12+ Anti money laundering know your customer 2017 book pdf ideas in 2021

Home » money laundering Info » 12+ Anti money laundering know your customer 2017 book pdf ideas in 2021Your Anti money laundering know your customer 2017 book pdf images are ready in this website. Anti money laundering know your customer 2017 book pdf are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering know your customer 2017 book pdf files here. Find and Download all royalty-free images.

If you’re searching for anti money laundering know your customer 2017 book pdf images information linked to the anti money laundering know your customer 2017 book pdf topic, you have pay a visit to the right blog. Our site frequently gives you hints for seeking the highest quality video and picture content, please kindly search and locate more informative video articles and graphics that fit your interests.

Anti Money Laundering Know Your Customer 2017 Book Pdf. The Company shall follow customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature for the purpose of reporting it to appropriate authority. The policy is based on Anti Money Laundering AML standards. Adoption of appropriate know-your-customer KYC procedures within individual banks is an essential part of risk management in banks to safeguard the confidence and the integrity of banking systems. They may be small.

Anti Money Laundering Know Your Customer 2010 Book Pdf Laskoom From laskoom.blogspot.com

Anti Money Laundering Know Your Customer 2010 Book Pdf Laskoom From laskoom.blogspot.com

Increasingly correspondent banks are paying greater attention to their respondents Anti-Money Laundering Combating the. The funds and property may be from either legitimate or criminal sources. Anti-money laundering Know our customer and curbing the Financing of Terrorism 11 Purpose This document provides a contextual background to the issues around customer registration money laundering and terrorist financing with a focus on the interna. They may be small. In addition the book suggests a model system and offers deep insights into the methodology laws working rules and principles of the implementation of the AML and KYC systems. A Typical Money-Laundering Scheme Terrorism financing Terrorist financing involves dealing with money or property that may be used for financing terrorist activities.

The broad objective of KYC policy is to implement a well defined customer acceptance customer care and customer severance policy to ensure prompts and inclusive services to all customers within the.

On 15 November 2017 The Anti-Money Laundering Council AMLC issued AMLC Resolution No. KNOW YOUR CUSTOMER KYC AND ANTI MONEY LAUNDERING MEASURES POLICY INSTRUCTIONS As amended in the Board dated 12th October 2017 Objectives. Framework on Know Your Customer and Anti-Money Laundering measures with the approval of the Board is formulated and put in place. On 8 December 2017 the Executive Director of the AMLC Secretariat issued ARI A No. Read Anti-Money Laundering Know Your Customer book reviews author details and more at Amazonin. The book provides the theoretical background on the subject and practical steps for banks implementing an AMLKYC regime in accordance with international standards.

The policy is based on Anti Money Laundering AML standards. Increasingly correspondent banks are paying greater attention to their respondents Anti-Money Laundering Combating the. Adoption of appropriate know-your-customer KYC procedures within individual banks is an essential part of risk management in banks to safeguard the confidence and the integrity of banking systems. The Company shall follow customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature for the purpose of reporting it to appropriate authority. This text provides exhaustive knowledge to the concerned personnel about the implementation of the AML and KYC systems by financial institutions.

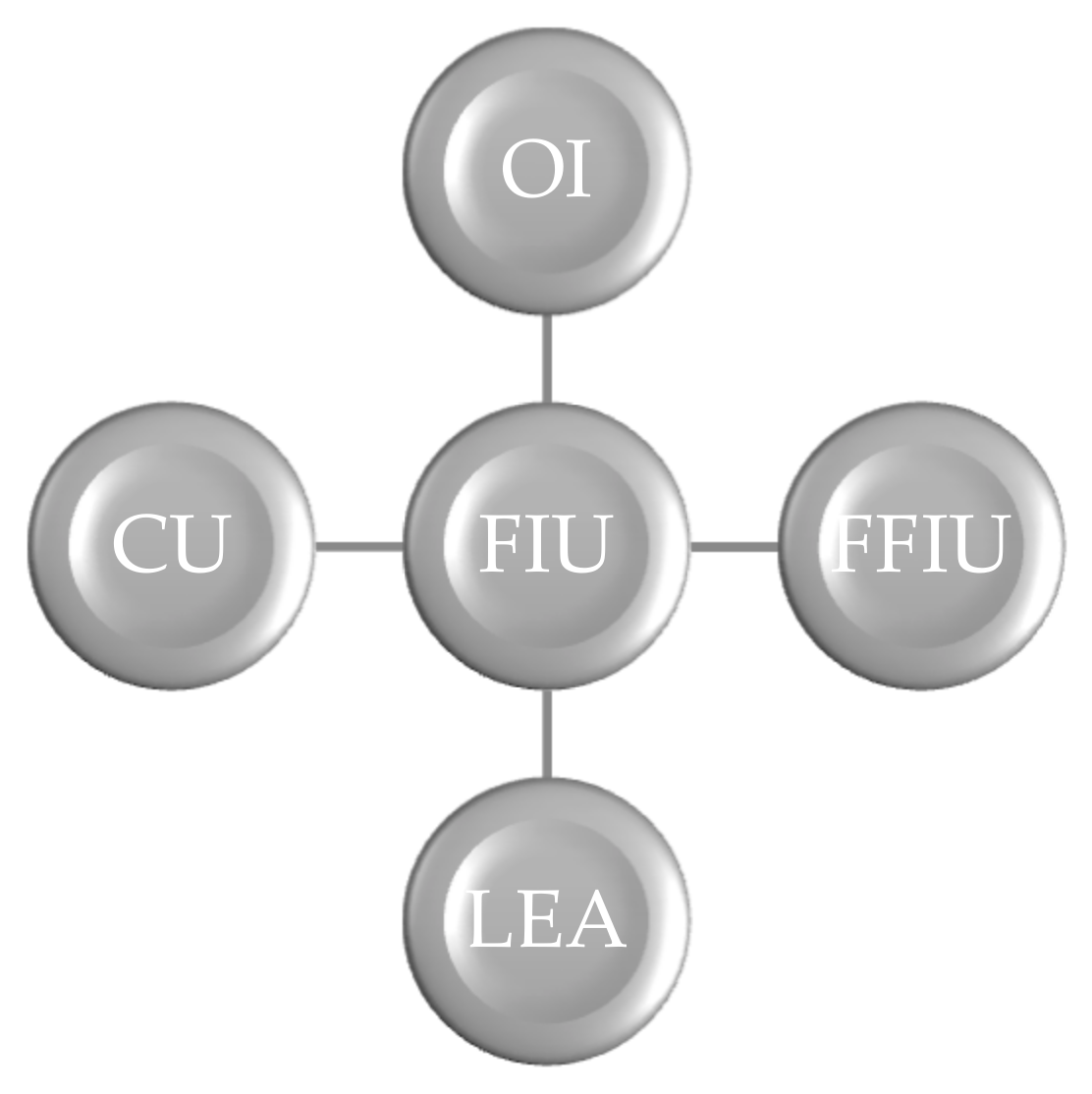

Source: researchgate.net

Source: researchgate.net

The textbook Anti-Money Laundering Know Your Customer published by Macmillan Publication is a recommended guide for aspirants of upcoming JAIIB Diploma in Banking and Finance. 107 series of 2017 approving the AMLC Registration and Reporting Guidelines. In addition the book suggests a model system and offers deep insights into the methodology laws working rules and principles of the implementation of the AML and KYC systems. The broad objective of KYC policy is to implement a well defined customer acceptance customer care and customer severance policy to ensure prompts and inclusive services to all customers within the. KNOW YOUR CUSTOMER KYC AND ANTI MONEY LAUNDERING MEASURES POLICY INSTRUCTIONS As amended in the Board dated 12th October 2017 Objectives.

Buy CAIIB books and JAIIB books for exam 2018 with 50 discount with home delivery services l OnlineBooksStorein June 2021 Get upto 50 discount on CAIIB Books and JAIIB books on the famous books of N S Toor and many others as per the lastest syllabus of IIBF to examine latest banking laws Practice and latest procedures followed by Banks. 107 series of 2017 approving the AMLC Registration and Reporting Guidelines. Increasingly correspondent banks are paying greater attention to their respondents Anti-Money Laundering Combating the. On 15 November 2017 The Anti-Money Laundering Council AMLC issued AMLC Resolution No. Read Anti-Money Laundering Know Your Customer book reviews author details and more at Amazonin.

Source: mdpi.com

Source: mdpi.com

Gaming industry is one of the most heavily regulated and controlled business sectors across the globe. This text provides exhaustive knowledge to the concerned personnel about the implementation of the AML and KYC systems by financial institutions. On 15 November 2017 The Anti-Money Laundering Council AMLC issued AMLC Resolution No. The textbook Anti-Money Laundering Know Your Customer published by Macmillan Publication is a recommended guide for aspirants of upcoming JAIIB Diploma in Banking and Finance. Anti money laundering book pdf.

Information collected from the customer for the purpose of opening of account shall be kept. Gaming industry is one of the most heavily regulated and controlled business sectors across the globe. The KYC or Know Your Customer procedure is one such important step taken by various financial institutions that is aimed at reducing financial risks for banks as a means to securing its financial systems. Anti-Money Laundering Know Your Customer by Indian Institute Of Banking Finance is a book that aims at eliminating money laundering and setting up the guidelines for Know Your Customer KYC norms. Based on the experience gained over the past year the Anti-Money Laundering Policy the Policy is.

Source: law-all.com

Source: law-all.com

Anti-Money Laundering Know Your Customer explains in a clear and concise manner the elements needed to build effective AML and KYC systems according to international guidelines. Audit and assurance consulting and tax services. The information we require is set out below. Anti money laundering book pdf. The scope has now been strengthened by the Securities.

Source: amazon.com

Source: amazon.com

Framework on Know Your Customer and Anti-Money Laundering measures with the approval of the Board is formulated and put in place. Best Practices for Anti-Money Laundering Compliance 2017 3 INTRODUCTION The US. Gaming operations are subject to federal anti-money laundering AML requirements. In the 2017 Correspondent Banking in Emerging Markets Survey2 of over 300 banking clients in 92 countries more than a quarter of global survey participants claimed reductions in correspondent banking relationships CBRs. 107 series of 2017 approving the AMLC Registration and Reporting Guidelines.

Source: researchgate.net

Source: researchgate.net

Gaming operations are subject to federal anti-money laundering AML requirements. 4 series of 2017. Purpose The purpose of this paper is to assess the effectiveness of anti-money laundering AML reporting system in India in terms of Suspicious Transaction Reports STRs and its impact on. Information collected from the customer for the purpose of opening of account shall be kept. The Company shall follow customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature for the purpose of reporting it to appropriate authority.

Source: laskoom.blogspot.com

Source: laskoom.blogspot.com

KNOW YOUR CUSTOMER KYC AND ANTI MONEY LAUNDERING MEASURES POLICY INSTRUCTIONS As amended in the Board dated 12th October 2017 Objectives. Buy CAIIB books and JAIIB books for exam 2018 with 50 discount with home delivery services l OnlineBooksStorein June 2021 Get upto 50 discount on CAIIB Books and JAIIB books on the famous books of N S Toor and many others as per the lastest syllabus of IIBF to examine latest banking laws Practice and latest procedures followed by Banks. Anti-Money Laundering Know Your Customer explains in a clear and concise manner the elements needed to build effective AML and KYC systems according to international guidelines. The book Anti-Money Laundering Know Your Customer gives the hypothetical foundation regarding the matter and functional strides for banks implementing an. 4 series of 2017.

Source: anyflip.com

Source: anyflip.com

4 series of 2017. Information collected from the customer for the purpose of opening of account shall be kept. In addition to comprehensive and stringent state gaming regulations US. Anti-Money Laundering Know Your Customer explains in a clear and concise manner the elements needed to build effective AML and KYC systems according to international guidelines. Based on the experience gained over the past year the Anti-Money Laundering Policy the Policy is.

Buy CAIIB books and JAIIB books for exam 2018 with 50 discount with home delivery services l OnlineBooksStorein June 2021 Get upto 50 discount on CAIIB Books and JAIIB books on the famous books of N S Toor and many others as per the lastest syllabus of IIBF to examine latest banking laws Practice and latest procedures followed by Banks. KNOW YOUR CUSTOMER KYC AND ANTI MONEY LAUNDERING MEASURES POLICY INSTRUCTIONS As amended in the Board dated 12th October 2017 Objectives. Introduction Money laundering is a way of converting the proceeds of crime into assets that appear to have a legitimate origin. 4 series of 2017. Gaming industry is one of the most heavily regulated and controlled business sectors across the globe.

Source: onlinebooksstore.in

Source: onlinebooksstore.in

Best Practices for Anti-Money Laundering Compliance 2017 3 INTRODUCTION The US. A Typical Money-Laundering Scheme Terrorism financing Terrorist financing involves dealing with money or property that may be used for financing terrorist activities. The textbook Anti-Money Laundering Know Your Customer published by Macmillan Publication is a recommended guide for aspirants of upcoming JAIIB Diploma in Banking and Finance. KNOW YOUR CUSTOMER KYC AND ANTI MONEY LAUNDERING MEASURES POLICY INSTRUCTIONS As amended in the Board dated 12th October 2017 Objectives. Read Anti-Money Laundering Know Your Customer book reviews author details and more at Amazonin.

Source: researchgate.net

Source: researchgate.net

Based on the experience gained over the past year the Anti-Money Laundering Policy the Policy is. The broad objective of KYC policy is to implement a well defined customer acceptance customer care and customer severance policy to ensure prompts and inclusive services to all customers within the. The book provides the theoretical background on the subject and practical steps for banks implementing an AMLKYC regime in accordance with international standards. Anti-Money Laundering Know Your Customer by Indian Institute Of Banking Finance is a book that aims at eliminating money laundering and setting up the guidelines for Know Your Customer KYC norms. Accordingly EFL put in place a KYC AMLA Policy with the approval of the Board on 18 Oct 2012.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering know your customer 2017 book pdf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas