14+ Anti money laundering supervision uk information

Home » money laundering idea » 14+ Anti money laundering supervision uk informationYour Anti money laundering supervision uk images are ready. Anti money laundering supervision uk are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering supervision uk files here. Get all free photos.

If you’re searching for anti money laundering supervision uk pictures information related to the anti money laundering supervision uk keyword, you have pay a visit to the ideal blog. Our website frequently gives you hints for viewing the maximum quality video and picture content, please kindly search and locate more informative video content and graphics that match your interests.

Anti Money Laundering Supervision Uk. Supervisors PBSs overseen by the Office for Professional Body Anti-Money Laundering Supervision OPBAS with guidance on how they and their supervised populations should submit better quality SARs to the NCA. Who needs AML supervision. In its capacities as a supervisory authority and a law enforcement authority HMRC may also use this regime to gather information for tax purposes. 118 As a supervisory authority HMRC is responsible for monitoring your compliance with the UK anti-money laundering regime.

Aml Compliance Service Amlcc From ifa.org.uk

Aml Compliance Service Amlcc From ifa.org.uk

12 HMRC is one of 25 Anti-Money. OPBAS supervises the 25 professional body supervisors in the legal and accountancy sectors. The Office for Professional Body Anti-Money Laundering Supervision OPBAS established in 2018 is based within the FCA and its objective is to improve the consistency of professional body AML supervision. OFFICE FOR PROFESSIONAL BODY ANTI-MONEY LAUNDERING SUPERVISION. The Government established OPBAS as part of its reforms to strengthen the UKs anti-money laundering AML supervisory regime. Our strategy is to provide robust anti-money laundering supervision through a risk-based regime focussing our efforts on firms where the risk that they will be used to enable money laundering is highest.

It should be read in conjunction with guidance on the NCA website wwwnationalcrimeagencygovuk.

OPBAS is housed within the FCA and its key objectives are to reduce the harm of money laundering and terrorist financing by. Youll need to sign in to your account to read them. In their report Progress and themes from 2019 they concluded there had been strong improvement across both the legal and accountancy sectors in AML supervision. For registration penalties such as a failure to register or notify us of changes to your business the charge will be up to 350 in addition to the amount of the penalty. If the firm or sole practitioner provides audit insolvency accountancy services tax advice and trust or company services it must be registered for anti-money laundering AML supervisionThe scope of the The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 Money Laundering. Our work is subject to oversight by the Office for Professional Body Anti-Money Laundering Supervision OPBAS.

Source: 16trinity.co.uk

Source: 16trinity.co.uk

It is therefore essential that businesses put in place adequate measures to prevent criminals from using their services to launder money and finance terrorism. 12 HMRC is one of 25 Anti-Money. Financial sanctions 116 EU financial sanctions. Supervisors PBSs overseen by the Office for Professional Body Anti-Money Laundering Supervision OPBAS with guidance on how they and their supervised populations should submit better quality SARs to the NCA. OFFICE FOR PROFESSIONAL BODY ANTI-MONEY LAUNDERING SUPERVISION.

Source: protiviti.com

Source: protiviti.com

We have an important role as the largest accountancy professional body supervisor in the UK supervising around 11000 firms. Financial sanctions 116 EU financial sanctions. In its capacities as a supervisory authority and a law enforcement authority HMRC may also use this regime to gather information for tax purposes. Our work is subject to oversight by the Office for Professional Body Anti-Money Laundering Supervision OPBAS. ICAEW supervises AML procedures on regulated and related work carried out by insolvency practitioners IP who have a licence with ICAEW.

Source: nfda-uk.co.uk

Source: nfda-uk.co.uk

Who needs AML supervision. The Office for Professional Body Anti-Money Laundering Supervision OPBAS established in 2018 is based within the FCA and its objective is to improve the consistency of professional body AML supervision. Our work is subject to oversight by the Office for Professional Body Anti-Money Laundering Supervision OPBAS. In their report Progress and themes from 2019 they concluded there had been strong improvement across both the legal and accountancy sectors in AML supervision. Anti-money laundering AML supervision for insolvency firms ICAEW is the AML supervisor of its member firms.

Source: rusi.org

Source: rusi.org

In its capacities as a supervisory authority and a law enforcement authority HMRC may also use this regime to gather information for tax purposes. Youre included in the supervised Accountancy Service Providers anti-money laundering controls and procedures suspicious activity reporting and training programmes you have a written contract with each of your customers confirming that every aspect of the relationship between you meets all anti-money laundering requirements. It is therefore essential that businesses put in place adequate measures to prevent criminals from using their services to launder money and finance terrorism. The Treasury appoints supervisors to monitor the anti-money laundering AML and counter-terrorist financing CTF compliance of businesses that. They enable PBSs statutory supervisors including HM Revenue.

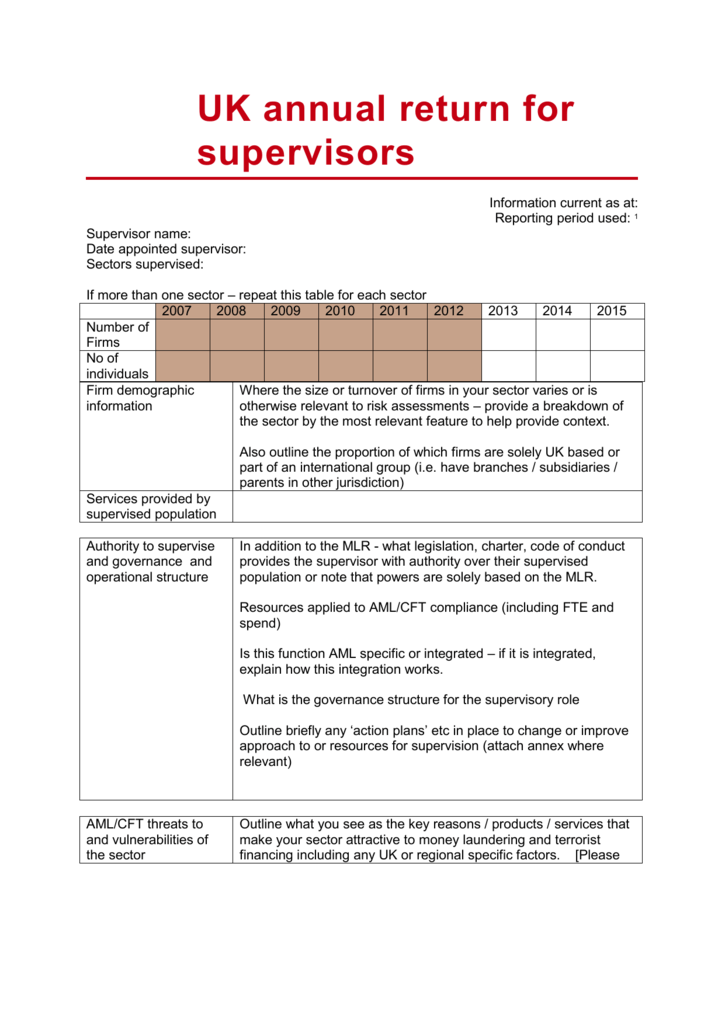

Source: studylib.net

Source: studylib.net

OPBAS is housed within the FCA and its key objectives are to reduce the harm of money laundering and terrorist financing by. OFFICE FOR PROFESSIONAL BODY ANTI-MONEY LAUNDERING SUPERVISION. It has the power to ensure that the professional body supervisors meet the standards required by the Regulations. Youll need to sign in to your account to read them. In their report Progress and themes from 2019 they concluded there had been strong improvement across both the legal and accountancy sectors in AML supervision.

Source: napier.ai

Source: napier.ai

OPBAS supervises the 25 professional body supervisors in the legal and accountancy sectors. Supervisors PBSs overseen by the Office for Professional Body Anti-Money Laundering Supervision OPBAS with guidance on how they and their supervised populations should submit better quality SARs to the NCA. 12 HMRC is one of 25 Anti-Money. OPBAS is housed within the FCA and its key objectives are to reduce the harm of money laundering and terrorist financing by. Financial sanctions 116 EU financial sanctions.

Source: getpropertycompliant.co.uk

Source: getpropertycompliant.co.uk

We have an important role as the largest accountancy professional body supervisor in the UK supervising around 11000 firms. It should be read in conjunction with guidance on the NCA website wwwnationalcrimeagencygovuk. Youll need to sign in to your account to read them. Supervisors PBSs overseen by the Office for Professional Body Anti-Money Laundering Supervision OPBAS with guidance on how they and their supervised populations should submit better quality SARs to the NCA. Who needs AML supervision.

Source: valueaddvirtual.co.uk

Source: valueaddvirtual.co.uk

Anti-money laundering AML supervision for insolvency firms ICAEW is the AML supervisor of its member firms. Our work is subject to oversight by the Office for Professional Body Anti-Money Laundering Supervision OPBAS. Financial sanctions 116 EU financial sanctions. Who needs AML supervision. Anti-money laundering AML supervision for insolvency firms ICAEW is the AML supervisor of its member firms.

Source: dnsassociates.co.uk

Source: dnsassociates.co.uk

It should be read in conjunction with guidance on the NCA website wwwnationalcrimeagencygovuk. We have an important role as the largest accountancy professional body supervisor in the UK supervising around 11000 firms. The Treasury appoints supervisors to monitor the anti-money laundering AML and counter-terrorist financing CTF compliance of businesses that. In its capacities as a supervisory authority and a law enforcement authority HMRC may also use this regime to gather information for tax purposes. In their report Progress and themes from 2019 they concluded there had been strong improvement across both the legal and accountancy sectors in AML supervision.

Source: rightwaycompliance.co.uk

Source: rightwaycompliance.co.uk

HMRC sends messages to your anti-money laundering supervision account not your business tax account. We have an important role as the largest accountancy professional body supervisor in the UK supervising around 11000 firms. 12 HMRC is one of 25 Anti-Money. It has the power to ensure that the professional body supervisors meet the standards required by the Regulations. Youll need to sign in to your account to read them.

Source: trainingexpress.org.uk

Source: trainingexpress.org.uk

HMRC sends messages to your anti-money laundering supervision account not your business tax account. This supervision covers all accountancy services and firm-wide areas including insolvency. Anti-money laundering AML supervision for insolvency firms ICAEW is the AML supervisor of its member firms. For registration penalties such as a failure to register or notify us of changes to your business the charge will be up to 350 in addition to the amount of the penalty. In their report Progress and themes from 2019 they concluded there had been strong improvement across both the legal and accountancy sectors in AML supervision.

Source: ifa.org.uk

Source: ifa.org.uk

Anti-money laundering AML supervision for insolvency firms ICAEW is the AML supervisor of its member firms. They enable PBSs statutory supervisors including HM Revenue. For registration penalties such as a failure to register or notify us of changes to your business the charge will be up to 350 in addition to the amount of the penalty. We have an important role as the largest accountancy professional body supervisor in the UK supervising around 11000 firms. Our work is subject to oversight by the Office for Professional Body Anti-Money Laundering Supervision OPBAS.

Source: fortesestates.co.uk

Source: fortesestates.co.uk

Our strategy is to provide robust anti-money laundering supervision through a risk-based regime focussing our efforts on firms where the risk that they will be used to enable money laundering is highest. In its capacities as a supervisory authority and a law enforcement authority HMRC may also use this regime to gather information for tax purposes. Financial sanctions 116 EU financial sanctions. It is therefore essential that businesses put in place adequate measures to prevent criminals from using their services to launder money and finance terrorism. In its capacities as a supervisory authority and a law enforcement authority HMRC may also use this regime to gather information for tax purposes.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering supervision uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information