20++ Amlctf risk definition information

Home » money laundering idea » 20++ Amlctf risk definition informationYour Amlctf risk definition images are available. Amlctf risk definition are a topic that is being searched for and liked by netizens now. You can Get the Amlctf risk definition files here. Get all royalty-free vectors.

If you’re looking for amlctf risk definition pictures information linked to the amlctf risk definition interest, you have come to the ideal blog. Our website always provides you with hints for seeking the maximum quality video and image content, please kindly search and find more informative video content and images that match your interests.

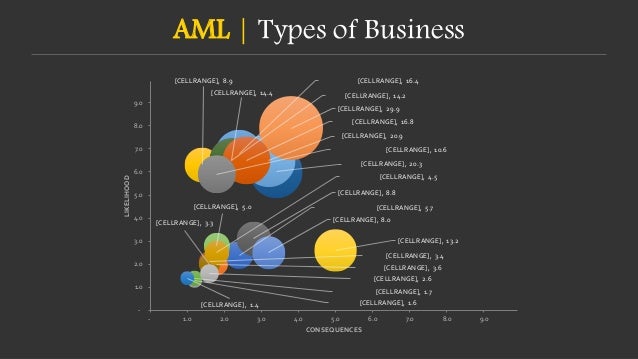

Amlctf Risk Definition. We asked that question in light of the stark change in the regulatory landscape over the last 12 18 months particularly with AUSTRACs well-publicised actions against various major organisations in the banking and payment space. In recent years regulators have dramatically stepped up enforcement of antimoney laundering AML and CFT laws and regulations. Model is populated with the most common AML CTF Sanctions risks as well as controls questionnaire. Promotes Financial Action policies to and the financingproliferation of weapons is an independent inter-governmentalthat developsrecognised as the global anti-money laundering AML and counter-terrorist financing CFT standard.

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Age Evaluation Employee Money Laundering Employee Evaluation Form From pinterest.com

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Age Evaluation Employee Money Laundering Employee Evaluation Form From pinterest.com

Money laundering The FATF Recommendations are body terrorist financing. Today it is not uncommon to see the US Justice Department and regulators announce multimillion dollar criminal or civil fines as settlements for AML violations. Formulas include two options for both inherent risk and controls weighting. However AMLCTF is often looked at as just another third-party system to be integrated rather than a foundation for organizational strategy on tackling money laundering and terrorism financing risks. The anonymity provided by the trade in virtual currencies on the internet. In line with the FATFs standards the fourth Money Laundering Directive MLD4 which entered into force on 26th June 2015 puts the risk-based approach at the centre of Europes AMLCTF regime.

Today it is not uncommon to see the US Justice Department and regulators announce multimillion dollar criminal or civil fines as settlements for AML violations.

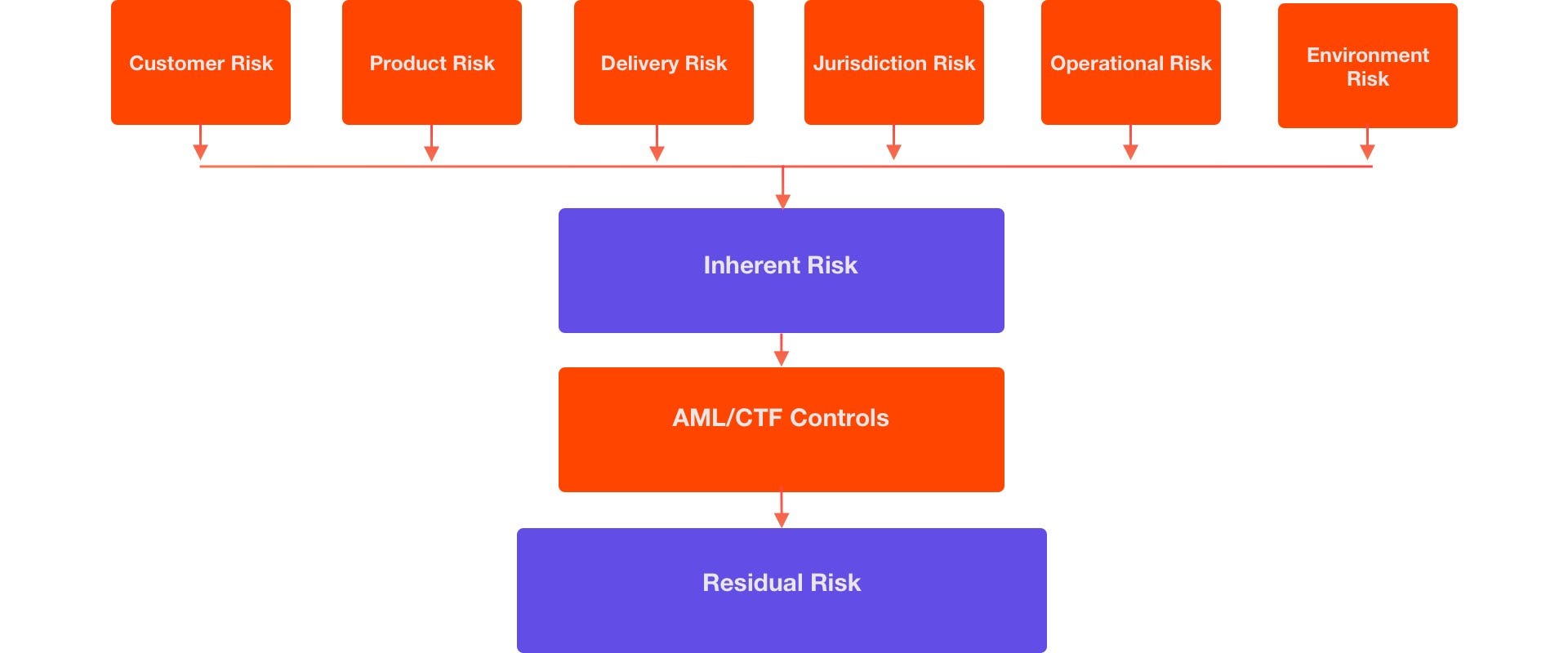

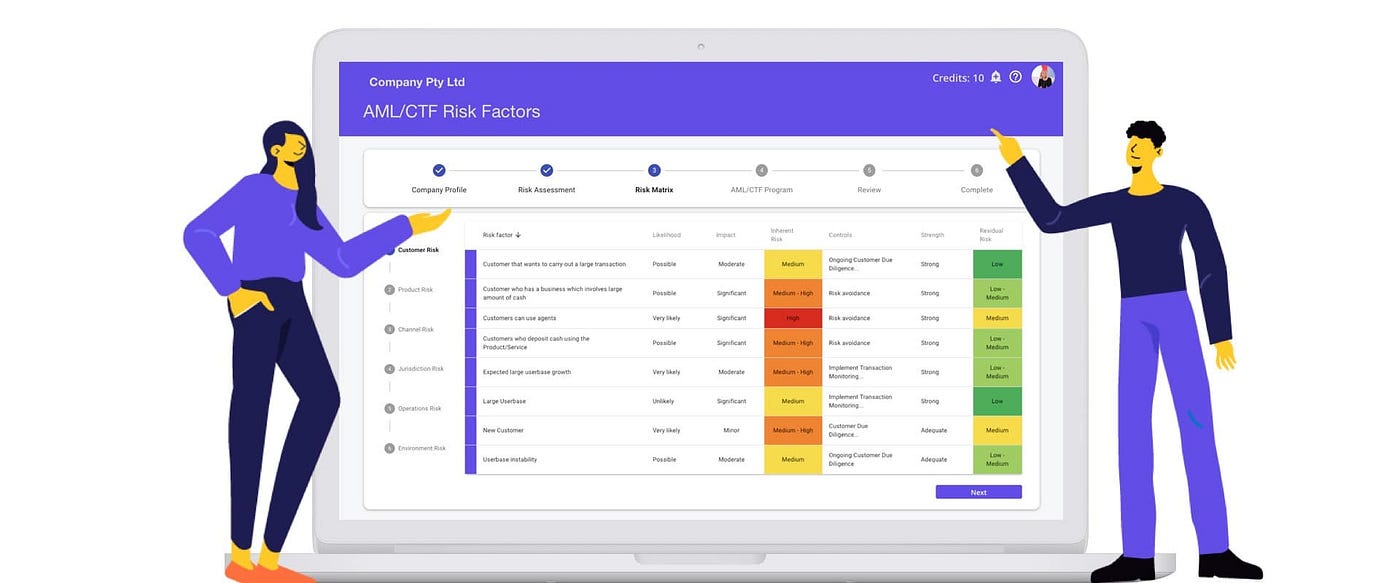

However AMLCTF is often looked at as just another third-party system to be integrated rather than a foundation for organizational strategy on tackling money laundering and terrorism financing risks. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. We asked that question in light of the stark change in the regulatory landscape over the last 12 18 months particularly with AUSTRACs well-publicised actions against various major organisations in the banking and payment space. AMLCTF Risk Assessment. The European Commission presented an ambitious package of legislative proposals to strengthen the EUs anti-money laundering and countering the financing of terrorism AMLCFT rules. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in.

Source: slidetodoc.com

Source: slidetodoc.com

Promotes Financial Action policies to and the financingproliferation of weapons is an independent inter-governmentalthat developsrecognised as the global anti-money laundering AML and counter-terrorist financing CFT standard. Find info on TravelSearchExpert. Formulas include two options for both inherent risk and controls weighting. The aim of an AML compliance program is to detect respond and eliminate inherent and residual money. AMLCTF Risk Assessment.

Source: bi.go.id

Source: bi.go.id

The European Commission presented an ambitious package of legislative proposals to strengthen the EUs anti-money laundering and countering the financing of terrorism AMLCFT rules. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. Identifying and assessing AMLCFT regulatory compliance risk helps an FSP to. The AMLCTF supervision off-site and on-site supervision by the CSSF is organised pursuant to the principles of a risk-based approach that takes into account the money laundering and terrorist financing risks to which the supervised entities and the sectors at large are exposed to. Latest news reports from the medical literature videos from the experts and more.

Source: medium.com

Source: medium.com

The anonymity provided by the trade in virtual currencies on the internet. Risk score summaries and dashboards are. Equal weights or custom user defined. In line with the FATFs standards the fourth Money Laundering Directive MLD4 which entered into force on 26th June 2015 puts the risk-based approach at the centre of Europes AMLCTF regime. Formulas include two options for both inherent risk and controls weighting.

Source: medium.com

Source: medium.com

However AMLCTF is often looked at as just another third-party system to be integrated rather than a foundation for organizational strategy on tackling money laundering and terrorism financing risks. Promotes Financial Action policies to and the financingproliferation of weapons is an independent inter-governmentalthat developsrecognised as the global anti-money laundering AML and counter-terrorist financing CFT standard. Equal weights or custom user defined. Appoint a person in your business to be the AUSTRAC contact person and to keep the Board or senior management informed of. MLD4 recognises that the risk of money laundering and terrorist financing can vary and that Member States competent authorities and firms within its scope have to identify and assess.

Source: bi.go.id

Source: bi.go.id

An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. Risk score summaries and dashboards are. MLD4 recognises that the risk of money laundering and terrorist financing can vary and that Member States competent authorities and firms within its scope have to identify and assess. The European Commission presented an ambitious package of legislative proposals to strengthen the EUs anti-money laundering and countering the financing of terrorism AMLCFT rules. The anonymity provided by the trade in virtual currencies on the internet.

Source: bi.go.id

Source: bi.go.id

The aim of an AML compliance program is to detect respond and eliminate inherent and residual money. Find info on TravelSearchExpert. Appoint a person in your business to be the AUSTRAC contact person and to keep the Board or senior management informed of. In recent years regulators have dramatically stepped up enforcement of antimoney laundering AML and CFT laws and regulations. Model is populated with the most common AML CTF Sanctions risks as well as controls questionnaire.

Source: medium.com

Source: medium.com

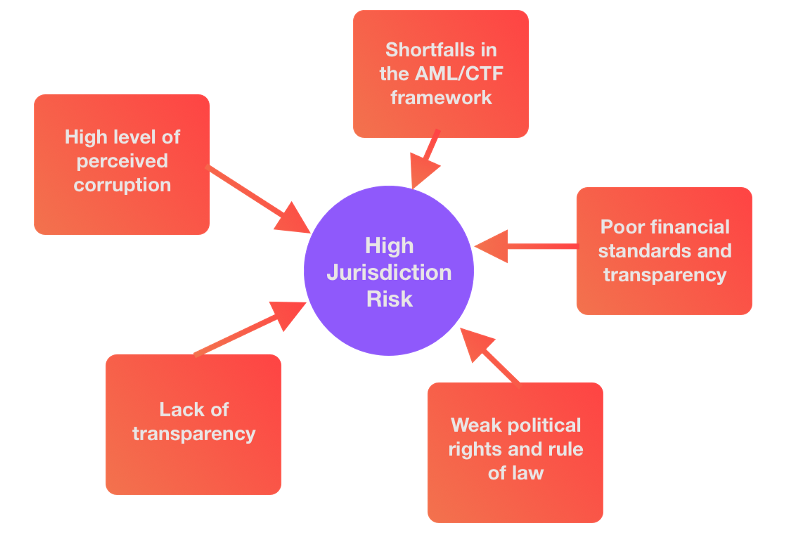

However other characteristics of virtual currencies coupled with their global reach present potential AMLCFT risks such as. An AMLCTF risk assessment is the process of identifying risk and developing policies and procedures to minimise and manage that risk whilst assessing the likelihood and severity of facilitating. Complying with AMLCTF laws and regulations Providing highly useful information to relevant government agencies in defined priority areas2 Establishing a reasonable and risk-based set of controls to mitigate the risks of a Financial Institution FI being used to facilitate illicit activity. In recent years regulators have dramatically stepped up enforcement of antimoney laundering AML and CFT laws and regulations. We recently wrote a piece asking if our clients are treating Anti-money laundering AMLCounter-terrorism financing CTF risk seriously enough.

Ad AML coverage from every angle. Explain the methodology used to conduct the MLTF Risk Assessment and either includes the AMLCTF Risk Assessment in the Program or referring to where it can be found. Appoint a person in your business to be the AUSTRAC contact person and to keep the Board or senior management informed of. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. FCC tops the agenda of regulators globally.

Source: pinterest.com

Source: pinterest.com

Today it is not uncommon to see the US Justice Department and regulators announce multimillion dollar criminal or civil fines as settlements for AML violations. The aim of an AML compliance program is to detect respond and eliminate inherent and residual money. MLD4 recognises that the risk of money laundering and terrorist financing can vary and that Member States competent authorities and firms within its scope have to identify and assess. The anonymity provided by the trade in virtual currencies on the internet. AMLCTF Risk Assessment.

Source: slideshare.net

Source: slideshare.net

Model is populated with the most common AML CTF Sanctions risks as well as controls questionnaire. Formulas include two options for both inherent risk and controls weighting. The anonymity provided by the trade in virtual currencies on the internet. FCC tops the agenda of regulators globally. Identifying and assessing AMLCFT regulatory compliance risk helps an FSP to.

Source: slideshare.net

Source: slideshare.net

AMLCTF Risk Assessment. This means VASP standards should equal other regulated FS institutions. We recently wrote a piece asking if our clients are treating Anti-money laundering AMLCounter-terrorism financing CTF risk seriously enough. Today it is not uncommon to see the US Justice Department and regulators announce multimillion dollar criminal or civil fines as settlements for AML violations. Model is populated with the most common AML CTF Sanctions risks as well as controls questionnaire.

Source: bi.go.id

Source: bi.go.id

Promotes Financial Action policies to and the financingproliferation of weapons is an independent inter-governmentalthat developsrecognised as the global anti-money laundering AML and counter-terrorist financing CFT standard. We asked that question in light of the stark change in the regulatory landscape over the last 12 18 months particularly with AUSTRACs well-publicised actions against various major organisations in the banking and payment space. Risk score summaries and dashboards are. The Luxembourg AMLCTF regulation requires the implementation of a clear AMLCTF risk appetite and strategy in line with the principle of sound and prudent management and aligned with the organisations goals in terms of AMLCTF prevention. Model is populated with the most common AML CTF Sanctions risks as well as controls questionnaire.

Source: siorik.com

Source: siorik.com

Money laundering The FATF Recommendations are body terrorist financing. Latest news reports from the medical literature videos from the experts and more. The package harmonises AMLCFT rules across the EU. Formulas include two options for both inherent risk and controls weighting. Find info on TravelSearchExpert.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title amlctf risk definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information