19+ Anti money laundering fines and penalties uk ideas in 2021

Home » money laundering idea » 19+ Anti money laundering fines and penalties uk ideas in 2021Your Anti money laundering fines and penalties uk images are ready in this website. Anti money laundering fines and penalties uk are a topic that is being searched for and liked by netizens now. You can Download the Anti money laundering fines and penalties uk files here. Get all free images.

If you’re searching for anti money laundering fines and penalties uk pictures information related to the anti money laundering fines and penalties uk keyword, you have come to the right site. Our website always provides you with suggestions for seeking the maximum quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

Anti Money Laundering Fines And Penalties Uk. The Financial Conduct Authority FCA has fined Standard Chartered Bank Standard Chartered 102163200 for Anti-Money Laundering AML breaches in two higher risk areas of its business. For a legal entity the maximum penalty is an unlimited fine. For registration penalties such as a failure to register or notify us of changes to your business the charge will be up to 350 in addition to the amount of the penalty. HSBC paid almost 2 billion to settle allegations that its failure to enforce anti-money laundering rules left Americas financial system exposed to drug cartels.

European Uk Aml Enforcement Remained Strong In 2020 Lexology From lexology.com

European Uk Aml Enforcement Remained Strong In 2020 Lexology From lexology.com

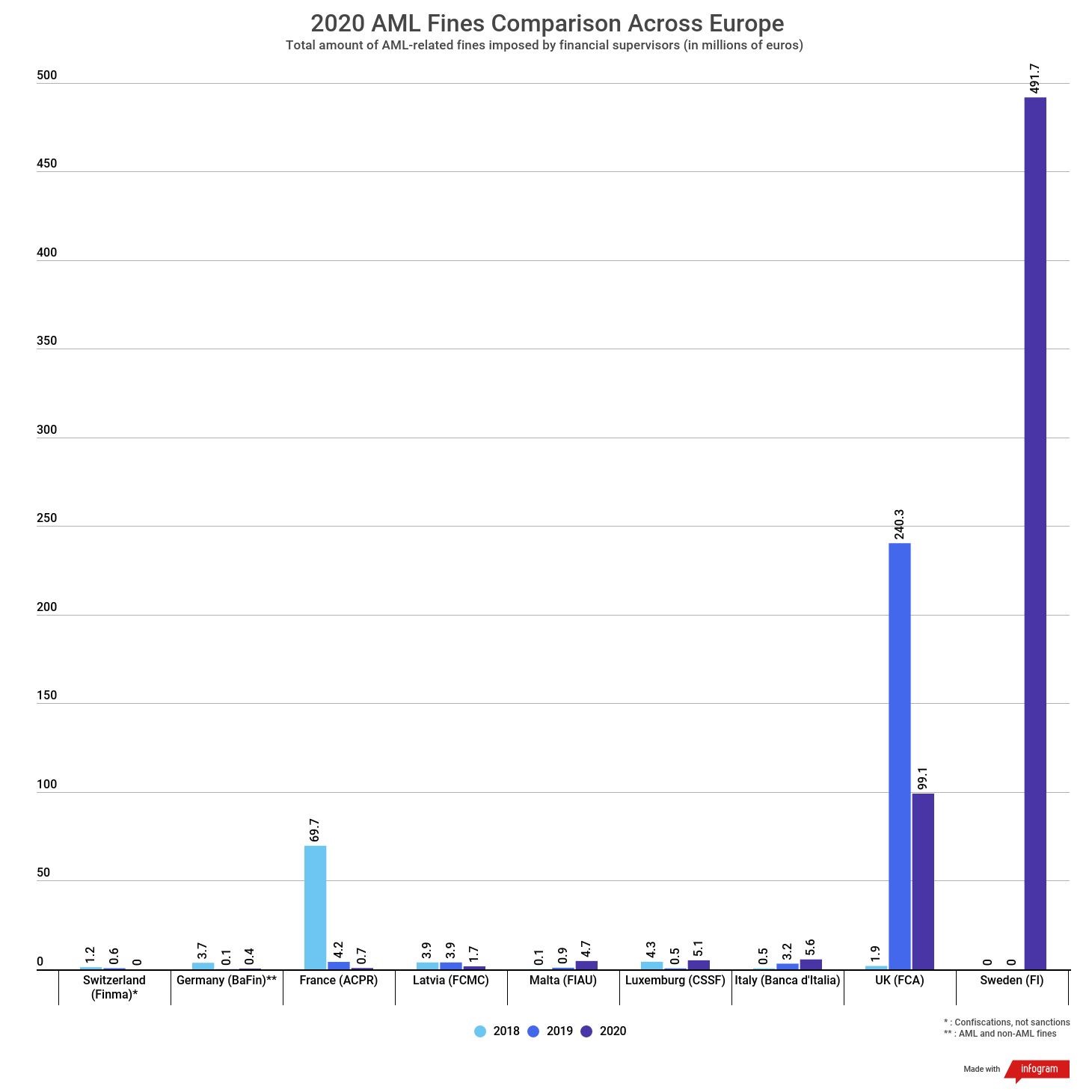

Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. The Financial Conduct Authority FCA imposed a 378 Million fine on the Commerzbank London. HSBC paid almost 2 billion to settle allegations that its failure to enforce anti-money laundering rules left Americas financial system exposed to drug cartels. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. According to reports of FCA the violations will result in huge risks and stability issues of the UKs financial system. The act gives the UK government powers to lift and impose sanctions in line with its ongoing international obligations and to devise new targeted sanctions as part of its own regime.

Failing to report knowledge and or suspicion of money laundering.

The fine was a result of the banks violation of AML controls. It is a course of by which dirty money is transformed into clear cash. The sources of the money in precise are felony and the money is invested in a means that makes it appear to be clear money. Following the US and the UK since 2002 European authorities issue the most anti-money laundering fines. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Using a range of civil penalties and prosecutions HMRC responds effectively to businesses who fail to comply with the money laundering regulations.

Source: paymentscardsandmobile.com

Source: paymentscardsandmobile.com

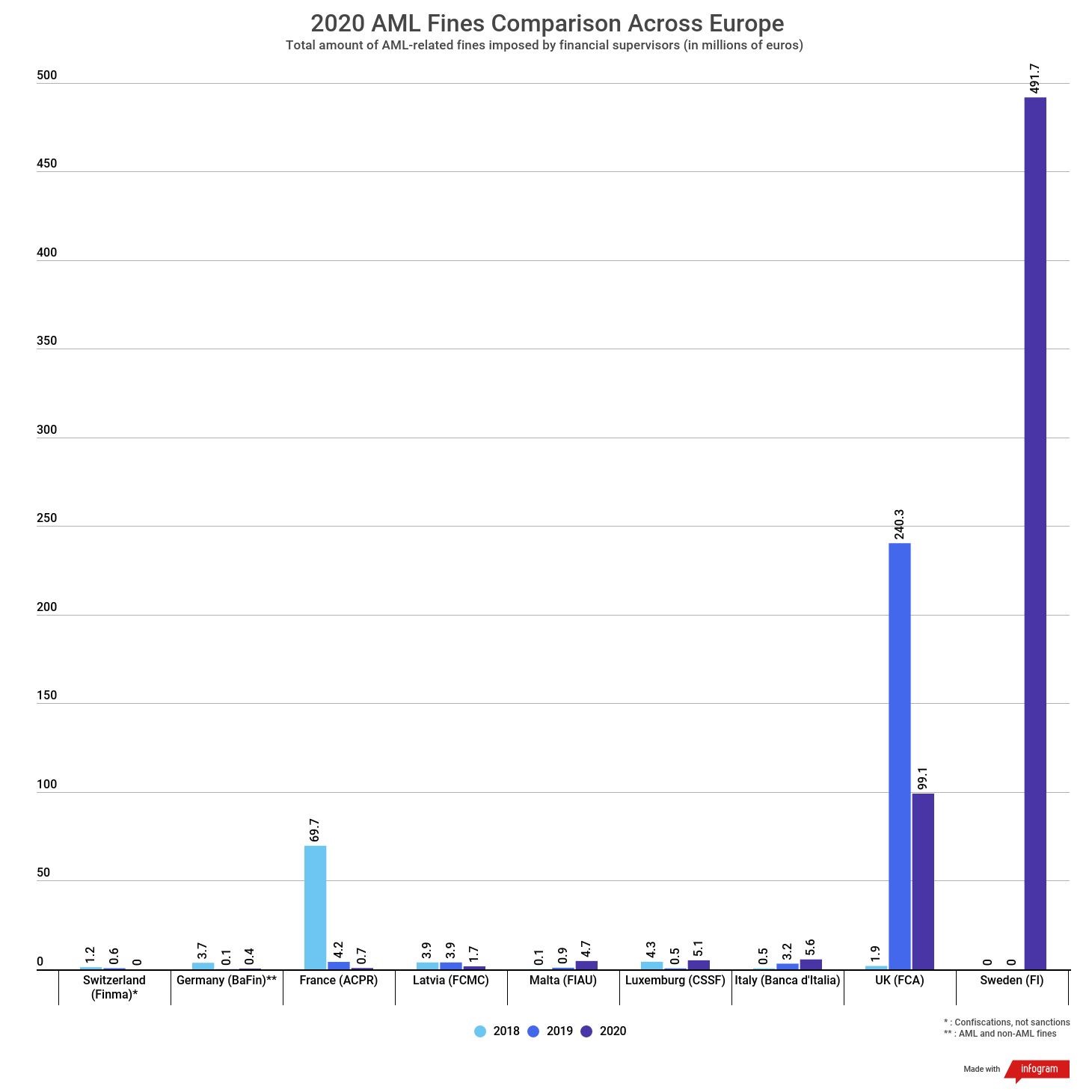

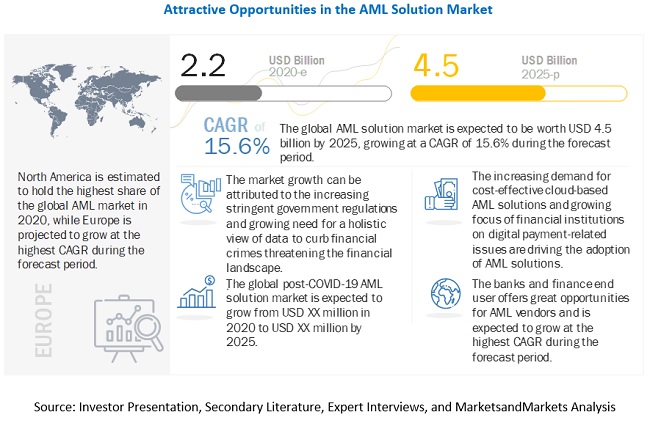

The US and UK financial regulators lead the way in anti-money laundering AML penalties issued in 2019 collectively accounting for more than 30 of the 814 billion total handed out in fines globally. The Financial Conduct Authority FCA imposed a 378 Million fine on the Commerzbank London. HSBC paid almost 2 billion to settle allegations that its failure to enforce anti-money laundering rules left Americas financial system exposed to drug cartels. The sources of the money in precise are felony and the money is invested in a means that makes it appear to be clear money. This uptick published in Duff Phelps 7th annual Global Enforcement Review suggests that after a short lull regulators are continuing their clamp down on anti-money laundering breaches.

Source: businessinsider.com

Money laundering is a criminal of fence. This is the second largest financial penalty for AML controls failings ever imposed by the FCA. For a legal entity the maximum penalty is an unlimited fine. Agustus 08 2021 The concept of money laundering is essential to be understood for those working in the financial sector. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine.

Source: moneylaundry.vercel.app

Source: moneylaundry.vercel.app

According to reports of FCA the violations will result in huge risks and stability issues of the UKs financial system. 2019 saw 644 billion in AML fines issued across Europe in the period between January and April with 1043 billion in fines issued since 2002. The fine was a result of the banks violation of AML controls. The Financial Conduct Authority FCA imposed a 378 Million fine on the Commerzbank London. Last year HMRC announced a.

Source: paymentscardsandmobile.com

Source: paymentscardsandmobile.com

HM Revenue and Customs has introduced a penalty administration charge for all Anti Money Laundering Supervision penalties issued from 25 July 2018. The act gives the UK government powers to lift and impose sanctions in line with its ongoing international obligations and to devise new targeted sanctions as part of its own regime. This was the second-largest fine ever imposed by the British. These serious crimes can involve the maximum prison sentence of 14 years. It was fined 38m in June by the UKs Financial Conduct Authority for failing to make adequate AML checks over a five-year period.

Source: encompasscorporation.com

For a legal entity the maximum penalty is an unlimited fine. Fines For Money Laundering Uk. Last year HMRC announced a. The largest single fine for anyone bank in history was the 19 billion fine levied on HSBC in 2012 for failing to comply with anti-money laundering regulations. Commerzbank Fined 378 Million by FCA.

Source: ctmfile.com

Source: ctmfile.com

FCA fines Deutsche Bank 163 million for serious anti-money laundering controls failings. The act gives the UK government powers to lift and impose sanctions in line with its ongoing international obligations and to devise new targeted sanctions as part of its own regime. HSBC paid almost 2 billion to settle allegations that its failure to enforce anti-money laundering rules left Americas financial system exposed to drug cartels. Using a range of civil penalties and prosecutions HMRC responds effectively to businesses who fail to comply with the money laundering regulations. In the UK penalties include unlimited fines andor terms of imprisonment ranging from two to 14 years.

Source: thelaundromat.kwm.com

Source: thelaundromat.kwm.com

In the UK penalties include unlimited fines andor terms of imprisonment ranging from two to 14 years. The most serious money laundering offences are deemed to be those involving sums of 10 million or more with 30 million given as the starting point for sentencing. The Financial Conduct Authority FCA has fined Standard Chartered Bank Standard Chartered 102163200 for Anti-Money Laundering AML breaches in two higher risk areas of its business. 2019 saw 644 billion in AML fines issued across Europe in the period between January and April with 1043 billion in fines issued since 2002. Fines For Money Laundering Uk.

Source: shuftipro.com

Source: shuftipro.com

2019 saw 644 billion in AML fines issued across Europe in the period between January and April with 1043 billion in fines issued since 2002. The Financial Conduct Authority FCA has today fined Deutsche Bank AG Deutsche Bank 163076224 for failing to maintain an adequate anti-money laundering AML control framework during the period between 1 January 2012 and 31 December 2015. HM Revenue and Customs has introduced a penalty administration charge for all Anti Money Laundering Supervision penalties issued from 25 July 2018. In the UK penalties include unlimited fines andor terms of imprisonment ranging from two to 14 years. Between 1 January and 31 December 2019 a record-breaking 58 AML fines were issued 37 of which were handed out by American and British.

Source: lexology.com

Source: lexology.com

According to reports of FCA the violations will result in huge risks and stability issues of the UKs financial system. The sources of the money in precise are felony and the money is invested in a means that makes it appear to be clear money. Commerzbank Fined 378 Million by FCA. The Financial Conduct Authority FCA imposed a 378 Million fine on the Commerzbank London. Youll have to pay a 1500 penalty administration charge as well as the penalty for breaches of the Money Laundering Regulations such as.

Source: marketsandmarkets.com

Source: marketsandmarkets.com

The US and UK financial regulators lead the way in anti-money laundering AML penalties issued in 2019 collectively accounting for more than 30 of the 814 billion total handed out in fines globally. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. It is a course of by which dirty money is transformed into clear cash. The act gives the UK government powers to lift and impose sanctions in line with its ongoing international obligations and to devise new targeted sanctions as part of its own regime. Youll have to pay a 1500 penalty administration charge as well as the penalty for breaches of the Money Laundering Regulations such as.

Source: moneylaundering.com

Source: moneylaundering.com

Money laundering is a criminal of fence. This uptick published in Duff Phelps 7th annual Global Enforcement Review suggests that after a short lull regulators are continuing their clamp down on anti-money laundering breaches. Failing to report knowledge and or suspicion of money laundering. These serious crimes can involve the maximum prison sentence of 14 years. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine.

Source: vinciworks.com

Source: vinciworks.com

The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. This was the second-largest fine ever imposed by the British. It is a course of by which dirty money is transformed into clear cash. The sources of the money in precise are felony and the money is invested in a means that makes it appear to be clear money. It is also possible to receive a community order as a punishment for money laundering.

Source: encompasscorporation.com

Last year HMRC announced a. The US and UK financial regulators lead the way in anti-money laundering AML penalties issued in 2019 collectively accounting for more than 30 of the 814 billion total handed out in fines globally. The sources of the money in precise are felony and the money is invested in a means that makes it appear to be clear money. This was the second-largest fine ever imposed by the British. To deal with the transition from the EUs sanctions regime to its new regime the UK passed the Sanctions and Anti-Money Laundering Act SAMLA in 2018.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering fines and penalties uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information