15+ Anti money laundering risk assessment template for solicitors ideas

Home » money laundering Info » 15+ Anti money laundering risk assessment template for solicitors ideasYour Anti money laundering risk assessment template for solicitors images are ready in this website. Anti money laundering risk assessment template for solicitors are a topic that is being searched for and liked by netizens today. You can Download the Anti money laundering risk assessment template for solicitors files here. Download all free images.

If you’re searching for anti money laundering risk assessment template for solicitors pictures information related to the anti money laundering risk assessment template for solicitors topic, you have visit the ideal site. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

Anti Money Laundering Risk Assessment Template For Solicitors. In spring 2019 we called in 400 firms anti-money laundering risk assessments. The risk of abuse of legal services for money laundering purposes remains high overall. Buy now Our template law firm office manual is perfect for ensuring that you meet your Solicitors Regulation Authority SRA obligations to put effective risk and compliance systems in place in your firm. Of the 400 firms we contacted.

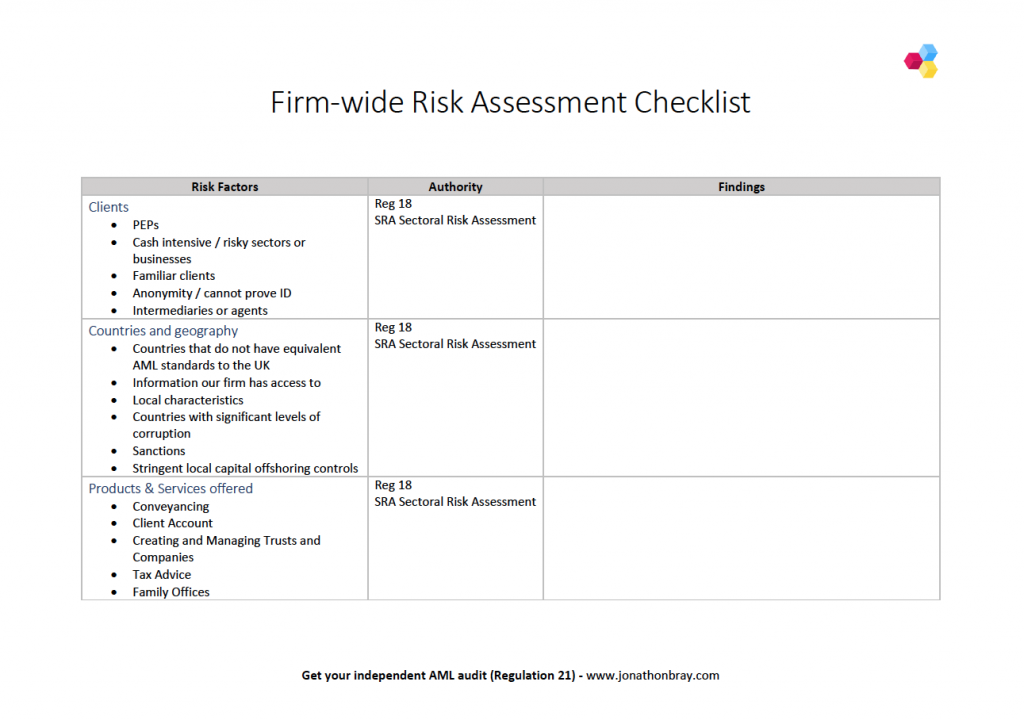

Office for Professional Body AML Supervision OPBAS Sanctions and High risk jurisdictions. Money Laundering Terrorist Financing Amendment regulations 2019. The Law Society said lawyers should follow its LawPoints LawTalk and other publications for more guidance and resources. Anti-money laundering firm-wide risk assessment. Legal service providers LSPs offer a wide range of services and the services most at risk of exploitation by criminals and corrupt elites for money laundering purposes continue to be conveyancing trust and company services and client accounts. Money laundering is the process of concealing the origin ownership or destination of illegally or dishonestly-obtained money by hiding it within legitimate economic activities in order to make it appear legal.

Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment.

To complement our anti-money laundering policy for a low risk business a new company wide risk assessment and a client identification checklist have been added to the corporate portfolio of templates. Money laundering is the process of concealing the origin ownership or destination of illegally or dishonestly-obtained money by hiding it within legitimate economic activities in order to make it appear legal. Moreover they are fully customisable and easy to edit. Those that do are reporting entities for the purposes of the Act. Anti-money laundering firm-wide risk assessment. The Law Society said lawyers should follow its LawPoints LawTalk and other publications for more guidance and resources.

Source: pdfprof.com

Source: pdfprof.com

A low risk business is one that is not regulated under current legislation and therefore not required to. The templates are as follows. National Risk Assessment of money laundering and terrorist financing 2020. Anti-money laundering firm-wide risk assessment. Our anti-money laundering AML template bundles can help with all the money laundering regulation aspects.

Source: academia.edu

Source: academia.edu

4 easy steps to client onboarding and Anti-Money Laundering AML checks The Sethi Partnership Solicitors strive to make life easier for our clients by embracing new technology. Customise the AML policy and prepare due diligence documents. New anti-money laundering risk assessment form available to firms. Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment. The SRA Solicitors Regulation Authority will be testing a sample of firms anti-money laundering policies every month as it increases efforts to combat misconduct in the profession.

Source: researchgate.net

Source: researchgate.net

Money laundering is the process of concealing the origin ownership or destination of illegally or dishonestly-obtained money by hiding it within legitimate economic activities in order to make it appear legal. Customise the AML policy and prepare due diligence documents. View as a pdf here. Getting your risk assessment in order. Proceeds of Crime Act 2002.

New anti-money laundering risk assessment form available to firms. 83 risk assessments were not compliant. To complement our anti-money laundering policy for a low risk business a new company wide risk assessment and a client identification checklist have been added to the corporate portfolio of templates. Customise the AML policy and prepare due diligence documents. Therefore AML templates enable firms to complete an AML risk assessment.

Source: researchgate.net

Source: researchgate.net

83 risk assessments were not compliant. View as a pdf here. 83 risk assessments were not compliant. Money Laundering Terrorist Financing Amendment regulations 2019. Office for Professional Body AML Supervision OPBAS Sanctions and High risk jurisdictions.

Source: researchgate.net

Source: researchgate.net

In spring 2019 we called in 400 firms anti-money laundering risk assessments. Proceeds of Crime Act 2002. 40 firms did not send us a firm risk assessment instead sending us something else. Customise the AML policy and prepare due diligence documents. Our ever popular law firm office manual covers SRA risk and compliance anti-money laundering GDPR cyber security and much more.

Source: slideshare.net

Source: slideshare.net

The SRA Solicitors Regulation Authority will be testing a sample of firms anti-money laundering policies every month as it increases efforts to combat misconduct in the profession. View as a pdf here. New anti-money laundering risk assessment form available to firms. The templates are as follows. The 2020 national risk assessment said.

Source: complyadvantage.com

Source: complyadvantage.com

Thousands of firms are to be contacted by the Solicitors Regulation Authority within the coming months asking what measures they have in place to combat money laundering. The 2020 national risk assessment said. Those that do are reporting entities for the purposes of the Act. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. Thousands of firms are to be contacted by the Solicitors Regulation Authority within the coming months asking what measures they have in place to combat money laundering.

Source: yumpu.com

Source: yumpu.com

New anti-money laundering risk assessment form available to firms. Therefore AML templates enable firms to complete an AML risk assessment. Leading a discussion of money laundering and financial crime risks at a staff meeting on date Staff were asked to furnish details of their concerns confidentially to me at any time. The templates are as follows. Legal service providers LSPs offer a wide range of services and the services most at risk of exploitation by criminals and corrupt elites for money laundering purposes continue to be conveyancing trust and company services and client accounts.

Source: dokumen.tips

Source: dokumen.tips

Legal service providers LSPs offer a wide range of services and the services most at risk of exploitation by criminals and corrupt elites for money laundering purposes continue to be conveyancing trust and company services and client accounts. ACCA has created a template with some hints and tips. Of the 400 firms we contacted. Moreover they are fully customisable and easy to edit. A low risk business is one that is not regulated under current legislation and therefore not required to.

Source: lexology.com

Source: lexology.com

To complement our anti-money laundering policy for a low risk business a new company wide risk assessment and a client identification checklist have been added to the corporate portfolio of templates. The templates are as follows. Money laundering is the process of concealing the origin ownership or destination of illegally or dishonestly-obtained money by hiding it within legitimate economic activities in order to make it appear legal. Customise the AML policy and prepare due diligence documents. A low risk business is one that is not regulated under current legislation and therefore not required to.

Source:

Buy now Our template law firm office manual is perfect for ensuring that you meet your Solicitors Regulation Authority SRA obligations to put effective risk and compliance systems in place in your firm. Office for Professional Body AML Supervision OPBAS Sanctions and High risk jurisdictions. Leading a discussion of money laundering and financial crime risks at a staff meeting on date Staff were asked to furnish details of their concerns confidentially to me at any time. ACCA has created a template with some hints and tips. Risk assessment compliance program money-laundering policies AML reporting procedure delayed customer due diligence CDD form exemption form matter risk assessment form and full CDD form.

Source: pinterest.com

Source: pinterest.com

The conclusion should include a short narrative in support of the conclusion. Money laundering is the process of concealing the origin ownership or destination of illegally or dishonestly-obtained money by hiding it within legitimate economic activities in order to make it appear legal. Our anti-money laundering AML template bundles can help with all the money laundering regulation aspects. View as a pdf here. Therefore AML templates enable firms to complete an AML risk assessment.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering risk assessment template for solicitors by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas