11++ Anti money laundering guidelines rbi ideas in 2021

Home » money laundering Info » 11++ Anti money laundering guidelines rbi ideas in 2021Your Anti money laundering guidelines rbi images are available in this site. Anti money laundering guidelines rbi are a topic that is being searched for and liked by netizens now. You can Find and Download the Anti money laundering guidelines rbi files here. Get all royalty-free photos.

If you’re looking for anti money laundering guidelines rbi images information related to the anti money laundering guidelines rbi keyword, you have visit the right site. Our website always provides you with suggestions for viewing the maximum quality video and image content, please kindly search and find more enlightening video articles and graphics that fit your interests.

Anti Money Laundering Guidelines Rbi. Know Your Customer KYC Guidelines - Anti-Money Laundering Standards - UCBs. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. The SEBI anti money laundering Guidelines have been. Identically RBI require financial institutions to appoint Compliance Officer to put in place anti money laundering compliance programs.

Legal Regime For Aml Anti Money Laundering From present5.com

Legal Regime For Aml Anti Money Laundering From present5.com

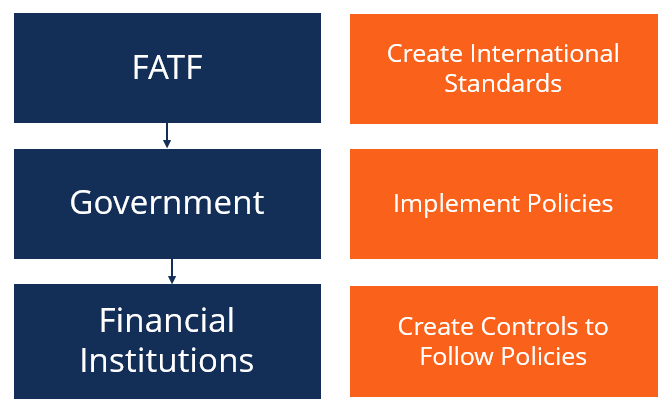

Know Your Customer Guidelines - Anti-Money laundering Standards - UCBs. The SEBI anti money laundering Guidelines have been. ANTI-MONEY LAUNDERING Prevention of Money Laundering Act 2002 KNOW YOUR CUSTOMER KYC Policy GUIDELINES IN BANK 3 4. Financial Institutions should remain compliant with guidelines laid down by Financial Action Task Force FATF. RBI advised the banks to follow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature. NBFCs were advised to ensure that they are fully compliant with the instructions before December 31 2005.

This Know Your Customer and Anti -Money Laundering P.

This has resulted in the implementation of rules on top of the statute. This has resulted in the implementation of rules on top of the statute. In view of the increased concerns regarding money laundering. RBI advised the banks to follow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature. The policy was to lay down the systems and procedures to help control. This Know Your Customer and Anti -Money Laundering P.

Source: authorstream.com

Source: authorstream.com

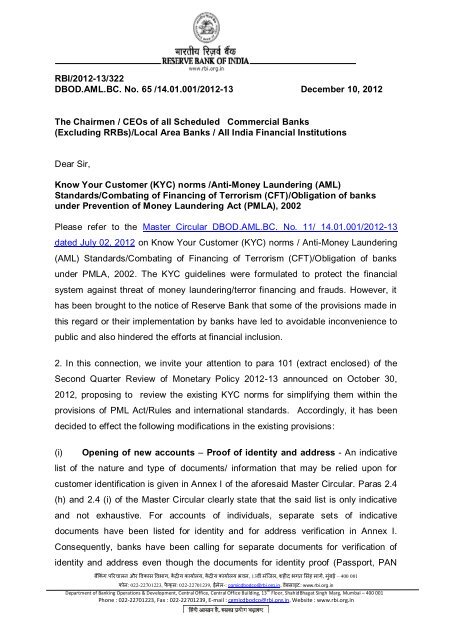

The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standardsCombating Financing of Terrorism CFTObligations of banks under PMLA 2002. NBFCs were advised to ensure that they are fully compliant with the instructions before December 31 2005. The policy was to lay down the systems and procedures to help control. Facilitating opening of bank accountsfor flood affected persons.

Source: slidetodoc.com

Source: slidetodoc.com

This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. Reserve Bank of India has issued regulatory guidelines on Know Your Customer KYC norms Anti Money Laundering AML Standards Combating of Financing of Terrorism CFT from time to time. RBI advised the banks to follow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature. The policy was to lay down the systems and procedures to help control. CAME professionals are the first line of defense to combat money laundering.

Source: slideshare.net

Source: slideshare.net

ANTI-MONEY LAUNDERING Prevention of Money Laundering Act 2002 KNOW YOUR CUSTOMER KYC Policy GUIDELINES IN BANK 3 4. The Reserve Bank of India RBI in consultation with the relevant government portfolios is in charge of prescribing the relevant procedure and manner for providing and maintaining the above-mentioned information. CAME professionals are the first line of defense to combat money laundering. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India.

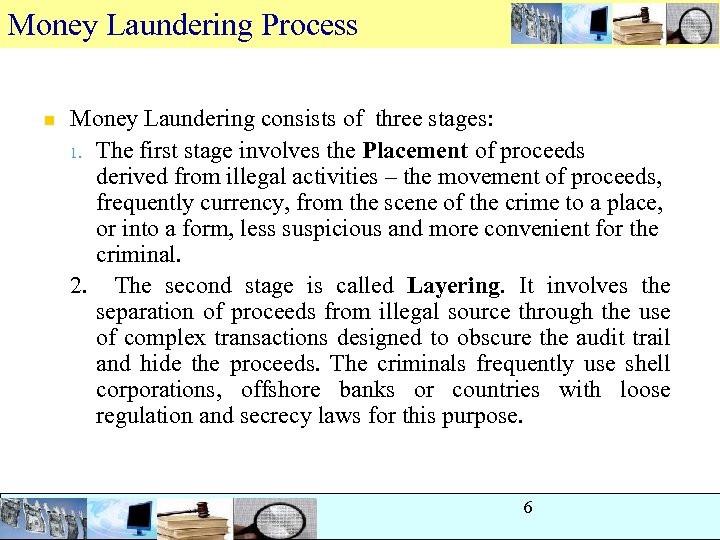

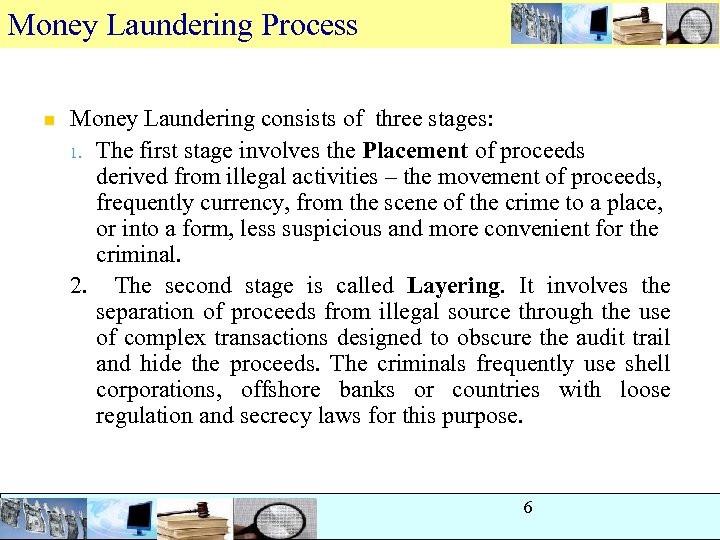

Know Your Customer and Anti-Money Laundering measures is formulated and put in place with the approval of the Board within three months of the date of this circular. There square measure 3 major steps in concealment placement layering and integration and varied controls square measure place in situ to watch suspicious activity that might be concerned in concealment. The objectiveof KYC guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money. In view of the increased concerns regarding money laundering. This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers.

This has resulted in the implementation of rules on top of the statute. This has resulted in the implementation of rules on top of the statute. While preparing operational guidelines NBFCs may bear in mind that. This Know Your Customer and Anti -Money Laundering P. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards.

Source: yumpu.com

Source: yumpu.com

With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standards Prevention of Money Laundering Act 2002 that are consolidated in the Master Circular DNBS PD CC No. This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. In view of the increased concerns regarding money laundering. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standards Prevention of Money Laundering Act 2002 that are consolidated in the Master Circular DNBS PD CC No.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The Reserve Bank of India RBI in consultation with the relevant government portfolios is in charge of prescribing the relevant procedure and manner for providing and maintaining the above-mentioned information. CAME professionals are the first line of defense to combat money laundering. In this regard banks may use for guidance in their own risk assessment a Report on Parameters for Risk-Based Transaction Monitoring RBTM dated March 30 2011 issued by Indian Banks Association on May 18 2011 as a supplement to their guidance note on Know Your Customer KYC norms Anti-Money Laundering AML standards issued in July 2009. Know Your Customer and Anti-Money Laundering measures is formulated and put in place with the approval of the Board within three months of the date of this circular. The Reserve Bank of India RBI in consultation with the relevant government portfolios is in charge of prescribing the relevant procedure and manner for providing and maintaining the above-mentioned information.

Source: slideserve.com

Source: slideserve.com

Guidelines on Know Your Customer norms And Anti-Money Laundering Measures Know Your Customer Standards 1. Facilitating opening of bank accountsfor flood affected persons. NBFCs were advised to ensure that they are fully compliant with the instructions before December 31 2005. The policy was to lay down the systems and procedures to help control. There square measure 3 major steps in concealment placement layering and integration and varied controls square measure place in situ to watch suspicious activity that might be concerned in concealment.

Source: slideplayer.com

Source: slideplayer.com

Identically RBI require financial institutions to appoint Compliance Officer to put in place anti money laundering compliance programs. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standardsCombating Financing of Terrorism CFTObligations of banks under PMLA 2002. Previous instructions A list of circulars issued in this regard is given in Annex III. This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India.

Source: slidetodoc.com

Source: slidetodoc.com

This Know Your Customer and Anti -Money Laundering P. This Know Your Customer and Anti -Money Laundering P. Reserve Bank of India has issued regulatory guidelines on Know Your Customer KYC norms Anti Money Laundering AML Standards Combating of Financing of Terrorism CFT from time to time. The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. ANTI-MONEY LAUNDERING Prevention of Money Laundering Act 2002 KNOW YOUR CUSTOMER KYC Policy GUIDELINES IN BANK 3 4.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Anti-money laundering refers to the laws rules and procedures purported to forestall criminals from disguising illicitly obtained funds as legitimate gain. Facilitating opening of bank accountsfor flood affected persons. This Know Your Customer and Anti -Money Laundering P. The SEBI anti money laundering Guidelines have been. There square measure 3 major steps in concealment placement layering and integration and varied controls square measure place in situ to watch suspicious activity that might be concerned in concealment.

Source: present5.com

Source: present5.com

The Reserve Bank of India RBI in consultation with the relevant government portfolios is in charge of prescribing the relevant procedure and manner for providing and maintaining the above-mentioned information. Guidelines on Know Your Customer norms And Anti-Money Laundering Measures Know Your Customer Standards 1. CAME professionals are the first line of defense to combat money laundering. The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board. Previous instructions A list of circulars issued in this regard is given in Annex III.

Source: slidetodoc.com

Source: slidetodoc.com

The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. This Know Your Customer and Anti -Money Laundering P. The SEBI anti money laundering Guidelines have been. Know Your Customer Guidelines - Anti-Money laundering Standards - UCBs. While preparing operational guidelines NBFCs may bear in mind that.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering guidelines rbi by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas