10++ Anti money laundering process flow ideas

Home » money laundering Info » 10++ Anti money laundering process flow ideasYour Anti money laundering process flow images are ready. Anti money laundering process flow are a topic that is being searched for and liked by netizens now. You can Find and Download the Anti money laundering process flow files here. Find and Download all royalty-free photos.

If you’re looking for anti money laundering process flow pictures information related to the anti money laundering process flow topic, you have come to the ideal site. Our website frequently gives you hints for viewing the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that match your interests.

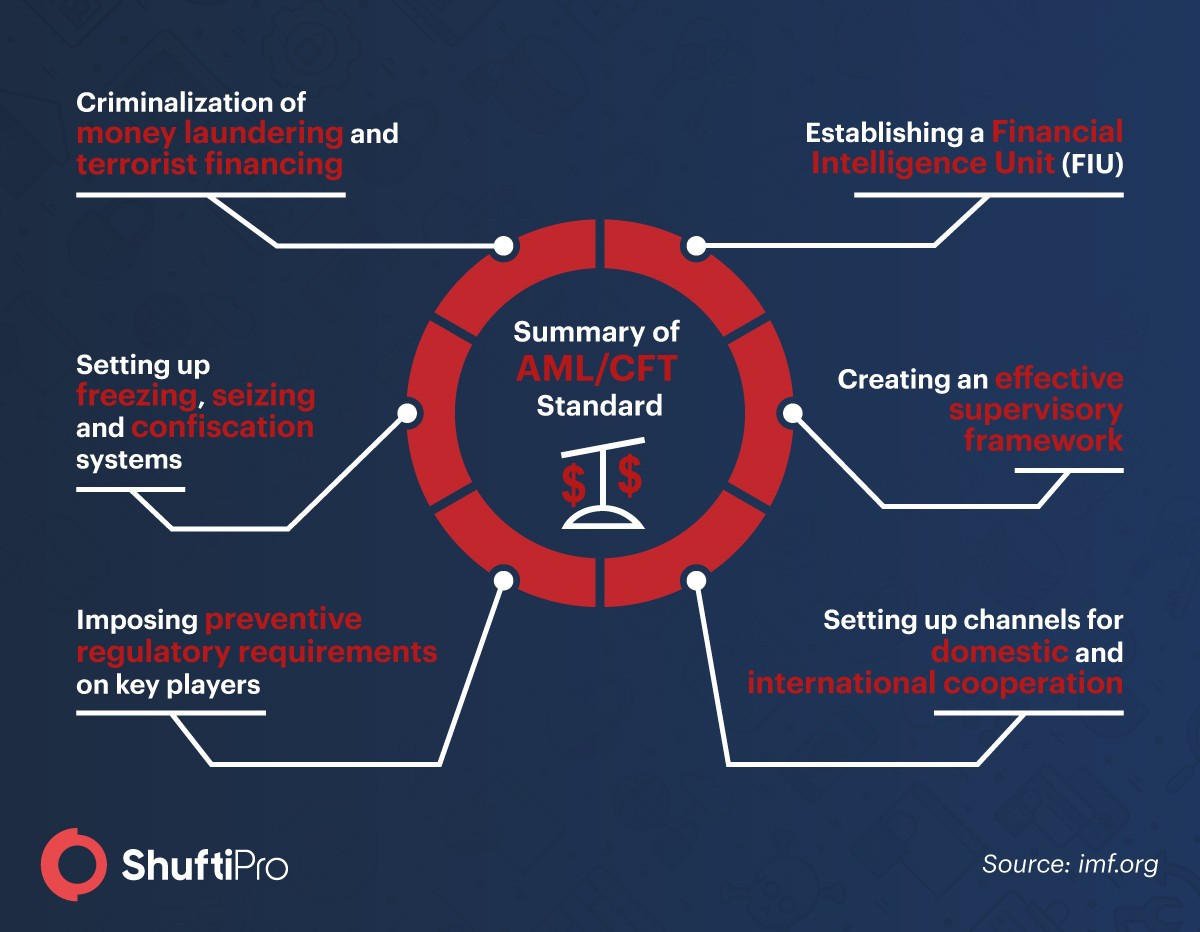

Anti Money Laundering Process Flow. However it is important to remember that money laundering is a single process. The stages of money laundering include the. The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation. Ad Lucidcharts process diagram software is quick easy to use.

Implementation Of Aml Compliance Challenges And Fundamentals From shuftipro.com

Implementation Of Aml Compliance Challenges And Fundamentals From shuftipro.com

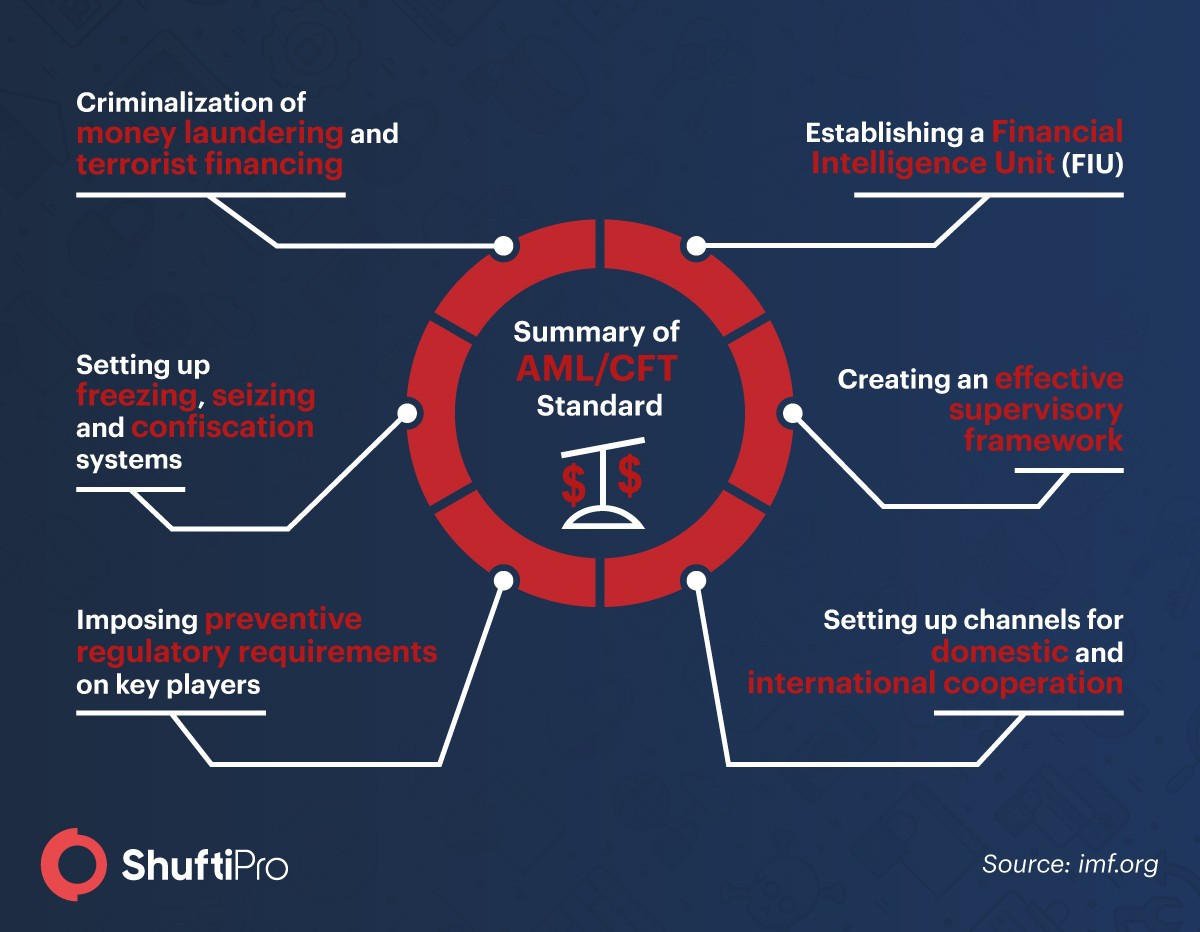

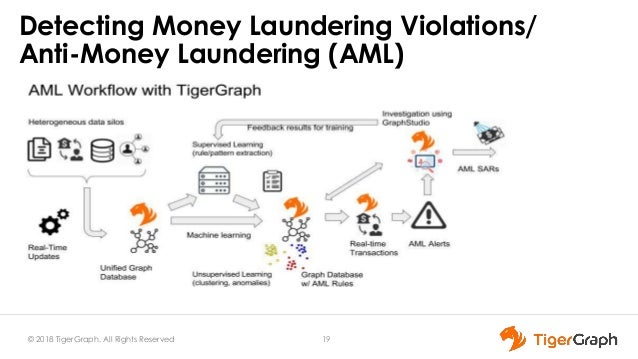

The AML Transaction Monitoring process is a legal requirement for businesses under AML obligations. At the first stage illegal money is placed at a bank account. The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation. Most notably HSBC for violating the Bank Secrecy Act. Though these laws cover a relatively limited range of transactions and. In the third stage money flows back to the beneficiary.

Notable money laundering scandal.

Enhanced due diligence EDD with respect to these transactions may result in escalation and the generation of a suspicious activity report SAR. Money laundering is the process of concealing the illicit origin of proceeds of crimes. In the third stage money flows back to the beneficiary. Because money laundering is a key part of terrorist organizations that are usually funded through illegal enterprises the FATF was also charged with directly fighting to cut off illegal cash flows to terrorists and terrorist groups. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. Most notably HSBC for violating the Bank Secrecy Act.

Source: pinterest.com

Source: pinterest.com

Depending on the risk classification of the client there should be an ongoingannual review of the clients transactional activities if you want to properly adhere to the AML KYC process flow. Enhanced due diligence EDD with respect to these transactions may result in escalation and the generation of a suspicious activity report SAR. Under anti-money laundering AML guidelines both entities are considered suspicious and should be subjects of an investigation. These regimes aim to increase awareness of the phenomenon both within the government and the private business sector and then to provide the necessary legal or regulatory tools to the authorities charged with combating the problem. In the third stage money flows back to the beneficiary.

Source: shuftipro.com

Source: shuftipro.com

At the first stage illegal money is placed at a bank account. At the first stage illegal money is placed at a bank account. Financial Institutions can control billions of transactions instantly by automating the transaction monitoring process flow. The regulations provide for cooperation between the supervisory authorities or for a single authority to take. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities.

Source: kyc2020.com

Source: kyc2020.com

For high-risk clients the average process is to conduct a know your customer review once a year or twice a year. 2 Anti-Money Laundering Regulations In general the money laundering process consists of three stages. Notable money laundering scandal. At the first stage illegal money is placed at a bank account. Millions of financial transactions take place around the world a day.

Source: scryanalytics.ai

Source: scryanalytics.ai

In the third stage money flows back to the beneficiary. Anti-Money Laundering Supervision START YES YES YES NO NO NO BOX 2 Where you are under the jurisdiction of more than one supervisory authority you may be subject to supervision for money laundering purposes by more than one. The regulations provide for cooperation between the supervisory authorities or for a single authority to take. In the third stage money flows back to the beneficiary. Anti-money laundering AML refers to a set of laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income.

Source: equbecompliance.com

Source: equbecompliance.com

In the case of money laundering the funds are always of illicit origin whereas in the case of terrorist financing funds can stem from both legal and illicit sources. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. However it is important to remember that money laundering is a single process. Financial Institutions can control billions of transactions instantly by automating the transaction monitoring process flow. For high-risk clients the average process is to conduct a know your customer review once a year or twice a year.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The money laundering cycle can be broken down into three distinct stages. Money laundering became the concern for the banks when regulators imposed heavy fines on banks. Terrorist financing is the collection or the provision of funds for terrorist purposes. For high-risk clients the average process is to conduct a know your customer review once a year or twice a year. Millions of financial transactions take place around the world a day.

Source: slideshare.net

Source: slideshare.net

These regimes aim to increase awareness of the phenomenon both within the government and the private business sector and then to provide the necessary legal or regulatory tools to the authorities charged with combating the problem. Operations are designed to take the proceeds of illegal activity such as profits from drug trafficking and cause them to appear to come from legitimate sources. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. For high-risk clients the average process is to conduct a know your customer review once a year or twice a year. Enhanced due diligence EDD with respect to these transactions may result in escalation and the generation of a suspicious activity report SAR.

Source: slideteam.net

Source: slideteam.net

Because money laundering is a key part of terrorist organizations that are usually funded through illegal enterprises the FATF was also charged with directly fighting to cut off illegal cash flows to terrorists and terrorist groups. Millions of financial transactions take place around the world a day. At the first stage illegal money is placed at a bank account. Anti-Money Laundering Supervision START YES YES YES NO NO NO BOX 2 Where you are under the jurisdiction of more than one supervisory authority you may be subject to supervision for money laundering purposes by more than one. Money laundering is the process by which criminals attempt to disguise illicit assets as legitimate assets that they have a right to possess and spend AUSTRAC 2011.

Source: researchgate.net

Source: researchgate.net

Terrorist financing is the collection or the provision of funds for terrorist purposes. Ad Lucidcharts process diagram software is quick easy to use. At the first stage illegal money is placed at a bank account. Money laundering is the process by which criminals attempt to disguise illicit assets as legitimate assets that they have a right to possess and spend AUSTRAC 2011. Most notably HSBC for violating the Bank Secrecy Act.

Source: redhat.com

These regimes aim to increase awareness of the phenomenon both within the government and the private business sector and then to provide the necessary legal or regulatory tools to the authorities charged with combating the problem. Because money laundering is a key part of terrorist organizations that are usually funded through illegal enterprises the FATF was also charged with directly fighting to cut off illegal cash flows to terrorists and terrorist groups. Because money laundering is a key part of terrorist organizations that are. Money laundering is the process by which criminals attempt to disguise illicit assets as legitimate assets that they have a right to possess and spend AUSTRAC 2011. A great deal can be done to fight money laundering and indeed many governments have already established comprehensive anti-money laundering regimes.

Source: acamstoday.org

Source: acamstoday.org

In the third stage money flows back to the beneficiary. Anti-money laundering AML refers to a set of laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income. By using an account with a low risk the money launderer avoids to be detected by authorities. Most notably HSBC for violating the Bank Secrecy Act. Financial Institutions can control billions of transactions instantly by automating the transaction monitoring process flow.

Source: redhat.com

Millions of financial transactions take place around the world a day. Money laundering is the process of concealing the illicit origin of proceeds of crimes. A great deal can be done to fight money laundering and indeed many governments have already established comprehensive anti-money laundering regimes. Enhanced due diligence EDD with respect to these transactions may result in escalation and the generation of a suspicious activity report SAR. Ad Lucidcharts process diagram software is quick easy to use.

Source:

Because money laundering is a key part of terrorist organizations that are usually funded through illegal enterprises the FATF was also charged with directly fighting to cut off illegal cash flows to terrorists and terrorist groups. Money laundering became the concern for the banks when regulators imposed heavy fines on banks. Money laundering is the process by which criminals attempt to disguise illicit assets as legitimate assets that they have a right to possess and spend AUSTRAC 2011. Though these laws cover a relatively limited range of transactions and. Anti money laundering process flow.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering process flow by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas