12+ Anti money laundering act nz ideas

Home » money laundering Info » 12+ Anti money laundering act nz ideasYour Anti money laundering act nz images are ready in this website. Anti money laundering act nz are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering act nz files here. Download all free vectors.

If you’re searching for anti money laundering act nz pictures information connected with to the anti money laundering act nz topic, you have come to the right blog. Our site frequently gives you hints for seeking the highest quality video and picture content, please kindly search and locate more enlightening video articles and images that fit your interests.

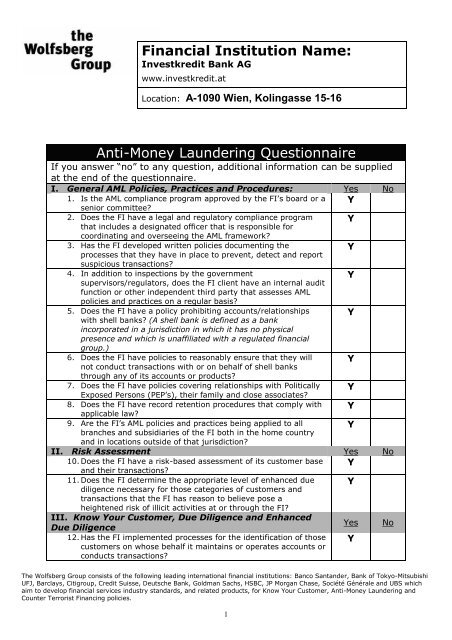

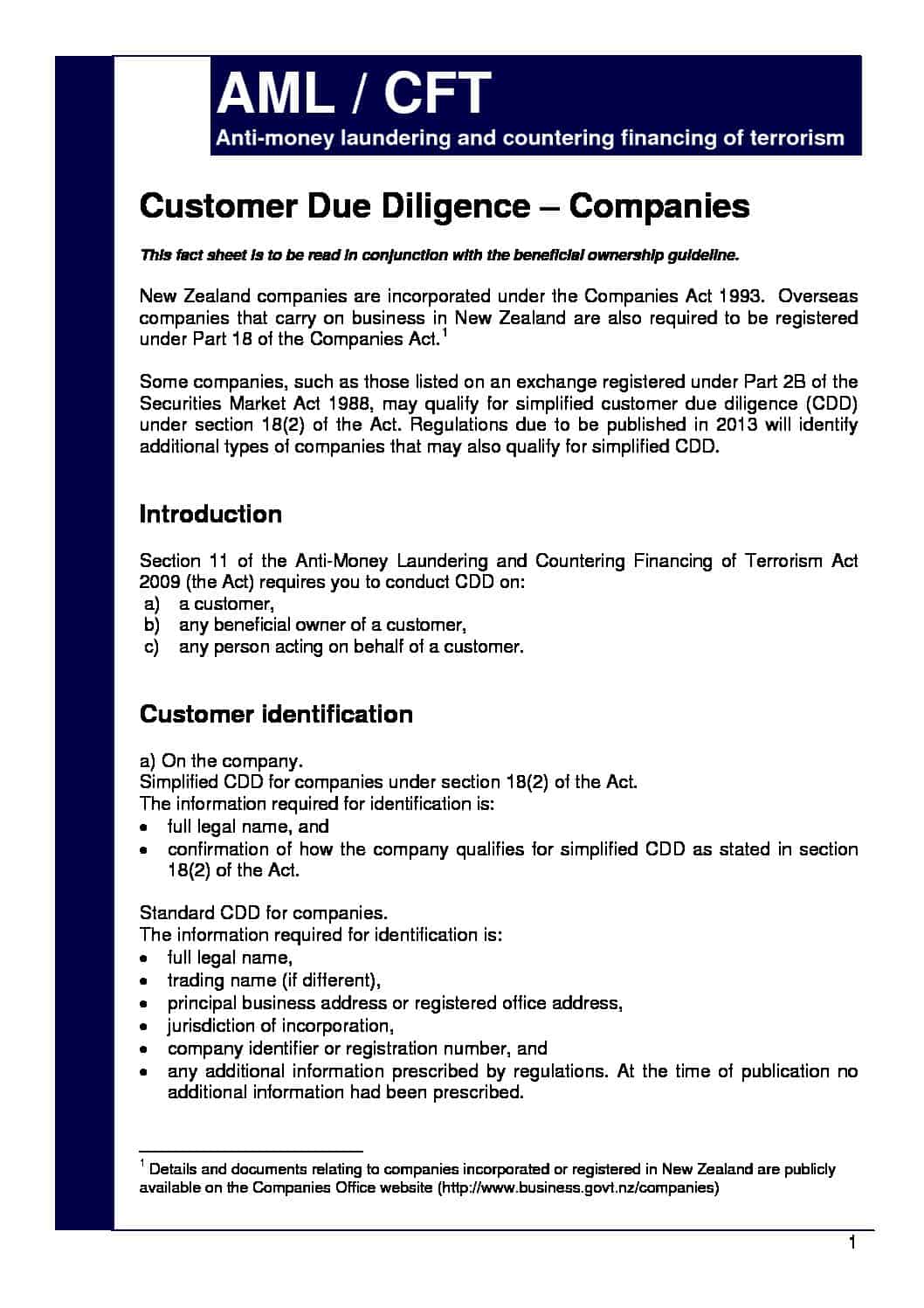

Anti Money Laundering Act Nz. For resources and guidelines relevant to your business click on your business sector from the links below. Go to the Anti-Money Laundering and Countering Financing of Terrorism Act AMLCFT Act Read the Act and regulations. Money laundering offence means an offence against section 243 of the Crimes Act 1961 or section 12B of the Misuse of Drugs Act 1975 or any act committed overseas that if committed in New Zealand would be an offence under those sections of those Acts. The Act which came into full force in 2013 also requires banks to gather more information about customers than previously.

Anti Money Laundering Policy Pdf From pdfprof.com

Anti Money Laundering Policy Pdf From pdfprof.com

The Act and regulations came fully into effect on 30 June 2013. The Act which came into full force in 2013 also requires banks to gather more information about customers than previously. The Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act is being expanded to cover a lot more New Zealand businesses. View our Regulatory Framework 2020 PDF 1 page 186kb View our Regulatory Findings Report 201819 PDF 27 pages 12mb. However by verifying your identity you will be helping protect New Zealand businesses from being misused for the purposes of criminal activity. For resources and guidelines relevant to your business click on your business sector from the links below.

However by verifying your identity you will be helping protect New Zealand businesses from being misused for the purposes of criminal activity.

The Anti-Money Laundering and Countering Financing of Terrorism Act AMLCFT Act was passed in 2009. 6 Application of this Act to reporting entities 1 Subject to subsections 2 and 3 and to Schedule 1 this Act as amended by the Anti-Money Laundering and Countering Financing of Terrorism Amendment Act 2017 applies to any reporting entity that is in existence at the commencement of this section or that comes into existence on or after the commencement of this section. Providing Proof of Identification As a customer of a business that has to comply with the AMLCFT Act you may be asked to provide proof of identification. Anti-Money Laundering and Countering Financing of Terrorism Act 2009. The Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act is being expanded to cover a lot more New Zealand businesses. Changes authorised by subpart 2 of Part 2 of the Legislation Act 2012 have been made in this official reprint.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The Anti-Money Laundering and Countering Financing of Terrorism Act AMLCFT Act was passed in 2009. Note 4 at the end of this reprint provides a list of the amendments incorporated. Information on Anti money laundering in New Zealand Information for business on AML compliance assessment and more. Regulation 16 declares certain financial advisers to be reporting entities for the purposes of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009. Changes authorised by subpart 2 of Part 2 of the Legislation Act 2012 have been made in this official reprint.

Source: hughson.co.nz

Source: hughson.co.nz

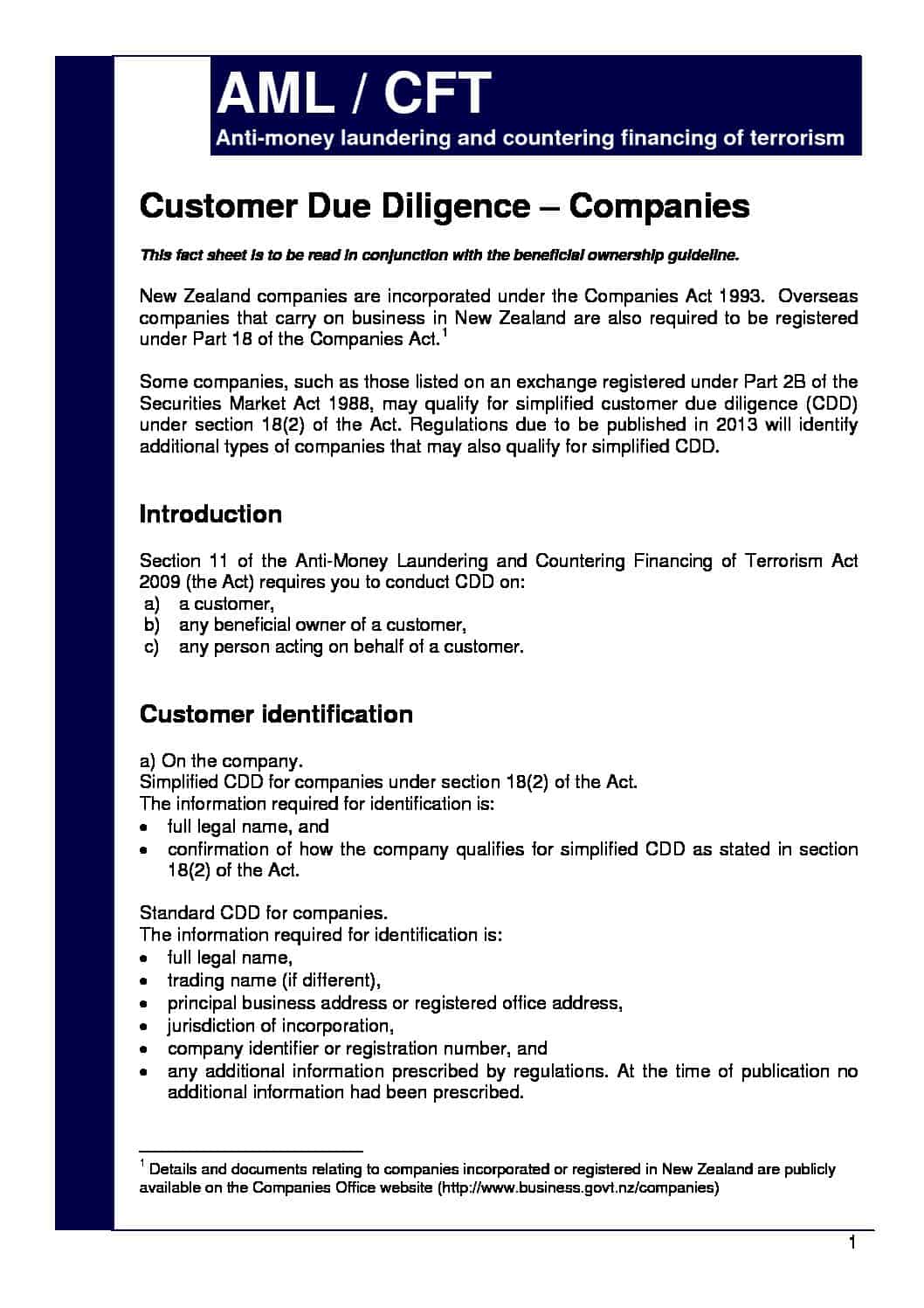

Go to the Anti-Money Laundering and Countering Financing of Terrorism Act AMLCFT Act Read the Act and regulations. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act requires reporting entities to conduct customer due diligence CDD on their customers their customers beneficial owners and anyone acting on behalf of their customers. Regulation 16 declares certain financial advisers to be reporting entities for the purposes of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009. To help real estate agents understand the risks they face the Department of Internal Affairs has just released a. Read the Anti-Money Laundering and Countering Financing of Terrorism Act 2009.

Source: yumpu.com

Source: yumpu.com

These regulations which come into force on 15 March 2021 amend regulation 16 of the Anti-Money Laundering and Countering Financing of Terrorism Definitions Regulations 2011. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 is designed to help detect and deter money laundering and terrorism financing. Under the law all banks in New Zealand are required to do more to verify a customers identity and in some cases account activity. 6 Application of this Act to reporting entities 1 Subject to subsections 2 and 3 and to Schedule 1 this Act as amended by the Anti-Money Laundering and Countering Financing of Terrorism Amendment Act 2017 applies to any reporting entity that is in existence at the commencement of this section or that comes into existence on or after the commencement of this section. To help real estate agents understand the risks they face the Department of Internal Affairs has just released a.

Source: pdfprof.com

Source: pdfprof.com

Under the law all banks in New Zealand are required to do more to verify a customers identity and in some cases account activity. For resources and guidelines relevant to your business click on your business sector from the links below. The Anti-Money Laundering and Countering Financing of Terrorism Act AMLCFT Act was passed in 2009. The Act which came into full force in 2013 also requires banks to gather more information about customers than previously. View our Regulatory Framework 2020 PDF 1 page 186kb View our Regulatory Findings Report 201819 PDF 27 pages 12mb.

However by verifying your identity you will be helping protect New Zealand businesses from being misused for the purposes of criminal activity. Businesses that appear on this list have been identified as reporting entities supervised by the Department of Internal Affairs under section 5 of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act. 6 Application of this Act to reporting entities 1 Subject to subsections 2 and 3 and to Schedule 1 this Act as amended by the Anti-Money Laundering and Countering Financing of Terrorism Amendment Act 2017 applies to any reporting entity that is in existence at the commencement of this section or that comes into existence on or after the commencement of this section. Go to the Anti-Money Laundering and Countering Financing of Terrorism Act AMLCFT Act Read the Act and regulations. The Department of Internal Affairs supervises a range of businesses who need to comply with the AMLCFT legislation.

Source: bankomb.org.nz

Source: bankomb.org.nz

The Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act is being expanded to cover a lot more New Zealand businesses. View our Regulatory Framework 2020 PDF 1 page 186kb View our Regulatory Findings Report 201819 PDF 27 pages 12mb. The Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act is being expanded to cover a lot more New Zealand businesses. The Department of Internal Affairs supervises a range of businesses who need to comply with the AMLCFT legislation. Information on Anti money laundering in New Zealand Information for business on AML compliance assessment and more.

Source: pdfprof.com

Source: pdfprof.com

Information on Anti money laundering in New Zealand Information for business on AML compliance assessment and more. We want businesses to be able to operate safely. Financial institutions have had to comply with the AMLCFT Act since 2013 now other businesses will also need to comply including real estate agents and many lawyers and accountants. This Act is administered by the Ministry of Justice. For resources and guidelines relevant to your business click on your business sector from the links below.

Source: pdfprof.com

Source: pdfprof.com

Regulation 16 declares certain financial advisers to be reporting entities for the purposes of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009. Businesses that appear on this list have been identified as reporting entities supervised by the Department of Internal Affairs under section 5 of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act. The Anti-Money Laundering and Countering the Financing of Terrorism Act 2009 obliges New Zealands financial institutions and businesses to detect and deter money laundering and the financing of terrorism. To help real estate agents understand the risks they face the Department of Internal Affairs has just released a. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act requires reporting entities to conduct customer due diligence CDD on their customers their customers beneficial owners and anyone acting on behalf of their customers.

Source: pdfprof.com

Source: pdfprof.com

For resources and guidelines relevant to your business click on your business sector from the links below. Read the Anti-Money Laundering and Countering Financing of Terrorism Act 2009. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act requires reporting entities to conduct customer due diligence CDD on their customers their customers beneficial owners and anyone acting on behalf of their customers. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 is designed to help detect and deter money laundering and terrorism financing. The action includes the issuance of a formal warning under section 100 of the Anti-Money Laundering and Counter Terrorist Financing Act 2015 an enforceable undertaking from BSP that it will remove and replace certain executive management staff and for the BSP to engage an external auditor to determine the full extent of the underlying good.

Source: interest.co.nz

Source: interest.co.nz

The Act and regulations came fully into effect on 30 June 2013. Businesses that appear on this list have been identified as reporting entities supervised by the Department of Internal Affairs under section 5 of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act. For resources and guidelines relevant to your business click on your business sector from the links below. Financial institutions have had to comply with the AMLCFT Act since 2013 now other businesses will also need to comply including real estate agents and many lawyers and accountants. Read the Anti-Money Laundering and Countering Financing of Terrorism Act 2009.

Source: pdfprof.com

Source: pdfprof.com

The Department of Internal Affairs supervises a range of businesses who need to comply with the AMLCFT legislation. Information on Anti money laundering in New Zealand Information for business on AML compliance assessment and more. Providing Proof of Identification As a customer of a business that has to comply with the AMLCFT Act you may be asked to provide proof of identification. However by verifying your identity you will be helping protect New Zealand businesses from being misused for the purposes of criminal activity. View our Regulatory Framework 2020 PDF 1 page 186kb View our Regulatory Findings Report 201819 PDF 27 pages 12mb.

Source: srblaw.co.nz

Source: srblaw.co.nz

Providing Proof of Identification As a customer of a business that has to comply with the AMLCFT Act you may be asked to provide proof of identification. Providing Proof of Identification As a customer of a business that has to comply with the AMLCFT Act you may be asked to provide proof of identification. Information on Anti money laundering in New Zealand Information for business on AML compliance assessment and more. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 is designed to help detect and deter money laundering and terrorism financing. Go to the Anti-Money Laundering and Countering Financing of Terrorism Act AMLCFT Act Read the Act and regulations.

Source: pdfprof.com

Source: pdfprof.com

The Anti-Money Laundering and Countering the Financing of Terrorism Act 2009 obliges New Zealands financial institutions and businesses to detect and deter money laundering and the financing of terrorism. For resources and guidelines relevant to your business click on your business sector from the links below. This Act is administered by the Ministry of Justice. Note 4 at the end of this reprint provides a list of the amendments incorporated. The Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act is being expanded to cover a lot more New Zealand businesses.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering act nz by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas