13++ Anti money laundering definitions ideas

Home » money laundering Info » 13++ Anti money laundering definitions ideasYour Anti money laundering definitions images are ready in this website. Anti money laundering definitions are a topic that is being searched for and liked by netizens today. You can Find and Download the Anti money laundering definitions files here. Find and Download all royalty-free photos.

If you’re looking for anti money laundering definitions pictures information related to the anti money laundering definitions topic, you have come to the right blog. Our website always gives you suggestions for viewing the maximum quality video and image content, please kindly search and find more informative video articles and images that fit your interests.

Anti Money Laundering Definitions. 1 For the purposes of this Act money laundering is an offence under section 261 of the Criminal Code Strafgesetzbuch. Section 1 GwG Definitions. Anti-Money Laundering Law means any Law relating to money laundering or terrorism financing any predicate crime to money laundering or any financial record keeping or reporting requirements related thereto including for the avoidance of doubt any Law administered or enforced by the Financial Transactions and Reports Analysis Centre of Canada the Autorité des marchés financiers and the. This process is of critical importance as it enables the criminal.

Money Laundering is an act of act of disguising the illegal source of income. Prevention of money laundering combating financing of terrorism matters connected therewith. German Anti-Money Laundering Act GwG Part 1 Definitions and obliged entities. Anti-Money Laundering refers to a set of laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income. Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme. Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways.

Anti-Money Laundering and Cybersecurity.

According to John Byrne a former executive vice president of the Association of Anti-Money Laundering Specialists quoted in McCoys piece money laundering has more than 200 distinct federal criminal predicates. Therefore the future of cybersecurity and AML which combat similar targets and threats. Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. Section 6 GwG Internal controls and safeguards. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. It is implemented within government systems and large financial institutions to monitor potentially fraudulent activity.

Source: tookitaki.ai

Source: tookitaki.ai

Part 2 Risk management. 1 For the purposes of this Act money laundering is an offence under section 261 of the Criminal Code Strafgesetzbuch. The conduct of illegal activities such as money laundering fraud identity theft by electronic systems is called cybercrime. Instigating or aiding and abetting an offence within the meaning of no. Money Laundering is an act of act of disguising the illegal source of income.

Section 4 GwG Risk management. Section 1 GwG Definitions. German Anti-Money Laundering Act GwG Part 1 Definitions and obliged entities. Money Laundering is an act of act of disguising the illegal source of income. Apostille An Apostille is a certificate that authenticates the origin of a public document eg a.

Source: slideshare.net

Source: slideshare.net

This process is of critical importance as it enables the criminal. Section 2 GwG Obliged entities power to issue statutory instruments. Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. Section 7 GwG Money laundering officer. Section 4 GwG Risk management.

Source: eimf.eu

Source: eimf.eu

Money Laundering is the process of changing the colors of the money. Money Laundering is an act of act of disguising the illegal source of income. Instigating or aiding and abetting an offence within the meaning of no. The FATF Recommendations are recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard. According to John Byrne a former executive vice president of the Association of Anti-Money Laundering Specialists quoted in McCoys piece money laundering has more than 200 distinct federal criminal predicates.

Source: efinancemanagement.com

Source: efinancemanagement.com

Section 2 GwG Obliged entities power to issue statutory instruments. Anti-Money Laundering Laws means any and all laws statutes regulations or obligatory government orders decrees ordinances or rules applicable to a Credit Party its Subsidiaries or Affiliates related to terrorism financing or money laundering including any applicable provision of the Patriot Act and The Currency and Foreign Transactions Reporting Act also known as the Bank Secrecy Act 31 USC. Anti-Money Laundering AML is policies laws and regulations to prevent financial crime. Anti-Money Laundering and Countering Financing of Terrorism Definitions Regulations 2011 SR 2011222 as at 09 July 2021 Contents New Zealand Legislation. If the institution does not conduct due diligence properly it may be held legally liable for the money laundering activities.

Source: acronymsandslang.com

Source: acronymsandslang.com

Apostille An Apostille is a certificate that authenticates the origin of a public document eg a. 2 For the purposes of this Act terrorist financing means. Anti-Money Laundering Laws means any and all laws statutes regulations or obligatory government orders decrees ordinances or rules applicable to a Credit Party its Subsidiaries or Affiliates related to terrorism financing or money laundering including any applicable provision of the Patriot Act and The Currency and Foreign Transactions Reporting Act also known as the Bank Secrecy Act 31 USC. Therefore the future of cybersecurity and AML which combat similar targets and threats. Anti-Money Laundering and Countering Financing of Terrorism Definitions Regulations 2011 SR 2011222 as at 09 July 2021 Contents New Zealand Legislation.

Source: jagranjosh.com

Source: jagranjosh.com

Section 7 GwG Money laundering officer. According to John Byrne a former executive vice president of the Association of Anti-Money Laundering Specialists quoted in McCoys piece money laundering has more than 200 distinct federal criminal predicates. 2 For the purposes of this Act terrorist financing means. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Instigating or aiding and abetting an offence within the meaning of no. Part 2 Risk management. Section 2 GwG Obliged entities power to issue statutory instruments. 1 For the purposes of this Act money laundering is an offence under section 261 of the Criminal Code Strafgesetzbuch. Money Laundering is the process of changing the colors of the money.

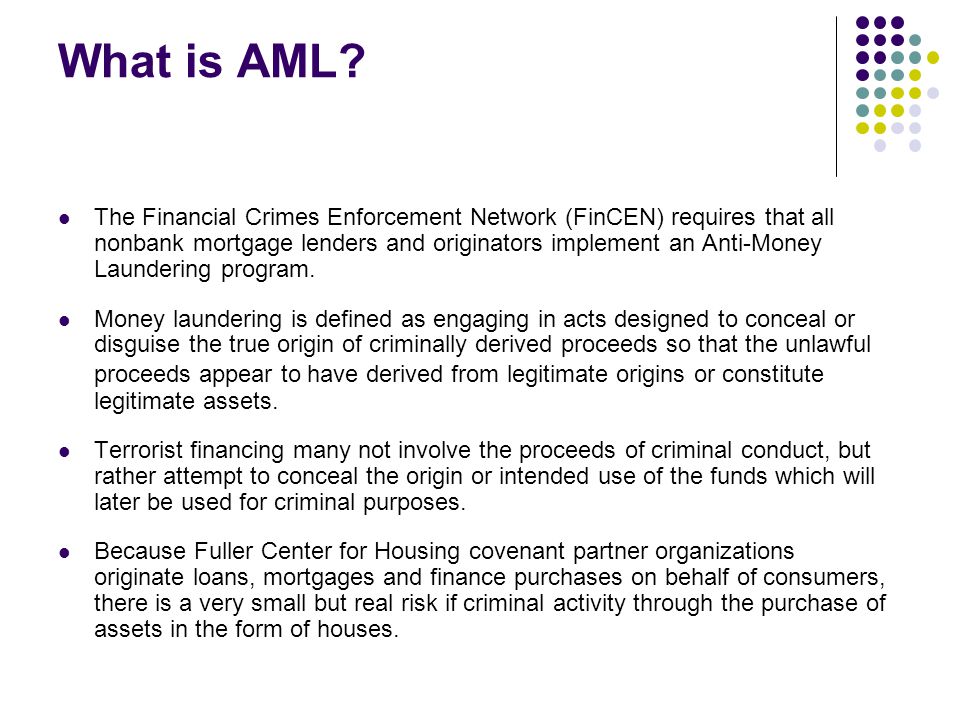

Source: slideplayer.com

Source: slideplayer.com

Money Laundering is the process of changing the colors of the money. Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways. Anti-Money Laundering and Cybersecurity. 2 For the purposes of this Act terrorist financing means. This process is of critical importance as it enables the criminal.

Source: slideshare.net

Source: slideshare.net

Part 2 Risk management. Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. Anti-Money Laundering Law means any Law relating to money laundering or terrorism financing any predicate crime to money laundering or any financial record keeping or reporting requirements related thereto including for the avoidance of doubt any Law administered or enforced by the Financial Transactions and Reports Analysis Centre of Canada the Autorité des marchés financiers and the. Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways. Section 5 GwG Risk analysis.

Source: slideplayer.com

Source: slideplayer.com

Therefore the future of cybersecurity and AML which combat similar targets and threats. Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. Anti-Money Laundering and Countering Financing of Terrorism Definitions Regulations 2011 SR 2011222 as at 09 July 2021 Contents New Zealand Legislation. Money Laundering is the process of changing the colors of the money.

Source: amlcompliance.ie

Source: amlcompliance.ie

Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. Promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. Section 1 GwG Definitions. Money Laundering is the process of changing the colors of the money. Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering.

Source: en.ppt-online.org

Source: en.ppt-online.org

If the institution does not conduct due diligence properly it may be held legally liable for the money laundering activities. Anti-Money Laundering and Countering Financing of Terrorism Definitions Regulations 2011 SR 2011222 as at 09 July 2021 Contents New Zealand Legislation. Anti-Money Laundering refers to a set of laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income. If the institution does not conduct due diligence properly it may be held legally liable for the money laundering activities. Section 1 GwG Definitions.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering definitions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas