10+ Assisting money laundering penalty uk information

Home » money laundering idea » 10+ Assisting money laundering penalty uk informationYour Assisting money laundering penalty uk images are ready. Assisting money laundering penalty uk are a topic that is being searched for and liked by netizens now. You can Download the Assisting money laundering penalty uk files here. Get all royalty-free vectors.

If you’re looking for assisting money laundering penalty uk images information related to the assisting money laundering penalty uk keyword, you have come to the ideal blog. Our site frequently provides you with hints for seeking the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

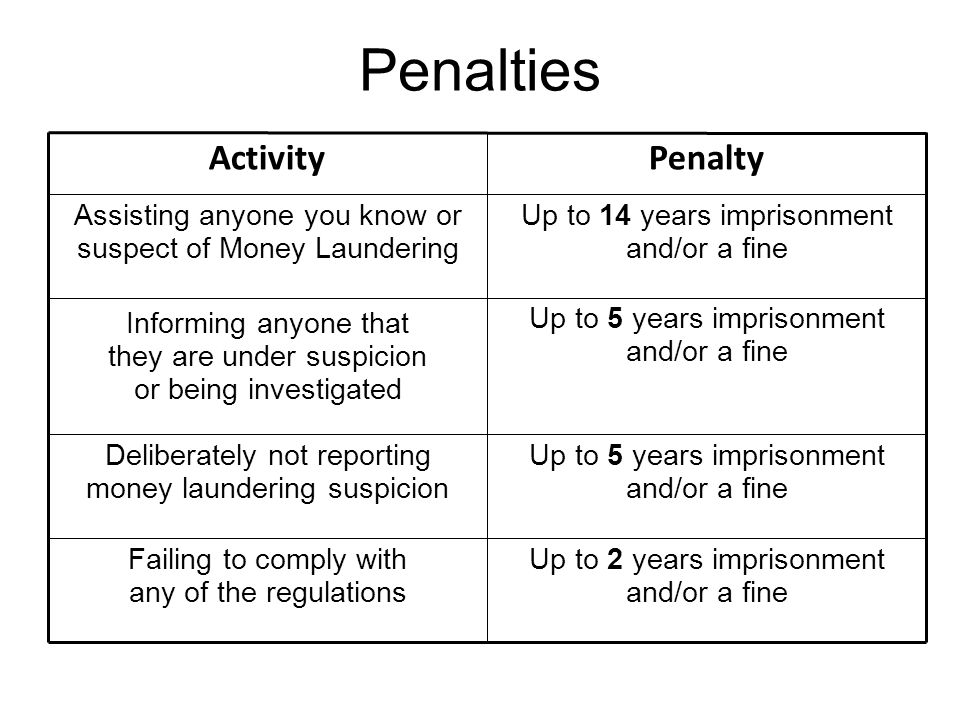

Assisting Money Laundering Penalty Uk. The length of imprisonment when charged with money laundering also depends on the severity of the case but it can reach up to 20 years. Evasion of VAT in the magistrates court the maximum sentence is 6 months in jail or a fine of up to 20000. What is the penalty for it in the UK. Penalty For Assisting Money Laundering Edit.

Prevention Of Money Laundering Combating Terrorist Financing Ppt Video Online Download From slideplayer.com

Prevention Of Money Laundering Combating Terrorist Financing Ppt Video Online Download From slideplayer.com

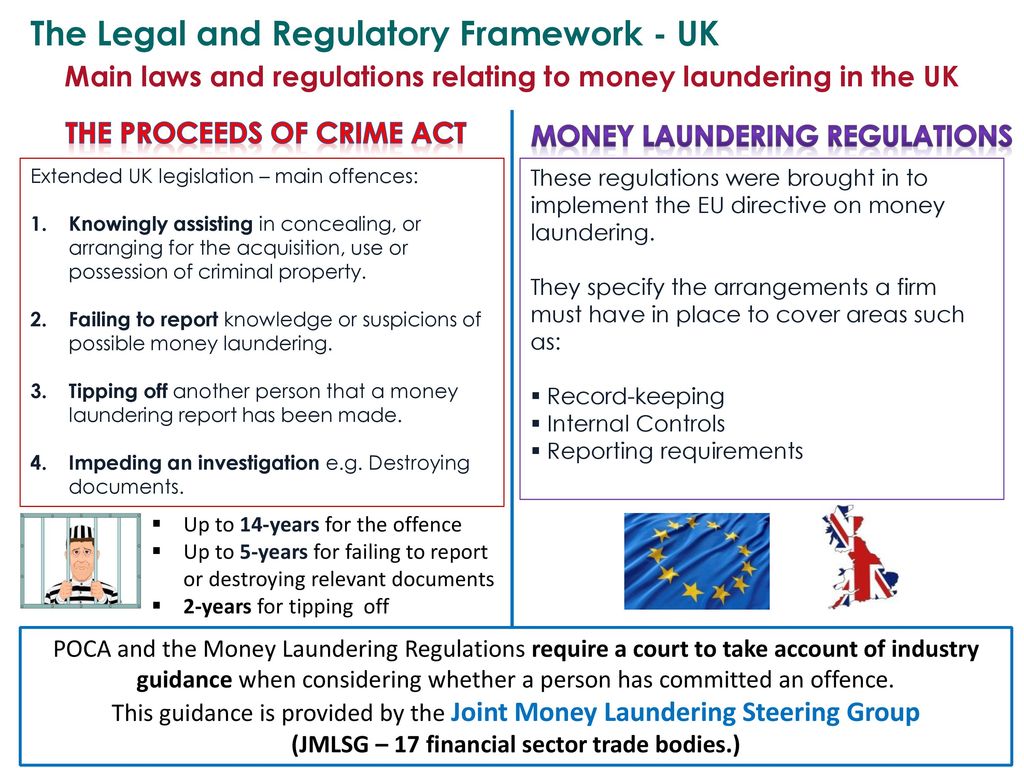

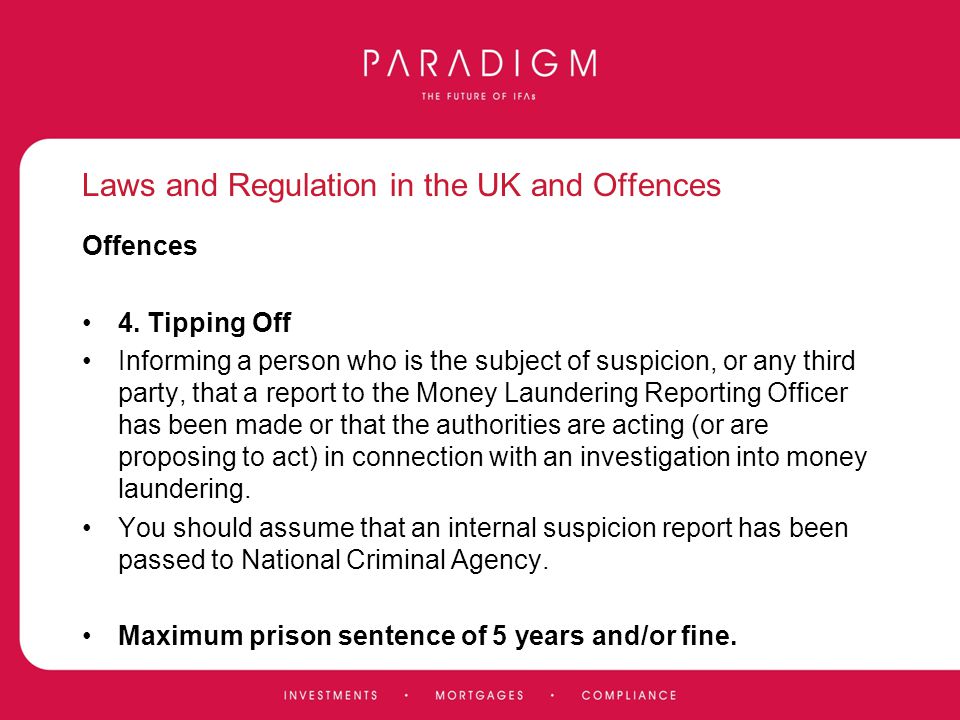

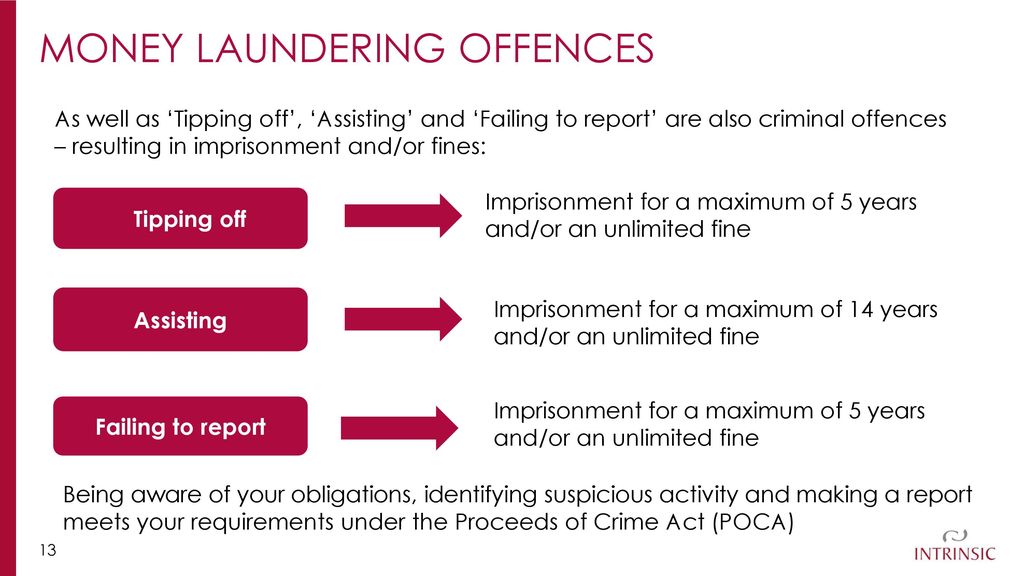

Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. The penalty will depend on which of the offences is the. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. An offenders possession of the proceeds of his own crime falls within the UK definition of money laundering. The risk-based approach means a focus on outputs. Evasion of VAT in the magistrates court the maximum sentence is 6 months in jail or a fine of up to 20000.

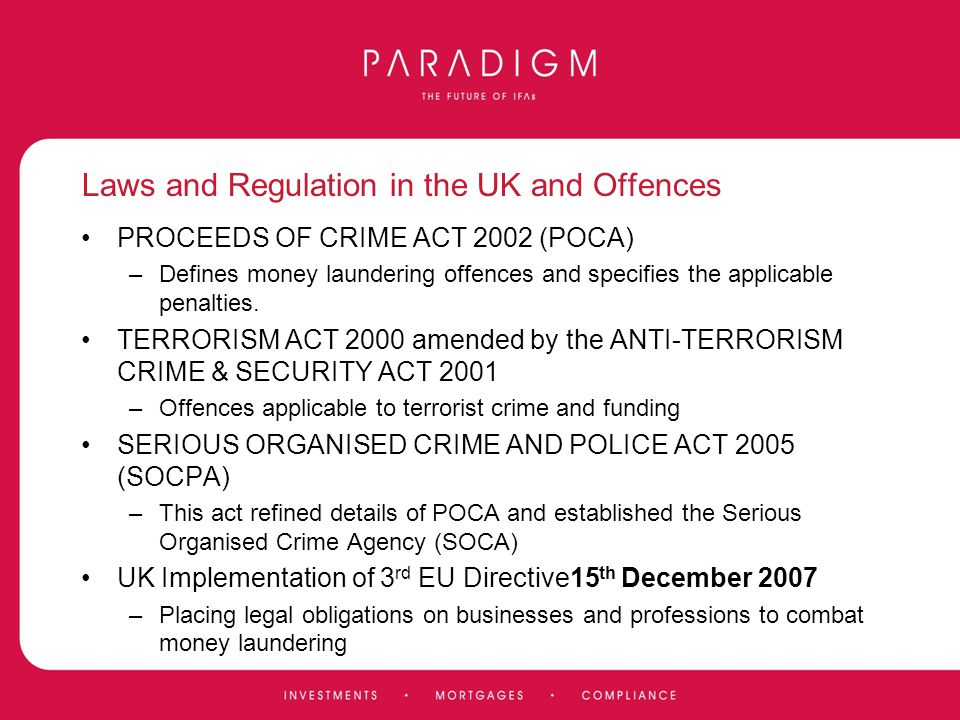

Part 2 of the Serious Crime Act 2007 creates at sections 44 to 46 three inchoate offences of intentionally encouraging or assisting an offence.

Part 2 of the Serious Crime Act 2007 creates at sections 44 to 46 three inchoate offences of intentionally encouraging or assisting an offence. Crown Court cases can be a maximum of seven years in prison or an unlimited fine. Fines for money laundering can reach as high as half a million dollars depending on the kind of things involved in the laundering transaction. There may also be sentencing for the crime committed to gain illegal money in the first place. Money laundering is widely defined in the UK. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among.

Source: slideplayer.com

Source: slideplayer.com

The length of imprisonment when charged with money laundering also depends on the severity of the case but it can reach up to 20 years. In effect any handling or involvement with any proceeds of any crime or monies or assets representing the proceeds of crime can be a money laundering offence. Evasion of VAT in the magistrates court the maximum sentence is 6 months in jail or a fine of up to 20000. Evasion of VAT in the magistrates court the maximum sentence is 6 months in jail or a fine of up to 20000. There may also be fees and restrictions applied to how you live your life.

In effect any handling or involvement with any proceeds of any crime or monies or assets representing the proceeds of crime can be a money laundering offence. There may also be sentencing for the crime committed to gain illegal money in the first place. The maximum sentence for money laundering offences is 14 years in custody. Money Laundering Penalties And The Maximum Penalty For Assisting A Money Launderer Any money laundering sentence whether it be passed down to the perpetrator of the crime itself or to any individuals assisting said perpetrator can consist of up to 14 years jail time depending on the severity of the crime and the circumstances under which it was committed. Crown Court cases can be a maximum of seven years in prison or an unlimited fine.

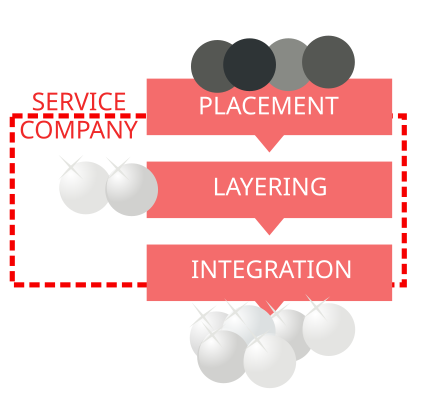

An offenders possession of the proceeds of his own crime falls within the UK definition of money laundering. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among. The penalty will depend on which of the offences is the. The sentence depends on the amount of. It is a course of by which soiled money is transformed into clear money.

Source: wikiwand.com

Source: wikiwand.com

Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. The penalty will depend on which of the offences is the. The risk-based approach to anti-money laundering. An offenders possession of the proceeds of his own crime falls within the UK definition of money laundering. Evasion of VAT in the magistrates court the maximum sentence is 6 months in jail or a fine of up to 20000.

Source: slideplayer.com

Source: slideplayer.com

In effect any handling or involvement with any proceeds of any crime or monies or assets representing the proceeds of crime can be a money laundering offence. It is also an offence for a person to provide advice or assistance to anyone engaged in money laundering. Money Laundering Penalties And The Maximum Penalty For Assisting A Money Launderer Any money laundering sentence whether it be passed down to the perpetrator of the crime itself or to any individuals assisting said perpetrator can consist of up to 14 years jail time depending on the severity of the crime and the circumstances under which it was committed. Offences against the Person Act 1861 s37. Money laundering under the Proceeds of Crime Act can lead to a sentence of up to 14 years in jail or a large fine.

Source:

Part 2 of the Serious Crime Act 2007 creates at sections 44 to 46 three inchoate offences of intentionally encouraging or assisting an offence. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. There may also be sentencing for the crime committed to gain illegal money in the first place. Evasion of VAT in the magistrates court the maximum sentence is 6 months in jail or a fine of up to 20000. Crown Court cases can be a maximum of seven years in prison or an unlimited fine.

Source: researchgate.net

Source: researchgate.net

The penalty will depend on which of the offences is the. Penalty For Assisting Money Laundering Edit. The risk-based approach means a focus on outputs. There may also be fees and restrictions applied to how you live your life. Part 2 of the Serious Crime Act 2007 creates at sections 44 to 46 three inchoate offences of intentionally encouraging or assisting an offence.

Source: djcareynotaries.co.uk

Source: djcareynotaries.co.uk

The risk-based approach to anti-money laundering. Evasion of VAT in the magistrates court the maximum sentence is 6 months in jail or a fine of up to 20000. UK AML Sanctions Regime Under the Brexit Withdrawal Agreement EU sanctions will apply in the UK until December 31 2020. Money laundering under the Proceeds of Crime Act can lead to a sentence of up to 14 years in jail or a large fine. The concept of cash laundering is essential to be understood for those working in the financial sector.

Source: slideplayer.com

Source: slideplayer.com

An offenders possession of the proceeds of his own crime falls within the UK definition of money laundering. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. The maximum sentence for money laundering offences is 14 years in custody. The penalty will depend on which of the offences is the.

Source: slideplayer.com

Source: slideplayer.com

There may also be fees and restrictions applied to how you live your life. An offenders possession of the proceeds of his own crime falls within the UK definition of money laundering. The length of imprisonment when charged with money laundering also depends on the severity of the case but it can reach up to 20 years. UK AML Sanctions Regime Under the Brexit Withdrawal Agreement EU sanctions will apply in the UK until December 31 2020. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact.

Source: wikiwand.com

Source: wikiwand.com

The sentence depends on the amount of. Crown Court cases can be a maximum of seven years in prison or an unlimited fine. The penalty will depend on which of the offences is the. The risk-based approach to anti-money laundering. Offences against the Person Act 1861 s37.

Source: slideplayer.com

Source: slideplayer.com

Part 2 of the Serious Crime Act 2007 creates at sections 44 to 46 three inchoate offences of intentionally encouraging or assisting an offence. The Sentencing Council has produced offence specific guidelines for fraud bribery and money laundering offences to assist in the sentencing of individual and corporate offenders respectively and which summarise the steps which the courts must follow when determining an appropriate sentence for a money laundering offence. To deal with the transition from the EUs sanctions regime to its new regime the UK passed the Sanctions and Anti-Money Laundering Act SAMLA in 2018. Evasion of VAT in the magistrates court the maximum sentence is 6 months in jail or a fine of up to 20000. The sentence depends on the amount of.

Source: slideplayer.com

Source: slideplayer.com

Offences against the Person Act 1861 s37. UK AML Sanctions Regime Under the Brexit Withdrawal Agreement EU sanctions will apply in the UK until December 31 2020. Offences against the Person Act 1861 s37. The length of imprisonment when charged with money laundering also depends on the severity of the case but it can reach up to 20 years. Evasion of VAT in the magistrates court the maximum sentence is 6 months in jail or a fine of up to 20000.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title assisting money laundering penalty uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information