10++ Anti money laundering checks info

Home » money laundering Info » 10++ Anti money laundering checks infoYour Anti money laundering checks images are ready. Anti money laundering checks are a topic that is being searched for and liked by netizens now. You can Find and Download the Anti money laundering checks files here. Download all free photos.

If you’re searching for anti money laundering checks images information linked to the anti money laundering checks keyword, you have come to the ideal blog. Our website frequently provides you with hints for viewing the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that fit your interests.

Anti Money Laundering Checks. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. The document provides a framework. It is a process by which dirty money is converted into clear cash. The checks are made to validate your identity and to ensure that the money has not been acquired illegally or that the bank itself is not being used as part of criminal activity most known as misuse of facility.

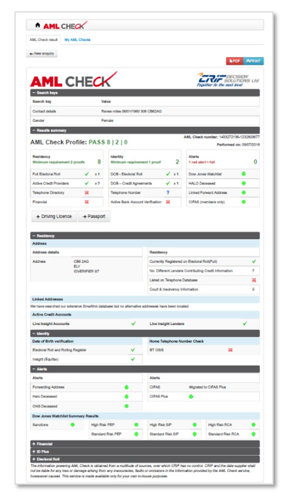

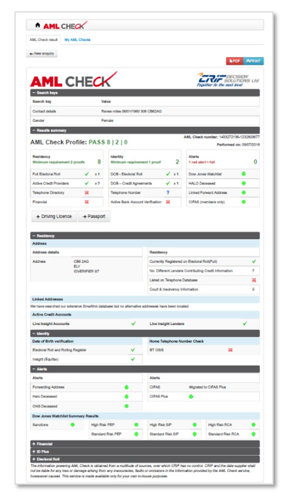

Aml Check Anti Money Laundering Checks Aml Compliance From crifdecisionsolutions.co.uk

Aml Check Anti Money Laundering Checks Aml Compliance From crifdecisionsolutions.co.uk

Best practices for Anti-Money Laundering Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. An AML check involves identity checks and verification plus monitoring of financial transactions to detect fraud. When onboarding new customers or reviewing existing ones electronic identity checking helps meet your regulatory obligations. Financial institutions and public bodies use them widely to comply with their Know Your Client KYC obligations but other companies also conduct a range of checks to protect their interests. Weve added some additional checks to further tighten our money laundering controls. The document provides a framework.

With the whole process completed online its never been easier to get your financial checks.

Additional anti money laundering AML checks. An Anti-Money Laundering check is a process your business needs to undertake to prevent Money Laundering activity. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. Best practices for Anti-Money Laundering Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. What is an anti-money laundering check. Anti-money laundering checks are used to validate a persons true identity and check the money has been acquired through legitimate means.

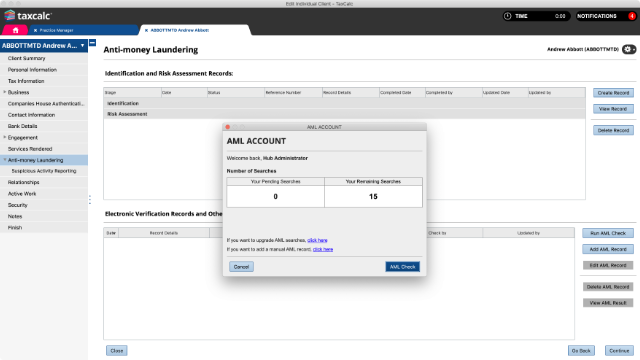

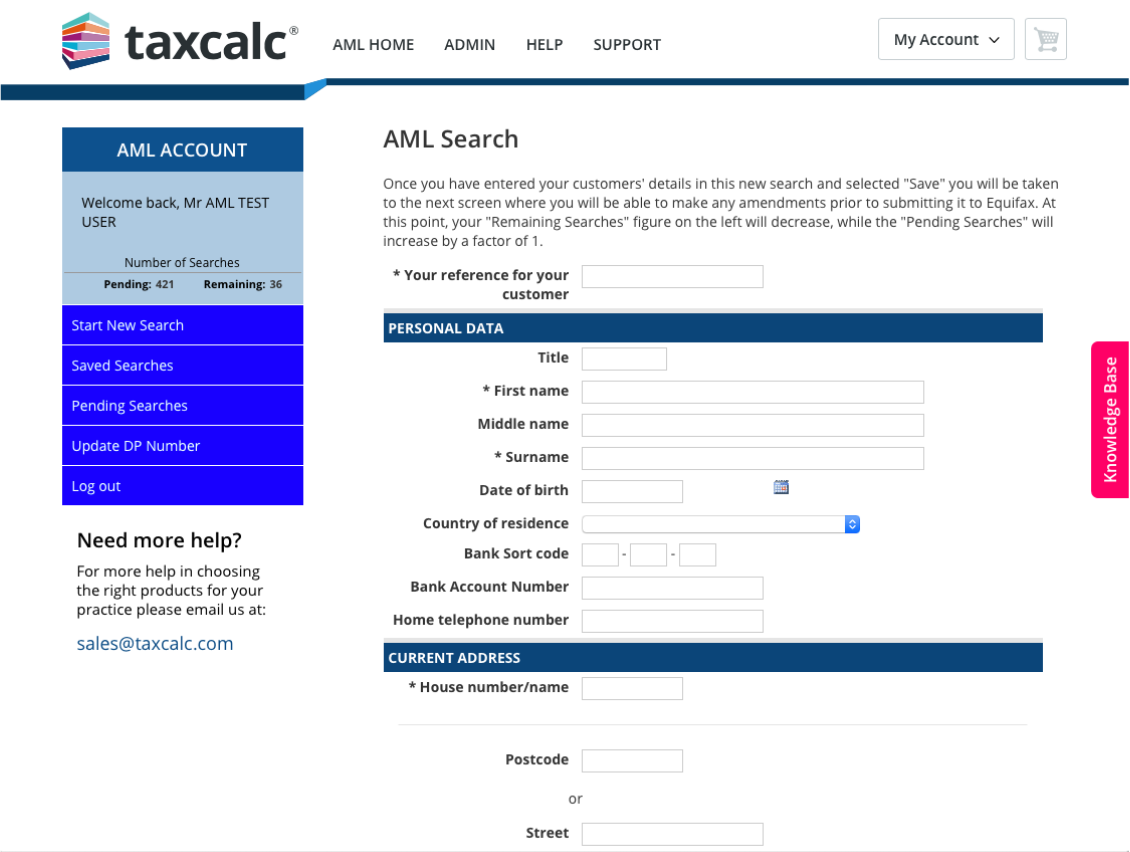

Source: taxcalc.com

Source: taxcalc.com

When onboarding new customers or reviewing existing ones electronic identity checking helps meet your regulatory obligations. With the whole process completed online its never been easier to get your financial checks. Online AML checks searches Our anti-money laundering AML search helps ensure your due diligence is carried out in line with regulatory bodies giving you accurate results peace of mind and protecting you your clients and your firm. This is carried out via the use of a mobile app which with the ever-growing use and need for technology is a major development for anti-money laundering checks. AML procedures form part of the customer due diligence and employment.

Source: crifdecisionhub.co.uk

Source: crifdecisionhub.co.uk

The legal framework includes several different Acts and Regulations and some. Financial institutions and public bodies use them widely to comply with their Know Your Client KYC obligations but other companies also conduct a range of checks to protect their interests. The sources of the cash in precise are criminal and the cash is invested in a manner that makes it appear like clear money and conceal the identity of the prison a. Anti-Money Laundering Checks are required by law for all banks before they are allowed to handle money from you. Additional anti money laundering AML checks.

Source: taxcalc.com

Source: taxcalc.com

A check against politically exposed persons PEPs lists sanctions lists and other watchlists. Online AML checks searches Our anti-money laundering AML search helps ensure your due diligence is carried out in line with regulatory bodies giving you accurate results peace of mind and protecting you your clients and your firm. The concept of money laundering is very important to be understood for these working within the monetary sector. The document provides a framework. The checks are made to validate your identity and to ensure that the money has not been acquired illegally or that the bank itself is not being used as part of criminal activity most known as misuse of facility.

Source: help.creditsafeuk.com

Source: help.creditsafeuk.com

Furthermore anti-money laundering checks help prevent a wide range of criminal activities including corruption tax evasion market manipulation and illicit goods trade. AML procedures form part of the customer due diligence and employment. The concept of money laundering is very important to be understood for these working within the monetary sector. An Anti-Money Laundering AML check is an identity assessment to ensure all investors are who they claim to be and are not investing on behalf of somebody else. Weve added some additional checks to further tighten our money laundering controls.

Source: neuralt.com

Source: neuralt.com

Best practices for Anti-Money Laundering Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. An Anti-Money Laundering check is a process your business needs to undertake to prevent Money Laundering activity. When onboarding new customers or reviewing existing ones electronic identity checking helps meet your regulatory obligations. Even if you arent applying for the Governments Future Fund its still good practice to comply with AML regulation and KYC requirements during your funding round this is mandatory for most investors and run through the checks.

Source: amlcheck.es

Source: amlcheck.es

For new applications we need to verify that the name of the person or company paying for a new protection application matches the. The sources of the cash in precise are criminal and the cash is invested in a manner that makes it appear like clear money and conceal the identity of the prison a. CVChecks online Anti Money Laundering Check will reveal any record of money laundering or terrorism financing and will identify a politically exposed person both nationally and internationally. Additional anti money laundering AML checks. Anti money laundering refers to a set of laws regulations and procedures.

Source: help.creditsafeuk.com

Source: help.creditsafeuk.com

Anti-Money Laundering Checks are required by law for all banks before they are allowed to handle money from you. Financial institutions and public bodies use them widely to comply with their Know Your Client KYC obligations but other companies also conduct a range of checks to protect their interests. The document provides a framework. In most cases these checks will be completed in the background using electoral data. The concept of money laundering is very important to be understood for these working within the monetary sector.

Source: credas.co.uk

Source: credas.co.uk

Best practices for Anti-Money Laundering Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. Our AML offering ensures you comply with the. A check against politically exposed persons PEPs lists sanctions lists and other watchlists. The concept of money laundering is very important to be understood for these working within the monetary sector. Anti Money Laundering Checks Quicker customer onboarding greater confidence in meeting your compliance needs Our AML solutions mean you can easily identify high-risk applicants and manage them appropriately.

Source: gbgplc.com

Source: gbgplc.com

The concept of money laundering is very important to be understood for these working within the monetary sector. Financial institutions and public bodies use them widely to comply with their Know Your Client KYC obligations but other companies also conduct a range of checks to protect their interests. It is a process by which dirty money is converted into clear cash. Anti Money Laundering Checks Quicker customer onboarding greater confidence in meeting your compliance needs Our AML solutions mean you can easily identify high-risk applicants and manage them appropriately. Furthermore anti-money laundering checks help prevent a wide range of criminal activities including corruption tax evasion market manipulation and illicit goods trade.

Source: crifdecisionsolutions.co.uk

Source: crifdecisionsolutions.co.uk

An AML check is a vital component of employment screening and customer due diligence to ensure that your candidates and customers are not attempting to launder money through your businesscompany which is particularly relevant for banks and other financial institutions. The legal framework includes several different Acts and Regulations and some. Anti money laundering refers to a set of laws regulations and procedures. The concept of money laundering is very important to be understood for these working within the monetary sector. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering.

Source: crifdecisionsolutions.co.uk

Source: crifdecisionsolutions.co.uk

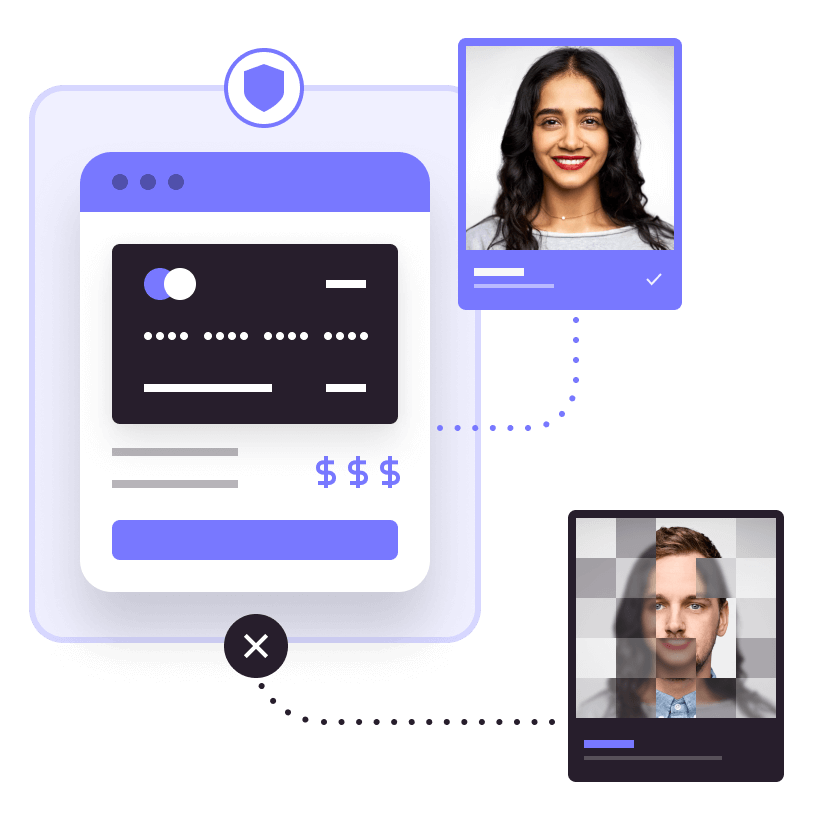

Anti-Money Laundering AML checks are an unescapable part of doing business today. An Anti-Money Laundering AML check is an identity assessment to ensure all investors are who they claim to be and are not investing on behalf of somebody else. For new applications we need to verify that the name of the person or company paying for a new protection application matches the. The document provides a framework. This is carried out via the use of a mobile app which with the ever-growing use and need for technology is a major development for anti-money laundering checks.

Source: help.creditsafeuk.com

Source: help.creditsafeuk.com

For new applications we need to verify that the name of the person or company paying for a new protection application matches the. Furthermore anti-money laundering checks help prevent a wide range of criminal activities including corruption tax evasion market manipulation and illicit goods trade. Weve added some additional checks to further tighten our money laundering controls. The legal framework includes several different Acts and Regulations and some. What is an anti-money laundering check.

Source: monexfintech.com

Source: monexfintech.com

Confirmation that you have completed AML Anti-Money Laundering and KYC Know your Customer checks are a requirement for application under the Governments Future Fund. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. Weve added some additional checks to further tighten our money laundering controls. An AML check is a vital component of employment screening and customer due diligence to ensure that your candidates and customers are not attempting to launder money through your businesscompany which is particularly relevant for banks and other financial institutions. Confirmation that you have completed AML Anti-Money Laundering and KYC Know your Customer checks are a requirement for application under the Governments Future Fund.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering checks by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas