11+ Anti money laundering act europe ideas in 2021

Home » money laundering idea » 11+ Anti money laundering act europe ideas in 2021Your Anti money laundering act europe images are ready in this website. Anti money laundering act europe are a topic that is being searched for and liked by netizens today. You can Download the Anti money laundering act europe files here. Get all free photos.

If you’re searching for anti money laundering act europe pictures information connected with to the anti money laundering act europe topic, you have visit the right site. Our site always provides you with hints for downloading the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that match your interests.

Anti Money Laundering Act Europe. Our goal is to provide a platform for those interested in strengthening EU anti-money laundering policy AML and legislation by ensuring effective dialogue with key EU and international policy-makers. Empowering the EBA was intended to boost coordination across the bloc to crack down on illicit funds moving within the EUs borders. One of the pillars of the European Unions legislation to combat money laundering and countering the financing of terrorism is Directive EU 2015849. Anti-money laundering and countering the financing of terrorism The EU has laws in place to combat money laundering and the financing of terrorism.

Eu Policy On High Risk Third Countries European Commission From ec.europa.eu

Eu Policy On High Risk Third Countries European Commission From ec.europa.eu

Anti-money Laundering Europe AME is a Brussels-based public and private sector forum on dealing with EU financial crime issues. The EUObserver reports. Anti-money-laundering Directive to a regulation thereby directly applicable in the Member States ii an EU level supervision with an EU -wide anti-money-laundering supervisory system and iii a coordination and support mechanism for Member States Financial Intelligence Units. In fighting anti-money laundering the European Commission should act fast toward creating a central supervisory authority. Section 6 GwG Internal controls and safeguards. The regulator even received more cash and manpower last year to beef up its anti-money laundering team in response to scandals in Denmark Estonia Germany Latvia Malta the Netherlands and Sweden.

German Anti-Money Laundering Act GwG Part 1 Definitions and obliged entities.

The European Union could soon get an anti-money laundering authority after the European Commission proposed on Tuesday an ambitious package of legislative proposals to strengthen the Unions rules concerning the fight against money laundering and the financing of terrorism AMLCFT. T o this end the UK Government passed the Sanctions and Anti-Money Laundering Act 2018 law. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. Anti-money-laundering Directive to a regulation thereby directly applicable in the Member States ii an EU level supervision with an EU -wide anti-money-laundering supervisory system and iii a coordination and support mechanism for Member States Financial Intelligence Units. German Anti-Money Laundering Act GwG Part 1 Definitions and obliged entities. The European Union is moving toward implementing a policy to strengthen antimoney laundering AML supervision across its Single Market namely enforcing requirements on banks and other firms to en.

Source: ceps.eu

Source: ceps.eu

EU legislators have taken a number of steps to clarify and strengthen the important link between anti-money launderingcountering the financing of terrorism AMLCFT and prudential issues and to complement the Unions existing legal framework. T o this end the UK Government passed the Sanctions and Anti-Money Laundering Act 2018 law. If the United Kingdom did not take any money laundering measures and terrorist financing after leaving the European Union it could violate international AML obligations. According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries. Section 5 GwG Risk analysis.

Source: ec.europa.eu

Source: ec.europa.eu

Section 7 GwG Money laundering officer. Section 7 GwG Money laundering officer. Anti-money-laundering Directive to a regulation thereby directly applicable in the Member States ii an EU level supervision with an EU -wide anti-money-laundering supervisory system and iii a coordination and support mechanism for Member States Financial Intelligence Units. Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission Directive 200670EC. Section 3 GwG Beneficial owner.

Source: global-amlcft.eu

Our goal is to provide a platform for those interested in strengthening EU anti-money laundering policy AML and legislation by ensuring effective dialogue with key EU and international policy-makers. Empowering the EBA was intended to boost coordination across the bloc to crack down on illicit funds moving within the EUs borders. Fighting money laundering and terrorist financing contributes to global security integrity of the financial system and sustainable growth. Part 2 Risk management. If the United Kingdom did not take any money laundering measures and terrorist financing after leaving the European Union it could violate international AML obligations.

Source: medium.com

Source: medium.com

Section 2 GwG Obliged entities power to issue statutory instruments. The EU contains several weak jurisdictions which act as entry points for illicit money into the European banking system. Section 2 GwG Obliged entities power to issue statutory instruments. German Anti-Money Laundering Act GwG Part 1 Definitions and obliged entities. Section 5 GwG Risk analysis.

Source: ec.europa.eu

Source: ec.europa.eu

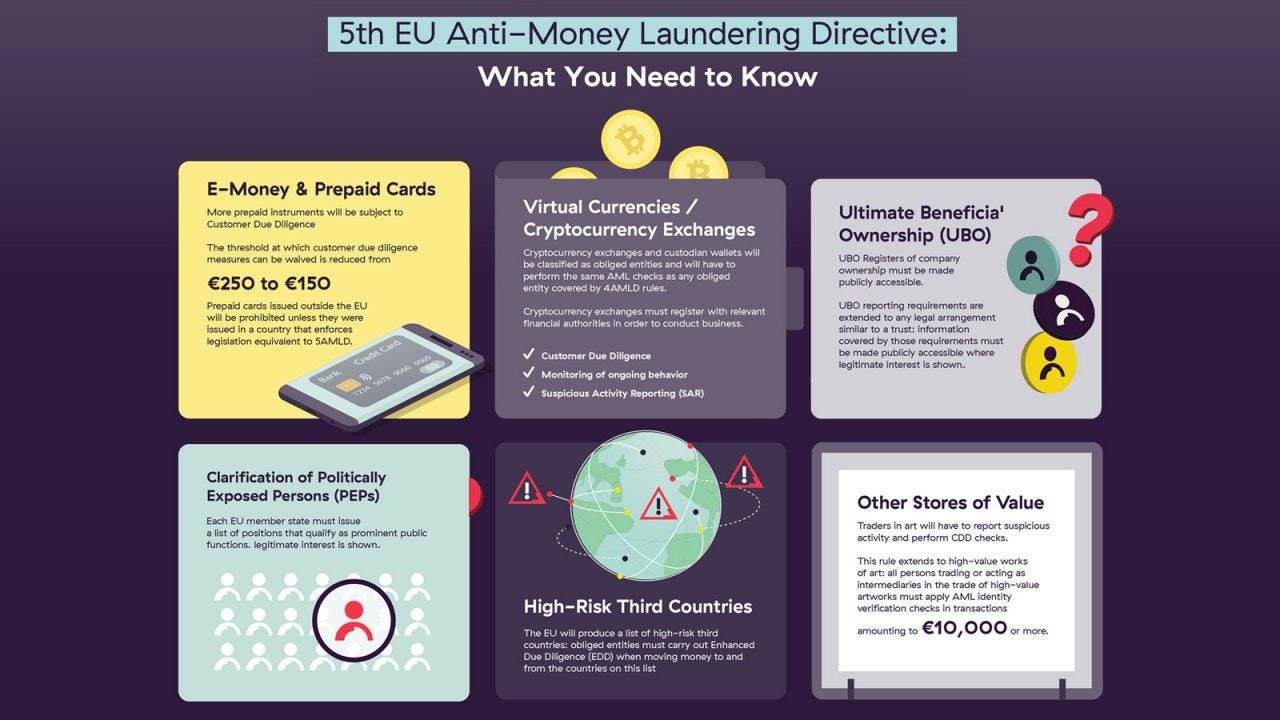

Anti-money laundering AMLD V - Directive EU 2018843 Law details Information about the Directive 2018843 AMLD V on anti-money laundering and terrorist financing including date of entry into force. Section 3 GwG Beneficial owner. The EU contains several weak jurisdictions which act as entry points for illicit money into the European banking system. T o this end the UK Government passed the Sanctions and Anti-Money Laundering Act 2018 law. Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission Directive 200670EC.

Source: skillcast.com

Source: skillcast.com

The European Union is moving toward implementing a policy to strengthen antimoney laundering AML supervision across its Single Market namely enforcing requirements on banks and other firms to en. These include Austria the Baltic states Cyprus Luxembourg and Malta The Commissions proposal said EU states will have to harmonise anti-money laundering laws for the project to work. Fighting money laundering and terrorist financing contributes to global security integrity of the financial system and sustainable growth. Something which was required to be completed by 10 January 2020. Anti-money laundering and countering the financing of terrorism The EU has laws in place to combat money laundering and the financing of terrorism.

Source: branddocs.com

Source: branddocs.com

Something which was required to be completed by 10 January 2020. Section 2 GwG Obliged entities power to issue statutory instruments. The European Union is moving toward implementing a policy to strengthen antimoney laundering AML supervision across its Single Market namely enforcing requirements on banks and other firms to en. While the Act transposes most of the elements of 5AMLD a few notable areas remain outstanding. German Anti-Money Laundering Act GwG Part 1 Definitions and obliged entities.

Source:

Section 1 GwG Definitions. These include Austria the Baltic states Cyprus Luxembourg and Malta The Commissions proposal said EU states will have to harmonise anti-money laundering laws for the project to work. The European Union is moving toward implementing a policy to strengthen antimoney laundering AML supervision across its Single Market namely enforcing requirements on banks and other firms to en. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. Anti-Money Laundering and Countering the Financing of Terrorism The EBA is required to ensure the integrity transparency and orderly functioning of financial markets.

Source: softelligence.net

Source: softelligence.net

Fighting money laundering and terrorist financing contributes to global security integrity of the financial system and sustainable growth. According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries. One of the pillars of the European Unions legislation to combat money laundering and countering the financing of terrorism is Directive EU 2015849. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. Anti-money Laundering Europe AME is a Brussels-based public and private sector forum on dealing with EU financial crime issues.

Source: researchgate.net

Source: researchgate.net

Part 2 Risk management. Anti-money laundering AMLD V - Directive EU 2018843 Law details Information about the Directive 2018843 AMLD V on anti-money laundering and terrorist financing including date of entry into force. Purpose and scope of regulation of Act 1 The purpose of this Act is by increasing the trustworthiness and transparency of the business environment to prevent the use of the financial system and economic space of the Republic of Estonia for money laundering and terrorist financing. Empowering the EBA was intended to boost coordination across the bloc to crack down on illicit funds moving within the EUs borders. Our goal is to provide a platform for those interested in strengthening EU anti-money laundering policy AML and legislation by ensuring effective dialogue with key EU and international policy-makers.

Source: bruegel.org

Source: bruegel.org

EU legislators have taken a number of steps to clarify and strengthen the important link between anti-money launderingcountering the financing of terrorism AMLCFT and prudential issues and to complement the Unions existing legal framework. Anti-money Laundering Europe AME is a Brussels-based public and private sector forum on dealing with EU financial crime issues. These include Austria the Baltic states Cyprus Luxembourg and Malta The Commissions proposal said EU states will have to harmonise anti-money laundering laws for the project to work. German Anti-Money Laundering Act GwG Part 1 Definitions and obliged entities. Our goal is to provide a platform for those interested in strengthening EU anti-money laundering policy AML and legislation by ensuring effective dialogue with key EU and international policy-makers.

Source: globalcompliancenews.com

Source: globalcompliancenews.com

The regulator even received more cash and manpower last year to beef up its anti-money laundering team in response to scandals in Denmark Estonia Germany Latvia Malta the Netherlands and Sweden. If the United Kingdom did not take any money laundering measures and terrorist financing after leaving the European Union it could violate international AML obligations. Something which was required to be completed by 10 January 2020. Purpose and scope of regulation of Act 1 The purpose of this Act is by increasing the trustworthiness and transparency of the business environment to prevent the use of the financial system and economic space of the Republic of Estonia for money laundering and terrorist financing. EU legislators have taken a number of steps to clarify and strengthen the important link between anti-money launderingcountering the financing of terrorism AMLCFT and prudential issues and to complement the Unions existing legal framework.

Source: coe.int

Source: coe.int

The European Union could soon get an anti-money laundering authority after the European Commission proposed on Tuesday an ambitious package of legislative proposals to strengthen the Unions rules concerning the fight against money laundering and the financing of terrorism AMLCFT. One of the pillars of the European Unions legislation to combat money laundering and countering the financing of terrorism is Directive EU 2015849. Fighting money laundering and terrorist financing contributes to global security integrity of the financial system and sustainable growth. These include Austria the Baltic states Cyprus Luxembourg and Malta The Commissions proposal said EU states will have to harmonise anti-money laundering laws for the project to work. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering act europe by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information