16++ Anti money laundering q a on the eu list of high risk third countries information

Home » money laundering idea » 16++ Anti money laundering q a on the eu list of high risk third countries informationYour Anti money laundering q a on the eu list of high risk third countries images are available. Anti money laundering q a on the eu list of high risk third countries are a topic that is being searched for and liked by netizens today. You can Find and Download the Anti money laundering q a on the eu list of high risk third countries files here. Find and Download all free photos.

If you’re searching for anti money laundering q a on the eu list of high risk third countries images information related to the anti money laundering q a on the eu list of high risk third countries topic, you have pay a visit to the right site. Our site always gives you hints for downloading the maximum quality video and picture content, please kindly surf and locate more informative video content and graphics that fit your interests.

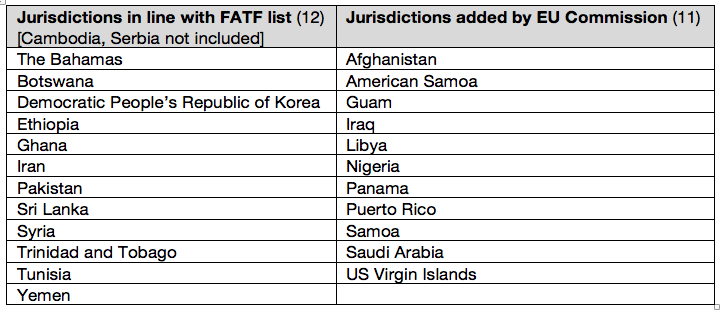

Anti Money Laundering Q A On The Eu List Of High Risk Third Countries. The list is a last resort for the EU but required by the 4th and 5th AML Directives. The 23 jurisdictions are. Q and A. Jurisdiction with strategic deficiencies.

Pdf The Eu Process Of Listing And Delisting Of High Risk Countries For Money Laundering And The Role Of The Financial Action Task Force From researchgate.net

Pdf The Eu Process Of Listing And Delisting Of High Risk Countries For Money Laundering And The Role Of The Financial Action Task Force From researchgate.net

Q and A. First identifying high-risk countries through blacklisting. On 7 May 2020 Mauritius was added to the EU list of high-risk third countries. This study evaluates four measures discussed by the European Parliament the European Commission and others to improve anti-money laundering policy. The new regulations naming the high-risk countries which mirror the list of countries that the Financial Action Task Force FATF has concerns over. Until the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive.

EU list of high-risk third countries.

Until the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive. On 7 May the European Commission EC announced a revised list of high-risk third countries to align with the Financial Action Task Force FATF. Alongside a refined methodology for identifying third countries with strategic deficiencies in their AMLCFT frameworks high-risk third countries see separate news itemT1 the Commission adopted a new list of these countries on 7 May 2020. Jurisdiction with strategic deficiencies. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes.

Source: thefinancialcrimenews.com

Source: thefinancialcrimenews.com

On 19 June 2020 the European Commission updated the list of high-risk third countries in respect of anti-money laundering and counter-terrorist financing AMLCTF due diligence. Third harmonising EU AML policies through regulations. 1 Afghanistan 2 American Samoa 3 The Bahamas 4 Botswana. The EUs revised list of high-risk third countries takes effect on 1 October 2020. Jurisdiction with strategic deficiencies.

Source: arachnys.com

Source: arachnys.com

On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. Alongside a refined methodology for identifying third countries with strategic deficiencies in their AMLCFT frameworks high-risk third countries see separate news itemT1 the Commission adopted a new list of these countries on 7 May 2020. First identifying high-risk countries through blacklisting. The UK has named 21 high-risk countries in the first anti-money laundering and combatting the financing of terrorism AMLCFT regulations framed by the country since Brexit when it withdrew from the EU.

Source: pillsburylaw.com

Source: pillsburylaw.com

The two lists complement each other in ensuring a double protection for the Single Market from external risks. The new third countries listed by the EU have been identified as having strategic deficiencies in their AMLCFT regimes. This study evaluates four measures discussed by the European Parliament the European Commission and others to improve anti-money laundering policy. The 23 jurisdictions are. It ensures protection of the EUs internal market by obliging financial entities to carry out extra checks if transactions from listed countries.

Source: camsafroza.com

Source: camsafroza.com

The two lists complement each other in ensuring a double protection for the Single Market from external risks. Fourth strengthening the European executive eg. New delegated act on high-risk third countries. Jurisdiction with strategic deficiencies. This study evaluates four measures discussed by the European Parliament the European Commission and others to improve anti-money laundering policy.

Source: researchgate.net

The new third countries listed by the EU have been identified as having strategic deficiencies in their AMLCFT regimes. Q and A. On 13 February 2019 the EU Commission presented a list of 23 high-risk third countries assessed as having strategic deficiencies in their Anti-Money Laundering and Combating the Financing of Terrorism AMLCFT regimes 1. The EUs revised list of high-risk third countries takes effect on 1 October 2020. Jurisdiction with strategic deficiencies.

Source: globalriskaffairs.com

Source: globalriskaffairs.com

As defined under the Fourth and Fifth Anti-Money Laundering Directives the EU has to establish a list of high-risk third countries to make sure the EU financial system is equipped to prevent money laundering and terrorist financing risks coming from third countries. On 19 June 2020 the European Commission updated the list of high-risk third countries in respect of anti-money laundering and counter-terrorist financing AMLCTF due diligence. Fourth Anti-Money Laundering Directive. Jurisdiction with strategic deficiencies. First identifying high-risk countries through blacklisting.

Source: ec.europa.eu

Source: ec.europa.eu

The 23 jurisdictions are. Jurisdiction with strategic deficiencies. 1 Afghanistan 2 American Samoa 3 The Bahamas 4 Botswana. This study evaluates four measures discussed by the European Parliament the European Commission and others to improve anti-money laundering policy. This follows the adoption of a new delegated regulation Delegated Regulation by the EU in relation to third countries which have strategic deficiencies in their anti-money launderingcombat the financing of terrorism regimes AMLCFT and that pose significant threats to the financial system of the Union.

Source: researchgate.net

Source: researchgate.net

The EUs revised list of high-risk third countries takes effect on 1 October 2020. First identifying high-risk countries through blacklisting. New delegated act on high-risk third countries. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this processAs of October 2018 the FATF has reviewed over 80 countries and. While the EU list of uncooperative tax jurisdictions is a Council-led process the EU list of high-risk third countries is established by the Commission based on EU anti-money laundering rules.

Source: ec.europa.eu

Source: ec.europa.eu

Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. Fourth Anti-Money Laundering Directive. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. On 13 February 2019 the EU Commission presented a list of 23 high-risk third countries assessed as having strategic deficiencies in their Anti-Money Laundering and Combating the Financing of Terrorism AMLCFT regimes 1.

Source: globalriskaffairs.com

Source: globalriskaffairs.com

The European Commission has published its list of high-risk third countries dubbed the blacklist which it says have weak anti-money laundering and terrorist financing regimes. EU money laundering blacklist explained28 Feb 2019. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. Second reducing laundering through letterbox or shell companies.

Source: ec.europa.eu

Source: ec.europa.eu

Fifth Anti-Money Laundering Directive. EU list of high-risk third countries. Third harmonising EU AML policies through regulations. First identifying high-risk countries through blacklisting. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries.

Source: researchgate.net

Source: researchgate.net

The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. The 23 jurisdictions are. EU money laundering blacklist explained28 Feb 2019. While the EU list of uncooperative tax jurisdictions is a Council-led process the EU list of high-risk third countries is established by the Commission based on EU anti-money laundering rules. The two lists complement each other in ensuring a double protection for the Single Market from external risks.

Source: thefinancialcrimenews.com

Source: thefinancialcrimenews.com

Second reducing laundering through letterbox or shell companies. The new third countries listed by the EU have been identified as having strategic deficiencies in their AMLCFT regimes. On 7 May the European Commission EC announced a revised list of high-risk third countries to align with the Financial Action Task Force FATF. First identifying high-risk countries through blacklisting. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering q a on the eu list of high risk third countries by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information