18++ Anti money laundering guidelines malaysia info

Home » money laundering idea » 18++ Anti money laundering guidelines malaysia infoYour Anti money laundering guidelines malaysia images are ready. Anti money laundering guidelines malaysia are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering guidelines malaysia files here. Get all royalty-free photos and vectors.

If you’re searching for anti money laundering guidelines malaysia pictures information related to the anti money laundering guidelines malaysia topic, you have visit the ideal blog. Our website always provides you with suggestions for downloading the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Anti Money Laundering Guidelines Malaysia. High-Risk Jurisdictions subject to a Call for Action Jurisdictions under Increased Monitoring 21 February 2020. Indicator Relevant to Terrorist Financing 2017 Risk-Based Approach on Anti - Money Laundering and Countering the Financing of Terrorism AMLCFT for Reporting Institutions Supervised by Bank Negara Malaysia BNM and the Definition of Family Members and Close Associates of. The relevant statutes are laid out below segregated. The Guidelines on Anti-Money Laundering and Combating the Financing of Terrorism Guidelines are issued pursuant to section 66E and section 83 of the Anti-Money Laundering and Anti-Terrorism Financing Act 2001 AMLA.

Malaysia passed the Anti-Money Laundering and Anti-Terrorism Financing Act AMLATFA in 2001. AML Fines in Malaysia. Read More These documents are formulated in accordance with the provisions of the Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 AMLA. The relevant statutes are laid out below segregated. This policy document sets out obligations of reporting. The AML Policy Documents impose reporting institution obligations not only on financial institutions but also on non-financial businesses and professional service providers to the financial.

FATF Public Statement on 18 October 2019.

Indicator Relevant to Terrorist Financing 2017 Risk-Based Approach on Anti - Money Laundering and Countering the Financing of Terrorism AMLCFT for Reporting Institutions Supervised by Bank Negara Malaysia BNM and the Definition of Family Members and Close Associates of. Malaysia passed the Anti-Money Laundering and Anti-Terrorism Financing Act AMLATFA in 2001. AMLATFA is implemented by multi-law enforcement authorities led by the Central Bank of Malaysia ie. The Act defines the offenses of money laundering and the financing of terrorism and sets out the measures that financial institutions must take to detect and prevent those criminal activities. AML Fines in Malaysia. The Guidelines are established and formulated to.

Source: at-mia.my

Source: at-mia.my

The Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 AMLA is the primary piece of AMLCFT legislation in Malaysia. Indicator Relevant to Terrorist Financing 2017 Risk-Based Approach on Anti - Money Laundering and Countering the Financing of Terrorism AMLCFT for Reporting Institutions Supervised by Bank Negara Malaysia BNM and the Definition of Family Members and Close Associates of. Guidelines on Prevention of Money Laundering and Terrorism Financing for Reporting Institutions in the Capital Market pdf previously known as Guidelines on Prevention of Money Laundering and Terrorism Financing for Capital Market Intermediaries Date Issued. The AML Policy Documents impose reporting institution obligations not only on financial institutions but also on non-financial businesses and professional service providers to the financial. Malaysias Guidelines on Anti-Money Laundering was drawn up in accordance with the Anti-Money Laundering and Anti-Terrorism Financing Act 2001 AMLATFA.

Source: amlcft.bnm.gov.my

Source: amlcft.bnm.gov.my

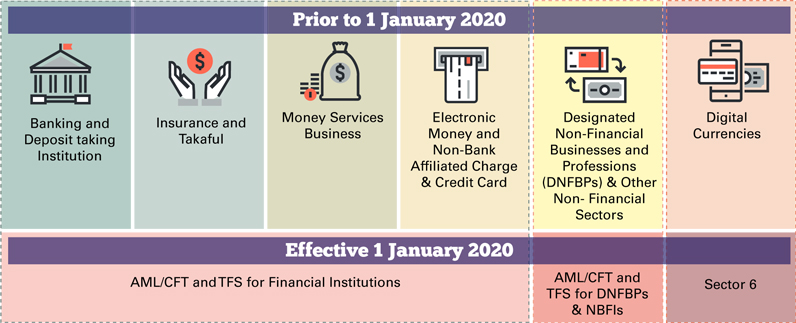

The Guidelines are established and formulated to. AMLATFA criminalizes money laundering. Read More These documents are formulated in accordance with the provisions of the Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 AMLA. AMLCFT and TFS Policy Documents relevant forms and templates for all sectors are provided as follow. This policy document sets out obligations of reporting.

Source: peps.org.my

Source: peps.org.my

The Act defines the offenses of money laundering and the financing of terrorism and sets out the measures that financial institutions must take to detect and prevent those criminal activities. FATF Public Statement on 21 June 2019. The AML Policy Documents impose reporting institution obligations not only on financial institutions but also on non-financial businesses and professional service providers to the financial. Anti-Money Laundering Counter Terrorism Financing. FATF Public Statement on 18 October 2019.

Source: en.ppt-online.org

Source: en.ppt-online.org

BNM has issued anti-money laundering guidelines policies and procedures under its Policy Documents on Anti-Money Laundering and Countering Financing of Terrorism AML Policy Documents. The Act defines the offenses of money laundering and the financing of terrorism and sets out the measures that financial institutions must take to detect and prevent those criminal activities. The Guidelines on Anti-Money Laundering and Combating the Financing of Terrorism Guidelines are issued pursuant to section 66E and section 83 of the Anti-Money Laundering and Anti-Terrorism Financing Act 2001 AMLA. BNM has issued anti-money laundering guidelines policies and procedures under its Policy Documents on Anti-Money Laundering and Countering Financing of Terrorism AML Policy Documents. FATF Public Statement on 21 June 2019.

Source: yumpu.com

Source: yumpu.com

FATF Public Statement on 18 October 2019. Different crimes under AMLATFA have different maximum penalties. AMLATFA is implemented by multi-law enforcement authorities led by the Central Bank of Malaysia ie. Malaysia passed the Anti-Money Laundering and Anti-Terrorism Financing Act AMLATFA in 2001. AMLCFT and TFS Policy Documents relevant forms and templates for all sectors are provided as follow.

Source: amlcft.bnm.gov.my

Source: amlcft.bnm.gov.my

FATF Public Statement on 21 June 2019. Anti-Money Laundering Countering Financing of Terrorism and Targeted Financial Sanctions for Financial Institutions AMLCFT and TFS for FIsNew - 3 May 2021. The maximum penalty for a money laundering offense under section 4 of the AMLATFA is 15 years imprisonment and a fine of not less than five times the offenses value. AMLATFA criminalizes money laundering. The relevant statutes are laid out below segregated.

BNM has issued anti-money laundering guidelines policies and procedures under its Policy Documents on Anti-Money Laundering and Countering Financing of Terrorism AML Policy Documents. Bank Negara Malaysia has issued the revised policy document on Anti-Money Laundering Countering Financing of Terrorism and Targeted Financial Sanctions for Designated Non-Financial Businesses and Professions DNFBPs Non-Bank Financial Institutions NBFIs AMLCFT and TFS for DNFBPs and NBFIs today. BNM has issued anti-money laundering guidelines policies and procedures under its Policy Documents on Anti-Money Laundering and Countering Financing of Terrorism AML Policy Documents. LAWS OF MALAYSIA Act 613 Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 Date of Royal Assent 25-Jun-2001 Date of publication in the Gazette 5-Jul-2001 An Act to provide for the offence of money laundering the measures to be taken for the prevention of money laundering and terrorism. The AML Policy Documents impose reporting institution obligations not only on financial institutions but also on non-financial businesses and professional service providers to the financial.

Read More These documents are formulated in accordance with the provisions of the Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 AMLA. For the purpose of complying with the Guidelines the Reporting Institution is required to make reference to-a the FATF Public Statement on jurisdictions subject to a FATF call on its members and other jurisdictions to apply counter-measures to protect the international financial system from the on-going and substantial MLTF risks emanating from such jurisdictionsb the FATF Public Statement- on jurisdictions with strategic anti-money laundering. This policy document sets out obligations of reporting. Indicator Relevant to Terrorist Financing 2017 Risk-Based Approach on Anti - Money Laundering and Countering the Financing of Terrorism AMLCFT for Reporting Institutions Supervised by Bank Negara Malaysia BNM and the Definition of Family Members and Close Associates of. AMLATFA is implemented by multi-law enforcement authorities led by the Central Bank of Malaysia ie.

Source: chengco.com.my

Source: chengco.com.my

The AML Policy Documents impose reporting institution obligations not only on financial institutions but also on non-financial businesses and professional service providers to the financial. The maximum penalty for a money laundering offense under section 4 of the AMLATFA is 15 years imprisonment and a fine of not less than five times the offenses value. Anti-Money Laundering Counter Terrorism Financing. The Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 AMLA is the primary piece of AMLCFT legislation in Malaysia. This policy document sets out obligations of reporting.

Source: amlcft.bnm.gov.my

Source: amlcft.bnm.gov.my

Anti-Money Laundering Countering Financing of Terrorism and Targeted Financial Sanctions for Financial Institutions AMLCFT and TFS for FIsNew - 3 May 2021. AMLATFA is implemented by multi-law enforcement authorities led by the Central Bank of Malaysia ie. The maximum penalty for a money laundering offense under section 4 of the AMLATFA is 15 years imprisonment and a fine of not less than five times the offenses value. AMLATFA criminalizes money laundering. FATF Public Statement on 18 October 2019.

Source: chengco.com.my

Source: chengco.com.my

Anti-Money Laundering Countering Financing of Terrorism and Targeted Financial Sanctions for Financial Institutions AMLCFT and TFS for FIsNew - 3 May 2021. For the purpose of complying with the Guidelines the Reporting Institution is required to make reference to-a the FATF Public Statement on jurisdictions subject to a FATF call on its members and other jurisdictions to apply counter-measures to protect the international financial system from the on-going and substantial MLTF risks emanating from such jurisdictionsb the FATF Public Statement- on jurisdictions with strategic anti-money laundering. AMLCFT Policies Issued by Bank Negara Malaysia. Anti-Money Laundering Counter Terrorism Financing. The maximum penalty for a money laundering offense under section 4 of the AMLATFA is 15 years imprisonment and a fine of not less than five times the offenses value.

Source: conventuslaw.com

Source: conventuslaw.com

For the purpose of complying with the Guidelines the Reporting Institution is required to make reference to-a the FATF Public Statement on jurisdictions subject to a FATF call on its members and other jurisdictions to apply counter-measures to protect the international financial system from the on-going and substantial MLTF risks emanating from such jurisdictionsb the FATF Public Statement- on jurisdictions with strategic anti-money laundering. Indicator Relevant to Terrorist Financing 2017 Risk-Based Approach on Anti - Money Laundering and Countering the Financing of Terrorism AMLCFT for Reporting Institutions Supervised by Bank Negara Malaysia BNM and the Definition of Family Members and Close Associates of. Malaysia passed the Anti-Money Laundering and Anti-Terrorism Financing Act AMLATFA in 2001. Bank Negara Malaysia BNM. AMLATFA criminalizes money laundering.

Source: bi.go.id

Source: bi.go.id

Anti-Money Laundering Counter Terrorism Financing. Different crimes under AMLATFA have different maximum penalties. AMLATFA criminalizes money laundering. The relevant statutes are laid out below segregated. The Act defines the offenses of money laundering and the financing of terrorism and sets out the measures that financial institutions must take to detect and prevent those criminal activities.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering guidelines malaysia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information