10+ Anti money laundering act rbi ideas in 2021

Home » money laundering idea » 10+ Anti money laundering act rbi ideas in 2021Your Anti money laundering act rbi images are available in this site. Anti money laundering act rbi are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering act rbi files here. Get all royalty-free vectors.

If you’re searching for anti money laundering act rbi images information related to the anti money laundering act rbi keyword, you have come to the right site. Our website frequently gives you hints for viewing the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

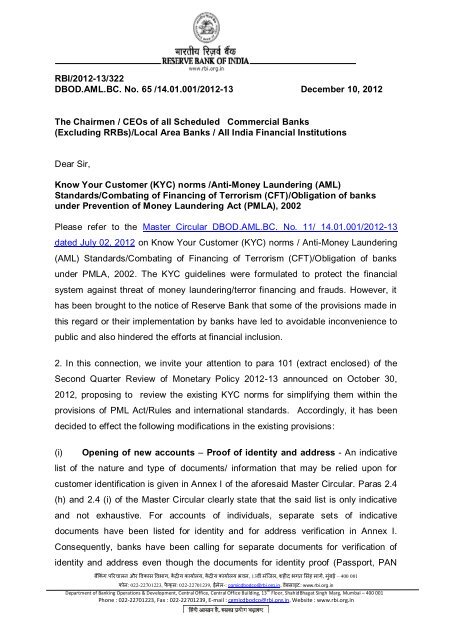

Anti Money Laundering Act Rbi. The objectiveof KYC guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money laundering activities. Money laundering is present in all jurisdictions. In this case a writ petition had been filed before the Delhi High Court Court challenging the provisions of Section 51 55 83 85 and 86 of the Prevention of Money Laundering Act 2002 Act. The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering.

Anti Money Laundering Overview Process And History From corporatefinanceinstitute.com

Anti Money Laundering Overview Process And History From corporatefinanceinstitute.com

These guidelines are issued under Section 35A of the Banking Regulation Act 1949 and Rule 7 of Prevention of Money-Laundering Maintenance of Records Rules 2005. Any contravention thereof or non-compliance shall attract penalties under Banking Regulation Act. Framework for Anti Money Laundering Compliance in India. RBI2014-15122 DNBSPDCCNo 4000310422014-15 July 14 2014 All Non-Banking Financial Companies Dear Sirs Know Your Customer KYC Norms Anti-Money Laundering AML Standards Combating of Financing of Terrorism CFT Obligation of NBFCs under. Money laundering is present in all jurisdictions. This Know Your Customer and Anti -Money Laundering P.

No32 09390002007-08 February 25 2008 The Chief Executive Officers All Primary Urban Co-operative Banks Dear Sir Know your Customer KYC Norms Anti-Money Laundering AML Standards Combating of Financing of Terrorism.

This Know Your Customer and Anti -Money Laundering P. Directly or indirectly attempted to. Any contravention thereof or non-compliance shall attract penalties under Banking Regulation Act. This Know Your Customer and Anti -Money Laundering P. The objectiveof KYC guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money laundering activities. RBI advised the banks to follow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature.

KYC procedures also enable banks to knowunderstand their customers and their financial dealings better which in turn help. This Know Your Customer and Anti -Money Laundering P. The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India enacted in January 2003. The Reserve Bank of India is managed by a central board of directors appointed to four-year terms and. KYC procedures also enable banks to knowunderstand their customers and their financial dealings better which in turn help.

Source: acuityitsol.com

Source: acuityitsol.com

In India the Reserve Bank of India RBI provides guidance on anti-money laundering provisions and the combating of terrorist financing. RBI advised the banks to follow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature. In this case a writ petition had been filed before the Delhi High Court Court challenging the provisions of Section 51 55 83 85 and 86 of the Prevention of Money Laundering Act 2002 Act. The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. Ibid -Laundering Maintenance of Records Rules 2005 the Reserve Bank of India being satisfied that it is necessary and expedient in the.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India enacted in January 2003. This Know Your Customer and Anti -Money Laundering P. No32 09390002007-08 February 25 2008 The Chief Executive Officers All Primary Urban Co-operative Banks Dear Sir Know your Customer KYC Norms Anti-Money Laundering AML Standards Combating of Financing of Terrorism. Anti-money laundering refers to the laws rules and procedures purported to forestall criminals from disguising illicitly obtained funds as legitimate gain. The Petitioners sought quashing of provisional attachment impugned original.

Source: present5.com

Source: present5.com

Offence of Money Laundering. RBI2014-15122 DNBSPDCCNo 4000310422014-15 July 14 2014 All Non-Banking Financial Companies Dear Sirs Know Your Customer KYC Norms Anti-Money Laundering AML Standards Combating of Financing of Terrorism CFT Obligation of NBFCs under. The policy was to lay down the systems and procedures to help control. Ii These guidelines are issued under Section 35A of the Banking Regulation Act 1949 and Rule 7 of Prevention of Money-Laundering Maintenance of Records of the Nature and Value of Transactions the Procedure and Manner of Maintaining and Time for Furnishing Information and Verification and Maintenance of Records of the Identity of the Clients of the Banking Companies Financial Institutions. Ii These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act.

Source: authorstream.com

Source: authorstream.com

Any contravention thereof or non-compliance shall attract penalties under Banking Regulation Act. As part of that supervisory role the RBI works to combat financial crime with a focus on anti-money laundering in India and on countering the financing of terrorism. RBI2014-15122 DNBSPDCCNo 4000310422014-15 July 14 2014 All Non-Banking Financial Companies Dear Sirs Know Your Customer KYC Norms Anti-Money Laundering AML Standards Combating of Financing of Terrorism CFT Obligation of NBFCs under. Ii These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act. Illegal Legal Dirty Conversion whiteMoney MoneyDefinition.

Source: present5.com

Source: present5.com

Ii These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act. Directly or indirectly attempted to. No32 09390002007-08 February 25 2008 The Chief Executive Officers All Primary Urban Co-operative Banks Dear Sir Know your Customer KYC Norms Anti-Money Laundering AML Standards Combating of Financing of Terrorism. The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. Anti-money laundering refers to the laws rules and procedures purported to forestall criminals from disguising illicitly obtained funds as legitimate gain.

Source: studylib.net

Source: studylib.net

Ibid -Laundering Maintenance of Records Rules 2005 the Reserve Bank of India being satisfied that it is necessary and expedient in the. In this case a writ petition had been filed before the Delhi High Court Court challenging the provisions of Section 51 55 83 85 and 86 of the Prevention of Money Laundering Act 2002 Act. The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India enacted in January 2003. KYC procedures also enable banks to knowunderstand their customers and their financial dealings better which in turn help. In India the Reserve Bank of India RBI provides guidance on anti-money laundering provisions and the combating of terrorist financing.

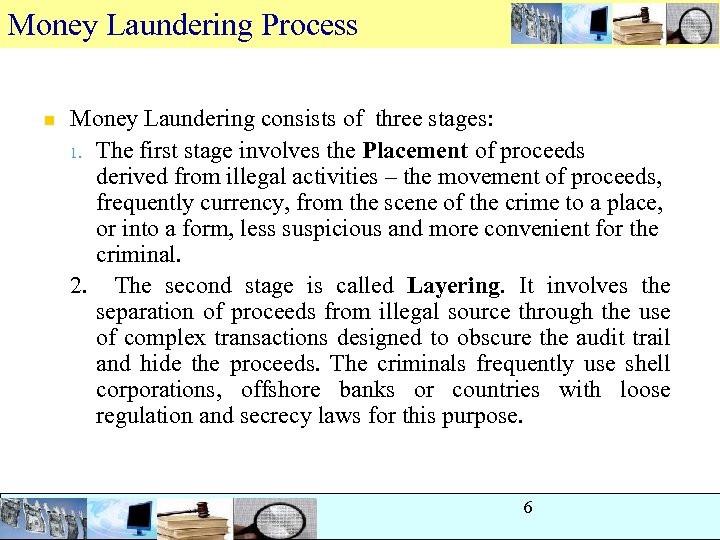

Source: slidetodoc.com

Source: slidetodoc.com

KYC procedures also enable banks to knowunderstand their customers and their financial dealings better which in turn help. The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board. The objectiveof KYC guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money laundering activities. The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India enacted in January 2003. These guidelines are issued under Section 35A of the Banking Regulation Act 1949 and Rule 9 14 of Prevention of Money-Laundering Maintenance of Records Rules 2005.

Source: pinterest.com

Source: pinterest.com

RBI2014-15122 DNBSPDCCNo 4000310422014-15 July 14 2014 All Non-Banking Financial Companies Dear Sirs Know Your Customer KYC Norms Anti-Money Laundering AML Standards Combating of Financing of Terrorism CFT Obligation of NBFCs under. The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board. As part of that supervisory role the RBI works to combat financial crime with a focus on anti-money laundering in India and on countering the financing of terrorism. These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act and Rule 7 of Prevention of Money-Laundering Maintenance of Records of the Nature and Value of Transactions the Procedure and Manner of Maintaining and Time for Furnishing Information and Verification and. Offence of Money Laundering.

Source: present5.com

Source: present5.com

Ibid -Laundering Maintenance of Records Rules 2005 the Reserve Bank of India being satisfied that it is necessary and expedient in the. Ibid -Laundering Maintenance of Records Rules 2005 the Reserve Bank of India being satisfied that it is necessary and expedient in the. Anti money laundering 1. RBI2014-15122 DNBSPDCCNo 4000310422014-15 July 14 2014 All Non-Banking Financial Companies Dear Sirs Know Your Customer KYC Norms Anti-Money Laundering AML Standards Combating of Financing of Terrorism CFT Obligation of NBFCs under. Directly or indirectly attempted to.

Source: academia.edu

Source: academia.edu

The Petitioners sought quashing of provisional attachment impugned original. Ii These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act. Ibid -Laundering Maintenance of Records Rules 2005 the Reserve Bank of India being satisfied that it is necessary and expedient in the. Anti-money laundering refers to the laws rules and procedures purported to forestall criminals from disguising illicitly obtained funds as legitimate gain. In India the Reserve Bank of India RBI provides guidance on anti-money laundering provisions and the combating of terrorist financing.

Source: slidetodoc.com

Source: slidetodoc.com

Any contravention thereof or non-compliance shall attract penalties under Banking Regulation Act. The objectiveof KYC guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money laundering activities. Any contravention thereof or non-compliance shall attract penalties under Banking Regulation Act. The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India enacted in January 2003. KYC procedures also enable banks to knowunderstand their customers and their financial dealings better which in turn help.

Source: yumpu.com

Source: yumpu.com

KYC procedures also enable banks to knowunderstand their customers and their financial dealings better which in turn help. KYC procedures also enable banks to knowunderstand their customers and their financial dealings better which in turn help. Any contravention thereof or non-compliance shall attract penalties under Banking Regulation Act. RBI advised the banks to follow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature. Anti money laundering 1.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering act rbi by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information