19++ At what stage of money laundering is an insurance company most vulnerable info

Home » money laundering idea » 19++ At what stage of money laundering is an insurance company most vulnerable infoYour At what stage of money laundering is an insurance company most vulnerable images are ready in this website. At what stage of money laundering is an insurance company most vulnerable are a topic that is being searched for and liked by netizens today. You can Find and Download the At what stage of money laundering is an insurance company most vulnerable files here. Download all royalty-free vectors.

If you’re looking for at what stage of money laundering is an insurance company most vulnerable images information linked to the at what stage of money laundering is an insurance company most vulnerable topic, you have pay a visit to the ideal site. Our website always gives you suggestions for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

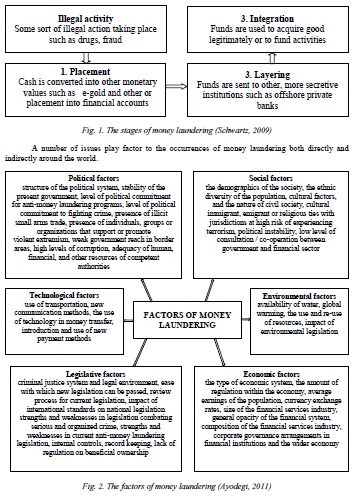

At What Stage Of Money Laundering Is An Insurance Company Most Vulnerable. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. The placement of the proceeds of crime can be done in a number of ways. Accordingly the first stage of the money laundering process is known as placement. It is during the placement stage that money launderers are the most vulnerable to being caught.

Acams Cams Exam From dokumen.tips

Acams Cams Exam From dokumen.tips

Accordingly the first stage of the money laundering process is known as placement. The primary purpose of this stage is to separate the illicit money from its source. It is during the placement stage that money launderers are the most vulnerable to being caught. So they effectively laundered their money several times. Vulnerability of life insurance Insurance products particularly in life insurance provide a very attractive and simple means of laundering money. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies.

Hedge funds typically allow investment and valuation on a monthly quarterly or annual basis.

Accordingly the first stage of the money laundering process is known as placement. Hedge funds typically allow investment and valuation on a monthly quarterly or annual basis. They subsequently made a fraudulent claim against the policy. Layering and Integration Stages According to experts including the International Association of Insurance Supervisors IAIS the insurance industry is most vulnerable to money laundering during the layering and integration stages of the laundering cycle. The agents and brokers are often unaware of the need to screen clients or to question payment methods. They subsequently made a fraudulent claim against the policy.

Source: wikiwand.com

Source: wikiwand.com

Buying furniture then buying a policy then receiving a clean cheque from their insurance company when they made a claim. Criminals may use several methodologies to place illegal money in the legitimate financial system including. In a case involving general insurance the criminals used dirty money to purchase a general insurance policy to insure some high-value goods. The use of two offsetting trades means that the market can move in either direction and the principal is safe. At what stage of money laundering is an insurance company most vulnerable.

Source: academia.edu

Source: academia.edu

In particular investment type life-insurance products are vulnerable. The use of two offsetting trades means that the market can move in either direction and the principal is safe. In a case involving general insurance the criminals used dirty money to purchase a general insurance policy to insure some high-value goods. These goods had also been purchased with dirty money. In some cases such agents and brokers have even joined criminals against insurers to facilitate money laundering.

Source: pinterest.com

Source: pinterest.com

So they effectively laundered their money several times. The loss of dirty money in one account is compensated by the creation of legitimate gains in another trading account. It is a process by which soiled cas. Vulnerability of life insurance Insurance products particularly in life insurance provide a very attractive and simple means of laundering money. Insurance companies have had to report transactions to the Financial Transaction Analysis Centre of Canada FINTRAC Canadas financial intelligence unit if there are.

Source: pinterest.com

Source: pinterest.com

Accordingly the first stage of the money laundering process is known as placement. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies. Layering and Integration Stages According to experts including the International Association of Insurance Supervisors IAIS the insurance industry is most vulnerable to money laundering during the layering and integration stages of the laundering cycle. Hedge funds typically allow investment and valuation on a monthly quarterly or annual basis. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and.

Source: researchgate.net

Source: researchgate.net

This stage is the most complex and often entails the international movement of the funds. Canadian Parliament enacted the Proceeds of Crime Money Laundering Act in 2000. Accordingly the first stage of the money laundering process is known as placement. The use of two offsetting trades means that the market can move in either direction and the principal is safe. Buying furniture then buying a policy then receiving a clean cheque from their insurance company when they made a claim.

Source: slideplayer.com

Source: slideplayer.com

The idea of money laundering is essential to be understood for these working in the financial sector. Challenges of traditional detection technology for securities providers A key driver of this deficiency is the difficulty in detecting money laundering typologies in securities products since the sector is most vulnerable to the integration stage of money laundering. Layering and Integration Stages According to experts including the International Association of Insurance Supervisors IAIS the insurance industry is most vulnerable to money laundering during the layering and integration stages of the laundering cycle. In some cases such agents and brokers have even joined criminals against insurers to facilitate money laundering. Four methods of money launderingcash smuggling casinos and other gambling venues insurance policies and securitiesare described below in.

Source: infotaste.com

Source: infotaste.com

This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. Canadian Parliament enacted the Proceeds of Crime Money Laundering Act in 2000. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies. The loss of dirty money in one account is compensated by the creation of legitimate gains in another trading account. Hedge funds typically allow investment and valuation on a monthly quarterly or annual basis.

Source: dokumen.tips

Source: dokumen.tips

Life insurance companies are currently subject to the act and have been since November 2001. Funneling illegal funds through legitimate businesses that deal heavily in cash transactions. Hedge funds typically allow investment and valuation on a monthly quarterly or annual basis. Challenges of traditional detection technology for securities providers A key driver of this deficiency is the difficulty in detecting money laundering typologies in securities products since the sector is most vulnerable to the integration stage of money laundering. So they effectively laundered their money several times.

Source: researchgate.net

Source: researchgate.net

This stage is the most complex and often entails the international movement of the funds. The placement of the proceeds of crime can be done in a number of ways. In a case involving general insurance the criminals used dirty money to purchase a general insurance policy to insure some high-value goods. The placement of the proceeds of crime can be done in a number of ways. Challenges of traditional detection technology for securities providers A key driver of this deficiency is the difficulty in detecting money laundering typologies in securities products since the sector is most vulnerable to the integration stage of money laundering.

Source: pinterest.com

Source: pinterest.com

The agents and brokers are often unaware of the need to screen clients or to question payment methods. Buying furniture then buying a policy then receiving a clean cheque from their insurance company when they made a claim. It is during the placement stage that money launderers are the most vulnerable to being caught. The primary purpose of this stage is to separate the illicit money from its source. So they effectively laundered their money several times.

Source: allbankingalerts.com

Source: allbankingalerts.com

Buying furniture then buying a policy then receiving a clean cheque from their insurance company when they made a claim. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. Buying furniture then buying a policy then receiving a clean cheque from their insurance company when they made a claim. Money Laundering in the Insurance. It is during the placement stage that money launderers are the most vulnerable to being caught.

Source:

It is during the placement stage that money launderers are the most vulnerable to being caught. Layering and Integration Stages According to experts including the International Association of Insurance Supervisors IAIS the insurance industry is most vulnerable to money laundering during the layering and integration stages of the laundering cycle. The correct answer is C. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. It is during the placement stage that money launderers are the most vulnerable to being caught.

Source: slideplayer.com

Source: slideplayer.com

With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. Buying furniture then buying a policy then receiving a clean cheque from their insurance company when they made a claim. The placement of the proceeds of crime can be done in a number of ways. Accordingly the first stage of the money laundering process is known as placement. The correct answer is C.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title at what stage of money laundering is an insurance company most vulnerable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information