14++ Anti money laundering geographic risk information

Home » money laundering idea » 14++ Anti money laundering geographic risk informationYour Anti money laundering geographic risk images are available in this site. Anti money laundering geographic risk are a topic that is being searched for and liked by netizens now. You can Download the Anti money laundering geographic risk files here. Find and Download all royalty-free photos.

If you’re searching for anti money laundering geographic risk pictures information related to the anti money laundering geographic risk keyword, you have visit the ideal blog. Our site frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly search and find more enlightening video articles and graphics that fit your interests.

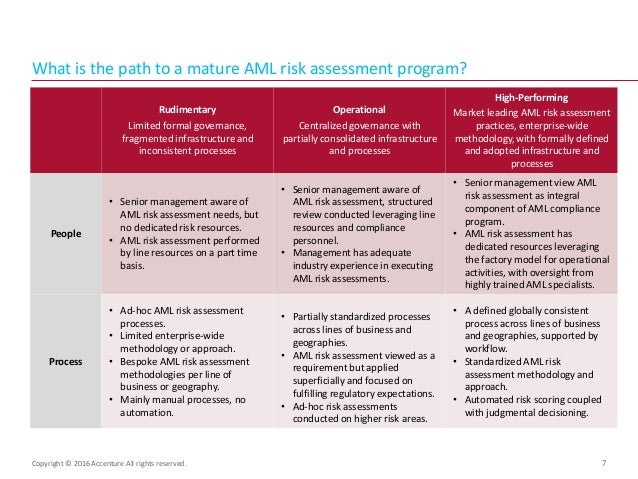

Anti Money Laundering Geographic Risk. You can compile your own list of jurisdictions you consider to be high risk. Once youve analysed your business money laundering risks you need to risk assess and monitor your customer base by. Identify the money laundering risks that are relevant to your business. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of.

Geographic Risk Data Data Derivatives From dataderivatives.com

Geographic Risk Data Data Derivatives From dataderivatives.com

The Correspondent Banking Clients Geographic Risk Certain jurisdictions are internationally recognised as having inadequate anti-money laundering standards insufficient regulatory supervision presenting greater risk for crime corruption terrorist financing or pose elevated risk of evading sanctions. Take effective measures to mitigate money laundering and terrorist financing risks for clients countries or geographical areas products services transactions delivery channels etc. Interface risk eg Non face-to-face business business networks etc Geographical risk eg. Origin of customers where they are accessing the service from funding method origin etc Customer-specific risk assessment. Because money laundering is made easier based on the geographical location of. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of.

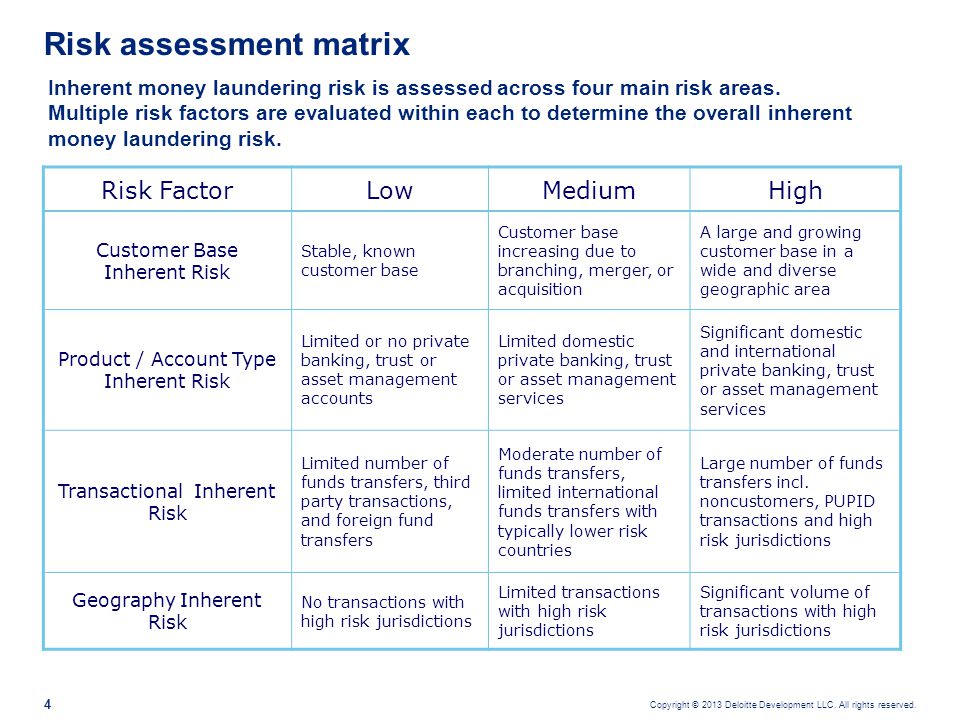

Geographic and country risk entities and clients risks and lastly product and transactions risk.

The first is the idea of geographic risk. This involves following a number of steps. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. Identify the money laundering risks that are relevant to your business. Identify and verify the identity of clients monitor transactions and report suspicious transactions. The vulnerability to money laundering threats that countries face at a national level.

The second is the idea of individual risk the specific risks that financial institutions face from their clients and how their internal AML process manages that risk. FATF We simplify what is normally bulky and complex data into a single country risk rating. Because money laundering is made easier based on the geographical location of. Interface risk eg Non face-to-face business business networks etc Geographical risk eg. This involves following a number of steps.

Source: aml360software.com

Source: aml360software.com

Geographic and country risk entities and clients risks and lastly product and transactions risk. Risk Based Approach RBA to Anti Money Laundering. The study of money laundering risk should be based on three main types of risk. Take effective measures to mitigate money laundering and terrorist financing risks for clients countries or geographical areas products services transactions delivery channels etc. Identify the money laundering risks that are relevant to your business.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

You can compile your own list of jurisdictions you consider to be high risk. Promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. The assessment process needs to consider the relevant risk factors before determining the overall risk level and appropriate mitigation level and type. However there are official lists that must be consulted. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism.

Source: slideplayer.com

Source: slideplayer.com

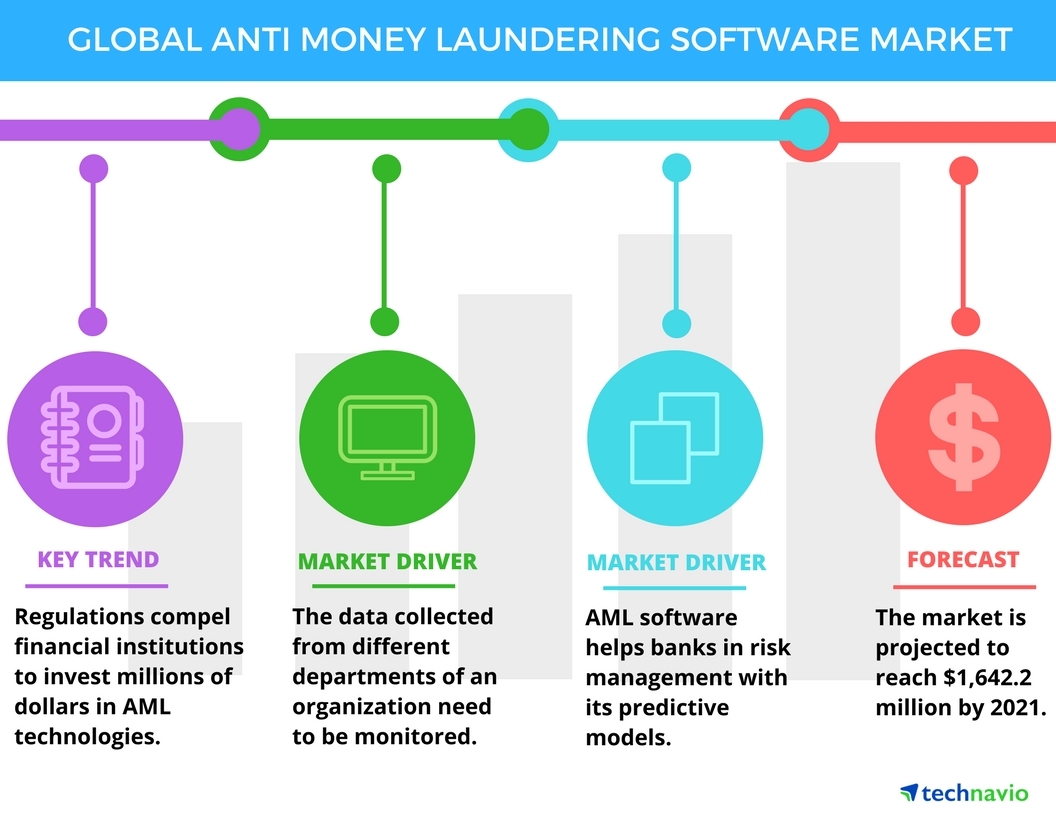

Anti-Money Laundering Risks for Global Companies Part I of III Non-financial institution companies operating in the global marketplace face ever-increasing risks of money laundering. The study of money laundering risk should be based on three main types of risk. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. Industries that have business locations centered in certain countries have an inherent risk of money laundering and terrorist financing. However there are official lists that must be consulted.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. The Individual Geographic Index indicates the level of evidence that an individuals address is located in a high-risk geographic location. Geographic Risk When assessing geographic risk you should consider if your client is based in a high risk jurisdiction or has links to a high risk jurisdiction. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism. Origin of customers where they are accessing the service from funding method origin etc Customer-specific risk assessment.

Source: bi.go.id

Source: bi.go.id

It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. Anti-Money Laundering Risks for Global Companies Part I of III Non-financial institution companies operating in the global marketplace face ever-increasing risks of money laundering. The first is the idea of geographic risk. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1.

Source: dataderivatives.com

Source: dataderivatives.com

This index can be used to validate and gather geographic information about the individual. The vulnerability to money laundering threats that countries face at a national level. The assessment process needs to consider the relevant risk factors before determining the overall risk level and appropriate mitigation level and type. The study of money laundering risk should be based on three main types of risk. The filers enable risk identification through individual country risk selection or alternatively risk can be analysed at a global risk level identifying all countries in that risk category.

Source: bi.go.id

You can compile your own list of jurisdictions you consider to be high risk. The study of money laundering risk should be based on three main types of risk. Once youve analysed your business money laundering risks you need to risk assess and monitor your customer base by. The assessment process needs to consider the relevant risk factors before determining the overall risk level and appropriate mitigation level and type. Promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction.

Source: bi.go.id

Source: bi.go.id

The second is the idea of individual risk the specific risks that financial institutions face from their clients and how their internal AML process manages that risk. The Financial Action Task Force FATF or other international governing bodies identify such locations. You can compile your own list of jurisdictions you consider to be high risk. The Correspondent Banking Clients Geographic Risk Certain jurisdictions are internationally recognised as having inadequate anti-money laundering standards insufficient regulatory supervision presenting greater risk for crime corruption terrorist financing or pose elevated risk of evading sanctions. Interface risk eg Non face-to-face business business networks etc Geographical risk eg.

Source: bi.go.id

Source: bi.go.id

Industries that have business locations centered in certain countries have an inherent risk of money laundering and terrorist financing. Once youve analysed your business money laundering risks you need to risk assess and monitor your customer base by. Geographic and country risk entities and clients risks and lastly product and transactions risk. Industries that have business locations centered in certain countries have an inherent risk of money laundering and terrorist financing. Origin of customers where they are accessing the service from funding method origin etc Customer-specific risk assessment.

Source: slideshare.net

Source: slideshare.net

The assessment process needs to consider the relevant risk factors before determining the overall risk level and appropriate mitigation level and type. FATF We simplify what is normally bulky and complex data into a single country risk rating. The assessment process needs to consider the relevant risk factors before determining the overall risk level and appropriate mitigation level and type. Once youve analysed your business money laundering risks you need to risk assess and monitor your customer base by. Are several international organizations fighting for an anti-money laundering regime.

Source: aml360software.com

Source: aml360software.com

This index can be used to validate and gather geographic information about the individual. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. Geographic and country risk entities and clients risks and lastly product and transactions risk. Identify the money laundering risks that are relevant to your business. Interface risk eg Non face-to-face business business networks etc Geographical risk eg.

Source: bcfocus.com

Source: bcfocus.com

High-Risk Geographic Locations. The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues. Are several international organizations fighting for an anti-money laundering regime. Risk Based Approach RBA to Anti Money Laundering. The first is the idea of geographic risk.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering geographic risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information