18+ Anti money laundering high risk customer types ideas in 2021

Home » money laundering idea » 18+ Anti money laundering high risk customer types ideas in 2021Your Anti money laundering high risk customer types images are available. Anti money laundering high risk customer types are a topic that is being searched for and liked by netizens today. You can Find and Download the Anti money laundering high risk customer types files here. Find and Download all royalty-free vectors.

If you’re looking for anti money laundering high risk customer types pictures information linked to the anti money laundering high risk customer types keyword, you have visit the ideal blog. Our site always provides you with hints for seeking the maximum quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

Anti Money Laundering High Risk Customer Types. If the entity is a government organisation that has its own AML compliance processes in place it may be flagged as low risk whereas a business where a high-ranking politician has beneficial ownership may be flagged as high risk. Customer Due Diligence CDD. High-risk customers including politically exposed persons. New customers carrying out large one-off transactions a customer whos been introduced to you - because.

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk From webnuk.wordpress.com

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk From webnuk.wordpress.com

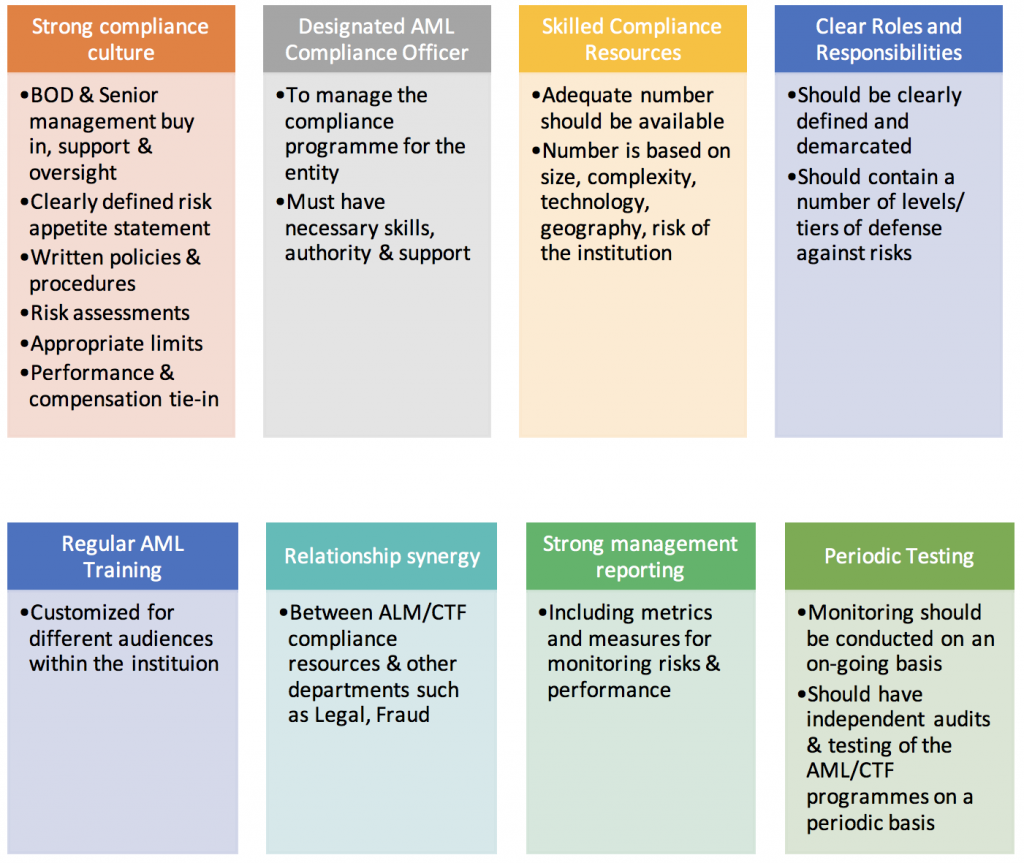

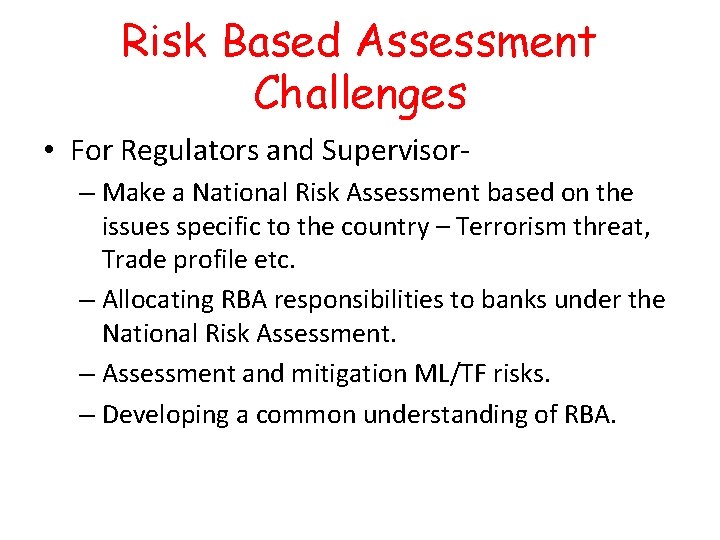

Identify and verify the identity of clients monitor transactions and report suspicious transactions. Carrying out a detailed risk assessment of the business including delivery channels products and locations Completing a risk assessment of all customers including types transactions customer behaviour. As a part of the assessment banks and FIs are required to carry out. Smaller banks viewed as high risk by at least four countries and that have been investigated for material AML breaches in at least one may also qualify for AMLA oversight as may large money services business and other non-bank financial institutions that operate in at least 10 EU nations and engage in sufficiently risky commerce. Cryptovirtual currency and money laundering. The premise behind the effort is clear.

Customers in these categories can pose an inherently high risk for money laundering.

This includes remote banking and payment services as well as currency exchanges and real estate transactions where the buyer is not present. Regulated firms are required to take a risk-based approach to customer due diligence and ongoing monitoring under the Money Laundering Regulations. If the entity is a government organisation that has its own AML compliance processes in place it may be flagged as low risk whereas a business where a high-ranking politician has beneficial ownership may be flagged as high risk. Prior experience with and knowledge of customer and hisherits transactions. High-risk customers including politically exposed persons. These indicators can reduce money laundering and terrorist financing in gaming and gambling businesses.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

High-Risk Delivery Channels Businesses that provide services to clients virtually and never actually meet them are at higher risk of being used for money laundering and terrorist financing. Some anti-money laundering controls include knowing your customers. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. Regulated firms are required to take a risk-based approach to customer due diligence and ongoing monitoring under the Money Laundering Regulations. Cryptovirtual currency and money laundering.

Source: acamstoday.org

Source: acamstoday.org

If the entity is a government organisation that has its own AML compliance processes in place it may be flagged as low risk whereas a business where a high-ranking politician has beneficial ownership may be flagged as high risk. This situation presents a higher risk of money laundering or terrorist financing because the money you receive will be a bulk transfer representing a collection of underlying transactions. Cryptovirtual currency and money laundering. Carrying out a detailed risk assessment of the business including delivery channels products and locations Completing a risk assessment of all customers including types transactions customer behaviour. Classification of the customers is done under three risk categories viz.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Similarly the following entities tend to be higher risk. CDD may have identified a handful of customers perceived to have a higher risk for example. Cryptovirtual currency and money laundering. The premise behind the effort is clear. As a result the gaming and gambling industry can adapt to AML OFAC compatibility programs.

Source: slideplayer.com

Source: slideplayer.com

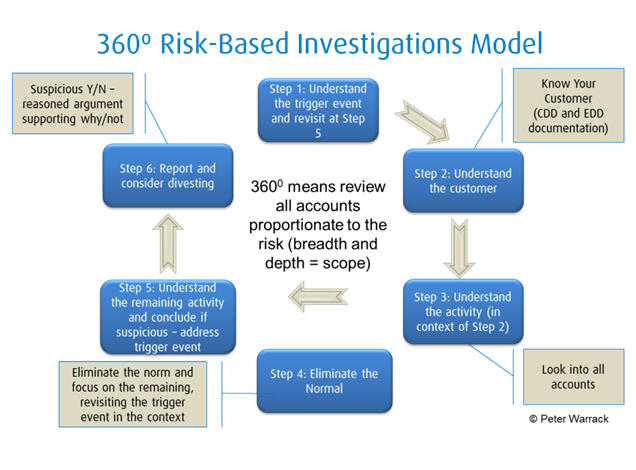

Customers in these categories can pose an inherently high risk for money laundering. Following these processes the analysts can create a customer risk profile relating to money laundering and terrorist financing. Customers in these categories can pose an inherently high risk for money laundering. Customer relationship pose money laundering and terrorist financing risk before the regulated financial institutions. Identify and verify the identity of clients monitor transactions and report suspicious transactions.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

Classification of the customers is done under three risk categories viz. New customers carrying out large one-off transactions a customer whos been introduced to you - because. Cryptovirtual currency and money laundering. Prior experience with and knowledge of customer and hisherits transactions. If the entity is a government organisation that has its own AML compliance processes in place it may be flagged as low risk whereas a business where a high-ranking politician has beneficial ownership may be flagged as high risk.

Source: ec.europa.eu

Source: ec.europa.eu

Nonresidents foreign customers or accounts for the benefit of people outside the country. Understanding risk within the Recommendation 12 context is important for two reasons. Nonresidents foreign customers or accounts for the benefit of people outside the country. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. Method channel of account opening eg.

Source: veriff.com

Source: veriff.com

Cryptovirtual currency and money laundering. Risk classification is an important parameter of the risk based kyc approach. Customers that might pose a risk Your business might be at risk of money laundering from. Prior experience with and knowledge of customer and hisherits transactions. As a result the gaming and gambling industry can adapt to AML OFAC compatibility programs.

Source: yumpu.com

Source: yumpu.com

Nonresidents foreign customers or accounts for the benefit of people outside the country. EDD is a more advanced type of KYC procedure for high-risk customers. Risk classification is an important parameter of the risk based kyc approach. Understanding risk within the Recommendation 12 context is important for two reasons. Customers that might pose a risk Your business might be at risk of money laundering from.

Source: en.ppt-online.org

Source: en.ppt-online.org

Understanding risk within the Recommendation 12 context is important for two reasons. High-Risk Delivery Channels Businesses that provide services to clients virtually and never actually meet them are at higher risk of being used for money laundering and terrorist financing. Prior experience with and knowledge of customer and hisherits transactions. Carrying out a detailed risk assessment of the business including delivery channels products and locations Completing a risk assessment of all customers including types transactions customer behaviour. Customers that might pose a risk Your business might be at risk of money laundering from.

Non-bank financial institutions such as money service businesses casinos and dealers. This includes remote banking and payment services as well as currency exchanges and real estate transactions where the buyer is not present. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management. Customers identity Socialfinancial status Nature of. Nonresidents foreign customers or accounts for the benefit of people outside the country.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

Nonresidents foreign customers or accounts for the benefit of people outside the country. Enhanced Due Diligence EDD. Cryptovirtual currency and money laundering. Occupation or nature of business. Regulated firms are required to take a risk-based approach to customer due diligence and ongoing monitoring under the Money Laundering Regulations.

Source: protiviti.com

Source: protiviti.com

Very Low Low Medium High and Very high values should be used. Cryptovirtual currency and money laundering. For example bitcoin ATMs can have holes with their AML compliance methods. Vulnerable to money laundering and terrorist financing MLTF risks and helps in the judicious and efficient allocation of resources to create a robust AML and CFT compliance programme. Understanding risk within the Recommendation 12 context is important for two reasons.

Source: slidetodoc.com

Source: slidetodoc.com

Vulnerable to money laundering and terrorist financing MLTF risks and helps in the judicious and efficient allocation of resources to create a robust AML and CFT compliance programme. The premise behind the effort is clear. And the degree of regulatory compliance by online cryptocurrency trading markets exchanges varies. Non-bank financial institutions such as money service businesses casinos and dealers. Face-to-face mail Internet Length of relationship with client.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering high risk customer types by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information