19+ Anti money laundering compliance meaning information

Home » money laundering idea » 19+ Anti money laundering compliance meaning informationYour Anti money laundering compliance meaning images are ready in this website. Anti money laundering compliance meaning are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering compliance meaning files here. Find and Download all free images.

If you’re looking for anti money laundering compliance meaning pictures information linked to the anti money laundering compliance meaning interest, you have come to the ideal site. Our site frequently provides you with hints for viewing the maximum quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

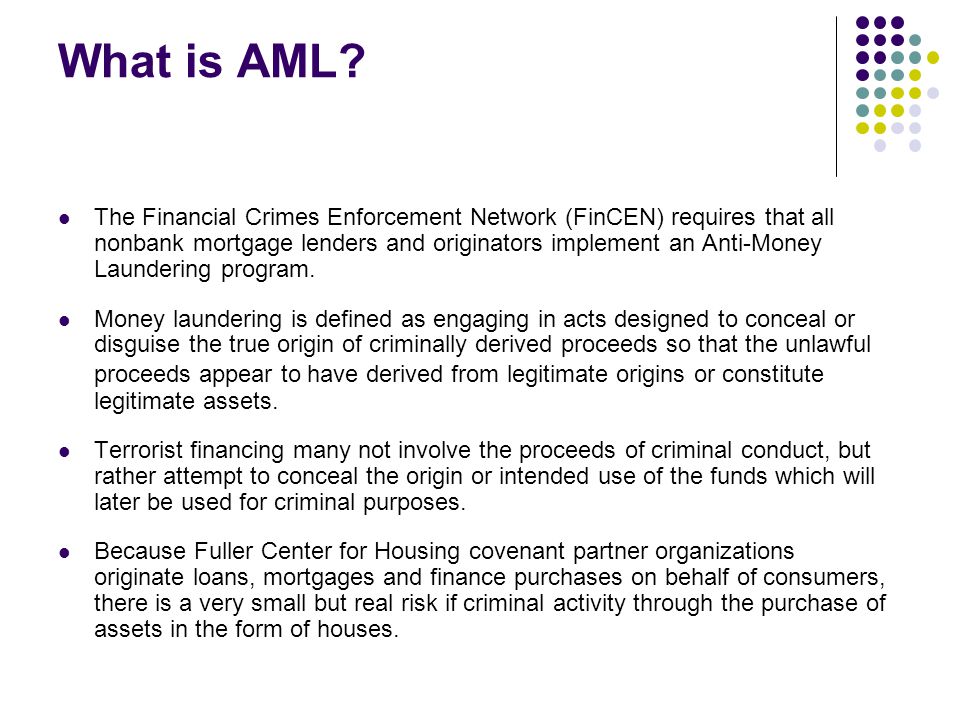

Anti Money Laundering Compliance Meaning. Money laundering is a way to conceal illegally obtained funds. Anti-money laundering AML compliance. Anti money laundering meaning hindi. Corporations consumers and financial institutions.

Anti Money Laundering What Is Aml Compliance And Why Is It Important From shuftipro.com

Anti Money Laundering What Is Aml Compliance And Why Is It Important From shuftipro.com

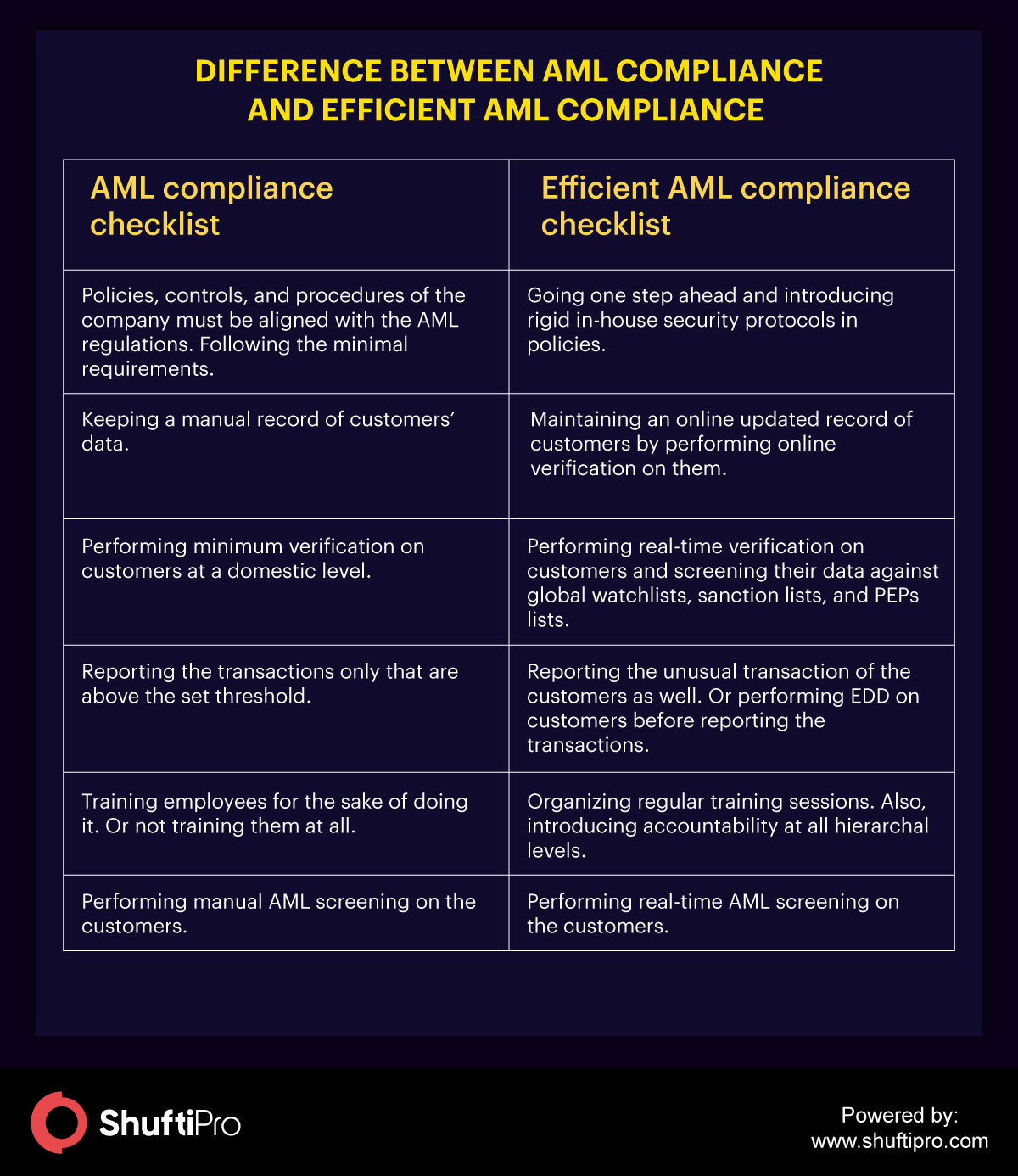

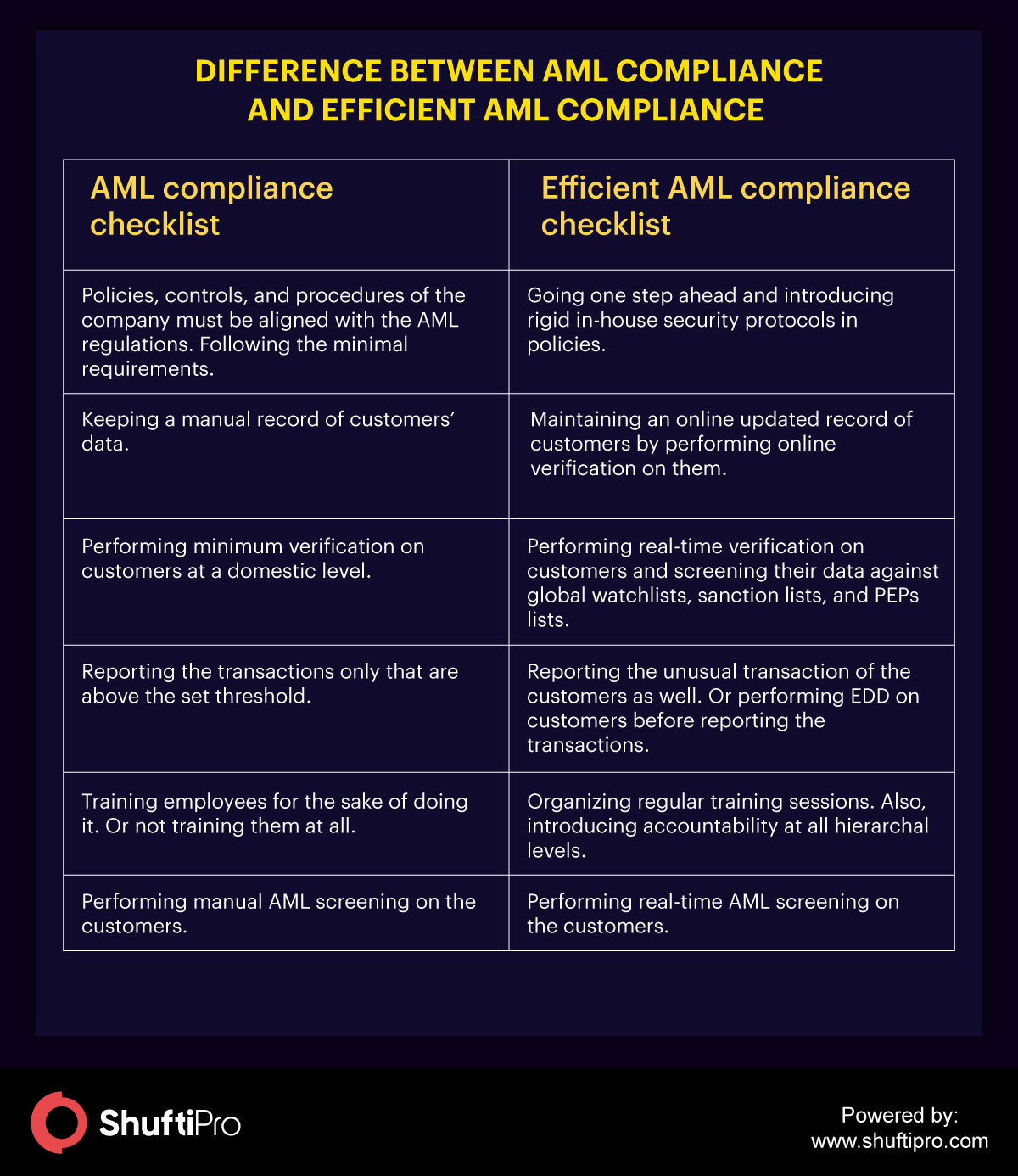

Anti-money laundering compliance refers to the measures institutions follow in order to be fully AML compliant. Faster payments are a response to the need to modernise current payment settlement networks as a result of market technology and demographic trends. AML laws require that financial instutions report any financial crime they detect to relevant regulators. Anti-money laundering refers to a set of rules and regulations that have been implemented to validate transactions and identification. The code identifies the factors associated with high-risk money laundering by identifying common features in such areas. Applicability of Anti Money Laundering Compliance.

Anti-money laundering risk assessment is required to determine the risk exposure and the secretary singles out factors such as certain areas having unusually high rates of suspicious illegal and money laundering activities.

Anti-Money Laundering Compliance Program The Anti-Money Laundering AML Compliance Program is everything that companies at risk of financial crime do in combating financial crime and compliance processes. Anti-money laundering compliance refers to the measures institutions follow in order to be fully AML compliant. Anti-money laundering compliance is the process of background screening and ongoing monitoring of customers to identify and eliminate any efforts of money laundering. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. Anti Money Laundering and KYC compliance are carried out to prevent money laundering activities. They must be prevented from financing money laundering and or terrorism.

Source: slideplayer.com

Source: slideplayer.com

Anti-money laundering refers to a set of rules and regulations that have been implemented to validate transactions and identification. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. These include risk assessments parts of an AMLCFT programme and making suspicious activity reports or prescribed transaction reports. Money laundering and terrorist financing are global issues. Criminals use money laundering to conceal their crimes and the money derived from them.

Source: bi.go.id

Source: bi.go.id

AML legislation is becoming increasingly strict for financial service providers. Another advantage of KYC is to understand the dealings of customers and prevent any form of risk that is prone to customer dealings. AML legislation is becoming increasingly strict for financial service providers. Through KYC banks will comply with the norms issued by the RBI. Anti-Money Laundering Compliance Program The Anti-Money Laundering AML Compliance Program is everything that companies at risk of financial crime do in combating financial crime and compliance processes.

Source: shuftipro.com

Source: shuftipro.com

Another advantage of KYC is to understand the dealings of customers and prevent any form of risk that is prone to customer dealings. A member of a designated business group DBG can rely on another member to carry out some obligations on their behalf as set out in section 32 of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. They must be prevented from financing money laundering and or terrorism. Through KYC banks will comply with the norms issued by the RBI.

Source: tookitaki.ai

Source: tookitaki.ai

Anti Money Laundering and KYC compliance are carried out to prevent money laundering activities. Anti Money Laundering and KYC compliance are carried out to prevent money laundering activities. They work seamlessly with the existing processes procedures and due diligence when it comes to verifying customers and screening financial transactions. They must be prevented from financing money laundering and or terrorism. Anti-money laundering risk assessment is required to determine the risk exposure and the secretary singles out factors such as certain areas having unusually high rates of suspicious illegal and money laundering activities.

Source: shuftipro.com

Source: shuftipro.com

Money laundering and terrorist financing are global issues. Anti-money laundering compliance is the process of background screening and ongoing monitoring of customers to identify and eliminate any efforts of money laundering. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. For businesses the anti-money laundering compliance officer is a very vital. Through KYC banks will comply with the norms issued by the RBI.

Source: veriff.com

Source: veriff.com

These include risk assessments parts of an AMLCFT programme and making suspicious activity reports or prescribed transaction reports. Money laundering is a way to conceal illegally obtained funds. Anti-Money Laundering Compliance Program The Anti-Money Laundering AML Compliance Program is everything that companies at risk of financial crime do in combating financial crime and compliance processes. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. Criminals use money laundering to conceal their crimes and the money derived from them.

Source: trulioo.com

Source: trulioo.com

Criminals use money laundering to conceal their crimes and the money derived from them. Anti-money laundering risk assessment is required to determine the risk exposure and the secretary singles out factors such as certain areas having unusually high rates of suspicious illegal and money laundering activities. The AML compliance procedure is a continuous procedure that acquires observant consideration. Anti Money Laundering and KYC compliance are carried out to prevent money laundering activities. Money laundering is a way to conceal illegally obtained funds.

Source: slidetodoc.com

Source: slidetodoc.com

Anti-money laundering risk assessment is required to determine the risk exposure and the secretary singles out factors such as certain areas having unusually high rates of suspicious illegal and money laundering activities. They work seamlessly with the existing processes procedures and due diligence when it comes to verifying customers and screening financial transactions. Anti money laundering meaning hindi. Money laundering is a way to conceal illegally obtained funds. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures.

Source: plianced.com

Criminals use money laundering to conceal their crimes and the money derived from them. For businesses the anti-money laundering compliance officer is a very vital. Another advantage of KYC is to understand the dealings of customers and prevent any form of risk that is prone to customer dealings. It is the companys anti-money laundering compliance officers responsibility to make sure anti-money laundering compliance of a company and the implementation of the stages of the money laundering program. These include risk assessments parts of an AMLCFT programme and making suspicious activity reports or prescribed transaction reports.

Source: tookitaki.ai

Source: tookitaki.ai

The AML compliance procedure is a continuous procedure that acquires observant consideration. Corporations consumers and financial institutions. These include risk assessments parts of an AMLCFT programme and making suspicious activity reports or prescribed transaction reports. They must be prevented from financing money laundering and or terrorism. Anti-money laundering AML compliance.

Source: bi.go.id

Source: bi.go.id

The AML compliance procedure is a continuous procedure that acquires observant consideration. Money laundering and terrorist financing are global issues. These include risk assessments parts of an AMLCFT programme and making suspicious activity reports or prescribed transaction reports. We also require that firms. Faster payments are a response to the need to modernise current payment settlement networks as a result of market technology and demographic trends.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Money laundering and terrorist financing are global issues. Anti Money Laundering AML also known as anti-money laundering is the execution of transactions to eventually convert illegally obtained money into legal money. The code identifies the factors associated with high-risk money laundering by identifying common features in such areas. Corporations consumers and financial institutions. Anti Money Laundering and KYC compliance are carried out to prevent money laundering activities.

Source: complyadvantage.com

Source: complyadvantage.com

Anti-money laundering risk assessment is required to determine the risk exposure and the secretary singles out factors such as certain areas having unusually high rates of suspicious illegal and money laundering activities. Anti-money laundering compliance is the process of background screening and ongoing monitoring of customers to identify and eliminate any efforts of money laundering. Anti Money Laundering and KYC compliance are carried out to prevent money laundering activities. It is the companys anti-money laundering compliance officers responsibility to make sure anti-money laundering compliance of a company and the implementation of the stages of the money laundering program. Anti-money laundering risk assessment is required to determine the risk exposure and the secretary singles out factors such as certain areas having unusually high rates of suspicious illegal and money laundering activities.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering compliance meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information