11++ Amld5 eur lex ideas in 2021

Home » money laundering idea » 11++ Amld5 eur lex ideas in 2021Your Amld5 eur lex images are ready. Amld5 eur lex are a topic that is being searched for and liked by netizens now. You can Get the Amld5 eur lex files here. Find and Download all free images.

If you’re looking for amld5 eur lex pictures information linked to the amld5 eur lex topic, you have come to the right site. Our website always gives you suggestions for downloading the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

Amld5 Eur Lex. As the name would imply it is the fifth iteration of the AML directive that was first introduced by the EU in 1991. G providers engaged in exchange services between virtual currencies and fiat currencies. Search EUR-Lex for the full text of acts adopted by the EFTA institutions. EUR-Lex - 32018L0843 - EN Document 32018L0843.

Amld5 Guide Holland Fintech From hollandfintech.com

Amld5 Guide Holland Fintech From hollandfintech.com

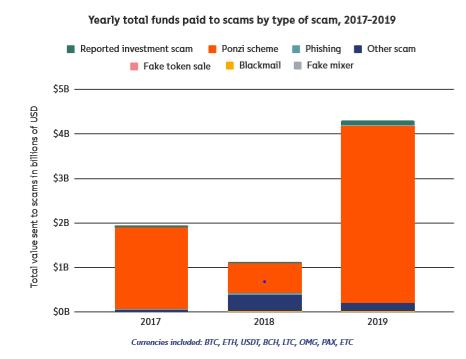

Highlights press releases and speeches We welcome the adoption by the European Parliament of the 5 th Anti-Money Laundering Directive. National UBO registers and expanding its reach eg. EUR-Lex - 32018L0843 - EN - EUR-Le imise the anonymity associated with transactions in virtual currency and the concealment of such transactions. Virtual currencies AMLD5 provides the first definition of virtual currency that covers all its potential uses such as means of payment means of exchange investment store-of-value products or use. AMLD 5 was published in the Official Journal of the EU on 19 June 2018 and called upon EU member states to transpose it by 10 January 2020. The payment instrument is not reloadable and has a monthly maximum payment transaction limit of EUR 150 under AMLD4 this threshold was set at EUR 250.

Text Document information Procedure National transposition Save to My items Up-to-date link Permanent link Bookmark this item.

Under AMLD5 such conditions include among other things the following. The AMLD5 modifies the fourth Anti-Money Laundering Directive AMLD4 released only in 2015. AMLD5 is the first European Union EU legislation which provides a legal definition for the term virtual currency. This Directive is the fourth directive to address the threat of money laundering. The remaining other Member States notified trusts or. H custodian wallet providers.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

EUR-Lex - 32018L0843 - EN - EUR-Le. EUR-Lex - 32018L0843 - EN - EUR-Le. The EU Commission proposed the revised AMLD in July 2016 as part of its Action Plan against terrorism announced in February 2016 after the attacks in Paris and Brussels and as a reaction to the Panama Papers published in April 2016. 10 Virtual currencies should not to be confused with electronic money as defined in point 2 of Article 2 of Directive 2009110EC of the European Parliament and of the Council 1 with the larger concept of funds as defined in point 25 of Article 4 of Directive EU 20152366 of the European Parliament and of the Council 2 nor with. The payment instrument is not reloadable and has a monthly maximum payment transaction limit of EUR 150 under AMLD4 this threshold was set at EUR 250.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

Highlights press releases and speeches We welcome the adoption by the European Parliament of the 5 th Anti-Money Laundering Directive. EUR-Lex - 32018L0843 - EN - EUR-Le. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector. G providers engaged in exchange services between virtual currencies and fiat currencies. Search the official journal of the European Union the main source of EUR-Lex content.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. 2 AML 5 further strengthens the EUs anti-money laundering and combatting. National UBO registers and expanding its reach eg. 6 Further information on the requirements and establishment of the Eur opean Central Platform can be found in Directive 201217EU of the European Parliament and of the Council of 13 June 2012. The AMLD5 modifies the fourth Anti-Money Laundering Directive AMLD4 released only in 2015.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

Information about the Directive 2018843 AMLD V on anti-money laundering and terrorist financing including date of entry into force. Search EUR-Lex for case law from the EU Court of Justice including judgments orders disputes and opinions. 1- The Ministry of Finance infringes the AMLD5 by adding in wording text and effect a de facto license regime while using the label registration to suggest compliance with the registration requirement 2 - The Ministry of Finance is primarily responsible for the legitimate behaviour of the financial supervisor. The payment instrument is not reloadable and has a monthly maximum payment transaction limit of EUR 150 under AMLD4 this threshold was set at EUR 250. The remaining other Member States notified trusts or.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

10 Virtual currencies should not to be confused with electronic money as defined in point 2 of Article 2 of Directive 2009110EC of the European Parliament and of the Council 1 with the larger concept of funds as defined in point 25 of Article 4 of Directive EU 20152366 of the European Parliament and of the Council 2 nor with. AMLD5 is going to deploy at the start of 2020 enforcing legal beneficial owners to take identification measures for authentication of prepaid cards threshold to make sure that any cardholder identity does not place credit more than the amount specified by the directive. The AMLD5 2 is part of the European Commissions anti-money laundering and anti-terrorism efforts aimed at increasing transparency eg. EUR-Lex - 32018L0843 - EN - EUR-Le. For the first time in AMLD5 The following points are added to art1.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

This Directive is the fourth directive to address the threat of money laundering. It is however the. Prepaid cards specific CSPs. EU Member States were required to transpose ie implement into national legislation AML 5 into national law by January 10 2020. This Directive is the fourth directive to address the threat of money laundering.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

This Directive is the fourth directive to address the threat of money laundering. It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. Search EUR-Lex for the full text of acts adopted by the EFTA institutions. 1- The Ministry of Finance infringes the AMLD5 by adding in wording text and effect a de facto license regime while using the label registration to suggest compliance with the registration requirement 2 - The Ministry of Finance is primarily responsible for the legitimate behaviour of the financial supervisor. The payment instrument is not reloadable and has a monthly maximum payment transaction limit of EUR 150 under AMLD4 this threshold was set at EUR 250.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

1- The Ministry of Finance infringes the AMLD5 by adding in wording text and effect a de facto license regime while using the label registration to suggest compliance with the registration requirement 2 - The Ministry of Finance is primarily responsible for the legitimate behaviour of the financial supervisor. National UBO registers and expanding its reach eg. It is however the. H custodian wallet providers. G providers engaged in exchange services between virtual currencies and fiat currencies.

Source:

Information about the Directive 2018843 AMLD V on anti-money laundering and terrorist financing including date of entry into force. A first list of Member States notifications was published on 24 October 2019 3 and was reviewed twice with the most recent list published on the 27 April 2020. Download notice Follow this document Table of. This Directive is the fourth directive to address the threat of money laundering. Virtual currencies AMLD5 provides the first definition of virtual currency that covers all its potential uses such as means of payment means of exchange investment store-of-value products or use.

Source: hollandfintech.com

Source: hollandfintech.com

For the first time in AMLD5 The following points are added to art1. AMLD 5 was published in the Official Journal of the EU on 19 June 2018 and called upon EU member states to transpose it by 10 January 2020. The remaining other Member States notified trusts or. EUR-Lex - 32018L0843 - EN - EUR-Le. Under AMLD5 such conditions include among other things the following.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

It is however the. G providers engaged in exchange services between virtual currencies and fiat currencies. 4 This third list forms the basis of the analysis in this report. Directive 200197EC of the European Parliament and of the Council 5 extended the scope of Directive 91308EEC both in. It is however the.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

Search EUR-Lex for the full text of acts adopted by the EFTA institutions. This Directive is the fourth directive to address the threat of money laundering. National UBO registers and expanding its reach eg. 10 Virtual currencies should not to be confused with electronic money as defined in point 2 of Article 2 of Directive 2009110EC of the European Parliament and of the Council 1 with the larger concept of funds as defined in point 25 of Article 4 of Directive EU 20152366 of the European Parliament and of the Council 2 nor with. The 5th Anti-Money Laundering Directive AMLD5 is an update to the European Unions anti-money laundering AML legal framework.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

Information about the Directive 2018843 AMLD V on anti-money laundering and terrorist financing including date of entry into force. Sixteen Member States 5 indicated that no trusts or similar legal arrangements are governed by their laws. EUR-Lex - 32018L0843 - EN - EUR-Le. The AMLD5 modifies the fourth Anti-Money Laundering Directive AMLD4 released only in 2015. National UBO registers and expanding its reach eg.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title amld5 eur lex by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information