12++ Axis bank tds declaration form ideas

Home » money laundering idea » 12++ Axis bank tds declaration form ideasYour Axis bank tds declaration form images are ready. Axis bank tds declaration form are a topic that is being searched for and liked by netizens today. You can Download the Axis bank tds declaration form files here. Download all royalty-free photos.

If you’re looking for axis bank tds declaration form images information related to the axis bank tds declaration form interest, you have pay a visit to the ideal blog. Our site frequently gives you hints for seeking the maximum quality video and image content, please kindly hunt and locate more informative video articles and images that match your interests.

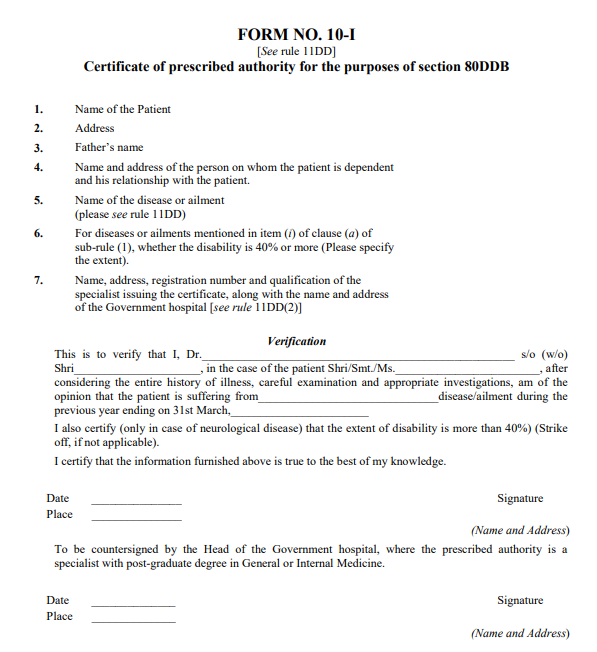

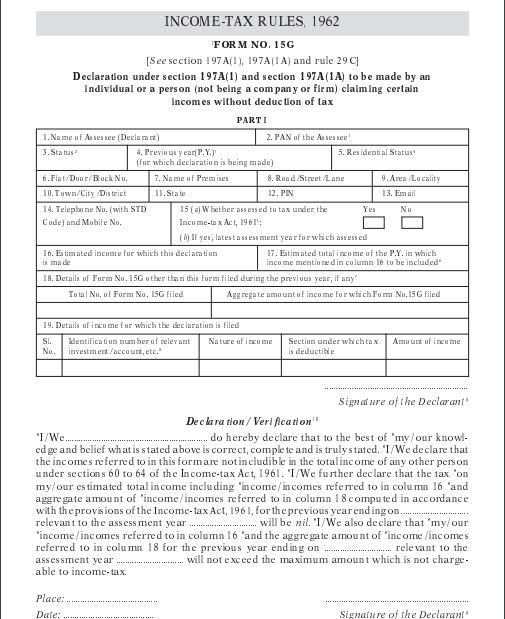

Axis Bank Tds Declaration Form. Statement for tax deducted at source on all payments other than salaries. Statement for tax deducted at source from salaries. This is to inform you that by clicking on the hyper-linkok you will be accessing a website operated by a third party namely Such links are provided only for the convenience of the Client and Axis Bank does not control or endorse such websites and is not responsible for their contents. Form 15G is for an individual below 60 while Form 15H is for the senior citizen.

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Investment Quotes Investing Infographic Money Book From in.pinterest.com

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Investment Quotes Investing Infographic Money Book From in.pinterest.com

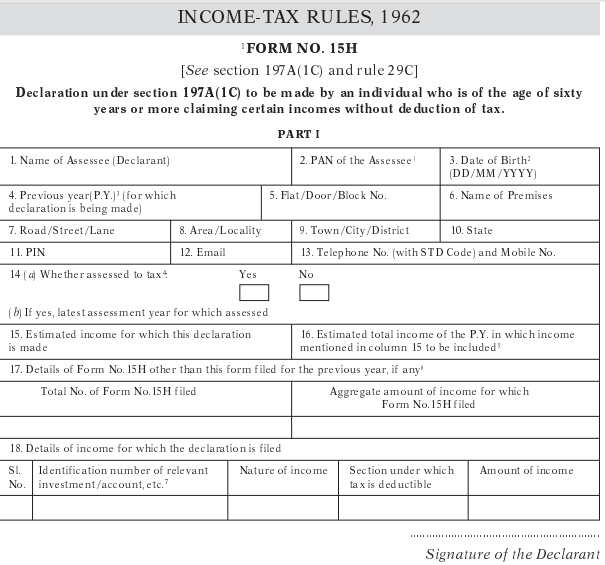

Statement for tax deducted at source from salaries. This is to inform you that by clicking on the hyper-linkok you will be accessing a website operated by a third party namely Such links are provided only for the convenience of the Client and Axis Bank does not control or endorse such websites and is not responsible for their contents. 15G Form for HDFC Bank PDF Generally Form 15G and Form 15H are self declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit. You can also submit Form 15G and Form 15H to the bank if the total taxable income is below the total taxable limit. Generation of Form 15GH will not take place in case Constitution or Date of birth is not updated in Bank records. Stated above is coffect complete and is tmly stated LAVe declare that the incomes refeffed to in this form are not includible in the total income of any other person under sections 60 to 64 of the Income-tax Act 1961 IWe further declare that the tax on my our estimated total income including incomeincomes refe-ffed to in column 16 and.

Name of Assessee Declarant 2.

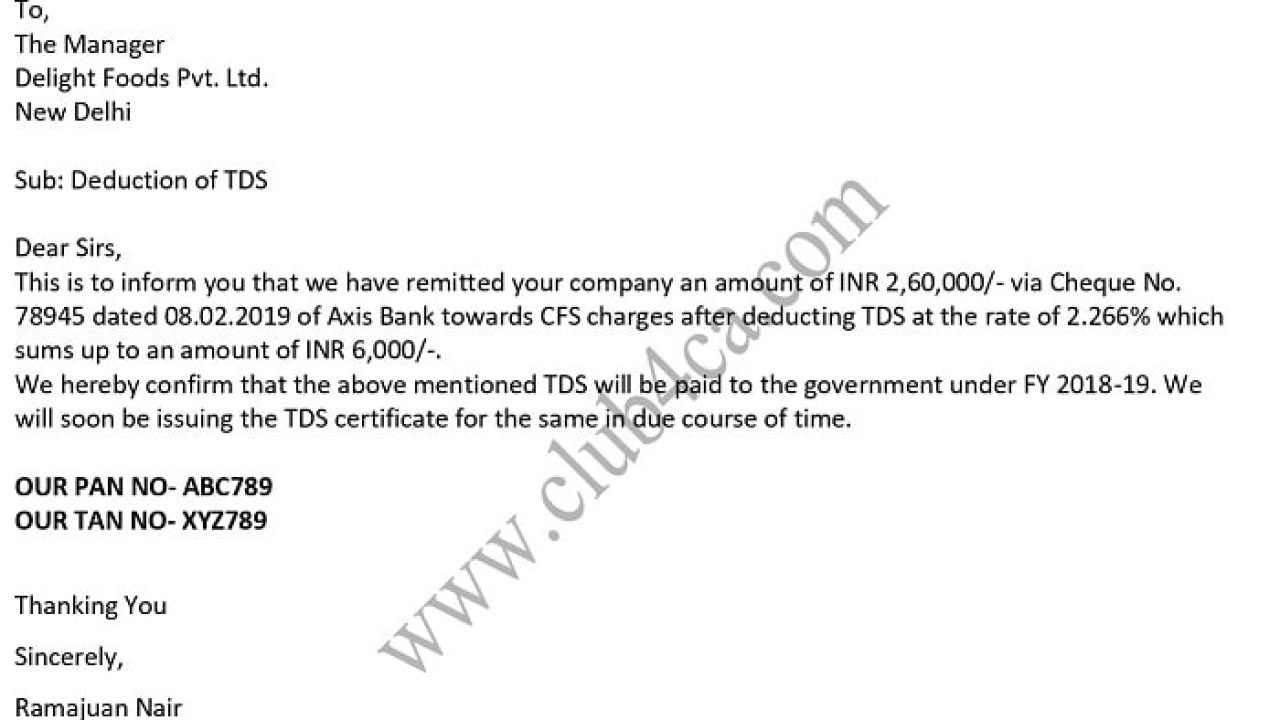

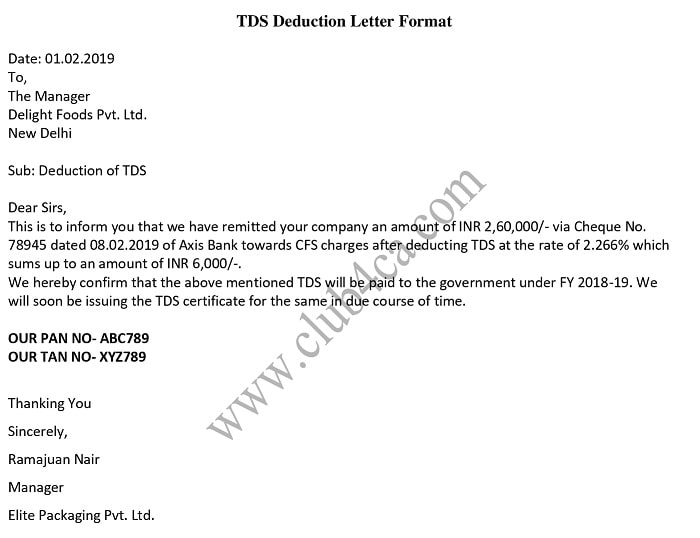

Name of the Bank and Branch Date. 15H See section 197A1C and rule 29C Declaration under section 197A1C to be made by an individual who is of the age of sixty years or more claiming certain incomes without deduction of tax. We also understand that submission of this e-Payment Request Form does not imply payment of tax which is subject to availability of funds in our Axis Bank Current Account as well as accessibility of TIN-NSDL Website. 78945 dated 08022019 of Axis Bank towards CFS charges after deducting TDS at the rate of 2266 which sums up to an amount of INR 6000-. Here Form 15G for Axis Bank is available and use the given link to download the Axis Bank Form 15G in PDF format. Date of Birth2DDMMYYYY 4.

Source: wisdomjobs.com

Source: wisdomjobs.com

While Form 15G is for individuals below 60 years Form 15H is for individuals above 60 years of age. While Form 15G is for individuals below 60 years Form 15H is for individuals above 60 years of age. PAN of the Assessee 1 3. Form 15G is for an individual below 60 while Form 15H is for the senior citizen. Statement for tax deducted at source from salaries.

Source: club4ca.com

Source: club4ca.com

Signature of person making payment Rs. The bank also offers services like updation of address email PAN linking of Aadhaar for Government and other such benefits. Senior Citizen customers 60 years and above can submit declaration in Form 15H duly signed in duplicate subject to eligibility under section 197A 1C of the Income Tax Act for non- deduction of TDS from interest on term deposits Senior Citizen rates are not applicable for NRI Customers A fresh declaration in Form 15G15H both for. Taxpayers Counterfoil To be filled up by taxpayer SPACE FOR BANK SEAL TAN Received from Name Cash Debit to Ac Cheque No. Particulars of the TDS Return Forms.

Source: club4ca.com

Source: club4ca.com

Statement for tax deducted at source on all payments other than salaries. Taxpayers Counterfoil To be filled up by taxpayer SPACE FOR BANK SEAL TAN Received from Name Cash Debit to Ac Cheque No. Previous yearPY3 for which declaration is being made 5. Generally Form 15G and Form 15H are self declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit. Form 15G is for an individual below 60 while Form 15H is for the senior citizen.

Source: wisdomjobs.com

Source: wisdomjobs.com

Form 15G can be submitted by the Individuals below 60 years HUFs Trusts and Associations. Date of Birth2DDMMYYYY 4. Generation of Form 15GH will not take place in case Constitution or Date of birth is not updated in Bank records. If your total income is below Income tax slab then you can submit a Form 15G or 15H to the bank at the start of the year to avoid TDS deduction done by the bank. Statement for tax deducted at source from salaries.

Source: pinterest.com

Source: pinterest.com

Statement for tax deducted at source from salaries. Form 15GH are self-declaration forms required to be furnished by the assessee to the banker for nil deduction lower deduction of TDS tax deducted at source on interest income. Form 15G individuals claiming income without tax deduction Form 15H for senior citizens claiming income without tax deduction Charge Dispute Form to report transaction dispute Form for settlement of claim in deceased depositors account with nomination of survivorship clause. The bank in this case will not deduct any TDS on your interest income. Statement for tax deducted at source on all payments other than salaries.

Source: in.pinterest.com

Source: in.pinterest.com

We understand that the Bank will make the CBDT e-Payment on our behalf based on this e-Payment Request Form submitted by us. While Form 15G is for individuals below 60 years Form 15H is for individuals above 60 years of age. Signature of person making payment Rs. Senior Citizen customers 60 years and above can submit declaration in Form 15H duly signed in duplicate subject to eligibility under section 197A 1C of the Income Tax Act for non- deduction of TDS from interest on term deposits Senior Citizen rates are not applicable for NRI Customers A fresh declaration in Form 15G15H both for. Statement for tax deducted at source on all payments other than salaries.

Source: bemoneyaware.com

Source: bemoneyaware.com

15G Form for HDFC Bank PDF Generally Form 15G and Form 15H are self declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit. Generally Form 15G and Form 15H are self declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit. We also understand that submission of this e-Payment Request Form does not imply payment of tax which is subject to availability of funds in our Axis Bank Current Account as well as accessibility of TIN-NSDL Website. In case you failed to submit the investment proof to your employer and the bank deducted the TDS you can file a return and claim a refund of it provided your total taxable income is below the total taxable limit. Senior Citizen customers 60 years and above can submit declaration in Form 15H duly signed in duplicate subject to eligibility under section 197A 1C of the Income Tax Act for non- deduction of TDS from interest on term deposits Senior Citizen rates are not applicable for NRI Customers A fresh declaration in Form 15G15H both for.

Source:

Generation of Form 15GH will not take place in case Constitution or Date of birth is not updated in Bank records. The bank in this case will not deduct any TDS on your interest income. Statement for tax deducted at source on all payments other than salaries. Particulars of the TDS Return Forms. Here Form 15G for Axis Bank is available and use the given link to download the Axis Bank Form 15G in PDF format.

Source: paisabazaar.com

Source: paisabazaar.com

How to avoid TDS You can submit a declaration Form 15G or 15H to avoid TDS on interest income. While Form 15G is for individuals below 60 years Form 15H is for individuals above 60 years of age. Senior Citizen customers 60 years and above can submit declaration in Form 15H duly signed in duplicate subject to eligibility under section 197A 1C of the Income Tax Act for non- deduction of TDS from interest on term deposits Senior Citizen rates are not applicable for NRI Customers A fresh declaration in Form 15G15H both for. You can also submit Form 15G and Form 15H to the bank if the total taxable income is below the total taxable limit. India has signed a Double Taxation Avoi.

Source: in.pinterest.com

Source: in.pinterest.com

The bank in this case will not deduct any TDS on your interest income. The bank in this case will not deduct any TDS on your interest income. Name of Assessee Declarant 2. In case you failed to submit the investment proof to your employer and the bank deducted the TDS you can file a return and claim a refund of it provided your total taxable income is below the total taxable limit. PAN of the Assessee 1 3.

Source: groww.in

Source: groww.in

Name of the Bank and Branch Date. In case you failed to submit the investment proof to your employer and the bank deducted the TDS you can file a return and claim a refund of it provided your total taxable income is below the total taxable limit. The bank also offers services like updation of address email PAN linking of Aadhaar for Government and other such benefits. Stated above is coffect complete and is tmly stated LAVe declare that the incomes refeffed to in this form are not includible in the total income of any other person under sections 60 to 64 of the Income-tax Act 1961 IWe further declare that the tax on my our estimated total income including incomeincomes refe-ffed to in column 16 and. PAN of the Assessee 1 3.

Source: paisabazaar.com

Source: paisabazaar.com

Date of Birth2DDMMYYYY 4. Stated above is coffect complete and is tmly stated LAVe declare that the incomes refeffed to in this form are not includible in the total income of any other person under sections 60 to 64 of the Income-tax Act 1961 IWe further declare that the tax on my our estimated total income including incomeincomes refe-ffed to in column 16 and. Now you can reduce the TDS from your NRO Fixed Deposits if you submit the DTAA form and other relevant details. 15G Form for HDFC Bank PDF Generally Form 15G and Form 15H are self declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit. In case you failed to submit the investment proof to your employer and the bank deducted the TDS you can file a return and claim a refund of it provided your total taxable income is below the total taxable limit.

Source: maxlifeinsurance.com

Source: maxlifeinsurance.com

Date of Birth2DDMMYYYY 4. PAN of the Assessee 1 3. The bank also offers services like updation of address email PAN linking of Aadhaar for Government and other such benefits. 15G Form for Axis Bank PDF. Generally Form 15G and Form 15H are self declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title axis bank tds declaration form by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information