15+ Anti money laundering checklist for solicitors info

Home » money laundering Info » 15+ Anti money laundering checklist for solicitors infoYour Anti money laundering checklist for solicitors images are ready in this website. Anti money laundering checklist for solicitors are a topic that is being searched for and liked by netizens now. You can Get the Anti money laundering checklist for solicitors files here. Download all royalty-free photos.

If you’re looking for anti money laundering checklist for solicitors pictures information linked to the anti money laundering checklist for solicitors topic, you have pay a visit to the right blog. Our site always provides you with hints for refferencing the maximum quality video and image content, please kindly surf and locate more informative video articles and images that fit your interests.

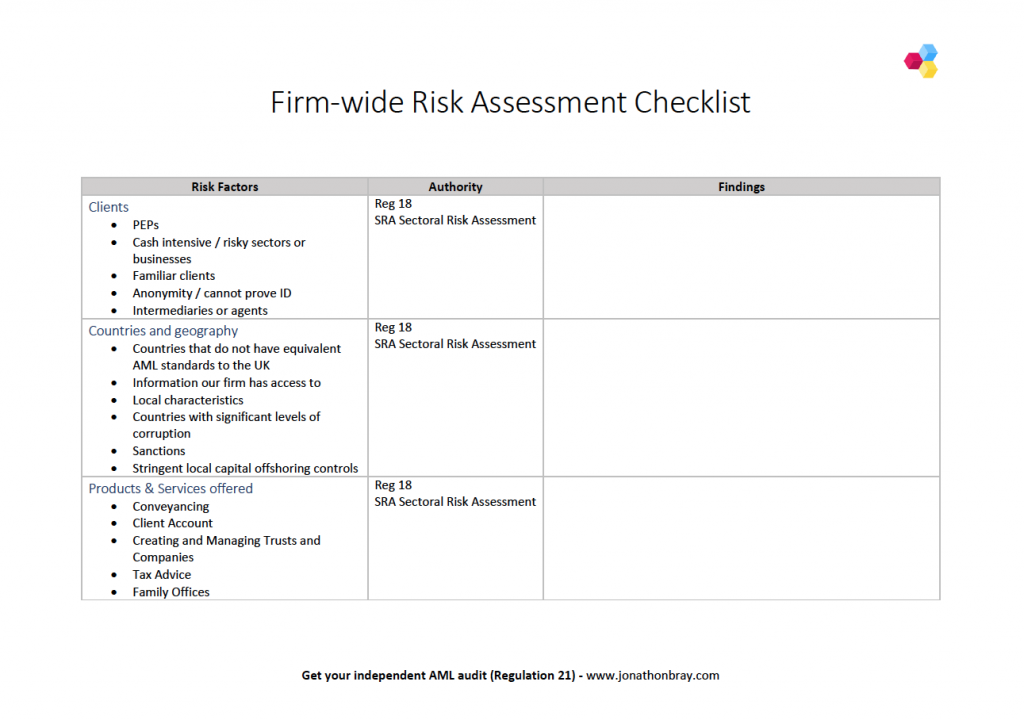

Anti Money Laundering Checklist For Solicitors. We have condensed the most relevant anti-money laundering legislation and regulatory boards recommendations into 6 key components. Veriphy is designed to help assist solicitors with the latest compliance requirements. 3 Report to the Bar Council on the Impact of AntiMoney Laundering Legislation on the Advocate Solicitor 15 Aug 2003 4 Anti-Money Laundering and Anti-Terrorism Financing Act 2001. This is carried out via the use of a mobile app which with the ever-growing use and need for technology is a major development for anti-money laundering checks.

Aml Cft Pdf From pdfprof.com

Aml Cft Pdf From pdfprof.com

3 Report to the Bar Council on the Impact of AntiMoney Laundering Legislation on the Advocate Solicitor 15 Aug 2003 4 Anti-Money Laundering and Anti-Terrorism Financing Act 2001. We are required to confirm that these details are correct and need the following documents to help us do so. This research is performed to prevent money-laundering anti-money laundering and the finance of terrorism. We were encouraged that small practices and sole practitioners tended to produce very good and detailed risk assessments often from scratch using their expert knowledge of their clients and work. Solicitors can access a dedicated AML section under the Solicitors Regulations menu providing useful information and links to external AML resources for solicitors. Id verification is imperative for good AML practice.

We have condensed the most relevant anti-money laundering legislation and regulatory boards recommendations into 6 key components.

This research is performed to prevent money-laundering anti-money laundering and the finance of terrorism. The basic information we need is. Record the reasons for your risk assessment. Be aware of your obligations under the financial sanctions legislation. Your current residential address. Details of your approach to preventing money laundering including named individuals and their responsibilities.

Source: lexology.com

Source: lexology.com

To help firms and individuals comply. The basic information we need is. We have condensed the most relevant anti-money laundering legislation and regulatory boards recommendations into 6 key components. 3 Report to the Bar Council on the Impact of AntiMoney Laundering Legislation on the Advocate Solicitor 15 Aug 2003 4 Anti-Money Laundering and Anti-Terrorism Financing Act 2001. If you are required to comply with the MLR17 we have developed a Anti Money Laundering Checklist that contains over 60 assessment questions and helps firms to assess their compliance with the money laundering.

This research is performed to prevent money-laundering anti-money laundering and the finance of terrorism. FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML. It is an offence not to carry out the appropriate money laundering controls. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. The changes introduced by the 5th Anti-Money Laundering Directive expand both the requirement to conduct EDD and the factors to be considered.

Source: docplayer.net

Source: docplayer.net

Details of your procedures for identifying and verifying customers and your. The basic information we need is. Drivers Licence plus one of the following. This research is performed to prevent money-laundering anti-money laundering and the finance of terrorism. Anti-money laundering legislation The Criminal Justice Money Laundering and Terrorist Financing Acts 2010 and 2013 aim to prevent money laundering.

Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. In this sense you are the expert. FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML. 2 Money laundering and terrorist financing 11-14 3 The anti-money laundering regime and solicitors 15-17 4 The risk based approach 18-25 5 Client due diligence 26-39 6 Identification and verification 40-50 7 Reliance on third parties 51-55 8 Reporting and tipping off 56-65 9 Suspicious transactions 66-71 10 Internal procedures 72-74. We have condensed the most relevant anti-money laundering legislation and regulatory boards recommendations into 6 key components.

Source: academia.edu

Source: academia.edu

In this sense you are the expert. We have condensed the most relevant anti-money laundering legislation and regulatory boards recommendations into 6 key components. What are the requirements. The AML module is turned off by default in Legalsense as not all Legalsense users have need to this module. The changes introduced by the 5th Anti-Money Laundering Directive expand both the requirement to conduct EDD and the factors to be considered.

Source: docplayer.net

Source: docplayer.net

Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. For proof of identity. We are required to confirm that these details are correct and need the following documents to help us do so. The changes introduced by the 5th Anti-Money Laundering Directive expand both the requirement to conduct EDD and the factors to be considered. It is an offence not to carry out the appropriate money laundering controls.

Source: djcareynotaries.co.uk

Source: djcareynotaries.co.uk

4 easy steps to client onboarding and Anti-Money Laundering AML checks The Sethi Partnership Solicitors strive to make life easier for our clients by embracing new technology. Record the reasons for your risk assessment. Understand what you need to do under the money laundering regulations Proceeds of Crime Act 2002 POCA and Terrorism Act 2000. We have condensed the most relevant anti-money laundering legislation and regulatory boards recommendations into 6 key components. The Legal Sector Affinity Group interim guidance sets out the major changes.

Source: pdfprof.com

Source: pdfprof.com

You must carry out a risk assessment which must be relevant to the size and nature of your business. To help prevent money laundering your solicitor must verify your identity and. The basic information we need is. The Legal Sector Affinity Group interim guidance sets out the major changes. The first step in the laundering process is for criminals to get their money into an.

3 Report to the Bar Council on the Impact of AntiMoney Laundering Legislation on the Advocate Solicitor 15 Aug 2003 4 Anti-Money Laundering and Anti-Terrorism Financing Act 2001. These cover how you can successfully carry out your AML obligations. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. Resources include the Societys Guidance Notes for Solicitors on Anti-Money Laundering. 3 Report to the Bar Council on the Impact of AntiMoney Laundering Legislation on the Advocate Solicitor 15 Aug 2003 4 Anti-Money Laundering and Anti-Terrorism Financing Act 2001.

Source: goldmanlegal.co.nz

Source: goldmanlegal.co.nz

In this sense you are the expert. The Legal Sector Affinity Group interim guidance sets out the major changes. The AML module is turned off by default in Legalsense as not all Legalsense users have need to this module. Understand what you need to do under the money laundering regulations Proceeds of Crime Act 2002 POCA and Terrorism Act 2000. The basic information we need is.

Source: skillcast.com

Source: skillcast.com

The first step in the laundering process is for criminals to get their money into an. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. Be aware of your obligations under the financial sanctions legislation. You should check the sanctions list from the Office of Financial Sanctions. This research is performed to prevent money-laundering anti-money laundering and the finance of terrorism.

Source: pdfprof.com

Source: pdfprof.com

Understand what you need to do under the money laundering regulations Proceeds of Crime Act 2002 POCA and Terrorism Act 2000. Anti-Money Laundering Required documents. Record the reasons for your risk assessment. Resources include the Societys Guidance Notes for Solicitors on Anti-Money Laundering. MG Legals solicitors in Preston understand that clients have busy lives with work and family commitments therefore may not always be able to physically attend one of our offices in order to carry out the necessary checks.

Source: pdfprof.com

Source: pdfprof.com

These cover how you can successfully carry out your AML obligations. Record the reasons for your risk assessment. To help firms and individuals comply. The Legal Sector Affinity Group interim guidance sets out the major changes. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering checklist for solicitors by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas