13+ Anti money laundering certificate in nigeria information

Home » money laundering Info » 13+ Anti money laundering certificate in nigeria informationYour Anti money laundering certificate in nigeria images are available in this site. Anti money laundering certificate in nigeria are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering certificate in nigeria files here. Get all royalty-free vectors.

If you’re searching for anti money laundering certificate in nigeria images information connected with to the anti money laundering certificate in nigeria interest, you have pay a visit to the right blog. Our site always gives you hints for viewing the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that match your interests.

Anti Money Laundering Certificate In Nigeria. Under Section 23 of the Money Laundering Act firms carry on the business of investment and securities this includes stock broking firms are designated as financial institutions and there is an obligation on them to file with the Nigerian Financial Intelligence Unit all suspicious transactions and file with the Nigerian Financial Intelligence Unit all currency transactions above N500 000 for individuals and the. ICLG - Anti-Money Laundering Laws and Regulations - Nigeria covers issues including criminal enforcement regulatory and administrative enforcement and requirements for financial institutions and other designated businesses in 29 jurisdictions. SCUML performs the following key functions to actualise its mandate. The principal law governing money laundering in Nigeria is the Money Laundering Prohibition Act 2011.

Special Control Unit Against Money Laundering Scuml The From slidetodoc.com

Special Control Unit Against Money Laundering Scuml The From slidetodoc.com

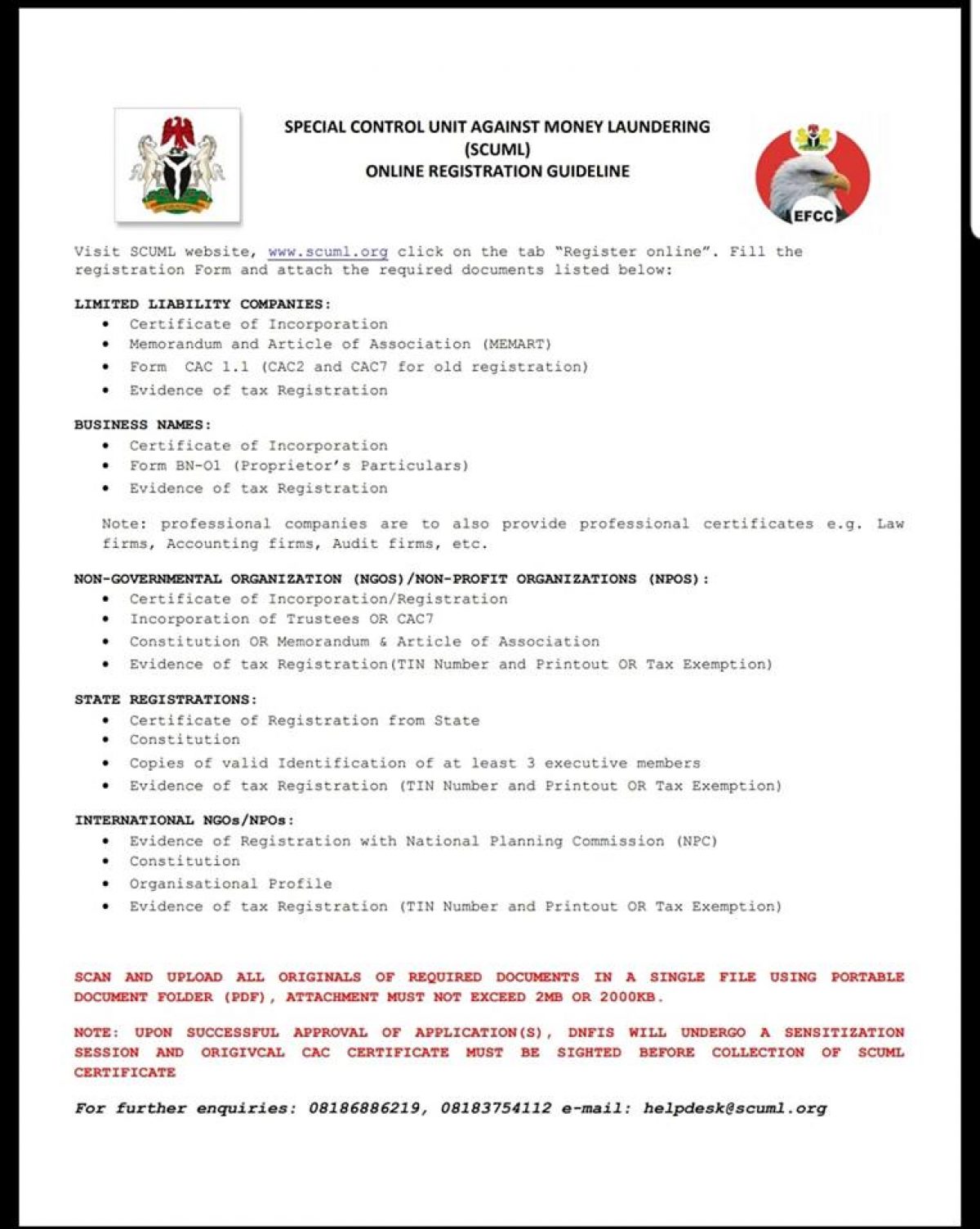

Anti-Money Laundering Laws and Regulations 2021. Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits. Certificate Program or Course on Anti Money Launering will give you knowledge about Transaction Monitoring Investor Education Record Keeping Retention of Records 1800229030. Often times business that intends to open a corporate bank account are requested to provide the SCUML certificate before the account can be opened. However section 151 of the Money Laundering Prohibition Act 2011 prohibits money laundering and makes it an offence for any person to. Money laundering in Nigeria remains a widespread problem despite the fact that the country has taken a number of steps to improve its Anti-Money Laundering AML system.

Certificate Program or Course on Anti Money Launering will give you knowledge about Transaction Monitoring Investor Education Record Keeping Retention of Records 1800229030.

It is therefore in their. Certificate Program or Course on Anti Money Launering will give you knowledge about Transaction Monitoring Investor Education Record Keeping Retention of Records 1800229030. Money laundering in Nigeria remains a widespread problem despite the fact that the country has taken a number of steps to improve its Anti-Money Laundering AML system. Anti Money Laundering courses in LagosNigeria COVID-19 Update. Continue learning the same over Live virtual classes at lower fees. Below is the registration guidelines on how to obtain the certificate the registration is free.

Source: proshareng.com

Source: proshareng.com

A control or disguise the origin of. Under Section 23 of the Money Laundering Act firms carry on the business of investment and securities this includes stock broking firms are designated as financial institutions and there is an obligation on them to file with the Nigerian Financial Intelligence Unit all suspicious transactions and file with the Nigerian Financial Intelligence Unit all currency transactions above N500 000 for individuals and the. The Special Control Unit Against Money Laun-dering SCUML was established as a special-ised unit of the Federal Ministry of Commerce and Industry by the Federal Executive Council of Nigeria in September 2005. Certificate Program or Course on Anti Money Launering will give you knowledge about Transaction Monitoring Investor Education Record Keeping Retention of Records 1800229030. Nigerian Capital Market Operators should note that these AMLCFT guidelines have prescribed sanctions for non-compliance with this Manual and other relevant anti-money laundering laws and regulations concerning CDD issues non-rendition of prescribed reports as well as failure to keep appropriate records.

Source: researchgate.net

Source: researchgate.net

Initially Nigerian criminals made advance fee fraud infamous. Fill the registration Form and. Course Duration and Fee. C remove from Nigeria. Advance fee fraud was first made famous by Nigerian criminals.

Source: academia.edu

Source: academia.edu

The last Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in Nigeria was undertaken by the Financial Action Task Force FATF in 2007. The Certificate program on Anti-money laundering aims to provide an understanding of. The requirements candidates should have to take the CAM exam includes Firstly the aspirants need to earn at least 40 credits of college coursework. Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits. According to that Evaluation Nigeria was deemed Compliant for 2 and Largely Compliant for 7 of the FATF 40 9 Recommendations.

SCUML is an acronym for Special Control Unit on Money Laundering. SCUML performs the following key functions to actualise its mandate. Fill the registration Form and. According to that Evaluation Nigeria was deemed Compliant for 2 and Largely Compliant for 7 of the FATF 40 9 Recommendations. Certified Anti-Money Laundering Specialist Requirments.

Source: tr.pinterest.com

Source: tr.pinterest.com

Continue learning the same over Live virtual classes at lower fees. SCUML is charged with the responsibility of monitoring supervising and regulating the activities of Designated Non-Financial Institutions DNFIs in line with the Money Laundering Prohibition Act ML PAct 2011 and the Prevention of Terrorism Act. Nigerian Capital Market Operators should note that these AMLCFT guidelines have prescribed sanctions for non-compliance with this Manual and other relevant anti-money laundering laws and regulations concerning CDD issues non-rendition of prescribed reports as well as failure to keep appropriate records. SCUML is an acronym for Special Control Unit on Money Laundering. SCUML has the mandate to.

Source: researchgate.net

Source: researchgate.net

Certified Anti-Money Laundering Specialist Requirments. Physical classrooms are limited. However section 151 of the Money Laundering Prohibition Act 2011 prohibits money laundering and makes it an offence for any person to. It is therefore in their. SCUML performs the following key functions to actualise its mandate.

Source: slideshare.net

Source: slideshare.net

B convert or transfer. Sensitization of DNFIs in Nigeria on their compliance obligations under the Money Laundering. A control or disguise the origin of. SCUML has the mandate to. Certified Anti-Money Laundering Specialist Requirments.

Source: researchgate.net

Source: researchgate.net

Anti money laundering certificate in nigeria. Below is the registration guidelines on how to obtain the certificate the registration is free. SCUML performs the following key functions to actualise its mandate. Nigerian Capital Market Operators should note that these AMLCFT guidelines have prescribed sanctions for non-compliance with this Manual and other relevant anti-money laundering laws and regulations concerning CDD issues non-rendition of prescribed reports as well as failure to keep appropriate records. The principal law governing money laundering in Nigeria is the Money Laundering Prohibition Act 2011.

Source: businesspost.ng

Source: businesspost.ng

Per participant USD1700 Fees Taxes as applicable. Continue learning the same over Live virtual classes at lower fees. Below is the registration guidelines on how to obtain the certificate the registration is free. Course Duration and Fee. Sensitization of DNFIs in Nigeria on their compliance obligations under the Money Laundering.

Certified Anti-Money Laundering Specialist Requirments. More recently nationals of many African countries and from a variety of countries around the world have begun to perpetrate advance fee fraud. SCUML is an acronym for Special Control Unit on Money Laundering. SCUML is a unit of the Economic and Financial Crimes Commission EFCC. The leading government agency investigating and prosecuting the offenses of money laundering in Nigeria is the Economic and Financial Crimes Commission EFCC.

Source: slidetodoc.com

Source: slidetodoc.com

SCUML performs the following key functions to actualise its mandate. Continue learning the same over Live virtual classes at lower fees. Under Section 23 of the Money Laundering Act firms carry on the business of investment and securities this includes stock broking firms are designated as financial institutions and there is an obligation on them to file with the Nigerian Financial Intelligence Unit all suspicious transactions and file with the Nigerian Financial Intelligence Unit all currency transactions above N500 000 for individuals and the. Certificate Program or Course on Anti Money Launering will give you knowledge about Transaction Monitoring Investor Education Record Keeping Retention of Records 1800229030. Initially Nigerian criminals made advance fee fraud infamous.

Source: proshareng.com

Source: proshareng.com

The principal law governing money laundering in Nigeria is the Money Laundering Prohibition Act 2011. Registration and certification of DNFIs in Nigeria. Course Duration and Fee. Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits. Sensitization of DNFIs in Nigeria on their compliance obligations under the Money Laundering.

Source: slideshare.net

Source: slideshare.net

SCUML is a unit of the Economic and Financial Crimes Commission EFCC. ICLG - Anti-Money Laundering Laws and Regulations - Nigeria covers issues including criminal enforcement regulatory and administrative enforcement and requirements for financial institutions and other designated businesses in 29 jurisdictions. The requirements candidates should have to take the CAM exam includes Firstly the aspirants need to earn at least 40 credits of college coursework. Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits. Registration and certification of DNFIs in Nigeria.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering certificate in nigeria by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas