19++ Anti money laundering act covered transactions ideas

Home » money laundering idea » 19++ Anti money laundering act covered transactions ideasYour Anti money laundering act covered transactions images are ready. Anti money laundering act covered transactions are a topic that is being searched for and liked by netizens now. You can Find and Download the Anti money laundering act covered transactions files here. Find and Download all free vectors.

If you’re searching for anti money laundering act covered transactions images information linked to the anti money laundering act covered transactions topic, you have visit the ideal site. Our site always gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

Anti Money Laundering Act Covered Transactions. On covered institutions under anti-money laundering act A transaction in cash or other equivalent monetary instrument may be the subject of an investigation Said transaction must involve a total amount in excess of Five Hundred Thousand Pesos Php 50000000 within one 1 banking day. Lawmakers then lowered the threshold for covered transactions to P500000 from P4 million empowered the central bank to. For offshore gaming operatorsservice providers however the general threshold amount of more than Php50000000 applies. 5 the fact that a customer came from a high risk jurisdiction.

The formal AMLC reporting form must be used. Anti Money Laundering Act Covered Transactions. It is a course of by which dirty money is transformed into clean money. Anti-Money Laundering and Countering Financing of Terrorism Act 2009. 4 the regularity or duration of the transaction. Note 4 at the end of this reprint provides a list of the amendments incorporated.

The sources of the money in precise are criminal and the cash is invested in a method that makes it.

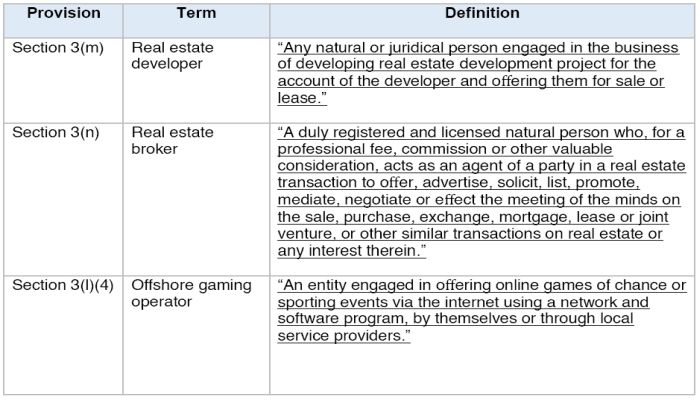

11521 adds two new covered persons who are now required to report covered and suspicious transactions to the Anti-Money Laundering Council AMLC 1 real estate developers and brokers and 2 offshore gaming operators as well as their service providers supervised accredited or regulated by the Philippine Amusement and Gaming Corporation PAGCOR or any government agency. Furthermore the Anti-Money Laundering Council AMLC now has an added function to require the Land Registration Authority LRA and all its Registries of Deeds to submit to the AMLC reports on all real estate transactions involving an amount in excess of Five hundred thousand pesos P50000000 within fifteen 15 days from the date of registration of the transaction in a form to be prescribed by the AMLC. Covered transaction is a transaction in cash or other equivalent monetary instrument involving a total amount in excess of Five hundred thousand pesos PhP 50000000 within one 1 banking day. A if all of the designated services provided by the reporting entity are covered by item 54 of table 1 in section 6 and there is no joint antimoney laundering and counterterrorism financing program that applies to and has been adopted by the reporting entity. 4 the regularity or duration of the transaction. The concept of money laundering is very important to be understood for these working in the monetary sector.

Source: bi.go.id

Source: bi.go.id

3 the amount of funds to be deposited by a customer or the size of transactions undertaken. 11521 adds two new covered persons who are now required to report covered and suspicious transactions to the Anti-Money Laundering Council AMLC 1 real estate developers and brokers and 2 offshore gaming operators as well as their service providers supervised accredited or regulated by the Philippine Amusement and Gaming Corporation PAGCOR or any. The criteria may include. On covered institutions under anti-money laundering act A transaction in cash or other equivalent monetary instrument may be the subject of an investigation Said transaction must involve a total amount in excess of Five Hundred Thousand Pesos Php 50000000 within one 1 banking day. 6 the existence of suspicious transaction indicators.

Republic Act RA No. And 7 such other factors the covered. Lawmakers then lowered the threshold for covered transactions to P500000 from P4 million empowered the central bank to. Anti-Money Laundering and Countering Financing of Terrorism Act 2009. 2 the purpose of the account or transaction.

B Covered transaction is a single series or combination of transactions involving a total amount in excess of Four million Philippine pesos Php400000000 or an equivalent amount in foreign currency based on the prevailing exchange rate within five 5 consecutive banking days except those between a covered institution and a person who at the time of the transaction was a properly. 11521 adds two new covered persons who are now required to report covered and suspicious transactions to the Anti-Money Laundering Council AMLC 1 real estate developers and brokers and 2 offshore gaming operators as well as their service providers supervised accredited or regulated by the Philippine Amusement and Gaming Corporation PAGCOR or any. Anti-Money Laundering and Countering Financing of Terrorism Act 2009. 2 the purpose of the account or transaction. T o protect and preserve the integrity and confidentiality of bank accounts and to ensure that the Philippines shall not be used as a money laundering site for the proceeds of any unlawful activity the Anti-Money Laundering Act.

Source: bi.go.id

Source: bi.go.id

Furthermore the Anti-Money Laundering Council AMLC now has an added function to require the Land Registration Authority LRA and all its Registries of Deeds to submit to the AMLC reports on all real estate transactions involving an amount in excess of Five hundred thousand pesos P50000000 within fifteen 15 days from the date of registration of the transaction in a form to be prescribed by the AMLC. 11521 further strengthens the Anti-Money Laundering Act AMLA of 2001 including giving additional powers to the Anti Money Laundering Council AMLC and expanding the list of covered persons. Covered transaction is a transaction in cash or other equivalent monetary instrument involving a total amount in excess of Five hundred thousand pesos PhP 50000000 within one 1 banking day. 1 the nature of the service or product to be availed of by the customers. It is a course of by which soiled cash is converted into clean money.

Source: mondaq.com

Source: mondaq.com

3 the amount of funds to be deposited by a customer or the size of transactions undertaken. For real estate developers and brokers a covered transaction refers to a single cash transaction involving an amount in excess of Php750000000. Covered transaction is a transaction in cash or other equivalent monetary instrument involving a total amount in excess of Five hundred thousand pesos PhP 50000000 within one 1 banking day. The concept of money laundering is very important to be understood for these working in the monetary sector. The formal AMLC reporting form must be used.

B Covered transaction is a single series or combination of transactions involving a total amount in excess of Four million Philippine pesos Php400000000 or an equivalent amount in foreign currency based on the prevailing exchange rate within five 5 consecutive banking days except those between a covered institution and a person who at the time of the transaction was a properly. What should be done to Suspicious Transactions and Covered Transactions. 1 the nature of the service or product to be availed of by the customers. It is a course of by which dirty money is transformed into clean money. The sources of the money in precise are criminal and the cash is invested in a method that makes it.

Source: pinterest.com

Source: pinterest.com

It is a course of by which dirty money is transformed into clean money. For offshore gaming operatorsservice providers however the general threshold amount of more than Php50000000 applies. Covered transaction is a transaction in cash or other equivalent monetary instrument involving a total amount in excess of Five hundred thousand pesos PhP 50000000 within one 1 banking day. Anti Money Laundering Act Covered Transactions. Furthermore the Anti-Money Laundering Council AMLC now has an added function to require the Land Registration Authority LRA and all its Registries of Deeds to submit to the AMLC reports on all real estate transactions involving an amount in excess of Five hundred thousand pesos P50000000 within fifteen 15 days from the date of registration of the transaction in a form to be prescribed by the AMLC.

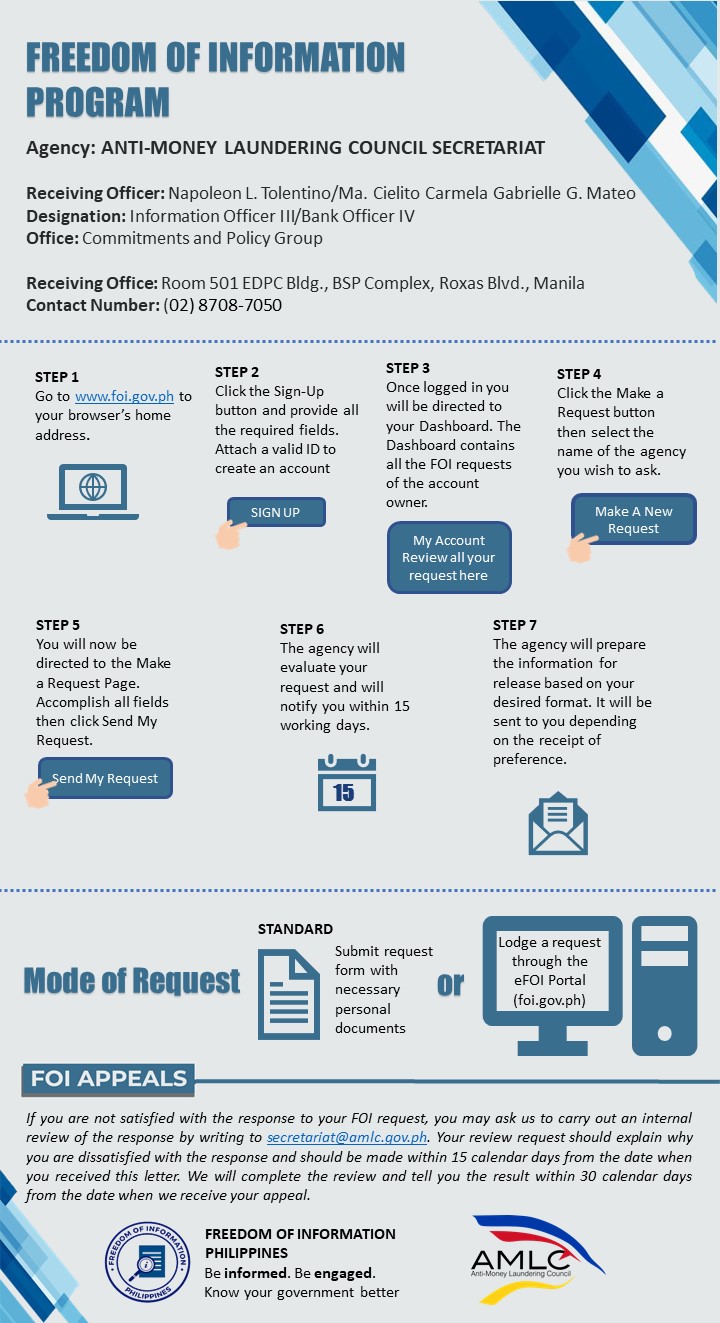

Source: amlc.gov.ph

Source: amlc.gov.ph

More on anti-money laundering act. For real estate developers and brokers a covered transaction refers to a single cash transaction involving an amount in excess of Php750000000. What should be done to Suspicious Transactions and Covered Transactions. 11521 further strengthens the Anti-Money Laundering Act AMLA of 2001 including giving additional powers to the Anti Money Laundering Council AMLC and expanding the list of covered persons. 2 the purpose of the account or transaction.

Source: bi.go.id

Source: bi.go.id

3 the amount of funds to be deposited by a customer or the size of transactions undertaken. Anti-Money Laundering and Countering Financing of Terrorism Act 2009. Lawmakers then lowered the threshold for covered transactions to P500000 from P4 million empowered the central bank to. It is a course of by which soiled cash is converted into clean money. 11521 further strengthens the Anti-Money Laundering Act AMLA of 2001 including giving additional powers to the Anti Money Laundering Council AMLC and expanding the list of covered persons.

Source: pinterest.com

Source: pinterest.com

It is a course of by which soiled cash is converted into clean money. 5 the fact that a customer came from a high risk jurisdiction. Changes authorised by subpart 2 of Part 2 of the Legislation Act 2012 have been made in this official reprint. Republic Act RA No. For offshore gaming operatorsservice providers however the general threshold amount of more than Php50000000 applies.

Source: vectorstock.com

Source: vectorstock.com

B Covered transaction is a single series or combination of transactions involving a total amount in excess of Four million Philippine pesos Php400000000 or an equivalent amount in foreign currency based on the prevailing exchange rate within five 5 consecutive banking days except those between a covered institution and a person who at the time of the transaction was a properly. Note 4 at the end of this reprint provides a list of the amendments incorporated. For real estate developers and brokers a covered transaction refers to a single cash transaction involving an amount in excess of Php750000000. Lawmakers then lowered the threshold for covered transactions to P500000 from P4 million empowered the central bank to. What should be done to Suspicious Transactions and Covered Transactions.

Source: bi.go.id

Source: bi.go.id

More on anti-money laundering act. The concept of money laundering is very important to be understood for these working in the monetary sector. 11521 adds two new covered persons who are now required to report covered and suspicious transactions to the Anti-Money Laundering Council AMLC 1 real estate developers and brokers and 2 offshore gaming operators as well as their service providers supervised accredited or regulated by the Philippine Amusement and Gaming Corporation PAGCOR or any. The financial institution participating in the transaction should report the Suspicious or Covered Transaction to the Anti-Money Laundering Council AMLC within FIVE working days from the date the transaction occurred. This Act is administered by the Ministry of Justice.

Source: researchgate.net

Source: researchgate.net

Note 4 at the end of this reprint provides a list of the amendments incorporated. On covered institutions under anti-money laundering act A transaction in cash or other equivalent monetary instrument may be the subject of an investigation Said transaction must involve a total amount in excess of Five Hundred Thousand Pesos Php 50000000 within one 1 banking day. 11521 adds two new covered persons who are now required to report covered and suspicious transactions to the Anti-Money Laundering Council AMLC 1 real estate developers and brokers and 2 offshore gaming operators as well as their service providers supervised accredited or regulated by the Philippine Amusement and Gaming Corporation PAGCOR or any. Lawmakers then lowered the threshold for covered transactions to P500000 from P4 million empowered the central bank to. Anti Money Laundering Act Covered Transactions.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering act covered transactions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information