11++ Anti money laundering insurance policy ideas

Home » money laundering idea » 11++ Anti money laundering insurance policy ideasYour Anti money laundering insurance policy images are ready. Anti money laundering insurance policy are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering insurance policy files here. Get all free images.

If you’re searching for anti money laundering insurance policy images information linked to the anti money laundering insurance policy interest, you have visit the right site. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly search and locate more enlightening video content and images that match your interests.

Anti Money Laundering Insurance Policy. Anti-Money Laundering AML Compliance Program for Insurance Companies. The implementation of such rules is mandatory and overseen by regulatory authorities. Money Laundering Policy March 2014frIUoLiIJ UIiLcUIapb. The Companys key AMLCFT Policy Objectives are.

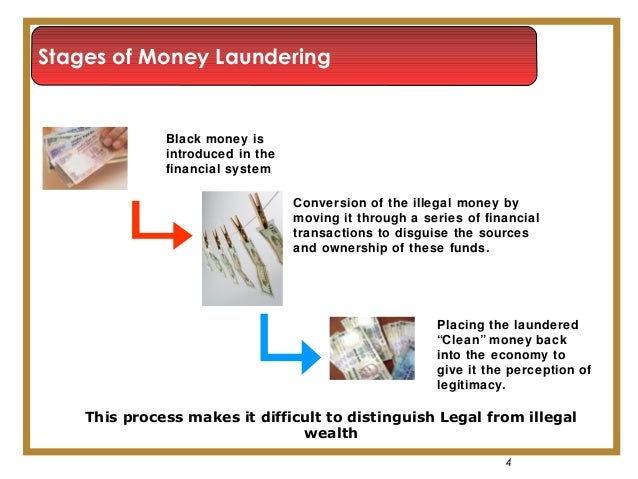

Emirates Insurance Company PSC. Accordingly governments and international authorities implement a range of anti-money laundering life insurance regulations and issue life insurance sanctions lists. Anti-Money Laundering AML Compliance Program for Insurance Companies. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. In order to maintain a comprehensive risk-based compliance program which has effective processes and procedures that comply with AML regulatory requirements the insurance company must abide by the following. 1 Introduction Put simply money laundering involves concealing the identity of illegally obtained money so that it appears to have come from a legal source.

Dealers from being used for money laundering and terrorist financing by criminals and terrorists.

Accordingly governments and international authorities implement a range of anti-money laundering life insurance regulations and issue life insurance sanctions lists. AXA Cooperative Insurance Company Anti Money Laundering and Combating Terrorism Financing Policy Page 2 A. Money Laundering Policy March 2014frIUoLiIJ UIiLcUIapb. This includes insurance fraud money laundering and more. This illegal money is derived from criminal activities such as the following. Anti-Money Laundering AML Compliance Program for Insurance Companies.

Source: slideshare.net

Source: slideshare.net

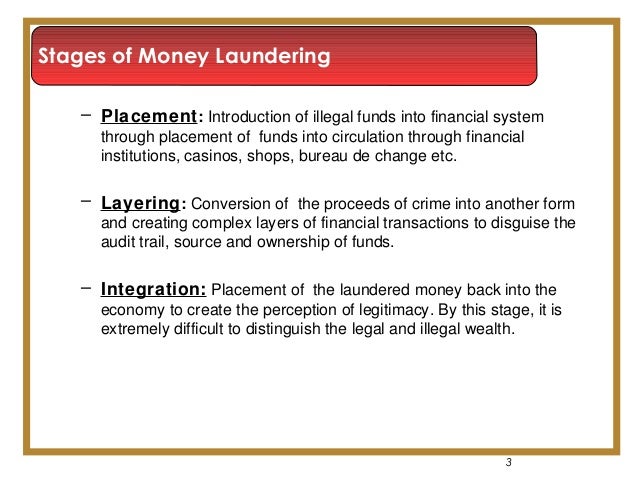

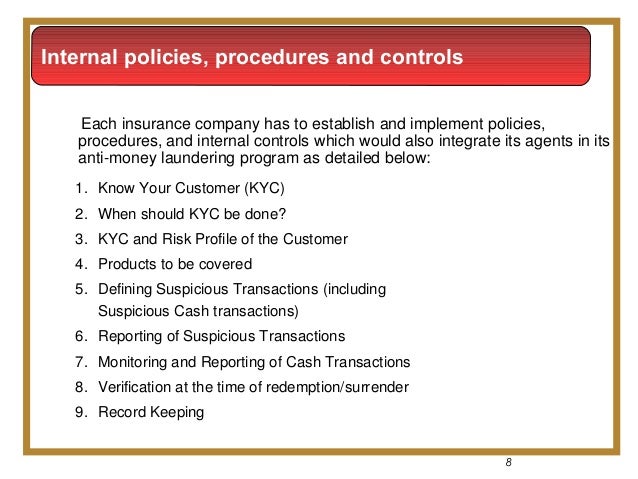

In order to maintain a comprehensive risk-based compliance program which has effective processes and procedures that comply with AML regulatory requirements the insurance company must abide by the following. For example a life insurance policy that can be cashed in is an attractive money laundering vehicle because it allows criminals to put dirty money in and take clean money out in the form of an insurance company check. 1 Introduction Put simply money laundering involves concealing the identity of illegally obtained money so that it appears to have come from a legal source. In the insurance industry KYC is important due to the potential risk of financial crimes. The final rule requires an insurance company that issues or underwrites covered products to develop and implement a written anti-money laundering program applicable to its covered products that is reasonably designed to prevent the insurance company from being used to facilitate money laundering.

Source: yumpu.com

Source: yumpu.com

For example a life insurance policy that can be cashed in is an attractive money laundering vehicle because it allows criminals to put dirty money in and take clean money out in the form of an insurance company check. Money Laundering Policy March 2014frIUoLiIJ UIiLcUIapb. The implementation of such rules is mandatory and overseen by regulatory authorities. The final rules apply to insurance companies that issue or underwrite certain products that present a high degree of risk for money laundering or the financing of terrorism. In order to maintain a comprehensive risk-based compliance program which has effective processes and procedures that comply with AML regulatory requirements the insurance company must abide by the following.

Source: slideshare.net

Source: slideshare.net

Home Investor Information Anti-Money Laundering Policy Global Insurance Settlements Funds PLC has implemented a policy which is intended to protect the firm its clients its employees and its systems from being used by criminals and terrorists in connection with criminal or terrorist activities. Insurance companies subject to these rules must establish an anti-money laundering program and start filing Suspicious Activity Reports 180 days after the date of the publication of the final rules in the Federal Register. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. Anti-money laundering policy is a combination of measures used by a financial institution to stop the reintroduction of the proceeds of illegal activities. Who regulates the process.

Source: letstalkaml.com

Source: letstalkaml.com

Insurance regulations only apply to insurance companies excluding agents and brokers from the requirements. Who regulates the process. This includes insurance fraud money laundering and more. In order to maintain a comprehensive risk-based compliance program which has effective processes and procedures that comply with AML regulatory requirements the insurance company must abide by the following. Anti-Money Laundering AML Compliance Program for Insurance Companies.

Source: researchgate.net

Source: researchgate.net

What is an AML policy. What is an AML policy. The program must be approved by senior management and made available to the Department of the Treasury or. Insurance companies that issue or underwrite covered products that may pose a higher risk of money laundering must comply with Bank Secrecy Actanti-money laundering BSAAML program requirements. Introduction AXA Cooperative Insurance Company ACIC is providing General and Life Insurance in Saudi Arabia.

Source: slideshare.net

Source: slideshare.net

Introduction AXA Cooperative Insurance Company ACIC is providing General and Life Insurance in Saudi Arabia. Anti-Money Laundering AML Compliance Program for Insurance Companies. Anti-Money Laundering and Counter-Terrorism Financing Systems and Controls Central Bullion Ltd is required under the Money Laundering Regulations 2017 to put in place appropriate systems and controls to forestall money laundering and terrorist financing. Home Investor Information Anti-Money Laundering Policy Global Insurance Settlements Funds PLC has implemented a policy which is intended to protect the firm its clients its employees and its systems from being used by criminals and terrorists in connection with criminal or terrorist activities. The final rule requires an insurance company that issues or underwrites covered products to develop and implement a written anti-money laundering program applicable to its covered products that is reasonably designed to prevent the insurance company from being used to facilitate money laundering.

Anti-money laundering policy is a combination of measures used by a financial institution to stop the reintroduction of the proceeds of illegal activities. With compliance penalties including fines and prison terms life insurance firms should ensure they understand their obligations and how to implement them as part of their AML policy. This includes insurance fraud money laundering and more. In order to maintain a comprehensive risk-based compliance program which has effective processes and procedures that comply with AML regulatory requirements the insurance company must abide by the following. Anti-Money Laundering AML Compliance Program for Insurance Companies.

Who regulates the process. The Companys key AMLCFT Policy Objectives are. Anti-money laundering policy is a combination of measures used by a financial institution to stop the reintroduction of the proceeds of illegal activities. Regulations issued by the Treasury. In the insurance industry it is possible for someone to use illegitimate funds to purchase an expensive policy.

Source: researchgate.net

Source: researchgate.net

Emirates Insurance Company PSC. The insurance company should develop risk-based policies and. The final rules apply to insurance companies that issue or underwrite certain products that present a high degree of risk for money laundering or the financing of terrorism. The purpose of this policy is to establish the general framework for the fight against money laundering and terrorism financing throughout the KBC Group. The Companys key AMLCFT Policy Objectives are.

Source: slideshare.net

Source: slideshare.net

Introduction AXA Cooperative Insurance Company ACIC is providing General and Life Insurance in Saudi Arabia. Home Investor Information Anti-Money Laundering Policy Global Insurance Settlements Funds PLC has implemented a policy which is intended to protect the firm its clients its employees and its systems from being used by criminals and terrorists in connection with criminal or terrorist activities. Introduction AXA Cooperative Insurance Company ACIC is providing General and Life Insurance in Saudi Arabia. To prevent the Companys services from being used as a channel for Money Laundering Terrorism Funding. Anti-Money Laundering AMLCFT.

Source: docplayer.net

Source: docplayer.net

In the insurance industry KYC is important due to the potential risk of financial crimes. Insurance companies subject to these rules must establish an anti-money laundering program and start filing Suspicious Activity Reports 180 days after the date of the publication of the final rules in the Federal Register. The Companys key AMLCFT Policy Objectives are. Anti-Money Laundering and Counter-Terrorism Financing Systems and Controls Central Bullion Ltd is required under the Money Laundering Regulations 2017 to put in place appropriate systems and controls to forestall money laundering and terrorist financing. Home Investor Information Anti-Money Laundering Policy Global Insurance Settlements Funds PLC has implemented a policy which is intended to protect the firm its clients its employees and its systems from being used by criminals and terrorists in connection with criminal or terrorist activities.

Source: legal.thomsonreuters.com

Source: legal.thomsonreuters.com

PLATINUM INSURANCE BROKER LLC constantly strives itself to meet with the Central Bank of United Arab Emirates Anti Money Laundering Regulations Conventions to the fullest extent. Anti Money Laundering AML in the Insurance Sector. This illegal money is derived from criminal activities such as the following. Perhaps one of the reasons why the introduction of anti-money laundering legislation and the consequent obligation to implement relative internal procedures and controls did not really cause as many challenges as perhaps other financial institutions experienced is that insurers already had risk assessment procedures indirectly incorporating features very similar to anti-money laundering. These are the Anti-Money Laundering ALM Policy and Procedures adopted by Klapton Insurance Company in compliance with Klaptons internal policies and regulatory obligations and The business will actively prevent and take measures to guard against being used as a medium for money laundering activities and terrorism financing activities and any other activity that facilitates money laundering or.

Source: alten.com

Source: alten.com

Insurance companies that issue or underwrite covered products that may pose a higher risk of money laundering must comply with Bank Secrecy Actanti-money laundering BSAAML program requirements. AXA Cooperative Insurance Company Anti Money Laundering and Combating Terrorism Financing Policy Page 2 A. Insurance companies that issue or underwrite covered products that may pose a higher risk of money laundering must comply with Bank Secrecy Actanti-money laundering BSAAML program requirements. Anti-Money Laundering and Counter-Terrorism Financing Systems and Controls Central Bullion Ltd is required under the Money Laundering Regulations 2017 to put in place appropriate systems and controls to forestall money laundering and terrorist financing. The Act requires insurance companies and broker dealers FINRA Rule 3310 to establish anti-money laundering AML programs that comply with minimum standards developed by the Department of the Treasury.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information