15+ Anti money laundering regulations for letting agents info

Home » money laundering Info » 15+ Anti money laundering regulations for letting agents infoYour Anti money laundering regulations for letting agents images are available. Anti money laundering regulations for letting agents are a topic that is being searched for and liked by netizens today. You can Download the Anti money laundering regulations for letting agents files here. Find and Download all free vectors.

If you’re looking for anti money laundering regulations for letting agents images information connected with to the anti money laundering regulations for letting agents keyword, you have come to the ideal site. Our site frequently provides you with hints for viewing the maximum quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

Anti Money Laundering Regulations For Letting Agents. New anti-money laundering regulations for agents February 5 2020 Categories. Anti-Money Laundering Regulations for Landlords In the UK Estate Agents are already required to demonstrate that they know their customer and apply Anti-Money Laundering measures and demonstrate due diligence with all new and continuing customers. Its a course of by which dirty money is converted into clear money. He is a member of the International Compliance.

Anti Money Laundering In The Uk Who Regulates Me From napier.ai

Anti Money Laundering In The Uk Who Regulates Me From napier.ai

The anti-money laundering regulations for letting agents apply to all new tenancies that began following 10th January 2020. Understanding risks and taking action for estate agency and letting agency businesses has been added. On 10 th January 2020 new AML rules will be put in place. The new rules for lettings agents As of 10 th January this year any UK letting agent managing properties residential or commercial that yield an income of 10000 Euros or more per month must comply with updated money laundering regulations under the Fifth Money Laundering Directive Agents handling these higher value rentals must now. Those letting agents who fall within the scope of regulated businesses and manage tenancies that meet the threshold will need to register for anti-money laundering AML supervision. Letting agents who deal in a rental property residential or commercial with a monthly rent of or equivalent to EUR 10000 or above are required to carry out customer due diligence CDD checks and comply with other anti-money laundering requirements.

The regulations have also been expanded to include the letting agency sector for high-value transactions with a monthly rent of 10000 euros.

Its a course of by which dirty money is converted into clear money. AML rules which have traditionally applied only for sales agents are designed to crack down on the use of the financial system and in this case specifically property purchases for funding of criminal activities via money laundering. New anti-money laundering rules for letting agencies from January 2020 Em Morley - December 6 2019 Changes to Anti-Money Laundering AML rules should not be overlooked despite everyones main focus currently being the upcoming General Election. Understanding risks and taking action for estate agency and letting agency businesses has been added. 17 July 2020 Updated to remove letting agency. These measures are found in the Money Laundering and Terrorist Financing Amendment Regulations 2019 the Regulations.

The new rules for lettings agents As of 10 th January this year any UK letting agent managing properties residential or commercial that yield an income of 10000 Euros or more per month must comply with updated money laundering regulations under the Fifth Money Laundering Directive Agents handling these higher value rentals must now. They also come into play whenever agents renew tenancies that existed before that date. The regulations have also been expanded to include the letting agency sector for high-value transactions with a monthly rent of 10000 euros. Criminal Finances Act 2017 and the 2017 Money Laundering Regulations. Those letting agents who fall within the scope of regulated businesses and manage tenancies that meet the threshold will need to register for anti-money laundering AML supervision.

Source: getpropertycompliant.co.uk

Source: getpropertycompliant.co.uk

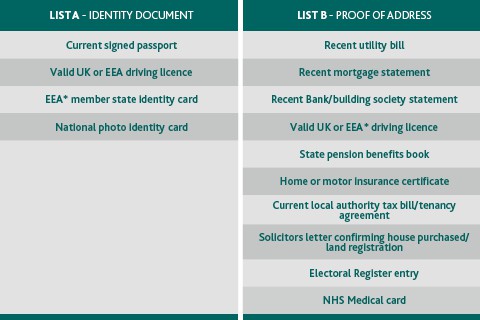

Anti-Money Laundering. Ad Stanley Partners - Ringmer Lewes Burgess Hill Hassocks. These range from registering with HMRC through to conducting customer due diligence steps on sellers and buyers. Letting agents who deal in a rental property residential or commercial with a monthly rent of or equivalent to EUR 10000 or above are required to carry out customer due diligence CDD checks and comply with other anti-money laundering requirements. He is a member of the International Compliance.

Source: foxtons.co.uk

Source: foxtons.co.uk

All letting agents across the UK are now supervised by HMRC for anti-money laundering AML and counter-terrorist financing purposes if they meet this requirement and must register with HMRC by 10 January 2021. Estate agency businesses are regulated by the Money Laundering Regulations of 2017 and as such there are numerous statutory obligations estate agents must comply with. Anti-Money Laundering Letting Agents From 10 January 2020 all letting agents who manage properties which individually yield an income of 10000 Euros per month or equivalent or more must now comply with regulations set out in the Fifth Money Laundering Directive. The regulations have also been expanded to include the letting agency sector for high-value transactions with a monthly rent of 10000 euros. If You Are Already Registered as for Sales.

Source: foxtons.co.uk

Source: foxtons.co.uk

The new rules for lettings agents As of 10 th January this year any UK letting agent managing properties residential or commercial that yield an income of 10000 Euros or more per month must comply with updated money laundering regulations under the Fifth Money Laundering Directive Agents handling these higher value rentals must now. AML rules which have traditionally applied only for sales agents are designed to crack down on the use of the financial system and in this case specifically property purchases for funding of criminal activities via money laundering. All letting agents across the UK are now supervised by HMRC for anti-money laundering AML and counter-terrorist financing purposes if they meet this requirement and must register with HMRC by 10 January 2021. CDD checks need to be carried out on any new tenants and landlords from 10 January 2020. 17 July 2020 Updated to remove letting agency.

Source: paymentscardsandmobile.com

Source: paymentscardsandmobile.com

If You Are Already Registered as for Sales. Anti-Money Laundering Regulations for Landlords In the UK Estate Agents are already required to demonstrate that they know their customer and apply Anti-Money Laundering measures and demonstrate due diligence with all new and continuing customers. All letting agents across the UK are now supervised by HMRC for anti-money laundering AML and counter-terrorist financing purposes if they meet this requirement and must register with HMRC by 10 January 2021. August 08 2021 The concept of cash laundering is essential to be understood for these working within the monetary sector. Criminal Finances Act 2017 and the 2017 Money Laundering Regulations.

Source: issuu.com

Source: issuu.com

AML rules which have traditionally applied only for sales agents are designed to crack down on the use of the financial system and in this case specifically property purchases for funding of criminal activities via money laundering. Those letting agents who fall within the scope of regulated businesses and manage tenancies that meet the threshold will need to register for anti-money laundering AML supervision. August 08 2021 The concept of cash laundering is essential to be understood for these working within the monetary sector. On 10 th January 2020 new AML rules will be put in place. The new rules for lettings agents As of 10 th January this year any UK letting agent managing properties residential or commercial that yield an income of 10000 Euros or more per month must comply with updated money laundering regulations under the Fifth Money Laundering Directive Agents handling these higher value rentals must now.

Source: slideshare.net

Source: slideshare.net

An estate agency or letting agency business may be regulated by the Financial Conduct Authority FCA for another purpose for example because they provide consumer finance or. 20 January 2021 930 AM. 17 July 2020 Updated to remove letting agency. These measures are found in the Money Laundering and Terrorist Financing Amendment Regulations 2019 the Regulations. Its a course of by which dirty money is converted into clear money.

Source: napier.ai

Source: napier.ai

Who will provide an overview on the latest AML legislation and what the rules mean for letting agents. Estate agency businesses are regulated by the Money Laundering Regulations of 2017 and as such there are numerous statutory obligations estate agents must comply with. A link to Money laundering. AML rules which have traditionally applied only for sales agents are designed to crack down on the use of the financial system and in this case specifically property purchases for funding of criminal activities via money laundering. Anti-Money Laundering Regulations for Landlords In the UK Estate Agents are already required to demonstrate that they know their customer and apply Anti-Money Laundering measures and demonstrate due diligence with all new and continuing customers.

Source:

Letting agents who deal in a rental property residential or commercial with a monthly rent of or equivalent to EUR 10000 or above are required to carry out customer due diligence CDD checks and comply with other anti-money laundering requirements. Those letting agents who fall within the scope of regulated businesses and manage tenancies that meet the threshold will need to register for anti-money laundering AML supervision. Anti-Money Laundering Regulations for Landlords In the UK Estate Agents are already required to demonstrate that they know their customer and apply Anti-Money Laundering measures and demonstrate due diligence with all new and continuing customers. They also come into play whenever agents renew tenancies that existed before that date. All letting agents across the UK are now supervised by HMRC for anti-money laundering AML and counter-terrorist financing purposes if they meet this requirement and must register with HMRC by 10 January 2021.

Source: slideplayer.com

Source: slideplayer.com

These range from registering with HMRC through to conducting customer due diligence steps on sellers and buyers. Money Laundering Four Stages. If You Are Already Registered as for Sales. 20 January 2021 930 AM. Anti-Money Laundering Regulations for Landlords In the UK Estate Agents are already required to demonstrate that they know their customer and apply Anti-Money Laundering measures and demonstrate due diligence with all new and continuing customers.

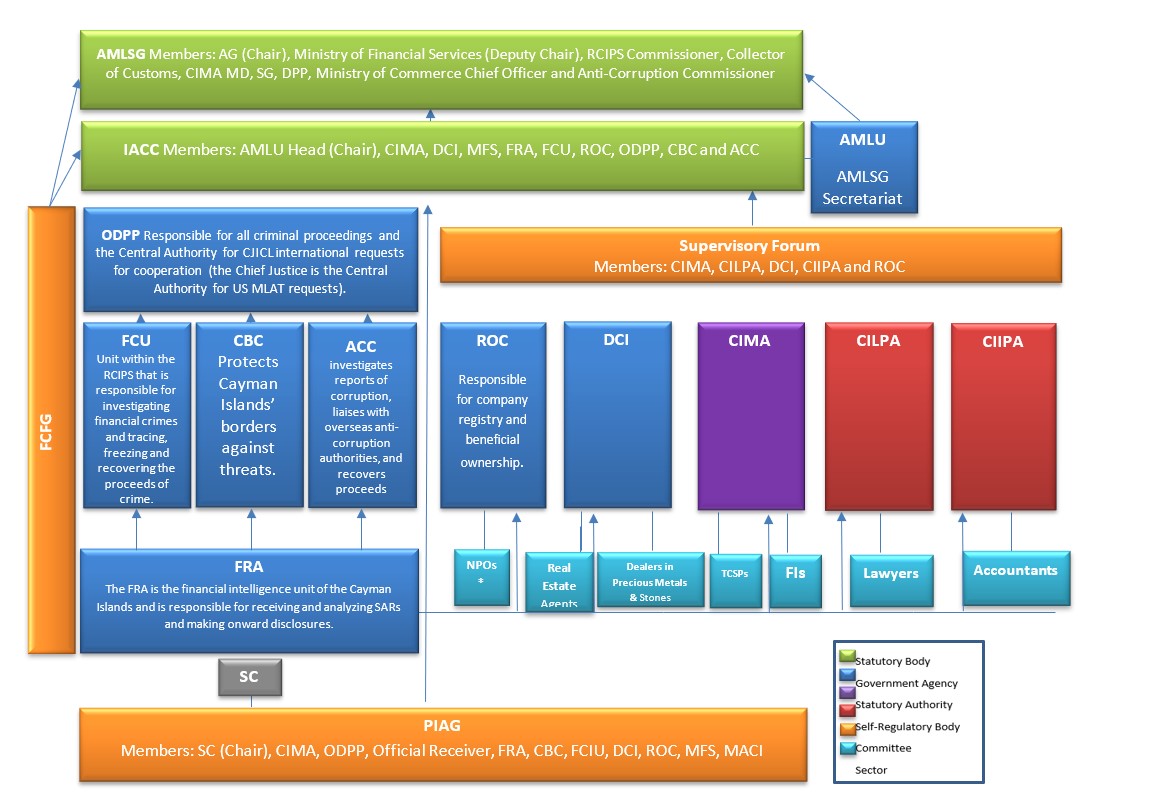

Source: cima.ky

Source: cima.ky

An estate agency or letting agency business may be regulated by the Financial Conduct Authority FCA for another purpose for example because they provide consumer finance or. The sources of the money in precise are criminal and the money is invested in a approach that makes it seem like clear money. Since January 2019 letting agents have been required to comply with anti-money laundering AML legislation for the first time. New anti-money laundering regulations for agents February 5 2020 Categories. Understanding risks and taking action for estate agency and letting agency businesses has been added.

Source: vinciworks.com

Source: vinciworks.com

Anti-Money Laundering. Its a course of by which dirty money is converted into clear money. Estate agency businesses are regulated by the Money Laundering Regulations of 2017 and as such there are numerous statutory obligations estate agents must comply with. They also come into play whenever agents renew tenancies that existed before that date. New anti-money laundering regulations for agents February 5 2020 Categories.

Source: vinciworks.com

Source: vinciworks.com

Those letting agents who fall within the scope of regulated businesses and manage tenancies that meet the threshold will need to register for anti-money laundering AML supervision. CDD checks need to be carried out on any new tenants and landlords from 10 January 2020. 17 July 2020 Updated to remove letting agency. A link to Money laundering. If You Are Already Registered as for Sales.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering regulations for letting agents by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas