12++ Anti money laundering firm risk assessment checklist info

Home » money laundering idea » 12++ Anti money laundering firm risk assessment checklist infoYour Anti money laundering firm risk assessment checklist images are ready in this website. Anti money laundering firm risk assessment checklist are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering firm risk assessment checklist files here. Find and Download all free photos.

If you’re searching for anti money laundering firm risk assessment checklist pictures information connected with to the anti money laundering firm risk assessment checklist topic, you have come to the ideal blog. Our site frequently gives you suggestions for seeing the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

Anti Money Laundering Firm Risk Assessment Checklist. Below we have created a template with some hints and tips to aid our firms in completing an AML Firm-wide risk assessment. Therefore its important to identify them. 1 Very limited sums of money could be laundered and the reputational damage to the firm would be low. Money laundering is the process and activities aimed at showing the values of the assets they obtained from the crime in a different way to hide the crimes of the people or bring a legal image to the crime income.

Aml 5 Business Risk Assessment Rulebook From dfsaen.thomsonreuters.com

Aml 5 Business Risk Assessment Rulebook From dfsaen.thomsonreuters.com

You must also have a thorough policy in place which details your firms AML policies and procedures. Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. 83 risk assessments were not compliant. Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. Firms risk assessment 3. Below we have created a template with some hints and tips to aid our firms in completing an AML Firm-wide risk assessment.

Below we have created a template with some hints and tips to aid our firms in completing an AML Firm-wide risk assessment.

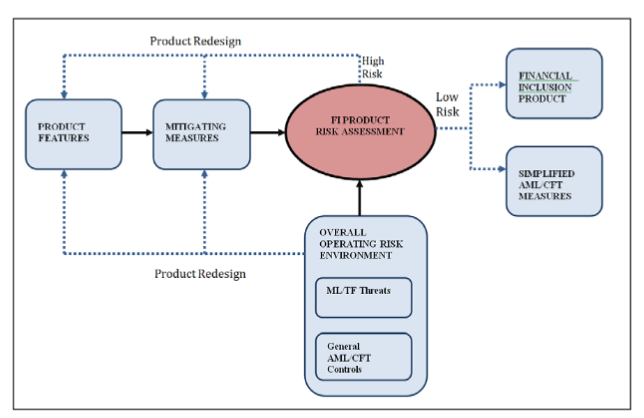

Therefore its important to identify them. This guideline is designed to help you conduct your money laundering and terrorism financing risk assessment risk assessment under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009 the Act. The concept of cash laundering is essential to be understood for those working in the financial sector. Anti-Money Laundering AML Terrorist Financing TF Compliance Checklist. Cover 100 of flood risk in Asia Pacific with RMS models and maps. You are best placed to.

Source: acamstoday.org

Source: acamstoday.org

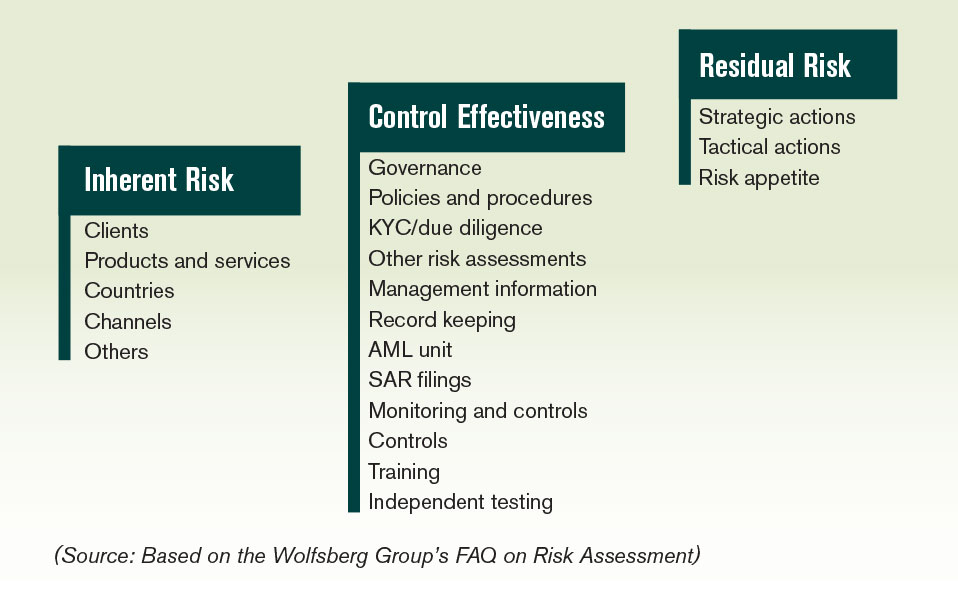

Nominated Officer of the firm. The firm wide risk assessment should be reviewed and updated on an annual basis. The draft LSAG AML Guidance for the legal sector 2021 describes this high level risk assessment as the cornerstone of anti-money laundering compliance. Assessment of risk Every accountancy firm will have risks. 1 Very limited sums of money could be laundered and the reputational damage to the firm would be low.

Source: slidetodoc.com

Source: slidetodoc.com

The sources of the money in actual are legal and the money is invested in a approach that makes it appear like clear cash and. It is a process by which soiled money is converted into clear money. Cover 100 of flood risk in Asia Pacific with RMS models and maps. Assessment of risk Every accountancy firm will have risks. This policy must include but isnt limited to the following.

Source: pdfprof.com

Source: pdfprof.com

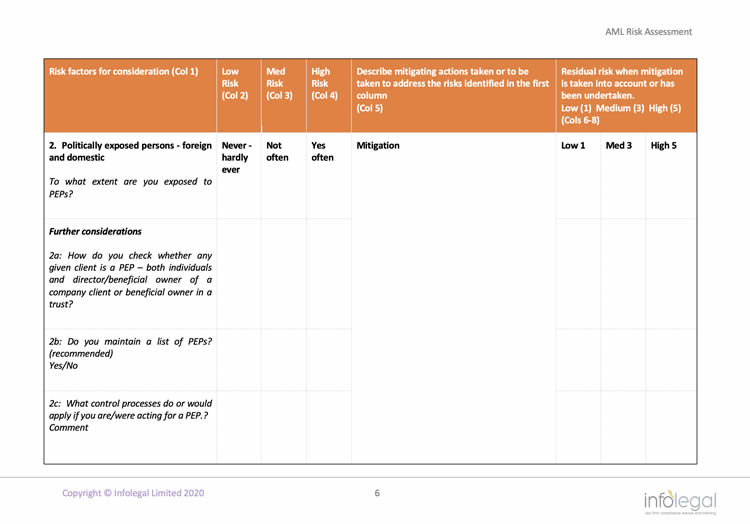

40 firms did not send us a firm risk assessment instead sending us something else. Assessment of risk Every accountancy firm will have risks. The sources of the money in actual are legal and the money is invested in a approach that makes it appear like clear cash and. Money Laundering Risk Assessment Form The concept of money laundering is very important to be understood for these working within the monetary sector. As part of our ongoing work to refresh the anti-money laundering AML resources we make available to the profession we have recently added an example AML Risk Assessment Form which can be downloaded and used by member firms.

Source: slidetodoc.com

Source: slidetodoc.com

Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. Cover 100 of flood risk in Asia Pacific with RMS models and maps. In this column detail the risks your firm may have Mitigating actions. Money Laundering Risk Assessment Form The concept of money laundering is very important to be understood for these working within the monetary sector. The sources of the money in actual are criminal and the money is invested in a means that makes it look like clear money and hide the identity of the prison part of the money earned.

Source: dfsaen.thomsonreuters.com

Source: dfsaen.thomsonreuters.com

2 Moderate sums of money could be laundered with some reputation damage to the frim. New anti-money laundering risk assessment form available to firms. Importantly you must properly identify and assess the risk of money laundering or terrorist financing and you must document your assessment. Firms risk assessment 3. An assessment of risk.

Source: jonathonbray.com

Source: jonathonbray.com

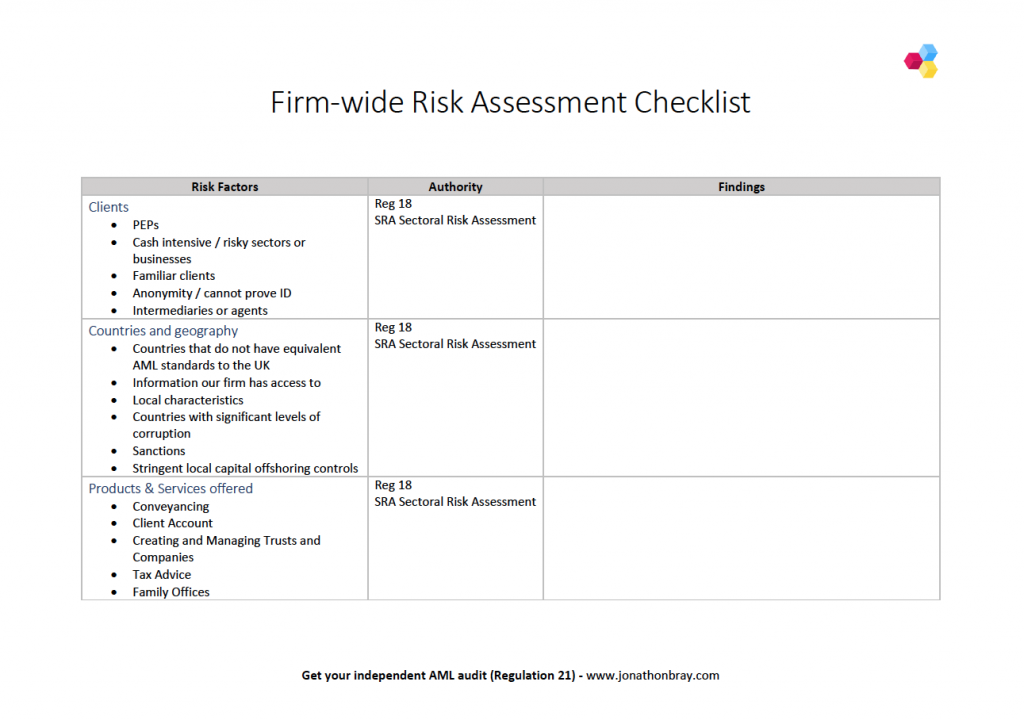

The draft LSAG AML Guidance for. It is a process by which soiled money is converted into clear money. Anti-money laundering firm-wide risk assessment Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment. Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. Client Due Diligence CDD 8.

Source: service.betterregulation.com

Source: service.betterregulation.com

You are best placed to. Client Due Diligence CDD 8. Reporting Procedures Tipping-Off 7. The sources of the money in actual are legal and the money is invested in a approach that makes it appear like clear cash and. FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310.

Source: slidetodoc.com

Source: slidetodoc.com

The sources of the money in actual are criminal and the money is invested in a means that makes it look like clear money and hide the identity of the prison part of the money earned. The sources of the money in actual are criminal and the money is invested in a means that makes it look like clear money and hide the identity of the prison part of the money earned. FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310. Identify the money laundering risks faced by the different areas of your business and the clients and markets you serve. The concept of cash laundering is essential to be understood for those working in the financial sector.

Source: service.betterregulation.com

Source: service.betterregulation.com

Its a course of by which soiled money is transformed into clear cash. We found high levels of non-compliance with the money laundering regulations with 21 not compliant. You must also have a thorough policy in place which details your firms AML policies and procedures. Cover 100 of flood risk in Asia Pacific with RMS models and maps. FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310.

Source: infolegal.co.uk

Source: infolegal.co.uk

Client Due Diligence CDD 8. In spring 2019 we called in 400 firms anti-money laundering risk assessments. Client Due Diligence CDD 8. This guideline is designed to help you conduct your money laundering and terrorism financing risk assessment risk assessment under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009 the Act. The sources of the money in actual are criminal and the money is invested in a means that makes it look like clear money and hide the identity of the prison part of the money earned.

Source: lexology.com

Source: lexology.com

Cover 100 of flood risk in Asia Pacific with RMS models and maps. Firms risk assessment 3. Money laundering is the process and activities aimed at showing the values of the assets they obtained from the crime in a different way to hide the crimes of the people or bring a legal image to the crime income. 1 Very limited sums of money could be laundered and the reputational damage to the firm would be low. 83 risk assessments were not compliant.

Source: slideplayer.com

Source: slideplayer.com

You understand your business better than anyone else. In spring 2019 we called in 400 firms anti-money laundering risk assessments. New anti-money laundering risk assessment form available to firms. Below we have created a template with some hints and tips to aid our firms in completing an AML Firm-wide risk assessment. The sources of the money in actual are legal and the money is invested in a approach that makes it appear like clear cash and.

Source: advisoryhq.com

Source: advisoryhq.com

Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. Its a course of by which soiled money is transformed into clear cash. Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. Cover 100 of flood risk in Asia Pacific with RMS models and maps. Anti-Money Laundering AML also refers to regulations and procedures implemented to prevent criminals from making illegal funds acquired.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering firm risk assessment checklist by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information