14++ Anti money laundering guidelines by rbi ideas

Home » money laundering Info » 14++ Anti money laundering guidelines by rbi ideasYour Anti money laundering guidelines by rbi images are available. Anti money laundering guidelines by rbi are a topic that is being searched for and liked by netizens today. You can Download the Anti money laundering guidelines by rbi files here. Download all royalty-free photos.

If you’re searching for anti money laundering guidelines by rbi images information connected with to the anti money laundering guidelines by rbi interest, you have pay a visit to the ideal site. Our website frequently gives you hints for refferencing the highest quality video and image content, please kindly search and locate more enlightening video content and images that fit your interests.

Anti Money Laundering Guidelines By Rbi. ANTI-MONEY LAUNDERING Prevention of Money Laundering Act 2002 KNOW YOUR CUSTOMER KYC Policy GUIDELINES IN BANK 3 4. Know Your Customer Guidelines Anti-Money laundering Standards UCBs. Guidelines on Anti-Money Laundering AML Standards and Combating the Financing of Terrorism CFT Obligations of Securities Market Intermediaries under the Prevention of Money Laundering Act 2002 and Rules framed there under. Authorised Persons under Prevention of Money Laundering Act PMLA 2002 as amended by Prevention of Money Laundering Amendment Act 2009- Money changing activities Attention of Authorized persons is invited to the Anti-Money Laundering Guidelines governing money changing transactions issued vide AP.

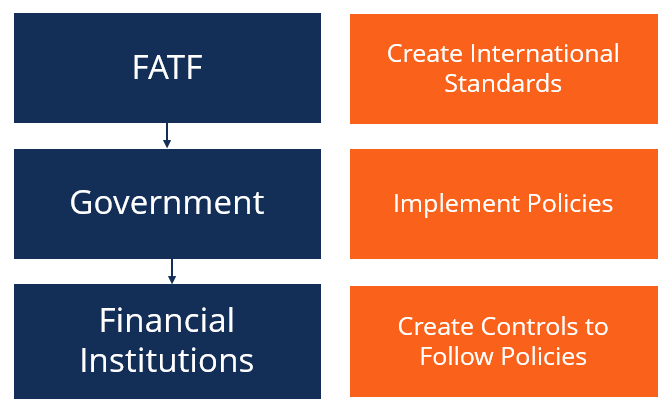

Banks were advised tofollow certain customer identification procedure for opening of accounts and monitoring transactions of a. These guidelines puts a duty on such intermediaries to enact policies and procedures to assist in the fight against money laundering which should include the communication of such group policies which relate to the anti-money laundering and illicit activities such as terrorist financing to all persons and employees involved in handling customer account information securities transactions client acceptance policy and CDD measures including requirements. Customer and Anti-Money Laundering measures with the approval of the Board is formulated and put in place. ANTI-MONEY LAUNDERING Prevention of Money Laundering Act 2002 KNOW YOUR CUSTOMER KYC Policy GUIDELINES IN BANK 3 4. In this regard banks may use for guidance in their own risk assessment a Report on Parameters for Risk-Based Transaction Monitoring RBTM dated March 30 2011 issued by Indian Banks Association on May 18 2011 as a supplement to their guidance note on Know Your Customer KYC norms Anti-Money Laundering AML standards issued in July 2009. 56 An intranet website on AML to share ideas experiences and case studies is in place.

Authorised Persons under Prevention of Money Laundering Act PMLA 2002 as amended by Prevention of Money Laundering Amendment Act 2009- Money changing activities Attention of Authorized persons is invited to the Anti-Money Laundering Guidelines governing money changing transactions issued vide AP.

This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. Authorised Persons under Prevention of Money Laundering Act PMLA 2002 as amended by Prevention of Money Laundering Amendment Act 2009- Money changing activities Attention of Authorized persons is invited to the Anti-Money Laundering Guidelines governing money changing transactions issued vide AP. Anti-Money Laundering training has been given the nature of the training and the names of the staff who have received the training. This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. 56 An intranet website on AML to share ideas experiences and case studies is in place. RBI is one of such authority which lays down anti-money laundering guidelines for banks and other financial institutions to adhere to.

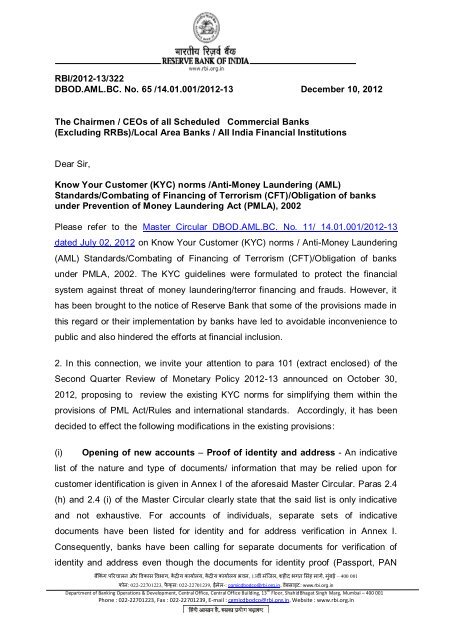

Facilitating opening of bank accounts for flood affected persons. UBDPCBCirNo6 09161002005-06 dated August 3 2005. Facilitating opening of bank accounts for flood affected persons. The policy was to lay down the systems and procedures to help control. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards.

Source: slidetodoc.com

Source: slidetodoc.com

In view of the increased concerns regarding money laundering. Know Your Customer KYC Guidelines Anti Money Laundering Standards Please refer to our circular DBOD. The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board. With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standards Prevention of Money Laundering Act 2002 that are consolidated in the Master Circular DNBS PD. Authorised Persons under Prevention of Money Laundering Act PMLA 2002 as amended by Prevention of Money Laundering Amendment Act 2009- Money changing activities Attention of Authorized persons is invited to the Anti-Money Laundering Guidelines governing money changing transactions issued vide AP.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Similarly SEBI has also prescribed certain requirements relating to Know Your Customer KYC norms for the financial intermediaries in securities market to follow to combat money laundering. AMLBC18 14010012002-2003 dated August 16 2002 on the guidelines on Know Your Customer norms. Know Your Customer KYC Guidelines - Anti-Money Laundering Standards - UCBs. Customer and Anti-Money Laundering measures with the approval of the Board is formulated and put in place. This Know Your Customer and Anti -Money Laundering P.

Facilitating opening of bank accountsfor flood affected persons. Facilitating opening of bank accountsfor flood affected persons. Authorised Persons under Prevention of Money Laundering Act PMLA 2002 as amended by Prevention of Money Laundering Amendment Act 2009- Money changing activities Attention of Authorized persons is invited to the Anti-Money Laundering Guidelines governing money changing transactions issued vide AP. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board.

Source: slideshare.net

Source: slideshare.net

Banks were advised tofollow certain customer identification procedure for opening of accounts and monitoring transactions of a. This Know Your Customer and Anti -Money Laundering P. RBI advised the banks to follow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature. The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standardsPrevention of Money Laundering Act 2002 that are consolidated in the. 56 An intranet website on AML to share ideas experiences and case studies is in place. Similarly SEBI has also prescribed certain requirements relating to Know Your Customer KYC norms for the financial intermediaries in securities market to follow to combat money laundering. Guidelines on Anti-Money Laundering AML Standards and Combating the Financing of Terrorism CFT Obligations of Securities Market Intermediaries under the Prevention of Money Laundering Act 2002 and Rules framed there under. The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering.

This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. Facilitating opening of bank accountsfor flood affected persons. 56 An intranet website on AML to share ideas experiences and case studies is in place. Know Your Customer KYC Guidelines Anti-Money Laundering Standards UCBs. Know Your Customer Guidelines Anti-Money laundering Standards UCBs.

Source: slidetodoc.com

Source: slidetodoc.com

Know Your Customer KYC Guidelines Anti-Money Laundering Standards UCBs. 56 An intranet website on AML to share ideas experiences and case studies is in place. RBI advised the banks to follow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature. Know Your Customer KYC Guidelines - Anti-Money Laundering Standards - UCBs. Previous instructions A list of circulars issued in this regard is given in Annex III.

The policy was to lay down the systems and procedures to help control. Similarly SEBI has also prescribed certain requirements relating to Know Your Customer KYC norms for the financial intermediaries in securities market to follow to combat money laundering. 56 An intranet website on AML to share ideas experiences and case studies is in place. The Prevention of Money Laundering Act PMLA 2002 is an Act of the. The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board.

Source: slideplayer.com

Source: slideplayer.com

56 An intranet website on AML to share ideas experiences and case studies is in place. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. These guidelines puts a duty on such intermediaries to enact policies and procedures to assist in the fight against money laundering which should include the communication of such group policies which relate to the anti-money laundering and illicit activities such as terrorist financing to all persons and employees involved in handling customer account information securities transactions client acceptance policy and CDD measures including requirements. With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standards Prevention of Money Laundering Act 2002 that are consolidated in the Master Circular DNBS PD. With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standardsPrevention of Money Laundering Act 2002 that are consolidated in the.

Source: authorstream.com

Source: authorstream.com

Facilitating opening of bank accounts for flood affected persons. The Prevention of Money Laundering Act PMLA 2002 is an Act of the. The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. Customer and Anti-Money Laundering measures with the approval of the Board is formulated and put in place. Know Your Customer KYC Guidelines - Anti-Money Laundering Standards - UCBs.

Source: yumpu.com

Source: yumpu.com

AMLBC18 14010012002-2003 dated August 16 2002 on the guidelines on Know Your Customer norms. MoneyGram Compliance Manual and Xpress Money. The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. AMLBC18 14010012002-2003 dated August 16 2002 on the guidelines on Know Your Customer norms. This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers.

Source: present5.com

Source: present5.com

UBDPCBCirNo6 09161002005-06 dated August 3 2005. In view of the increased concerns regarding money laundering. RBI ANTI-MONEY LAUNDERING GUIDELINES FOR AMCs MONEY CHANGING BUSINESS Reserve Bank of India has brought out detailed Anti-Money Laundering AML Guidelines to enable the AMCs to put in place the policy framework and systems for prevention of money laundering while undertaking money changing transactions. AMLBC18 14010012002-2003 dated August 16 2002 on the guidelines on Know Your Customer norms. UBDPCBCirNo6 09161002005-06 dated August 3 2005.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering guidelines by rbi by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas