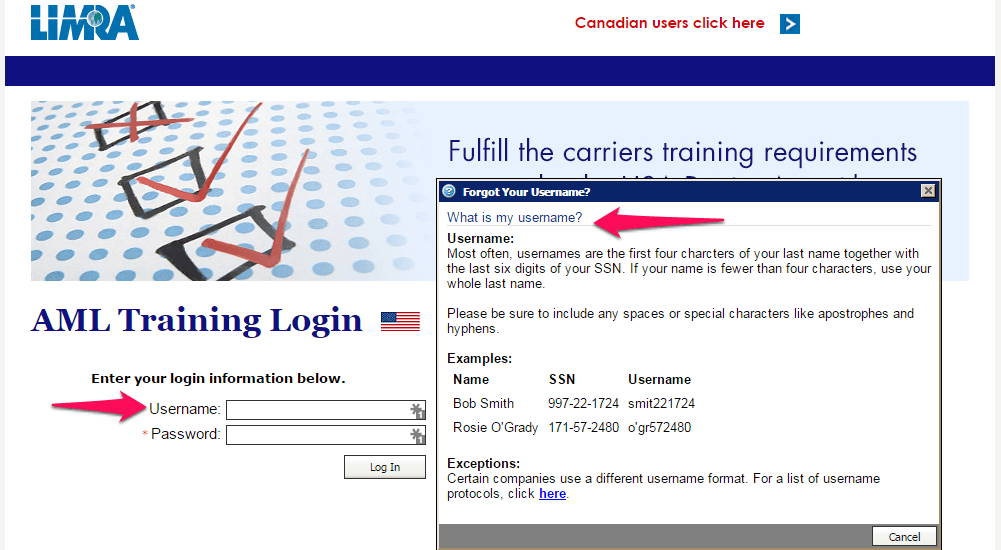

Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of. The training should be tailored to the requirements of the personnel according to their roles and responsibilities. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program. Sagicor Life Insurance Company requires that you complete an approved anti-money laundering AML training course every two years in order to solicit our products. For new hires as a part of their orientationinduction an overview of AML requirements should be provided. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations.

This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program.

This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program. Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. Best practices for Anti-Money Laundering. The training program must be documented in Part A of your AMLCTF program and help you make sure your business or organisation isnt used to support criminal activity. Insurance companies often require ongoing.

Source: pinterest.com

Source: pinterest.com

An insurance company may satisfy the training requirement under its anti-money laundering program with respect to its employees agents and brokers by directly training such persons or by verifying that those employees agents and brokers have received adequate training by another insurance company or by a competent third party with respect to the covered products offered by the insurance company. AML compliance checklist. We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of.

Source: pinterest.com

Source: pinterest.com

Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. The final rules apply to insurance companies that issue or underwrite certain products that present a high degree of risk for money laundering or the financing of terrorism. In Singapore for example the Monetary Authority of Singapore MAS includes specific requirements for insurers in Notice 314 on the Prevention of Money Laundering and Countering the Financing of Terrorism. Anti-Money Laundering Training Program is a fast easy and inexpensive way for financial services companies to meet key requirements of US. To meet this requirement you must have completed within 24 months of the date of your last course completion AML training from one of the following sources.

Source: pinterest.com

Source: pinterest.com

The AML training courses can be taken by a variety of professionals in the following industries. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies. Banking insurance financial planning securities gaming. The training should be tailored to the requirements of the personnel according to their roles and responsibilities. This Act requires insurance companies to establish anti-money laundering programs that comply with the minimum standards set by the Department of the Treasury.

Source: bi.go.id

Source: bi.go.id

Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of. Insurance and financial professionals use AML training courses to familiarize themselves with the process of money laundering the criminal business used to disguise the true origin and ownership of illegal cash and the laws that make it a crime. Proof of Anti-Money Laundering AML training for Life Insurance and Annuity producers is required by Federal law.

Source:

The training should include the banks internal BSAAML policies procedures and processes and other regulatory requirements. An insurance company may satisfy the training requirement under its anti-money laundering program with respect to its employees agents and brokers by directly training such persons or by verifying that those employees agents and brokers have received adequate training by another insurance company or by a competent third party with respect to the covered products offered by the insurance company. Insurance companies subject to these rules must establish an anti-money laundering program and start filing Suspicious Activity Reports 180 days after the date of the publication of the final rules in the Federal Register. Best practices for Anti-Money Laundering. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures.

Source: rsmus.com

Source: rsmus.com

A designated compliance officer responsible for effectively implementing the program Ongoing training of appropriate persons including insurance agents and brokers. Proof of Anti-Money Laundering AML training for Life Insurance and Annuity producers is required by Federal law. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. The training program must be documented in Part A of your AMLCTF program and help you make sure your business or organisation isnt used to support criminal activity. Anti-Money Laundering Training Requirements.

Source: blog.newhorizonsmktg.com

Source: blog.newhorizonsmktg.com

The BSA regulations require insurance companies offering covered products to have in place a written AML program that in relevant part provides for ongoing training. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. Sagicor Life Insurance Company requires that you complete an approved anti-money laundering AML training course every two years in order to solicit our products. Anti-Money Laundering Training Requirements. Insurance companies must develop a written risk-based BSAAML program addressing the covered insurance products.

Source: pinterest.com

Source: pinterest.com

The final rules apply to insurance companies that issue or underwrite certain products that present a high degree of risk for money laundering or the financing of terrorism. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. The agents and brokers are often unaware of the need to screen clients or to question payment methods. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents.

Source: nl.pinterest.com

Source: nl.pinterest.com

The BSA regulations require insurance companies offering covered products to have in place a written AML program that in relevant part provides for ongoing training. Insurance companies often require ongoing. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. You should regularly review your training program to make sure it covers changes to the level of. Anti-Money Laundering Training Requirements.

Source: pinterest.com

Source: pinterest.com

Insurance and financial professionals use AML training courses to familiarize themselves with the process of money laundering the criminal business used to disguise the true origin and ownership of illegal cash and the laws that make it a crime. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program. The BSA regulations require insurance companies offering covered products to have in place a written AML program that in relevant part provides for ongoing training. Like other jurisdictions insurance industry regulations in APAC are risk-based and entail a range of transaction monitoring requirements. The AML training courses can be taken by a variety of professionals in the following industries.

Source: nl.pinterest.com

Source: nl.pinterest.com

Insurance companies often require ongoing. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. The training should be tailored to the requirements of the personnel according to their roles and responsibilities. The BSA regulations require insurance companies offering covered products to have in place a written AML program that in relevant part provides for ongoing training. At a minimum the program must consist of the following features.

Source: pinterest.com

Source: pinterest.com

Proof of Anti-Money Laundering AML training for Life Insurance and Annuity producers is required by Federal law. The training should include the banks internal BSAAML policies procedures and processes and other regulatory requirements. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. The final rules apply to insurance companies that issue or underwrite certain products that present a high degree of risk for money laundering or the financing of terrorism. The training should be tailored to the requirements of the personnel according to their roles and responsibilities.

Source: redbirdagents.com

Source: redbirdagents.com

We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. Proof of Anti-Money Laundering AML training for Life Insurance and Annuity producers is required by Federal law. We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml training requirements for insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information